Summary

- We share data on 50 high-growth "pandemic darlings" that have sold off extremely hard, and with a special focus on Palantir.

- We go into the details on Palantir positives and negatives (including TAM, growth, leadership, products, margins, profits, valuation, government versus commercial, share-based compensation, dilution, and industrywide challenges).

- We also dive deep into the very ugly macroeconomic reasons to stay bearish on the market (things can still get much worse) and on Palantir, especially in the near term.

- After reviewing three high-growth stocks in total from the list, we conclude with some important takeaways and our strong opinion about investing in Palantir and in the current market environment.

After the initial pandemic shock in 2020, certain high-growth stocks performed well. Extremely well. Bolstered by extraordinarily low interest rates and a new crowd of "work-from-homers" (with newfound time to "invest") it seemed the sky was the limit. Until it wasn't. Flash forward to now, the markethas fallen sharply this year (especially high-growth stocks), and there is no short supply of reasons to stay bearish. Very bearish. In this report, we share data on 50 high-growth stocks that have crashed, run through a list of compelling reasons (data points) to stay bearish, and then discuss the merits of three interesting high-growth stocks from the list that have crashed particularly hard, with a special focus on pandemic darling, Palantir (NYSE:PLTR), including its positive and negatives (such as total addressable market, growth, leadership, products, margins, profits, valuation, government versus commercial, share based compensation, dilution and industrywide challenges). We conclude with some important takeaways and our very strong opinion about investing in Palantir and investing in this market in general.

50 High-Growth Pandemic Darlings That Crashed

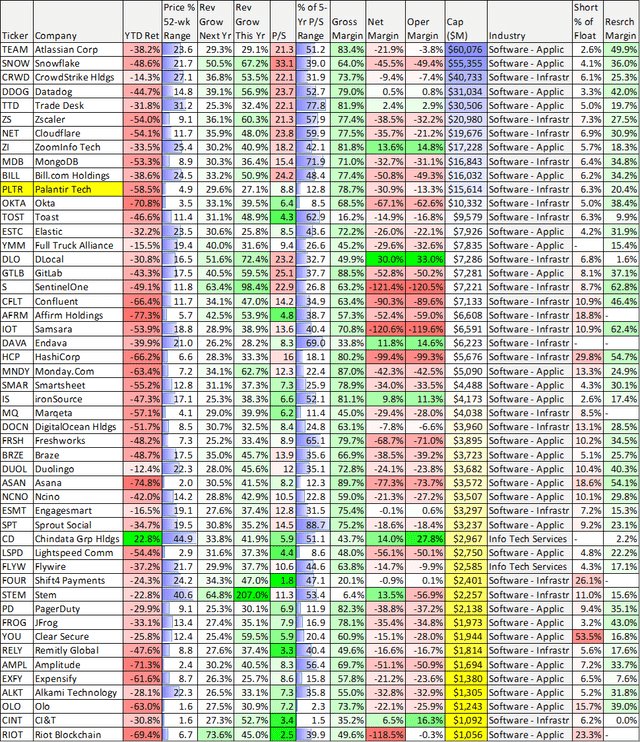

For starters, here is a look at 50 high-growth "pandemic darling" stocks (concentrated in software industries) that have crashed hard this year. The table is sorted by market cap, and you likely see at least a few that you are very familiar with.

Stock Rover

A lot of conservative value-oriented investors take a lot of satisfaction seeing the sharp declines this year. They warned (often loudly) that valuations were absurdly high considering many of these pandemic darlings have never even generated a profit. What's more, there are a lot of very compelling reasons to stay bearish on these stocks (such as high inflation, rising interest rates, lingering pandemic supply chain issues, a war in Europe and indications that corporate profit estimates are still too high based on the federal budget deficit) as we will cover in more detail in a later section of this report. But first, let's take a look at one of the most hyped stocks in recent history, that rose dramatically during the pandemic, and has now fallen very hard, Palantir.

Palantir: Pandemic Stock Poster Child

Palantir is basically a data-mining software company that has strangely generated a cult-like internet following since its September 2020 IPO (despite the fact that it has existed since 2003). Perhaps it's the company's secret government contracts that had so many investors mystified, or its expansion into the non-government Software-as-Service business at exactly the time when those stocks were being most hyped (because artificially low interest rates by the Fed dramatically magnified the present value of "possible" future earnings for those types of stocks) or maybe even its unusual name (it's named after a mystical, all-powerful seeing stone in "Lord of the Rings"). Whatever the case may be, Palantir shares soared to very high valuations (for example, see how its current price-to-sales multiple compares to its 5-year (technically 2-year) range in our earlier table above).

Palantir Positives:

Before getting into the very negative things working against Palantir in the next sections of this report (both company-specific and macroeconomic) let's first consider a few of the good things the company has going for it.

