Initial public offering of Didi Chuxing shapes up to be one of world’s largest this year.

China’s ride-hailing company Didi Chuxing is heading for the stock market. It might not be cheap to get a ride.

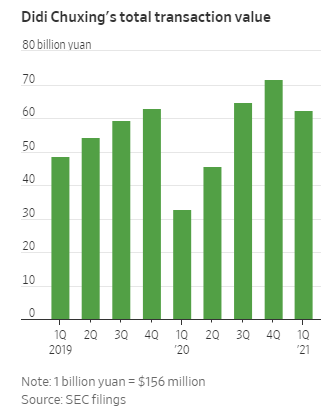

On Thursday, the Chinese companyfiled to list in the U.S.in a deal that could give the company a valuation above $70 billion, making it one of the world’s largest initial public offerings this year. The deal may helpto shift the U.S. IPO marketback into a higher gear; after a strong start of the year ithas slowed lately. Technology stock valuations have likewise retreated from their peaks. Chinese tech stocks have been hit particularly hard amid investor concerns about aregulatory crackdownfrom Beijing.

Didi’s star-studded lineup of existing investors could report big gains.SoftBank,whichhas already enjoyed windfallsfrom the buoyant IPO market, has a 21.5% stake.Ubersold its China business to Didi in 2016 in return for a stake, currently at 12.8%.

A $70 billion valuation would put Didi on about 3.2 times last year’s revenue. That might seem cheap compared with Uber and Lyft, which trade at around 8 to 9 times. But Didi’s ride-hailing business in China, which makes up nearly all of its sales, includes drivers’ earnings in its revenue, while Uber and Lyft only include their cut. Accounting for the difference, it is reasonable that Didi should trade at a much lower revenue multiple. This is still an IPO priced for growth.

Investors might want to own the share anyway, given that Didi is the only game in town for ride-hailing in China. The company has 83% of the market there, according to Euromonitor International.

That near-monopoly status could also make it a big target, though, given China’s movesto increase antitrust scrutinyof its technology companies. The company is no stranger to regulatory risk: It has been embroiled in passenger safety scandals in recent years.

Didi has also jumped on the electric-vehicle bandwagon on the basis that EVs have lower operating costs for its drivers. Last year it launched D1, its own EV. Diversification efforts outside of its core business—including to other countries and other segments such as online grocery—have brought limited success so far. These businesses only made up 7% of its revenue in the first quarter.

Investors afraid to miss out on a blockbuster tech IPO need to brace for bumps on the road.