Summary

- Intel will likely spend more than $100 billion in building new fabs in the next 5 years.

- Meanwhile, AMD continues to sub-contract its chip production to others.

- Intel's IP (Intellectual Property) should give it an advantage in the chip-making market.

- The ARMy is coming for both Intel and AMD.

Intel(NASDAQ:INTC) and AMD(NASDAQ:AMD) have been competitors for more than 50 years. Both were founded by former Fairchild Semiconductor International engineers, Intel in 1968 by Gordon Moore, and AMD in 1969 by Jerry Sanders.

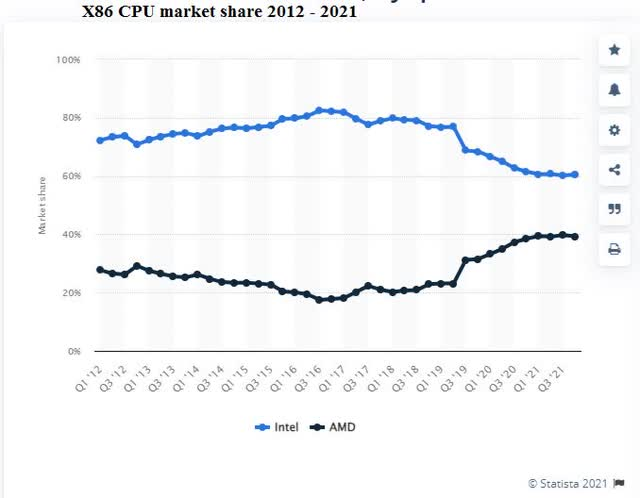

Fast forward to the 21st century and Intel dominated for the first 15 years, but AMD has made huge progress in the last five years and is now considered by many to be the superior technical innovator of X86 CPUs.

But as we look forward to the next five years, who will dominate? I would argue that the future will be much different than the past with the competitive situation between the two still prominent but the overall businesses themselves will diverge significantly by 2025.

I have written over 50 articles on the two companies and have been especially praiseworthy of AMD and its uber-CEO, Lisa Su. But over the next five years and beyond, I see less direct technical competition as Intel massively diversifies into the chip manufacturing business as well as maintaining its traditional CPU market.

In 2018 I wrote this about AMD and the management skills shown by its new CEO Lisa Su "AMD: 5 Reasons The Shorts Will Be Changing Their Shorts Shortly" while critiquing Intel in this article "Intel: There Are No Tails Big Enough To Wag This Dog".

Here are four points to consider when deciding whether to invest in AMD or Intel.