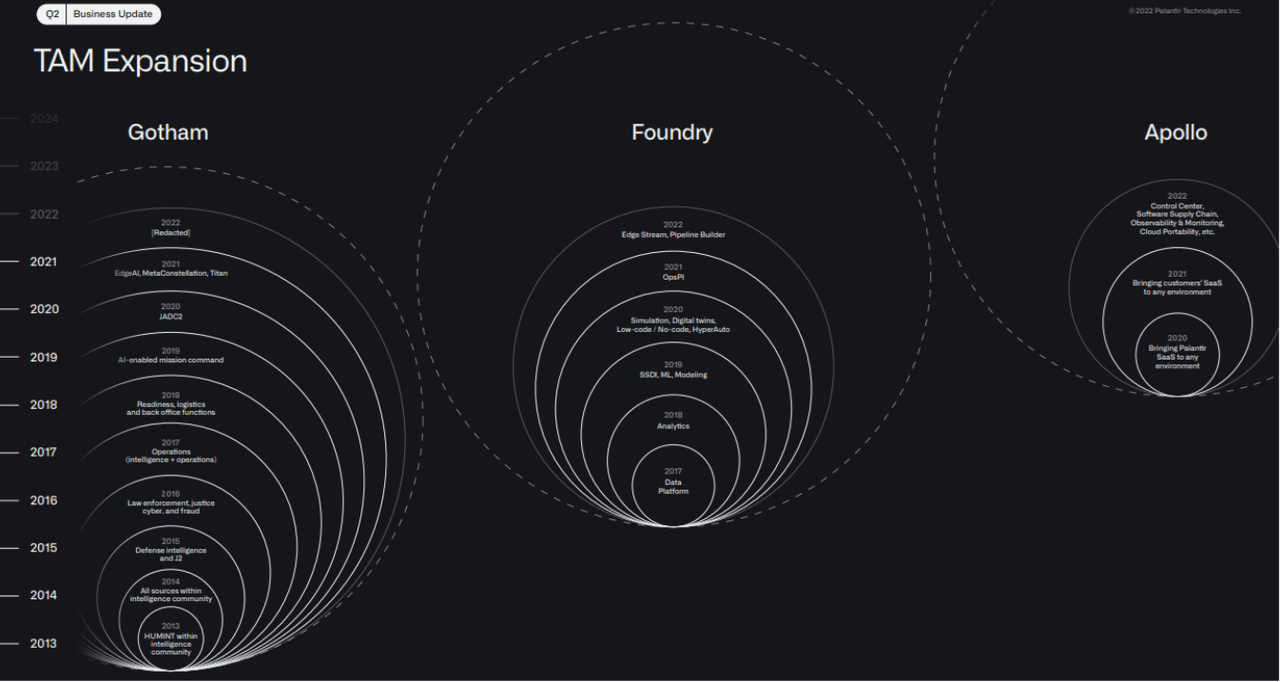

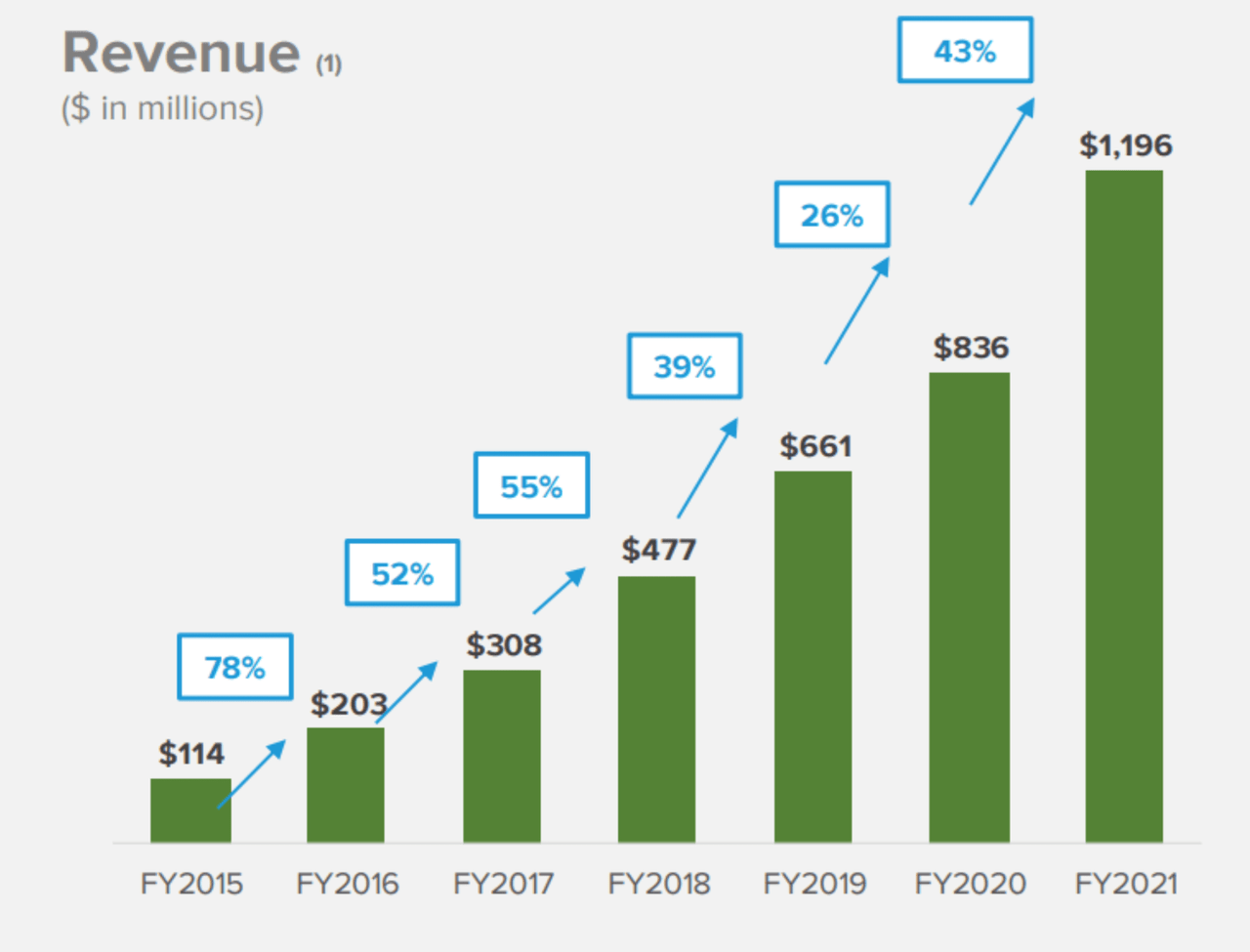

Three things to look for in a growth stock: For starters, three big things many long-term growth investors look for in a stock are a founder CEO (check: CEO Alex Karp cofounded Palantir), a very high revenue growth rate (check: the 3-year revenue CAGR is 41%, and it is expected to keep growing rapidly, per our earlier table) and a very large Total Addressable Market (check: see the "TAM" graphic below from Palantir's latest investorpresentation).

Palantir Investor Presentation

Large TAM: Specifically, as you can see in the chart above, each of Palantir's major businesses have continued to grow rapidly over time and continue to have large growth potential (dotted line). For reference:

Palantir Gotham is a software platform that enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants, as well as facilitates the handoff between analysts and operational users, helping operators plan and execute real-world responses to threats that have been identified within the platform.

Palantir Foundry is a platform that transforms the ways organizations operate by creating a central operating system for their data; and allows individual users to integrate and analyze the data they need in one place.

Apollo is a software that enables customers to deploy their own software virtually in any environment.

And according to CEO Alex Karp during the latest earnings call:

"We have 5 of the most interesting, important and crazy baller, impactful products in the world: PG, Foundry, Nexus Peering, MetaConstellation and Apollo, all of which were built before their time, all of which have made a 41% CAGR possible."

More specifically, in his latest letter to shareholders, Karp explained:

"Our platforms consist of more than 700 component parts and 65 separate applications...Each one of those component parts has the potential to become a dominant and standalone software product in its own right."

Further, Karp had this to say about TAM:

"We are working towards a future where all large institutions in the United States and its allies abroad are running significant segments of their operations, if not their operations as a whole, on Palantir.

Most other companies are targeting small segments of the market."

Founder CEO: Further, Karp is a strong leader constantly building the brand by highlighting the strengths of the products (for example, on the call he explained "their quintessential attribute that large companies, which essentially control distribution, cannot easily copy them or if at all"), and the long-term anti Wall Street approach to the business (for example, Karp says "we run this company as owners, and we do not run it purely to actually make people happy quarter-to-quarter.").

Client Growth: In addition to high revenue growth, Palantir continues to grow its clients (which have a very high retention rate - Palantir ended Q2 2022 with net dollar retention rate of 119% - high retention is often typical for the very attractive SaaS business model)

High Margins and Strong Innovation: Palantir has very high gross margins (see our earlier table), and strong innovation (as per its high research margin and strong expansion into non-government clients).

