Stock futures decline, while Russian shares jump and oil prices edge higher

U.S. stocks were poised for further volatility, as investors sought to make sense of the potentially far-reaching implications of war in Ukraine for individual companies and the wider economy.

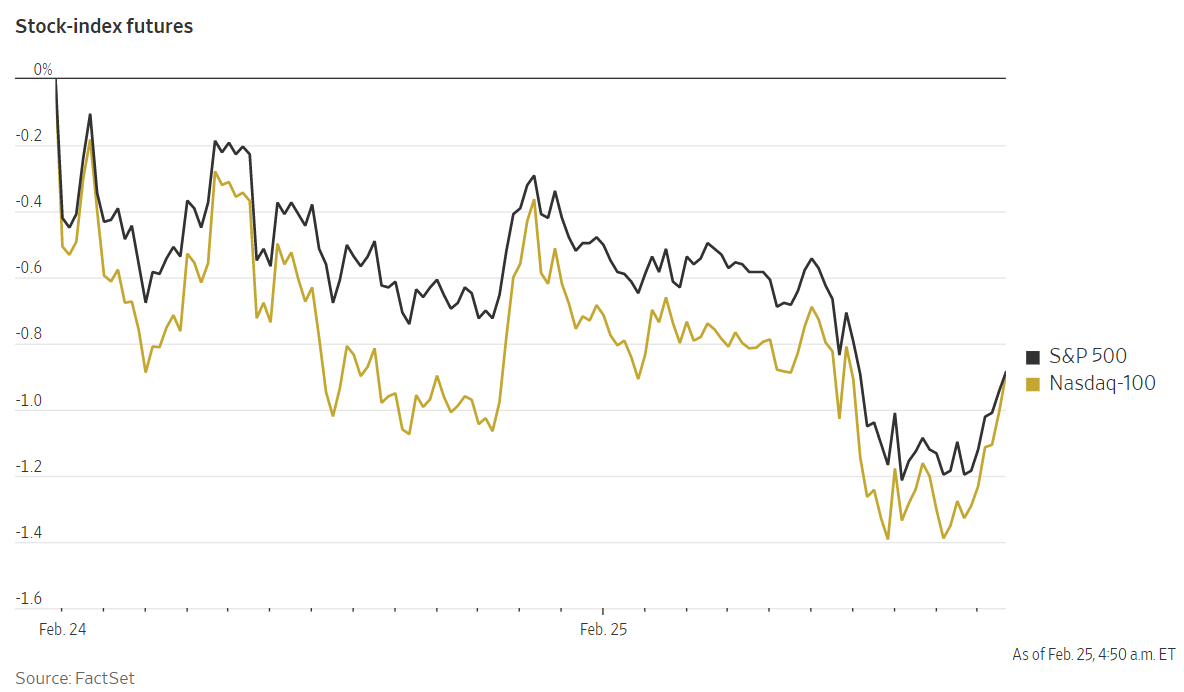

Futures for the S&P 500 fell 1.2% Friday, a day after the benchmark index capped a wild trading session by closing 1.5% higher, as investors piled into growth and technology stocks. Futures for the Dow Jones Industrial Average fell 1% and those for the technology-focused Nasdaq-100 lost 1.4% Friday.

Overseas, markets regained some poise after sanctions laid out by President Bidenstopped short of some of the most severe measures investors had thought might be on the table. Russia’s Moex stock-market gauge, which endured a historic blow Thursday, rose 12.9%.

The Stoxx Europe 600 rose 0.7%, led by shares of resource and travel companies. Japan’s Nikkei 225 rose 2%, and the CSI 300, which comprises the largest stocks listed in Shanghai and Shenzhen, rose 1%, after both fell Thursday. Hong Kong’s Hang Seng Index slipped 0.6%.

In energy markets, futures for Brent crude, the global oil benchmark, rose 1.5% to $96.81 a barrel, while European natural-gas prices retreated by almost a quarter after rocketing Thursday.Brent topped $100 a barrel early Thursday before falling back.

Russian forces renewed bombing Ukraine early Friday, with central Kyiv rocked by explosions. Investors are pondering how the fighting, its effect on commodity markets and retaliatory Western sanctions will ripple through a world economy already grappling with elevated inflation and coming interest-rate rises by major central banks.

The U.S. and its allies have laid out stiff restrictions on Russian companies and their ability to interact with the international financial system. The European Union will formally sign off on sanctions Friday that willc ut 70% of Russia’s banking system off from international financial markets. Officials in Ukraine, the Baltics and the U.K. are calling for the sanctions to go further, cutting Russia off completely from infrastructure that ties together banks around the world.

“I do not think that this highly volatile period is already coming to an end,” said Daniel Egger, chief investment officer at St. Gotthard Fund Management. “Right now we have to focus now on what’s happening in Kyiv, how bloody the coming days will be, and I would say definitely the Russian sanctions still can be stepped up.”

In bond markets, yields fell in a sign investors still sought the safety of safe-haven assets. The yield on the benchmark U.S. 10-year Treasury note declined to 1.949% from 1.969% Thursday. Yields and prices move inversely. Gold prices, however, slipped 0.7% to $1,914 a troy ounce.

Among individual European stocks, some companies that were hammered at the start of Russia’s attack clawed back some lost ground. Russian gold producer Polymetal International rose 14%. Hungarian budget airline Wizz Air rose 4.9%. But banks with exposure to Russia or commodity markets came under pressure, including ING Groep,Société Générale and UniCredit. Shares of British arms and aerospace company BAE Systems, which has gained on the prospect of higher defense spending, added a further 4.3%.

“It looks like the military action in Ukraine could be protracted,” said Yung-Yu Ma, chief investment strategist for BMO Wealth Management in the U.S. In this case, short-term market movement is difficult to predict, he said.

Rapid inflation and the prospect of tighter monetary policy were complicating the outlook for some traditional safe-haven assets such as Treasury bonds, the U.S. dollar and gold, Mr. Ma added.