Summary

- Nvidia's stock is still very overvalued, trading at a steep price-to-sales multiple.

- It will take a beat and raise a quarter of significance to boost the share price.

- An options trader is betting shares trade sub $230 between now and the middle of March.

Nvidia (NVDA) will report results on Wednesday after the close of trading. Analysts currently estimate that the company's fiscal fourth quarter 2022 earnings rose by 57.7% to $1.22 per share and are potentially as high as $1.25. Meanwhile, revenue is estimated to have grown 48.3% to $7.4 billion and could be as high as $7.6 billion. Gross margins are estimated at 67% and could be as high as 68%. Nvidia regularly beats estimates, so a beat is not surprising. The company will probably need to beat the high end of the range to move the stock up.

Nvidia is also a company that guides above street estimates. Currently, revenue is estimated at $7.28 billion and is seen as high as $7.6 billion. Gross margins are estimated at 67% and as high as 68.3%. A miss on estimates, whether it be on results or guidance, would be a devastating blow to the stock. Like the results themselves, guidance may need to exceed the high end of the range to satisfy investors mood given how expensive this stock is versus its historical trends to get shares moving higher again.

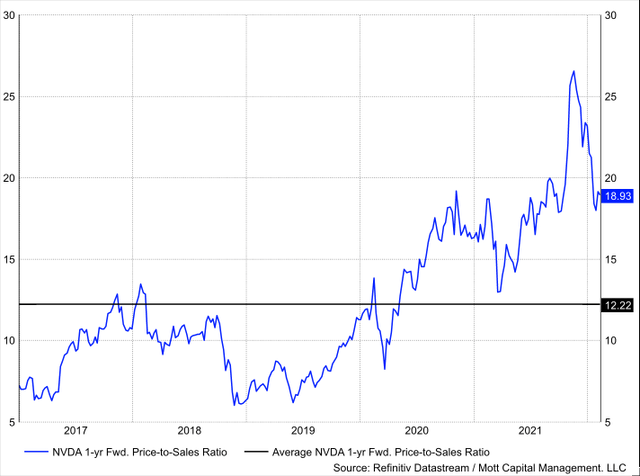

Nvidia Is Overvalued on Historical Basis

From 2017 until the end of 2019, Nvidia typically averaged a one-year forward price to sales multiple of nine, which peaked around 12-13 times sales. However, since the pandemic, the average has risen to 12, and the stock is now trading at 19 times 1-yr forward sales. At this point, the shares are trading at nearly double their pre-COVID historical average.

Datastream/ Mott Capital

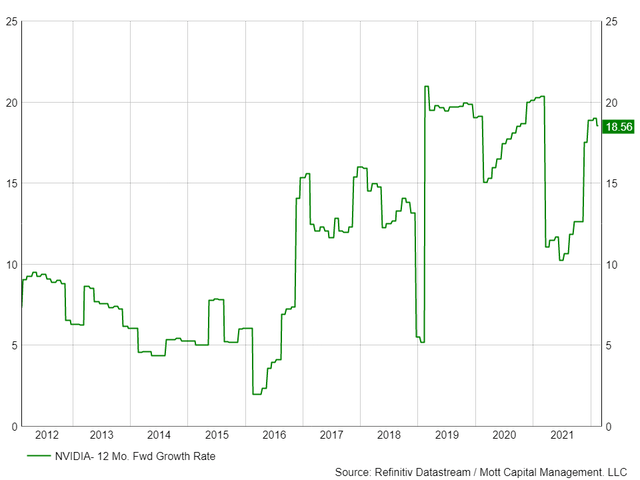

Today Nvidia's revenue growth rate is not expected to be any faster than in 2018 and 2019, when it traded for between 10 and 12 times sales estimates. The question remains whether Nvidia's deal for ARM was the reason why Nvidia shares have seen so much multiple expansion, and if so, how much did the expectation of an ARM deal act as a growth accelerant, helping to push the multiple up. Because an ARM deal would have added to revenue projections in the future, ultimately making the revenue growth rate higher, even if for just a year.

Datastream/ Mott Capital

If Nvidia fell back to its historic multiple, it would significantly drop the stock and greatly reduce the market cap. The market cap would drop to $386.1 billion, assuming a price to sales multiple of 12.2, a decline of about 35% from its current market cap of $598.7 billion. If it were to return to the historical average, not including the COVID bubble, the valuation would drop by 52.5% to $284.4 billion, using a multiple of 9. Yes, multiple expansion can significantly over-inflate a stock's value. Multiple compression would have nothing to do with future growth path either.

It's also possible to consider that Nvidia's future today is not all that different from where it stood in 2019 when the company was seeing data center sales ramp up along with solid gaming sales, and yes, even crypto-mining. Although all of this may seem like a new idea to some newer investors, and maybe they think they discovered something no one else did, they haven't. All of this growth potential was present as far back as 2018. One thing that may have changed is that the growth expectation of 2019 that was supposed to have occurred 3 to 5 years down the road got pulled forward. It could be one reason why Nvidia was eager to buy ARM, to help offset the organic sales slowdown from the pull forward of growth while taking advantage of its elevated stock price as currency.

Betting NVDA Shares Trade Below $230

It could even be why a trader is betting that Nvidia's stock falls in the weeks following the results. There has been a significant increase in the open interest of the March 18 $250 calls and puts. On February 14, the open interest for the calls increased by around 7,800 contracts, while the puts saw their open interest rise by more than 7,100 contracts. The data shows a bearish put favored spread was created with the trader buying the puts for around $20 while selling the calls for between $17 and $19.50 per contract. The trader expects the stock to stay below $230 by the middle of March to earn a profit. The further the stock falls below $230, the greater the profit. Meanwhile, the calls would expire at $0 since the shares stayed below $250.

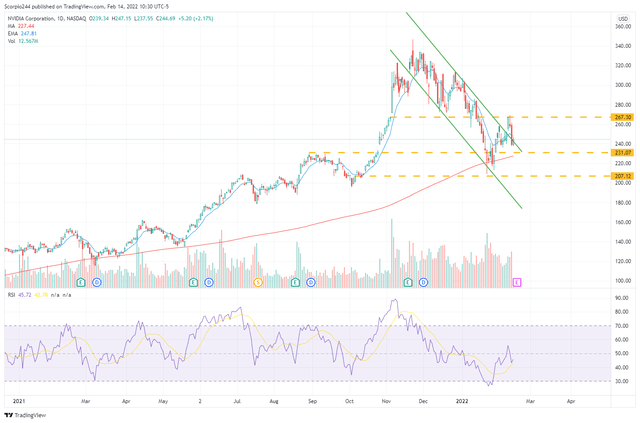

Technical Weakness

The technical chart suggests this is highly possible, as the stock is trending lower in a channel. There is support at $230, but once that level breaks, the next support level doesn't come until $207, a region that has already been tested one time just over the last month. Additionally, the relative strength is trending lower, suggesting momentum in this stock is very bearish and not oversold.

TradingView

Look, this isn't to say that Nvidia is a lousy company or has no growth prospects. It has a very positive future, but this stock is currently highly overvalued and has seen a tremendous amount of multiple expansion. While this company can undoubtedly continue to grow and even beat and raise forecasts, it may not deliver fast enough growth to satisfy the multiple the market has awarded it with because the macro backdrop is going from a period of multiple expansion to multiple contraction as interest rates rise. If this company reports a stellar quarter and gives better than expected guidance and the shares still drop, it will be a big tell about the multiple being too high.