With stock valuations sitting above long-term norms, investors will be looking to company executives for clues on future profits.

Wall Street is heading into earnings season this week with high expectations after strong profits fueled a stock market rally in the first half of the year.

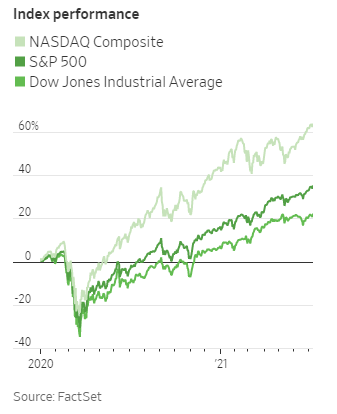

Money managers will be watching whether companies will again trounce Wall Street’s forecasts for earnings. The S&P 500 has gained 16% this year and notched 38 record closes, most recently on Friday.

With stock valuations sitting above long-term norms, investors will also be looking to executives for clues on what the future holds for company profits.

Investors this week will parse results from big banks like JPMorgan Chase & Co. and Bank of America Corp., as well as from companies ranging from PepsiCo Inc. toDelta Air LinesInc.DAL2.02%toUnitedHealth GroupInc.UNH0.53%

The company earnings will offer a glimpse into how businesses are doing more than a year after the pandemicplunged the U.S. into a recession. With questions about the path of inflation and the labor market unresolved, investors haveshown signs of skittishnessabout the market’s course in the coming months.

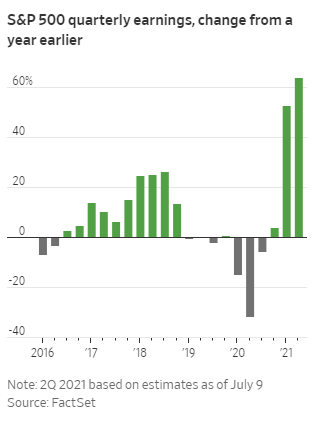

Analysts project that profits for S&P 500 companies rose 64% in the second quarter from a year earlier, according to FactSet, a growth rate that would be the highest in more than a decade. However, the growth will be measured from a period when much of the economy had been brought to a standstill from the pandemic as consumers retreated and some businesses saw steep declines in revenue. Analysts expect businesses constrained by the pandemic and economic slowdown, like the financial and industrial sectors, to more than double their profits from the same period in 2020.

Also, forecasts have drifted higher in recent months, helped by an unusually large number of companies advising investors that they expect earnings to come in higher than analysts had been estimating.

“The reason for that is simple: The speed and robustness of the recovery is greater today than everyone anticipated three months ago,” said Hal Reynolds, chief investment officer at Los Angeles Capital Management.

It is more common for companies to try to lower expectations as they head into a reporting season.

Federal Reserve officials at the central bank’s June policy meeting suggested theymight need to dial back their supportfor the economy earlier than expected because growth has been so strong.

At the same time, investors in recent days have been considering the threat that labor shortages, supply-chain bottlenecks and thehighly contagious Delta variantof the coronavirus might pose to their rosy economic outlooks.

A rally in ultrasafe government bonds pushed the yield on the benchmark 10-year U.S. Treasury notebelow 1.3% last week, settling Thursday at its lowest level since February. Stocks sold off, with the S&P 500, Dow Jones Industrial Average and tech-heavy Nasdaq Composite on Thursdaysuffering their worst daily performancesin nearly three weeks before bouncing higher Friday.

The S&P 500 traded Thursday at nearly 22 times expected earnings over the next 12 months, above a five-year average of a little more than 18.

“Valuations on their own don’t kill a market, but valuations make you vulnerable if there’s an unpleasant surprise,” said Tom Hancock, lead portfolio manager of the GMO Quality Fund.

The economy’s rebound from the pandemic has driven asurge in consumer prices, and investors want to know how higher costs for anything from materials to labor will affect corporations’ bottom lines.

Forecasts call for an S&P 500 net profit margin of 11.8% in the second quarter, above the five-year average of 10.6%, according to FactSet. That recent efficiency in generating profits could be vulnerable as costs rise.

There are signs investors might look harshly on companies struggling to stay fully staffed.FedExCorp.shares fell 3.9% the day after the delivery giant’s June earnings report—and executives saiddifficulty hiring package handlershad driven wages higher and created inefficiency.

If that experience turns out to be widely shared, it could reshape expectations for the costs that U.S. companies will bear going forward—and potentially the prices their shares are worth.

“I come back to inflation and margins being something that could really create a pause with stocks,” said Larry Cordisco, co-lead portfolio manager of the Osterweis Growth & Income Fund. “Certainly if there’s wage inflation that starts to take hold, I think that is going to get people’s attention.”

Shares ofDarden RestaurantsInc.meanwhile, rose 3.2% the day after the parent company of Olive Gardentopped earnings estimates, even as it pointed to a rise in the costs of food and labor. The company shared a sales forecast that assumes full operating capacity for essentially all restaurants and no significant interruptions related to the pandemic.