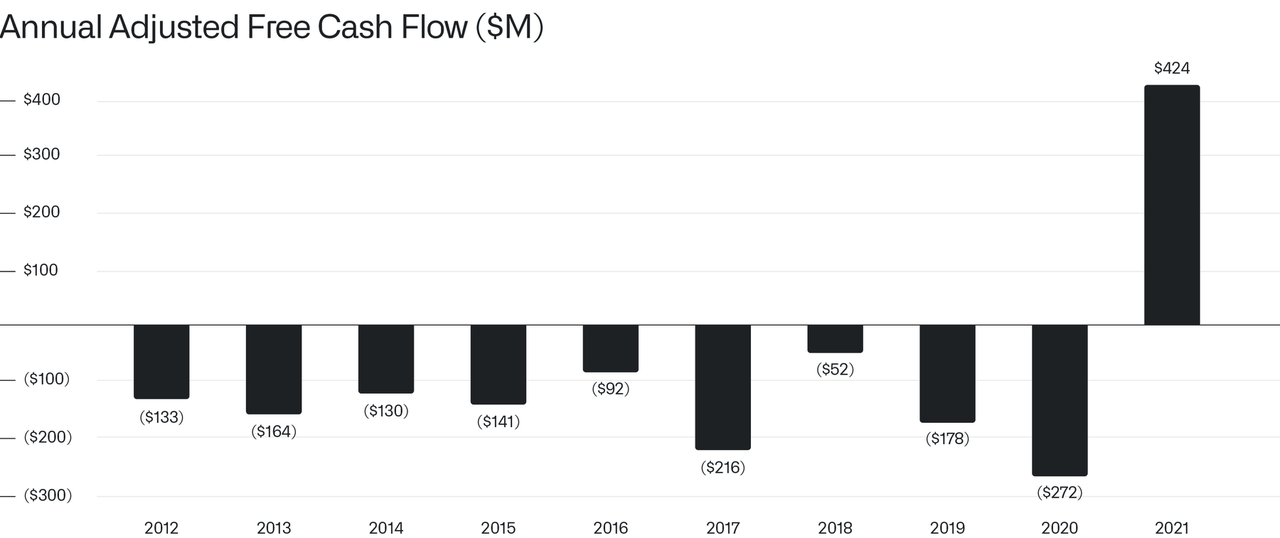

Improving Bottom Line: Like a lot of high-growth business, Palantir is not yet profitable. And while this may sound like a big negative (especially considering the company has been around for almost 20 years) it is actually by design. Specifically, Palantir continues to spend heavily to capture attractive revenue growth opportunities (the types of revenue growth opportunities other companies wish they had). Moreover, Palantir's losses are shrinking (it's moving towards profitability). Per the shareholder letter, Palantir is now strongly free cash flow positive, and per the quarterly call, Karp expects to be "a profitable company in 2025."

Palantir Shareholder Letter

As unattractive as it is to some, Palantir's decision to focus on revenue growth over bottom line income (for now) is the right decision in terms of maximizing long-term shareholder value (whether or not you are the right type of shareholder - you probably already know - but we will address this topic in the conclusion of this report).

Increasingly Reasonable Valuation: And of course, Palantir's valuation multiples are dramatically lower than they were (price-to-sales is now only 12.8% of what it was, per our earlier table) and relatively attractive as compared to peers and as compared to its high revenue growth and large TAM.

Despite the dramatic share price sell off (shares currently sit at only 4.9% of their 52-week price range), Palantir continues to have a lot of long-term attractive qualities.

Palantir Negatives:

Of course there are a lot of negative things (challenges) Palantir currently faces, including the negative company-specific things we will cover in this section, plus the massively daunting macroeconomic challenges we will cover in the next section.

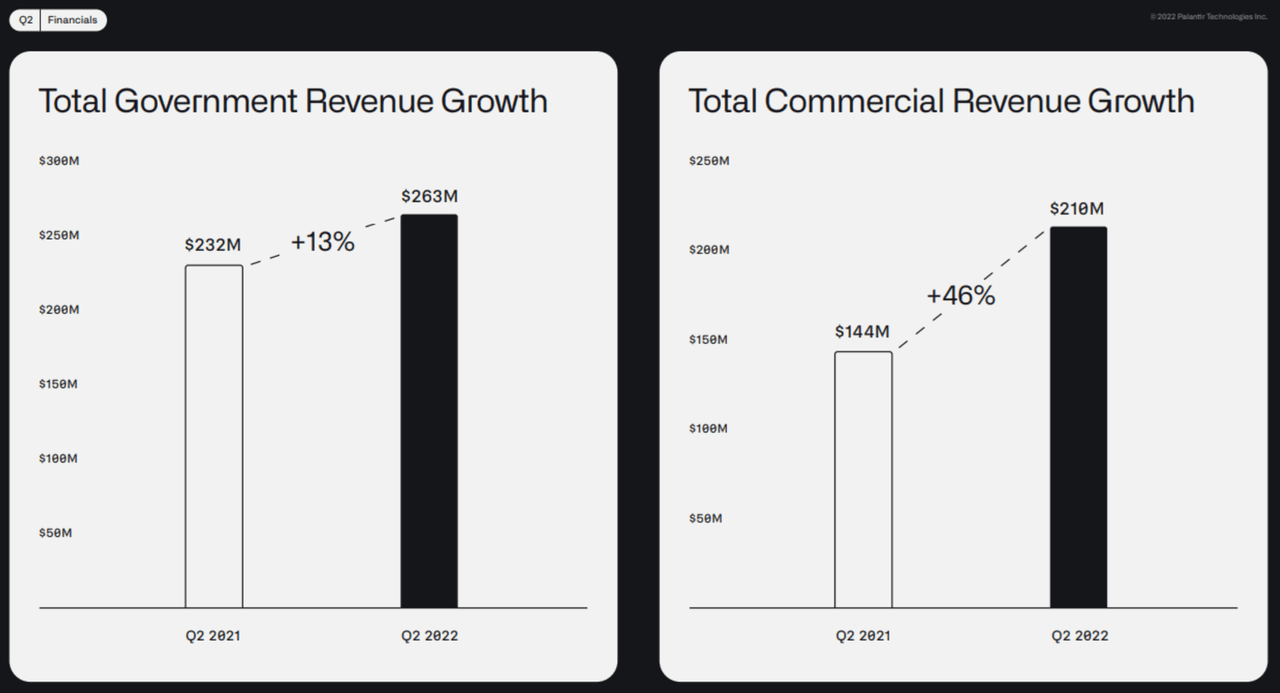

Slowing Government Revenue Growth: For example, Palantir'sgovernment revenue(supposedly its "bread and butter") is slowing.

Palantir Investor Presentation

According to a research note from Brad Zelnick at Deutsche Bank (Zelnick rates Palantir a "sell"):

"While we've always been more skeptical of Palantir's commercial opportunity, our thesis was rooted in what we saw as a uniquely strong position in Public Sector… Now with the Gov't business further decelerating off of easier compares and with diminished confidence/visibility ahead, we are left with very little to support our thesis."

