Summary

- Skillz is growing rapidly, with the potential for sales to accelerate as the company enhances monetization and completes the Aarki acquisition.

- The company enjoys fantastic margins which should lead to profitability without much struggle. Skillz has enough firepower to sustain several money-losing quarters without any dilution, regardless.

- Additionally, the stock is position greatly for a short squeeze based on its technicals, at a time when the Reddit army is actively looking for such opportunities.

- We are taking advantage of the increased volatility and high premiums to sell PUTs with the potential for massive returns.

If you have been paying attention to market news lately, you may have noticed the short squeeze frenzy caused by Reddit's Wall Street Bets community. Wall St. Bets Redditors have collectively bought stocks featuring a high short interest in bulk, shooting the so-called "meme stocks" to the skies and beyond.

Examples include the following stocks:

- Bed Bath & Beyond(NASDAQ:BBBY)

- BlackBerry(NYSE:BB)

- Virgin Galactic(NYSE:SPCE)

- Wendy's(NASDAQ:WEN)

- Rocket Companies(NYSE:RKT)

- ContextLogic(NASDAQ:WISH)

- Palantir(NYSE:PLTR)

- GameStop(NYSE:GME)

In this article, we want to share our thoughts on another highly shorted stock, Skillz (SKLZ), whose rapid growth and favorable technical indicators are likely to cause a short squeeze. This could send shares soaring in the short term as shorts begin purchasing stock in the panic of potentially higher losses.

The possibility that Skillz may become one of the next targets of the Wall Street Bets army due to its high short interest is certainly a welcome factor, though not one we necessarily rely on it.

In this article, we won't go through Skillz's business model and growing ecosystem as many S.A. authors have already sufficiently explained the company's merits with great detail. Instead, let's examine why Skillz's growth rates and technical indicators are likely to cause a short squeeze and how we have set up our own position.

A rapidly growing company

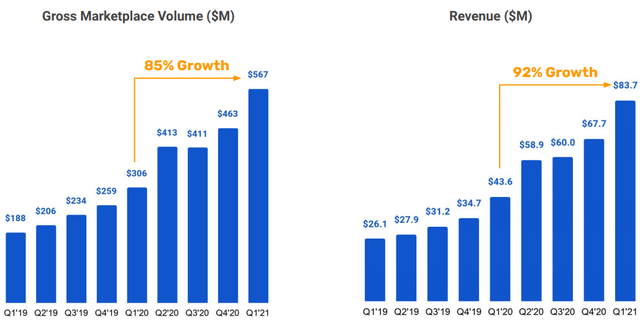

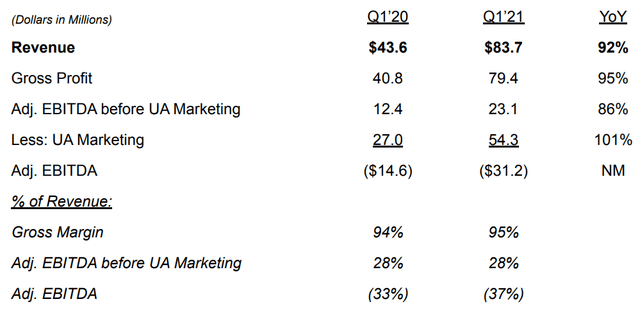

Skillz deliveredanother quarter of strong performance in Q1, achieving its 21st consecutive quarter of revenue growth. The company generated 92% of revenue growth year-over-year, primarily as a result of 81% growth in paying monthly active users. In addition, we want to highlight that revenue growth was much more substantial than the one achieved in Q1-2020 (67%), suggesting an acceleration.

Hence, the revenue growth projected by analysts over the next couple of years seems a bit gloomier than it should. Especially considering that the company has not even begun monetizing its non-paying users, which could accelerate revenue growth further if it decided to do so.

