Several indicators point to the possibility of another short-squeeze setup in AMC Entertainent's stock. Here's what investors need to know.

- AMC Entertainment's implied volatility reading suggests there's still plenty of room for price movement in this stock.

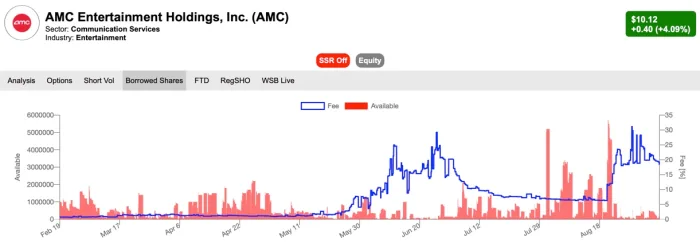

- Borrow fees — the fees short sellers pay to "borrow" stock to bet against — are close to all-time highs, indicating a lot of interest in shorting AMC.

- A rally in the broader stock market could send shares of AMC soaring.

AMC's Implied Volatility Trend

Implied volatility (IV) is a market forecast of a security's likely price movements. Usually, it increases in bearish markets and decreases in bull markets.

Supply, demand, and time value are generally the factors that determine the calculation of implied volatility. However, IV indicates a security's market sentiment based on its price range only, not on the underlying company's fundamentals.

AMC Entertainment's implied volatilitycurrently stands at 120.2. That's about 16% lower than its 20-day moving average. This points out that implied volatility is trending lower but remains super high. Apple's stock, for example, has an implied volatility of 25.1.

Generally, option contracts with lower levels of implied volatility result in cheaper option prices. Therefore, traders look to buy options in periods when the implied volatility is lower.

Also, when implied volatility is low, it's indicative that the market is not expecting the stock price to move much in the short term.

A Spike in Borrow Fee Rates

AMC's stock has jumped nearly 20% in the last five trading days. We've also seen a substantial increase inborrow fee ratesfrom the end of August to the present.

Take a look at the chart below:

Shorting costs are generally driven by utilization (the amount of shares available to sell short), availability, liquidity, volatility, and other factors that may determine asset pricing anomalies.

Also, note in the chart above that the availability of AMC shares for borrowing (in red) is at much lower levels than we saw throughout July and August.

AMC Is Still a Short-Selling Target

Finally, there's short interest.

Even though, when it comes to business fundamentals, AMC is in the best shape it's been in since before the COVID pandemic, short sellers are still betting heavily against the stock. And considering AMC's valuations, the short selling should continue.

Even though the last official data pointed out a decrease of short shares from 96.1 million in July to 89.1 million in August, roughly 17% of AMC's float is still being shorted.

High short interest is not necessarily a positive indicator. It warns that the market's bearishness on a stock may not be warranted. However, considering retail investors' continued interest in meme stocks, shorting AMC could be risky — especially when borrow fees are so high.

A Short-Squeeze Setup?

Ever since the meme-stock craze began in January 2021, short squeezes have been a big part of the AMC story. They're even listed as one of the top risks related to AMC common stock on the company'sForm 10-K.

AMC is a super-volatile trade. Traders are looking for gaps in the action to jump into cheaper options contracts.

With short sellers paying higher fees to bet against AMC, they naturally become more vulnerable — especially if pressured by AMC bulls.

AMC currently has a beta of 2, indicating a double correlation to broad market trends. Should the downtrend in the S&P 500 reverse, this will likely drive AMC's stock to rally again. So investors should be on the lookout for another short squeeze.