Apple stock remains Berkshire Hathaway’s number one position, by far. The Apple Maven explains why, despite the AAPL stake having been trimmed, Warren Buffett and team remain bullish.

Warren Buffett’s Berkshire Hathaway (ticker $BRK.A) has just disclosed its first quarter 2021 holdings. Once again, Apple stock (ticker $AAPL) was the conglomerate’s number one position, at a total portfolio allocation of 40%.

Today, the Apple Maven reviews (#1) what has changed in Berkshire’s AAPL ownership since last quarter, (#2) what the implications might be for Apple investors, and (#3) other noteworthy changes in the Oracle of Omaha’s portfolio.

#1. AAPL is still king

As of the end of the first period 2021, Berkshire Hathaway owned nearly 890 million shares of Apple stock. Priced at last quarter-end’s $122.15, the holding represented a $108 billion stake in the Cupertino company’s equity.

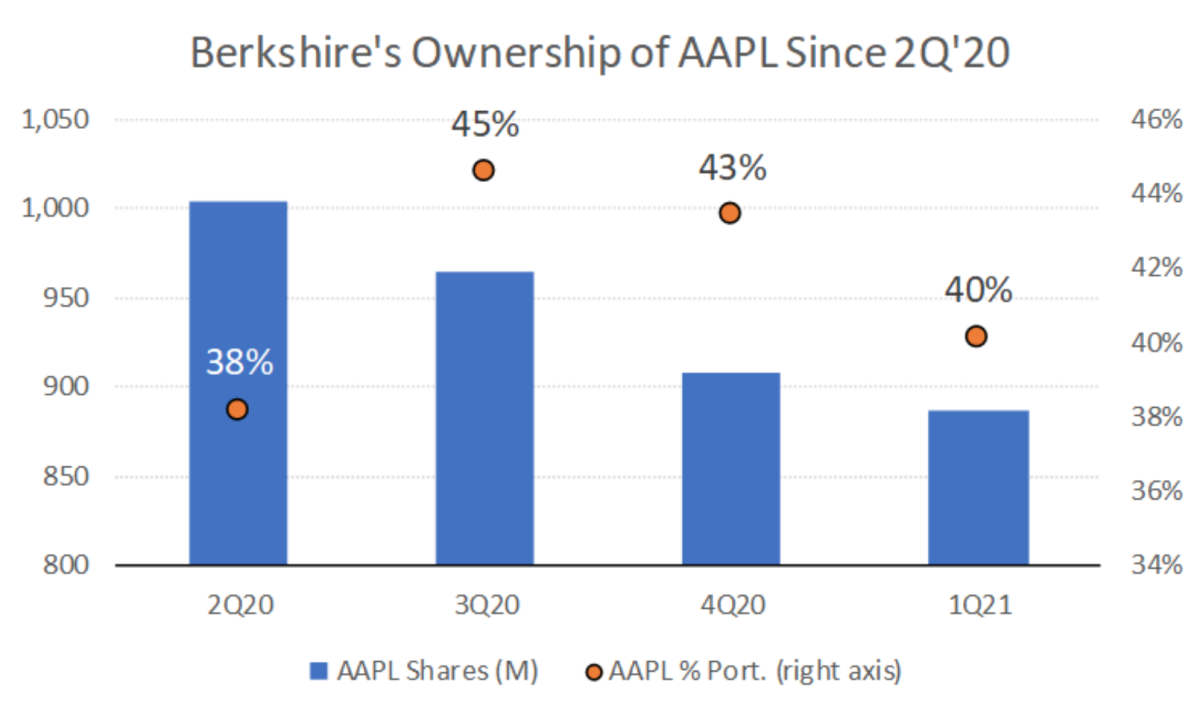

The chart below underscores a couple of interesting facts about Berkshire Hathaway’s AAPL ownership over the past four quarters:

- Number of shares owned has decreased progressively and consistently from a bit over 1 billion in the second calendar quarter 2020 (adjusted for the August 4-to-1 split).

- AAPL’s position relative to total portfolio value spiked in the third quarter 2020, alongside Apple share price, reaching a peak of 45%. Now, following some position trimming and the stock’s correction in the past six-to-eight months, the allocation has dipped to 40%.

#2. Is Buffett less bullish?

One top-of-mind question that Apple investors might have is whether Warren Buffett and his team have become less bullish on AAPL. Afterall, Berkshire seems to own less Apple stock by the quarter.

In my view, the answer is no. In fact, Warren Buffett himself has explained why trimming AAPL does not necessarily mean owning less of the Cupertino company. The trick has been possible due to Apple’s stock buyback efforts. Below is Mr. Buffett’s quote,from a few months ago:

“When we finished our purchases in mid-2018, Berkshire’s general account owned 5.2% of Apple. […] Since then, we have […] pocketed $11 billion by selling a small portion of our position. Despite that sale – voila! – Berkshire now owns 5.4% of Apple. That increase was costless to us, coming about because Apple has continuously repurchased its shares, thereby substantially shrinking the number it now has outstanding.”

To be fair, I had hoped to see a small increase in Berkshire’s AAPL stake in the first quarter.As I explained recently, Buffett could see the recent correction in Apple shares as an opportunity to buy. Not only that, Buffett’s right-hand Charlie Munger has evenarguedthat Berkshire should not have sold Apple stock in 2020.

Instead, I will have to be content with Berkshire’s mere 2% position trim since last quarter, compared to a 6% and 4% reduction in the fourth and third quarters of 2020, respectively.

#3. Other important portfolio changes

The Apple Maven cares about Apple stock first and foremost. However, in the first period of 2020, two stocks stood out after having been dumped by Berkshire; and one, for having been bought aggressively.

- Wells Fargo (ticker $WFC), one of Berkshire’s long-time but lately unsuccessful Big Bank holding, was effectively removed from the portfolio. Shares of the company were down about 0.5% in after-hours trading.

- The Chevron (ticker $CVX) position was slashed in half to now account for less than 1% of the portfolio. This could have been the result of oil and gas stocks having rallied so far and so fast over the past few months.

- Kroger (ticker $KR) saw its allocation roughly double quarter-over-quarter to 0.7%. The stock traded up 1.1% on Monday after hours.