As a side note, not monetizing its non-paying users also speaks of two qualities by the company worth. First, Skillz does not attempt to squeeze every bit of extra revenue immediately after its public listing to impress investors quickly. Secondly, the companyoptimizesits marketing budget to acquire paying users, not installs. This is very distinct from other mobile gaming companies that monetize via advertising, mindlessly trying to attract the largest number of eyeballs possible. This tells us that the company is in it for the long term, executing thoughtfully.

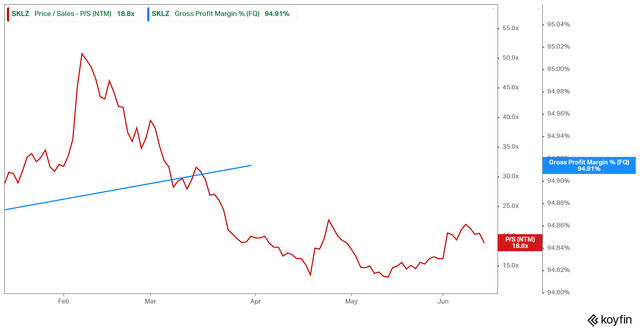

In any case, analyst expectations make little sense based on the company's current growth trajectory, and we expect sales growth to be more substantial. Moreover, sales growth becomes even more exciting when we consider the company's potential profitability powered by its ultra high-margin business model. The company enjoys gross margins of 94%, which indicates plenty of room for a rich bottom line as the company continues to scale.

Finally, the company ended the quarter with a strong balance sheet, including $613 million of cash. The company also recently struck a deal to acquire Aarki for $150 in cash and stock (another catalyst for accelerated revenue growth) as well). Thus, even if the whole company was to be acquired in cash only, Skillz would still have enough gun powder to sustain several quarters of losses (at its current run rate) without the need to raise extra funds.

We hence don't expect any further dilution, which could support the short case amid the additional sale of shares. This, of course, does not include dilution resulting from more acquisitions, which are going to (hopefully) benefit the company financially, and in which case they are welcome.

Finally, the company has no debt on its balance sheet to pressure its bottom line further. Considering the fat gross margins, it should not struggle to turn green if the company pursues the profitability road.

When everything is taken into consideration, the stock could easily attract a higher valuation multiple. We believe that Skillz's revenue growth rate and juicy margins could easily support a P/S ratio of around 25, suggesting upside regardless of a possible short squeeze scenario.