Palantir lowered its forward guidance this quarter based on uncertainty around government contracts. This issue was addressed repeatedly during the call by explaining revenues are lumpy (there have actually been "a number of years where [revenue] was flat or even negative"), but worth it considering government contracts "are so big and meaty that you got to kind of wait," according to Karp.

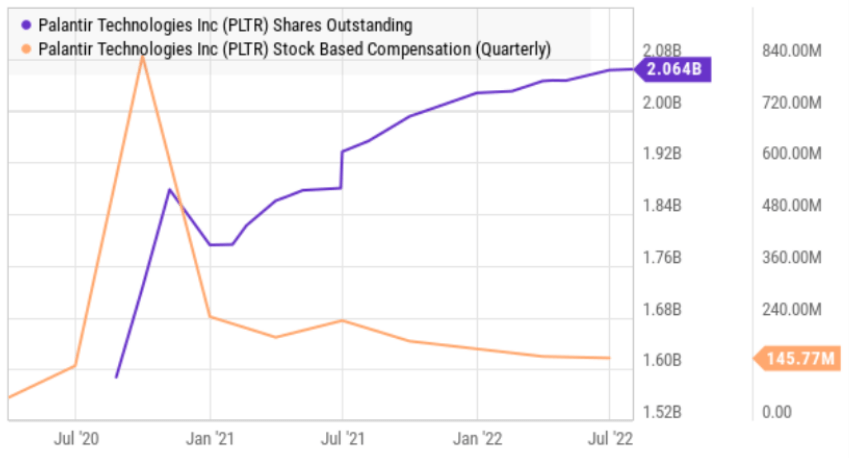

Stock-Based Compensation and Shareholder Dilution: Another chronic qualm with Palantir has been its heavy stock based compensation and shareholder dilution, as you can see in the chart below.

YCharts

However, in retrospect Palantir's actions appear prudent considering, as Karp puts it in the shareholder letter:

"We repeatedly decided to raise and preserve capital when others were spending.Our strategy in this regard has secured our ability to continue refining and developing our software platforms in order to maximize their value to our customers over the long term."

Specifically, Palantir was raising capital when its market value was higher (smart), has now eliminated all debt now that interest rates are higher (also smart) and now generates massive amounts of free cash flow and has ample cash on its balance sheet to support its business (at a time when raising external capital is now more expensive).

Negative Net Income: We mentioned "improving bottom line" as a positive, net income is still negative (and expected to stay that way until 2025) and that is a big negative to a lot of investors, especially in the current market environment where interest rates are rising and investors put increasingly more value on current earnings and less value on future earnings. Even though profitability is trending in the right direction, Palantir still generates no net income.

Industrywide Challenges: And another huge negative for Palantir is the current extreme challenges the overall industry (and economy) is facing (as we will cover in detail in the next section of this report). However, Palantir's Chief Business Affairs and Legal Officer explained it like this during the quarterly call:

As organizations around the world face more pressure and experience more pain, there will be a slowdown in the rate of spending and lengthening of sales cycles, but it will also reveal gaps in enterprises operations. Gaps our software can solve.In the short term, this means less revenue now. But on longer time horizons, it accelerates our business."

We'll share our strong opinion about investing in Palantir (in the current market environment) in the conclusion of this report, but first it is worthwhile to consider more of the macroeconomic environment which helps underpin our views.

Macroeconomic Reasons to Stay Bearish on Palantir (and the Market in General):

