Could 2022 be a great year for Netflix stock? Here's why shares of the streaming platform may outperform its competitors again next year.

After Netflix's great stock performance in 2021, fans of the streaming service are wondering what's in store for the company and its shares in 2022.

Let's sum up what happened to NFLX shares this year and whether they still present a good opportunity for investors.

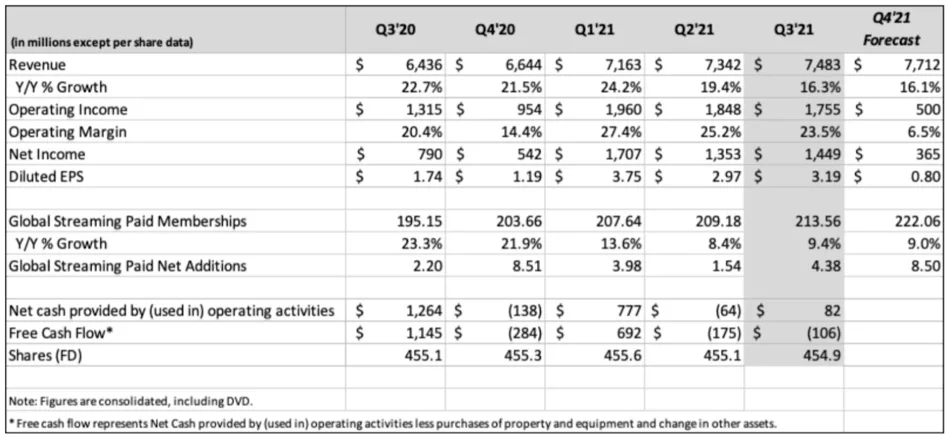

Netflix's 2021 Revenue Results

Looking at company revenue, Netflix continued to grow during 2021 but experienced a slowdown compared to 2020. This was likely due to the subscription boom the company experienced during 2020 thanks to COVID lockdowns.

Even so, during the last three quarters, Netflix's revenue showed year-over-year average revenue growth of 20%. In addition, its operating margins rose from 20.4% in the third quarter of 2020 to 23.5% in the third quarter of 2021.

Subscriber growth is another key metric for investors. Unfortunately, results here were disappointing in 2021.

In 2020, Netflix's subscriber growth was more than 20% per quarter. This dropped to 10% in 2021.

However, investors should take it into account that, during the early months of the pandemic, the company experienced record-breaking growth. The decrease we've seen this year may just be the result of subscriber growth returning to normal levels.

How Did NFLX Perform Against Other Streaming Services?

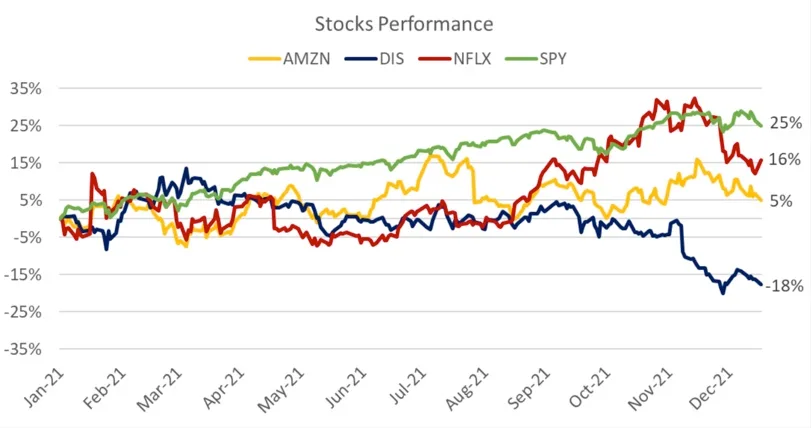

Compared to its competitors, NFLX did very well in 2021 with cumulative growth of 16%. Other stocks that compete in the video streaming segment saw worse returns. For example, Amazon shares appreciated only 5%, while Disney suffered a drop of nearly 20%.

However, NFLX's performance looks less stellar when compared to companies outside the streaming segment. In fact, the stock underperformed the S&P 500 in 2021.

As Netflix stock moves away from its peak in November, there may still be room for the company to grow.

What's Next?: Our Take on NFLX for 2022

Netflix was a pioneer in the video streaming segment. And despite fierce competition from giants like Disney and Amazon, it still has the largest market share in the industry.

In addition, Netflix is constantly betting on new segments for revenue growth. For example, it recently pushed beyond films by launching an interactive games division. Moves like this expose Netflix to new subscribers and boost its bottom line.

We believe that the recent fall in NFLX’s stock price translates to a buying opportunity for long-term investors who agree there’s still plenty of growth to come.