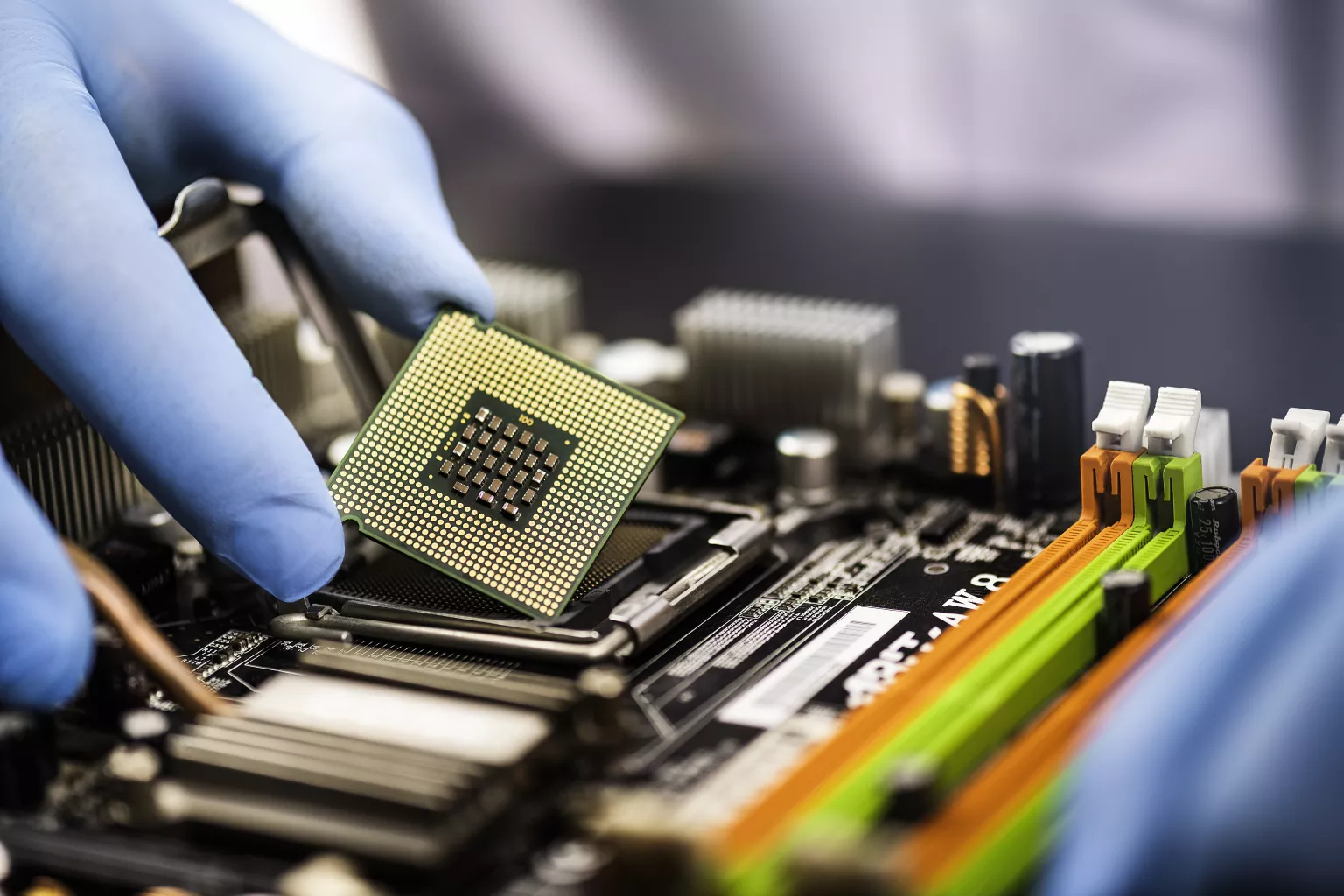

1. Intel will likely spend more than $100 billion in building new fabs in the next five years.

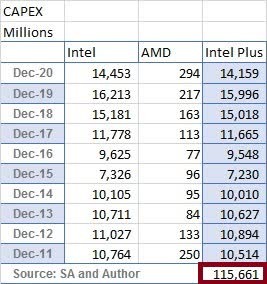

Intel is known for its large CAPEX spending ($65 billion over the last five years) but as it moves deliberately into the chip manufacturing business, that number will become much larger.

The chip shortage has made many countries realize they cannot depend upon overseas sources, to make their chips anymore. And to make sure it doesn't happen again they are handing out billions to companies like Intel to make fabs in their country so that their manufacturers can have enough chips to keep their factories (and employees) working around the clock.

In the US the bi-partisan CHIPS Act has already passed the Senate allocating a total of $52 billion to new chip facilities built in the US(see here). I would think Intel would get a good share of that $52 billion.

Also on the docket is the FABS act which would grant 25% tax credits to companies building new fabs in the US.

And Italy and Intel are talking about a $9 billion plant investment.

- The talks between Intel and the Italian government over the U.S. chip giant building an advanced semiconductor packaging plant are "intensifying," with a total package said to be worth more than 8 billion euros, or $9 billion,Reuters reported.

In the meantime, Intel has announced it is spending $20 billion on two fabs in Arizona with the possibility of another $95 billion worth in Europe which Intel CEO Pat Gelsinger called "big honkin’ fab". Big indeed.

All this leads one to think that in the near future Intel's business will be much less dependent on X86 proprietary chips and more as perhaps the most prominent semiconductor manufacturer in the world.

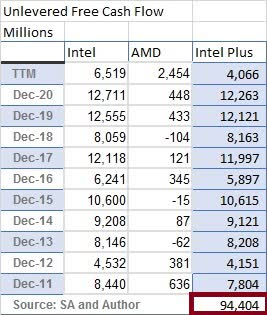

Why can Intel afford to invest so much in production? Since 2011, Intel's huge cash flow dwarfs AMD's by over $90 billion and that's after spending over $115 billion on CAPEX over the same time period.