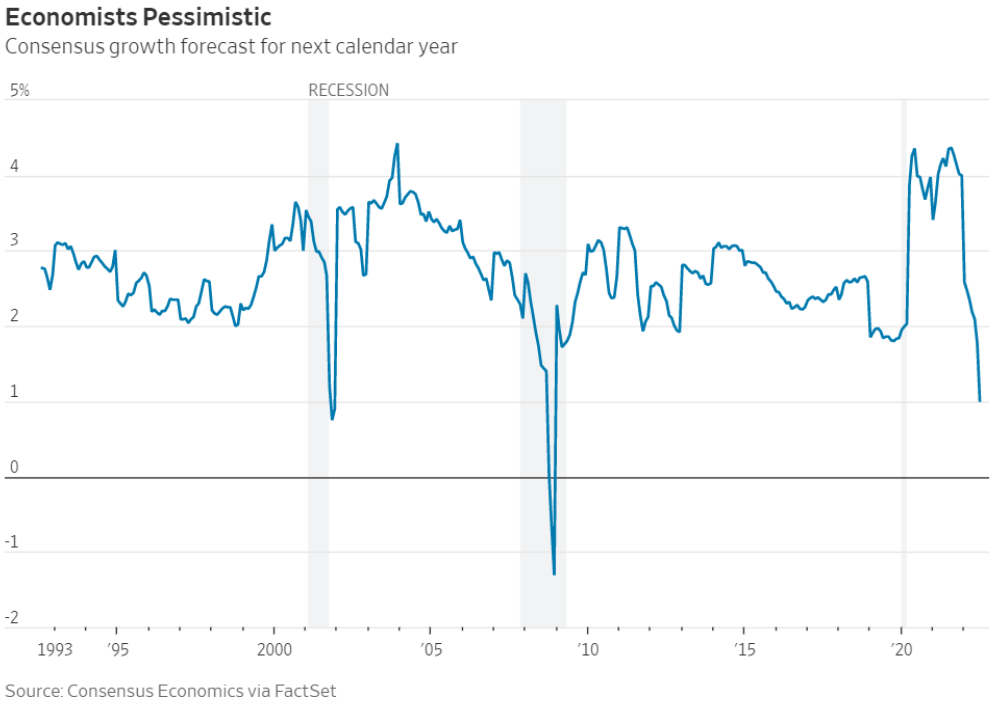

Like other companies, Palantir currently faces a variety of massive macroeconomic challenges that give a lot of investors reason to stay extremely bearish. For example, inflation is sky high (very bad for the economy), the Fed keeps raising rates to fight inflation (but this has the side effect of slowing the economy), there are lingering pandemic supply chain issues, a terrible war in Europe and economists remain very pessimistic (as you can see in the following chart).

Wall Street Journal

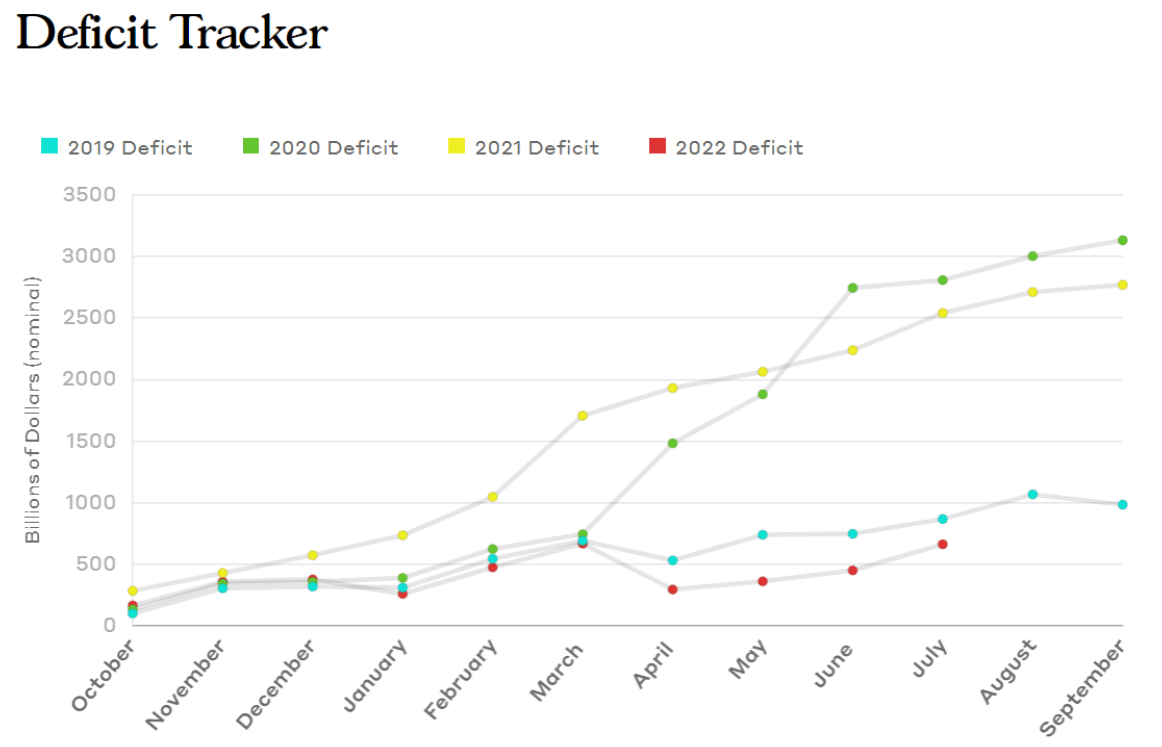

Further the federal budget deficit is about to create another big drag on the economy. If you don't know, the federal budget deficit is the difference between government revenues (i.e. taxes) and government spending. And while years of government deficit spending can create enormous long-term economic problems, the short-term deficit fluctuations can exacerbate near-term challenges.

Counterintuitive to some, when the economy is strong, the government should reduce spending (build a rainy-day fund), and when the economy is struggling, extra government spending can actually help end the funk. Unfortunately, the economy is struggling big time this year, yet the government has dramatically reduced deficit spending, as you can see in the following chart.

Bipartisan Policy Center

And according to GMO Capital'sJeremy Grantham, this reduced government deficit may be about to cause corporate profit margins and earnings to take a hit, due to the Kalecki equation(basically, reduced government deficit spending will be a hit to corporate earnings, and this is not yet reflected in stock prices).