The technicals and our play

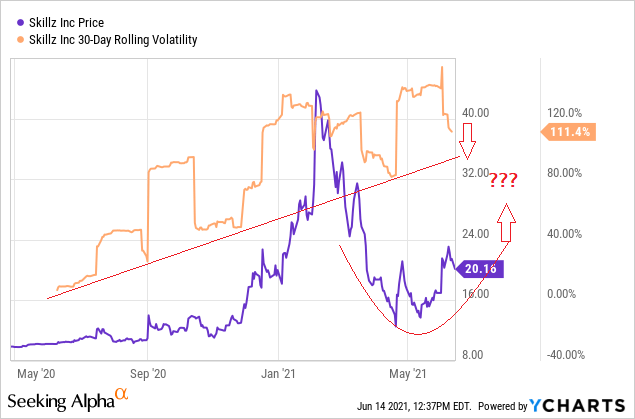

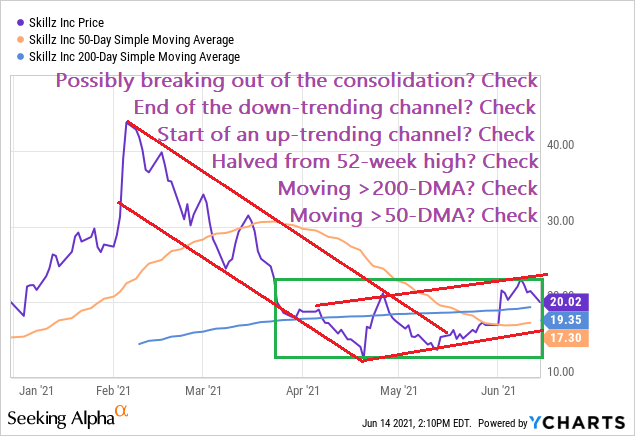

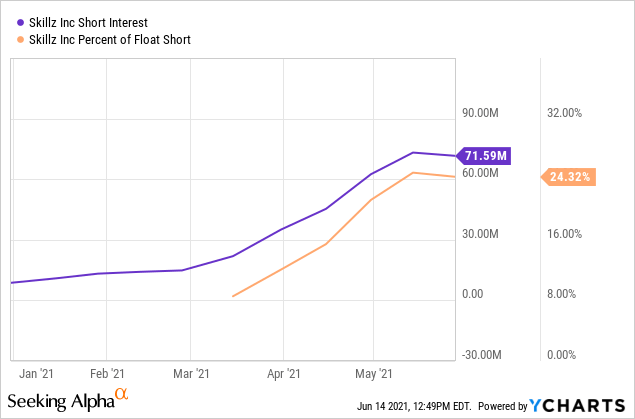

Now, let's move to the technicals, which, combined with Skillz's growth metrics and healthy financials, could result in a short interest decline in the short term.

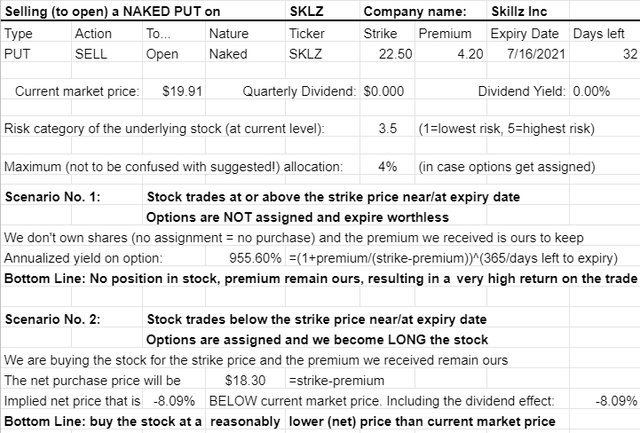

Firstly, we chose to sell PUTs to take advantage of the stock's high volatility, which translates to higher premiums. By selling PUTs here, we are finding the optimum point between a low price (of the underlying stock) and the high volatility (normally, there is a trade-off between the two.)

Then we are checking most (in this case, all) the main (technical) boxes. One could argue that these don't guarantee anything, of course, but the technicals here are surely looking encouraging.

Then, we are checking the stock's short interest, which is peaking/has peaked.

Everything combined creates the perfect setup for a short squeeze at a time when the Reddit army is attacking anything that looks like a potential.

However, we are always aiming for an additional margin of safety to mitigate our risk and narrow our total return expectations. By selling PUTs, we are not jumping in at all costs. Either making massive returns (see below) on these short-term options or buying the stock at a lower price while enhancing the predictability of our total returns.

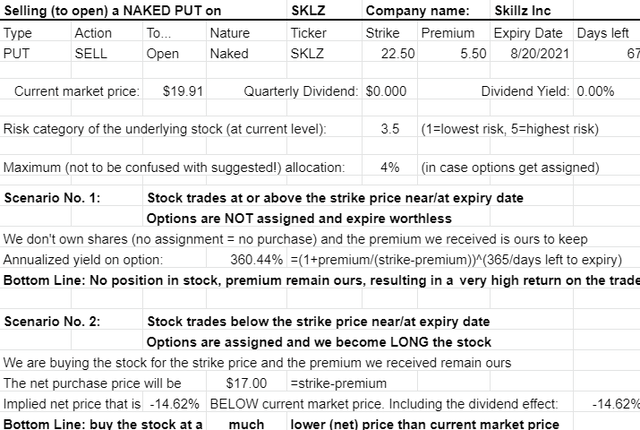

Here are the possible scenarios out of selling our PUTs:

- SELL (to open) SKLZ 07/16/2021 22.50 PUT @ $4.20

- SELL (to open) SKLZ 08/20/2021 22.50 PUT @ $5.50