This means at this point in their existence they are two very different companies with very different futures.

2. Meanwhile, AMD continues to sub-contract its chip production to others.

AMD stopped making its own chips in 2008 when it sold its foundries to Global Foundries. Since then it has used both Global Foundries and Taiwan Semiconductor(NYSE:TSM). So basically, AMD has become a chip designer with production done by others. It has proven its adeptness at design by gaining market share in the X86 market vis a vis Intel.

However, that comparison can be somewhat deceiving since Intel's revenue has increased each year of the chart though AMD's revenue has grown much faster. Currently, Intel's revenue is still 5X AMD's.

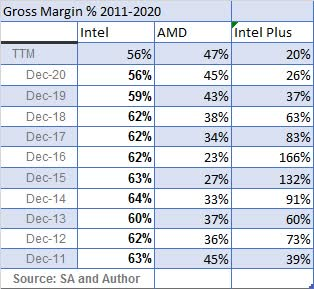

Typically, one of the negatives of not making your own chips is lower margins as can be seen with this Intel/AMD margin comparison.

Although AMD is catching up, Intel still has a substantial margin advantage.

3. Intel's IP (Intellectual Property) should give it an advantage in the chip-making market.

Intel has more than 60,000 patents total including thefifthmost in the world in 2020.

In fact, just in December 2021, Intel filed more than 170 patents with most of them having to do with process technology.

By offering to combine their proprietary technology with their customer's technology, Intel can offer better results for the same price.

4. The ARMy is coming for both Intel and AMD.

Many companies including Apple "Apple May Build 40-Core ARM-Based Mac Pro, Plans 10-Core MacBook Pro", Google" Google is designing its own Arm-based processors for 2023 Chromebooks", and Amazon"Category: Graviton"are going with ARM chips for their proprietary chip needs.

The advantage Intel has in the case of customers going to ARM is to fabricate those ARM chips in their fabs using their proprietary technology to make a superior product. With the huge number of fabs Intel is building they will also be able to provide better delivery times and volumes too.

AMD, on the other hand, will have to make their X86 even more superior than it is now and that will be no easy trick. They don't make their own chips so they can't possibly manufacture any chips for others.

AMD's customer base is very concentrated with the top five customers, including HP, Microsoft, and Sony, representing 54% of overall revenue and 70% of graphics revenue. It would be hard to imagine that those customers are not considering ARM for at least some of their chip requirements.

Conclusion: Is Intel or AMD Stock the Better Buy?

As the 50-year competition between Intel and AMD moves forward, big changes will be coming for both companies, but especially Intel.

Intel will become one of the biggest fabricators in the world while AMD continues its innovation success under Lisa Su. Intel is also moving on to other technology revenue sources such as autos with Mobileye and a new ARM competitor SiFive. SiFive has developed a RISC (Reduced Instruction Set Computer) that could replace ARM in phones as well as other devices.

Here's SiFive's CEO Patrick Little:

"By 2023, you're likely to see the first mobile phone with RISC-V," SiFive Chief Executive Patrick Little said in an October interview. "I think we have an excellent shot at the phone."

Source: MSN

If that does come true, the chips for both Mobileye and SiFive will be manufactured on one of Intel's fabs using both SiFive's and Intel's proprietary technology to take on ARM head to head.

Decades ago it looked like AMD founder Jerry Sanders was channeling the future, Lisa Su:

"We’re winning the fight, but they are a very formidable competitor. Intel has managed to put everybody else out of the business except us. So it's a two-man game right now. We're the challenger, they're the champion. But I think we've got a great chance here to continue to gain market share."

Exactly right I would say.

With a forward PE of 10 and a growing 3% dividend, Intel is a low-risk option on the rapidly accelerating chip-future of the world regardless of the task at hand. AMD, with a PE of 55, is certainly riskier but has proven itself to be more than competitive over the last five years. Never count Lisa Su and AMD out.

In my opinion, Intel is the better choice for the next five years because of its unique ability to expand fabs worldwide and its rather mundane expectations, and very modest PE ratio.

Intel is a buy if you have a five-year plan.