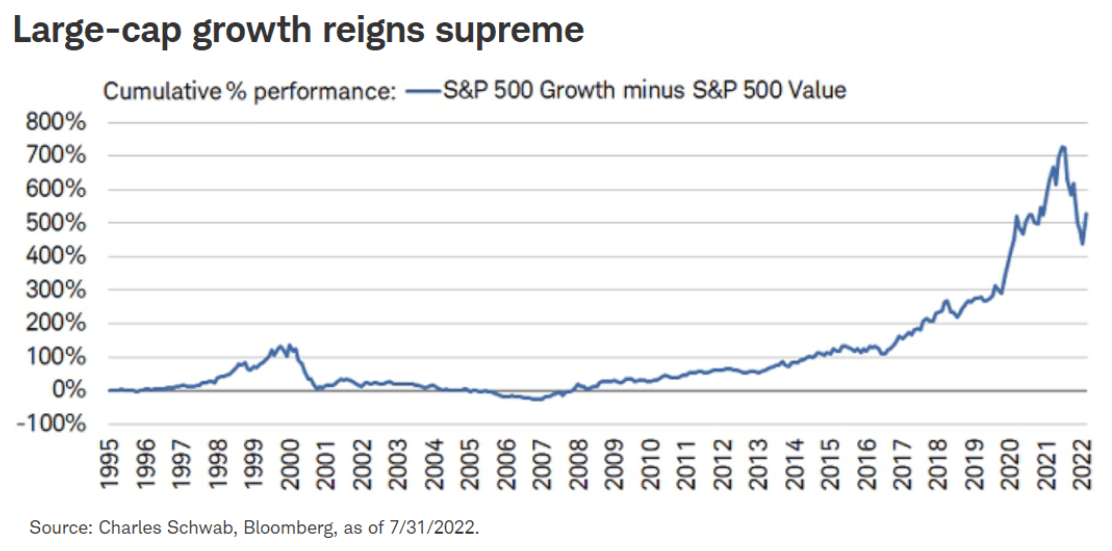

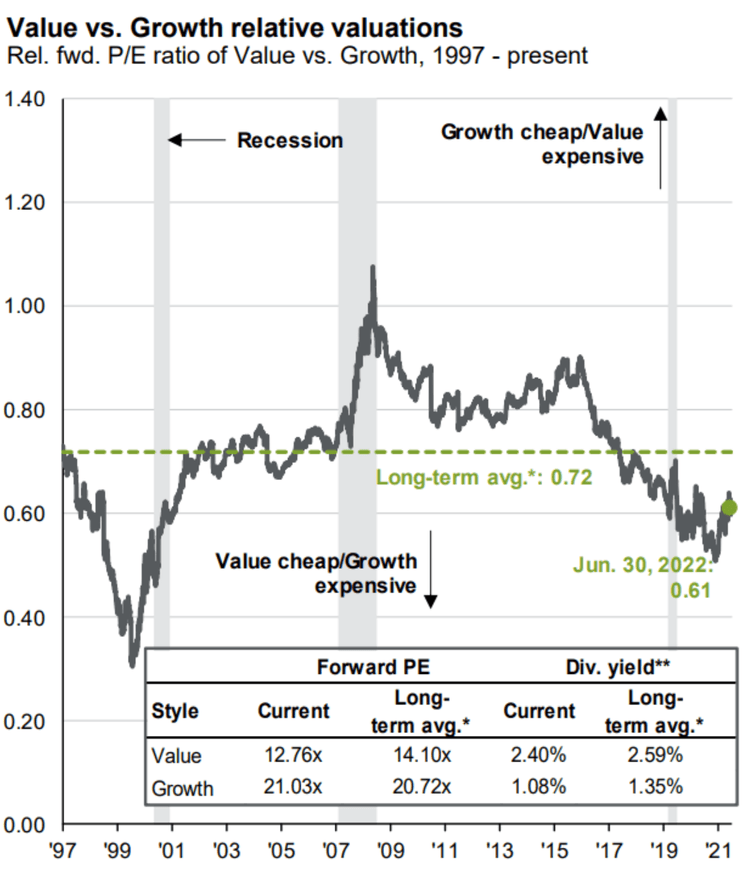

And of course we can make a strong case that growth stocks in particular (such as Palantir and the other names in our earlier table) are still greatly overvalued (versus value stocks) based on historical levels, such as this chart(below).

Charles Schwab

Notice the divergence (in the chart above) becomes most pronounced around the time the US implemented and accelerated quantitative easing following the Great Financial Crisis (2008-2009) and the pandemic bubble (2020-2021), and right before the tech bubble bust (2000). Importantly, the Fed is now starting to unwind quantitative easing (increasing rates and reducing its balance sheet) which could have the opposite affect (i.e. growth could start to underperform value dramatically). And here is another chart on growth versus value, for your consideration.

JP Morgan

Further, a slew of recent layoff announcements by technology companies (see table below) suggest growth stocks in particular are just now finally bracing for the challenging markets ahead.

Crunchbase

More Pandemic Darlings Worth Considering

With all of the negative things going on in the market, the thought of investing in growth stocks right now makes a lot of people want to puke. Even though Jeremy Grantham's latest report (linked earlier) suggests we are just now entering the final stage of the market's latest "super bubble," the market has already been puking (particularly growth stocks) this year, and from a contrarian long-term investment standpoint - some investors believe that's the best time to be buying stocks in buckets. Let's take a closer look at a few high growth stocks in particular, before finally concluding this report with a few important takeaways and our strong opinion on investing in this market.

