Stonks only go up... until they go down. The so-called everything bubble, or the superbubble, is up against forces that are challenging the investing landscape, with the Fed pivoting on its "transitory" inflation stance last November.

The shift commenced a monetary policy tightening cycle to combat price pressures, but it has continued to weigh on equities, along with a stronger dollar that is hitting earnings. Many have also warned that other industries and sectors have far exceeded fundamental value by a large margin, propped up by the Federal Reserve and the once-strong army of day traders that surfaced during the onset of the coronavirus pandemic.

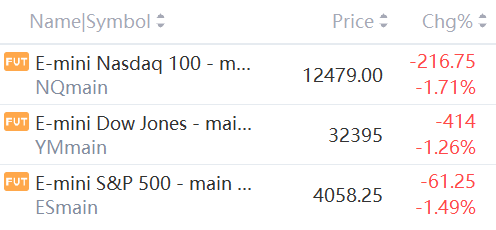

Futures early Monday (4:40 a.m. ET): Dow -1.26%; S&P 500 -1.48%; Nasdaq -1.71%.

Commentary: "Today in the U.S. we are in the fourth superbubble of the last hundred years," wrote famed fund manager Jeremy Grantham back in January. "Even more dangerously for all of us, the equity bubble, which last year was already accompanied by extreme low interest rates and high bond prices, has now been joined by a bubble in housing and an incipient bubble in commodities. What is new this time, and only comparable to Japan in the 1980s, is the extraordinary danger of adding several bubbles together, as we see today with three and a half major asset classes bubbling simultaneously for the first time in history."

A major selloff has plagued the Dow and S&P 500, while the tech-heavy Nasdaq has been in a bear market since March, with nearly half of the index's constituents off more than 50% below their 52-week highs.

Riskier crypto markets have also taken a hit (Bitcoin prices are off also down 50% from highs) and elevated commodity prices remain subject to supply chain problems, as well as volatile supply and demand. Meanwhile, purchases of ETFs in April fell to their lowest level since the depths of the COVID crisis as inflows from institutional money and retail investors dried up.

No more diamond hands: "Yields are climbing because investors think inflation is out of control," said Peter Andersen, founder of investment firm Andersen Capital Management. "

A lot of these guys started trading right around COVID so their only investing experience was the wacked-out, Fed-fueled market," added Matthew Tuttle, CEO at Tuttle Capital Management. "That all changed with the Fed pivot in November, but they didn't realize that because they have never seen a market that wasn’t supported by the Fed. The results have been horrific."