Stocks slip for a second day as China’s real estate slump persists; Gansu-based firms suffer after an earthquake rocked the northwestern province

EV maker Nio gets another round of capital injection from Abu Dhabi Investment Authority

Hong Kong stocks dropped for a second day on concerns China’s property market will struggle to overcome a multi-year slump, forcing funds to cut their holdings. Several companies based in Gansu weakened after an earthquake struck the northwestern Chinese province.

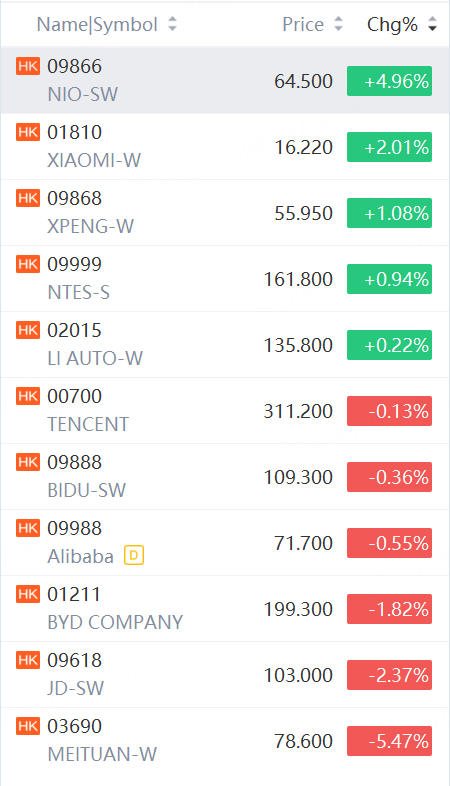

The Hang Seng Index fell 1.1 per cent to 16,453.59 at 10.14am local time. The Tech Index dropped 1.2 per cent while the Shanghai Composite Index retreated 0.2 per cent.

Developer Longfor Group slumped 3.6 per cent to HK$12.34 and property management firm Country Garden Services tumbled 11 per cent to HK$6.14. Alibaba Group lost 1 per cent to HK$71.40 and Tencent weakened 1 per cent to HK$308.60, while Meituan sank 5.4 per cent to HK$78.60.

China’s real estate market crisis continues to claim fresh victims as funding stress persists, with state-backed developer China South City seeking to restructure US$1.35 billion of bonds this week. Mainland funds sold US$1.3 billion of Hong Kong-listed stocks last week.

The Hang Seng Index has dropped 18 per cent this year, set for an unprecedented four-year slide, while the benchmark tracking major stocks in Shanghai and Shenzhen are on course of a record third year of losses.

Gansu Engineering Consulting fell 3.1 per cent to 11.11 yuan in Shanghai, while DuZhe Publishing plunged 8.7 per cent to 8 yuan in Shenzhen. A 6.2-magnitude earthquake hit the northwest province overnight, killing more than 110 people.

Elsewhere, Nio jumped 4.96 per cent to HK$64.50 after the Chinese EV maker secured another US$2.2 billion investment from a fund backed by Abu Dhabi Investment Authority. The fund had earlier ploughed US$738 million into Nio in June, and acquired more shares in Nio from Tencent.

Machine maker Wuxi Lingood Machinery Technology surged almost 200 per cent to 16.80 on the first day of trading in Beijing.

Other major Asian markets were mixed. Japan’s Nikkei 225 and South Korea’s Kospi both retreated 0.1 per cent, while Australia’s S&P/ASX 200 added 0.6 per cent.