- ‘Reopening-sensitive sectors’ are likely to add to headline inflation as China’s post-Covid recovery may differ from other typical business cycles: Goldman

- Market is focused on the `Two Sessions’ as traders look for policy stimulus signals from Beijing

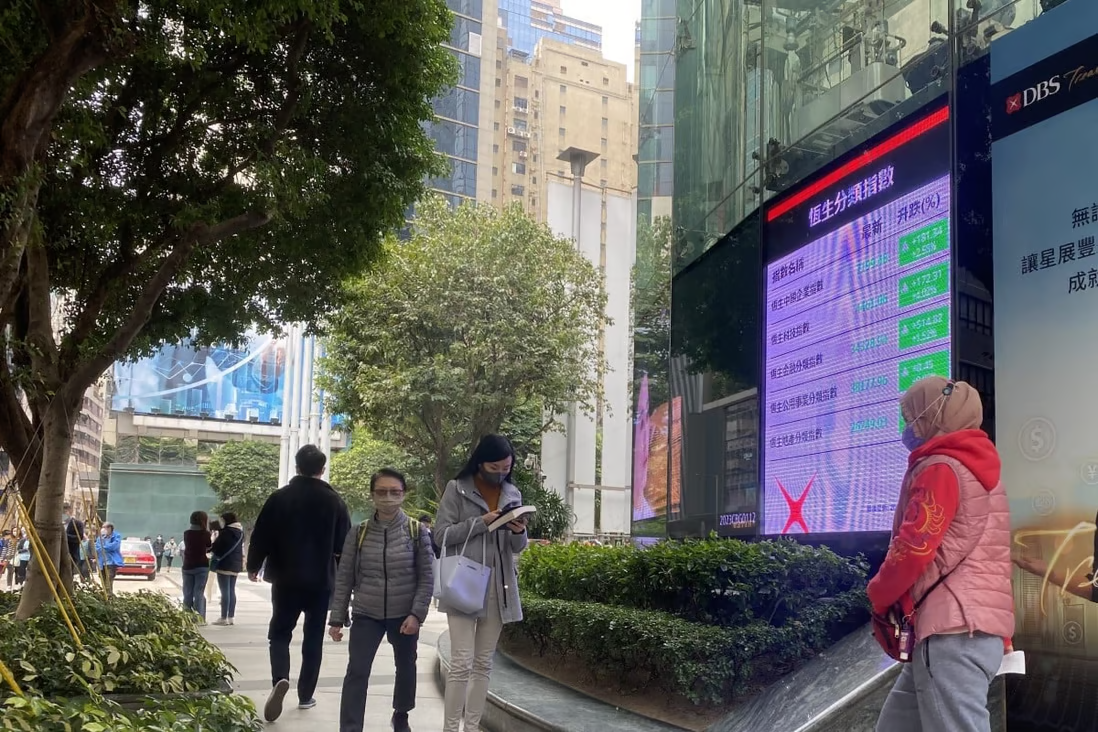

Hong Kong stocks dropped amid concerns a stronger than expected recovery in China’s economy will stoke inflation and limit the room for policymakers to inject fresh stimulus.

The Hang Seng Index lost 0.8 per cent to 20,459.34 at 11.04am local time. The Tech Index retreated 1.5 per cent, while the Shanghai Composite Index gained 0.1 per cent.

Alibaba Group slipped 4.2 per cent to HK$88.05, JD.com tumbled 2.8 per cent to HK$178.10 and Baidu dropped 2.6 per cent to HK$141.20. Budweiser sank 2.6 per cent to HK$24.50 after reporting a net loss in the fourth quarter. Country Garden slipped 1.9 per cent to HK$2.55, after founder Yeung Kwok-keung resigned from the board.

Local stocks surged 4.2 per cent on Wednesday as manufacturing and services reports underpinned the China recovery play. The market had earlier lost more than 10 per cent since January 27 in a technical correction, as investors worried Beijing would refrain from injecting more stimulus as growth surprised to the upside.

To reverse recent declines, the market now needs more policy support and better economic and corporate earnings momentum, Goldman Sachs strategist Timothy Moe said in a note on Wednesday.

“Reopening-sensitive sectors” represent the most upside risk to inflation in mainland China this year, the US bank said last month, as the post-Covid recovery may differ from typical business cycles. Policymakers are unlikely to unleash strong stimulus in the housing market to put a lid on surging rent inflation, it added.

Elsewhere, stronger vehicle sales in China last month failed to light a spark in auto stocks. BYD retreated 0.6 per cent to HK$223.00 after reporting a 85 per cent jump in sales. Similarly, peers Li Auto, Xpeng and Nio slid 1.5 to 12.4 per cent as analysts said the strength of market recovery remains to be seen.

Asian markets rose on Tuesday, with benchmark indexes in South Korea and Australia adding 0.2 to 0.5 per cent and Nikkei 225 in Japan little changed.