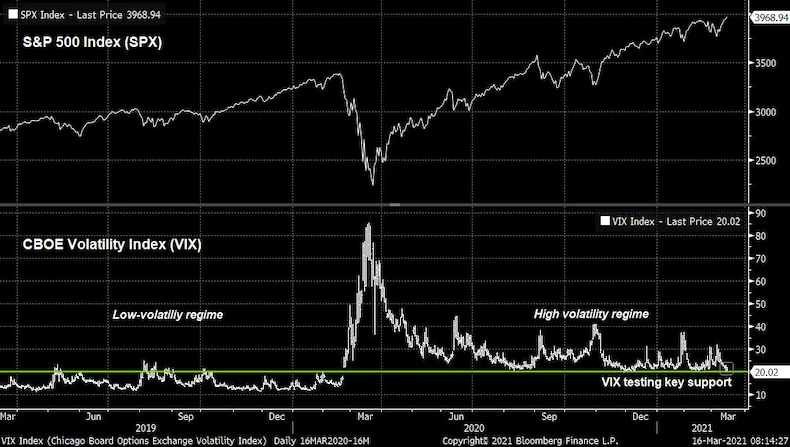

- A decline in stock-market volatility over the past few weeks suggests more upside ahead for stocks.

- On Tuesday, the CBOE Volatility Index fell below the key 20 level and hit its lowest levels since the start of the COVID-19 pandemic.

- According to Fairlead Strategies' Katie Stockton, a consistent VIX reading below 20 would signal a bullish shift in sentiment.

The stock market's fear gauge fell below a key level on Tuesday that suggested further upside was ahead for stocks.

The CBOE Volatility Index, also known as the VIX, fell below the 20 level and hit its lowest point since the start of the COVID-19 pandemic. A VIX below 20 is seen as a signal that the stock market is transitioning from a high-volatility regime to a low-volatility regime, according to Fairlead Strategies' Katie Stockton.

And according to Fundstrat's Tom Lee, a fall below 20 in the VIX signals a risk-on environment that would spark fund flows into stocks from systematic and quantitative investment funds.

"A fall below 20 takes this volatility index to pre-2020 levels and a drop in the VIX would be a risk-on signal," Lee said in a note last month.

But the VIX has staged multiple head fakes over the past few months, briefly falling below 20 before spiking higher in February, November, and August.

That's why Stockton recommends investors wait for confirmation of a breakdown in the VIX before making any portfolio changes, like removing market hedges. Confirmation of a VIX breakdown would require consecutive daily closes below the 20 level, according to a Tuesday note from Stockton.

"This would mark a potentially bullish shift in sentiment, and a move from a high-volatility regime to a low-volatility regime, last seen pre-Covid with a new floor for the VIX near 11," Stockton said, adding that a VIX breakdown "would support near-term upside follow-through for the inversely correlated S&P 500."