It is fascinating that even after months of steady declines, Alibaba Group Holding Limited(NYSE: BABA) still trades at a price-to-earnings (P/E) ratio of close to 30.

Yet, there are 2 interesting developments to follow. First, the stock doesn't have a significant short interest, and second – institutional investors are slowly stepping away.

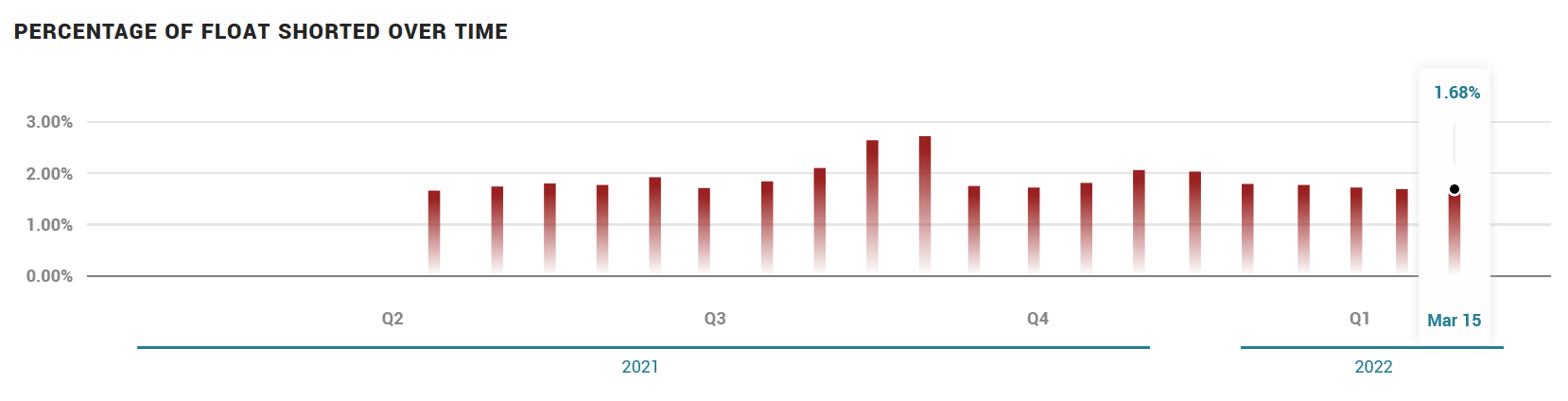

Lack of Short Interest

When we research the companies that experienced substantial declines, we often see high short interests, sometimes well into double-digits.

Yet, we cannot say the same for Alibaba. The stock lost over 65% from the peak, but short interest never went over 3%. Thus, we can conclude that this decline was not speculative but rather due to deteriorating investors' confidence to accept higher valuation.

Tracking the Ownership Change Over the Months

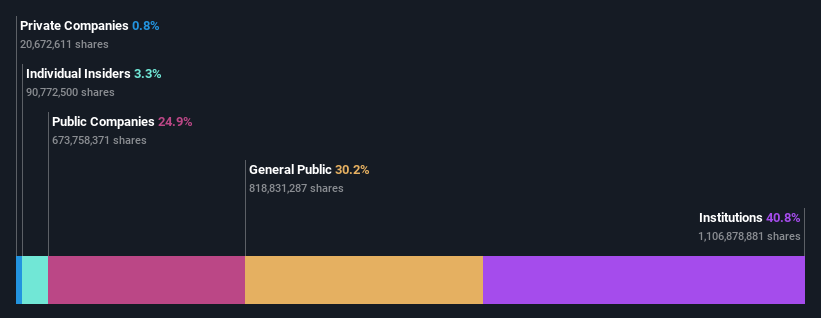

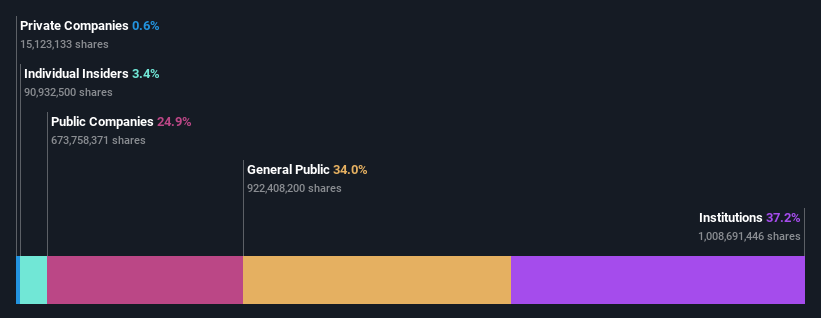

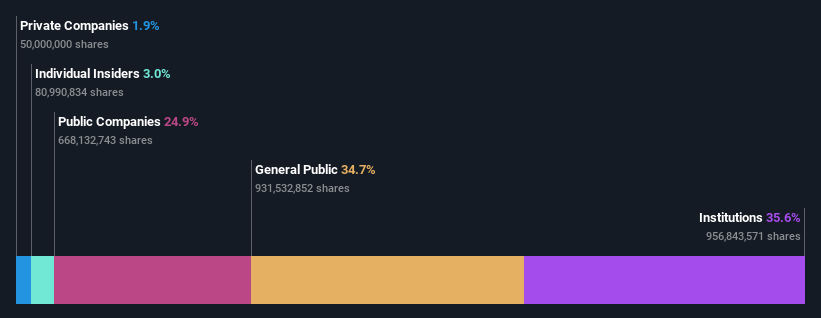

As we periodically track the ownership changes of the stock over the months, here are 3 snapshots from the last few quarters.

1. August 2021

2. December 2021

3. April 2022

As you can see from the trend, individual insiders have trimmed their stake while private companies boosted it.

However, the most significant change is the decline of institutional interest as they dropped about the same size of shares that retail investors picked up.

What Does This Mean for Investors?

All of the retail investors' favorite stocks that experienced significant rallies in the short term did so because of short-squeezes. These were stocks with exceptionally high short interest, usually deep into double-digits.

Yet, at the moment, Alibaba has a short interest of 1.68%. While this doesn't mean a short-term rally cannot occur. As recently as one month ago, the stock rallied over 50%. A retail-driven short-squeeze is unlikely due to a lack of short-sellers.

As for the ownership changes, there are 2 observations – both of which are negative. The first one is the lack of insider buying after a significant decline. If anything, insiders decreased their stake from 3.3% to 3%. The second one is a gradual decrease of interest from institutional investors, who slowly reduced their stake by over 5%. While institutions make mistakes like everyone else, their decisions are generally classified as informed.