We think that this economic cycle will be normal, strong and short. Each of these assumptions is being hotly debated by the market. Each is key to our investment strategy.

The debate over cycle 'normalcy' is self-explanatory. The pandemic created, without exaggeration, the single sharpest decline in output in recorded history. Then activity raced back, helped by policy support. The case for viewing this situation as unique, and distinct from other cyclical experiences, is based on the view that a fall and rise this violent never allowed for a traditional 'reset'.

But 'normal' in markets is a funny concept, with the rough edges of memory often smoothed and polished by the passage of time. The cycle of 2003-07 ended with the largest banking and housing crisis since the Great Depression. The cycle of 1992-2000 ended with the bursting of an enormous equity bubble, widespread accounting fraud and unspeakable tragedy. 'Normal' cycles are nice in theory, harder in practice.

Instead, let’s consider why we use the term ‘cycle’ at all. Economies and markets tend to follow cyclical patterns, patterns that tend to show up in market performance. It is those patterns we care about, and if they still apply, they can provide a useful guide in uncertain terrain.

Was last year’s recession preceded by late-cycle conditions such as an inverted yield curve, low volatility, low unemployment, high consumer confidence and narrowing equity market breadth? It was. Did the resulting troughs in equities, credit, yields and yield curves match the usual cadence between market and economic lows? They did. And were the leaders of the ensuing rally the usual early-cycle winners, like small and cyclical stocks, high yield credit and industrial metals? They were.

If it walks like a duck and quacks like a duck, we think that it’s a normal cycle. Or as normal as these things realistically are. If a lot of 'normal' cycle behavior has played out so far, it should continue to do so.

Specifically, this relates to patterns of performance as the market recovers. And as that recovery advances, those patterns should shift. As noted by my colleague Michael Wilson, we think that we are moving to a mid-cycle market, despite being just 16 months removed from the lows of economic activity. We see a number of similarities between current conditions and 1H04, a mid-cycle period that followed a large, reflationary rally. And importantly, despite recent fears about growth, we think that the global recovery will keep pushing on (see The Growth Scare Anniversary, July 11, 2021).

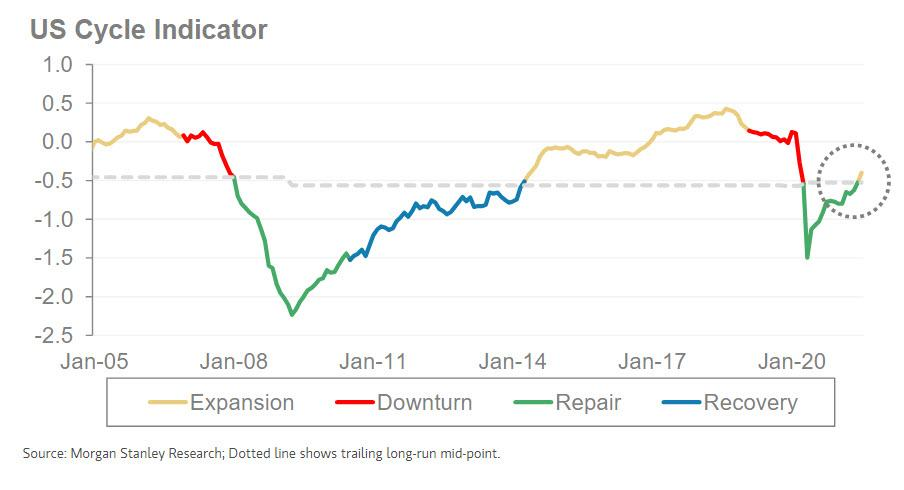

Because one can always find an indicator that fits their particular cycle view, we’ve long been fans of a composite. That’s our ‘cycle model’, which combines ten US metrics across macro, the credit cycle and corporate aggression to gauge where we are in the market cycle. After moving into late-cycle ‘downturn’ in June 2019, and early-cycle ‘repair’ in April 2020, it’s rocketed higher.It has risen so fast that it’s blown right past what should be the next phase ('recovery'), and moved right into ‘expansion’.

All this has a number of implications:

- The shorter the cycle, the worse for credit relative to other risky assets; credit enjoys fewer of the gains from the 'boom', is exposed if the next downturn is early, and faces more supply as corporate confidence increases. In the ‘expansion’ phase of our cycle model, US IG and HY credit N12M excess returns are 29bp and 161bp worse than average, respectively.

- In many of those periods, more mixed credit performance occurs despite default rates remaining low. Investors should try to take default risk over spread risk: our credit strategists like owning CDX HY 0-15%, and hedging with CDX IG payer spreads.

- In equities, we think that our model supports more balance in portfolios. We like healthcare in both the US and Europe as a sector with several nice factor exposures: quality, low valuation, high carry and low volatility. Globally, equities in Europe and Japan have tended to outperform 'mid-cycle', and we think that they can do so again.

- Interest rates are too pessimistic on the recovery. US 10-year Treasury N12M returns are 97bp worse than average during the ‘expansion’ phase of our cycle model. Guneet Dhingra and our US interest rate strategy team have moved underweight US 10-year Treasuries, and we in turn have moved back underweight government bonds in our global asset allocation.

This cycle is unusual. Most 'normal' cycles are. We think that the recovery is sustainable and more likely to be ‘hotter and shorter’. Sell Treasuries and trust the expansion.