Datadog(DDOG)

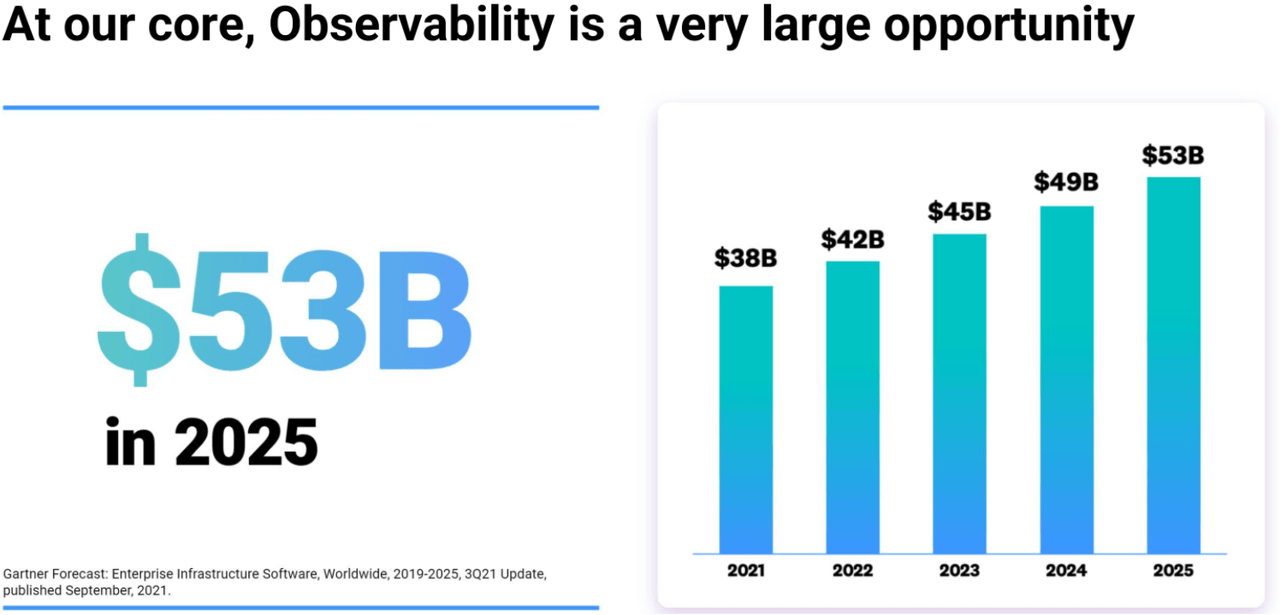

Datadog is a performance monitoring and cloud security platform, and the shares are more than 50% below their 52-week high as the valuation has taken an extreme hit as the pandemic bubble bursts.

Datadog Investor Presentation

However, Datadog continues to benefit from the three important growth stock characteristics we described earlier, including very high revenue growth (see chart above), a large TAM (so it can keep growing, see below) and the company is led by its founder (CEO Olivier Pomel cofounded the company along with CTO Alexis Lê-Quôc, in 2010).

Datadog Investor Presentation

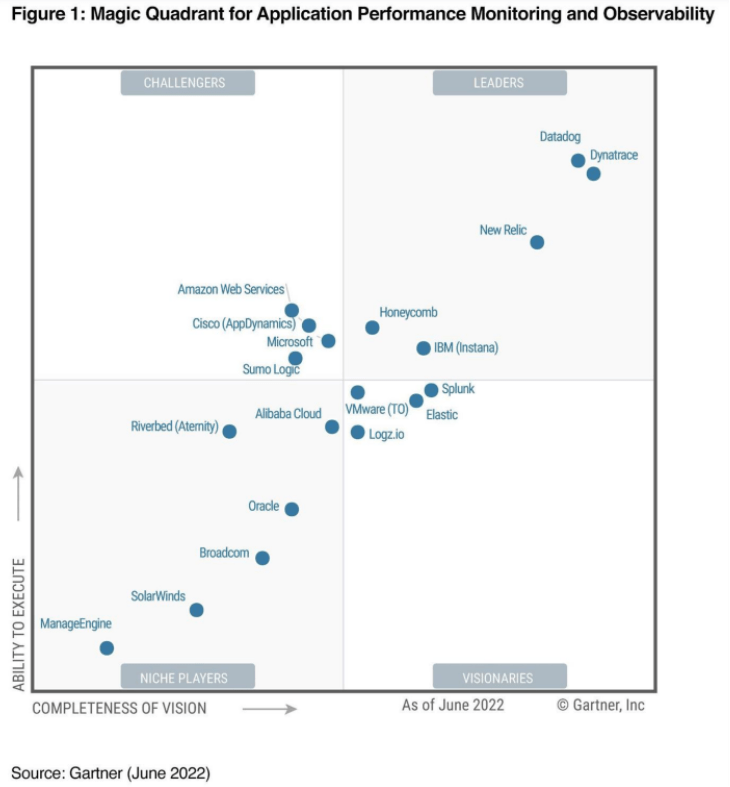

Also Datadog was named a leader in the 2022 Gartner Magic Quadrant for Application Performance Monitoring and Observability (see below). This is a very good thing for its continuing industry leadership.

Datadog Investor Presentation

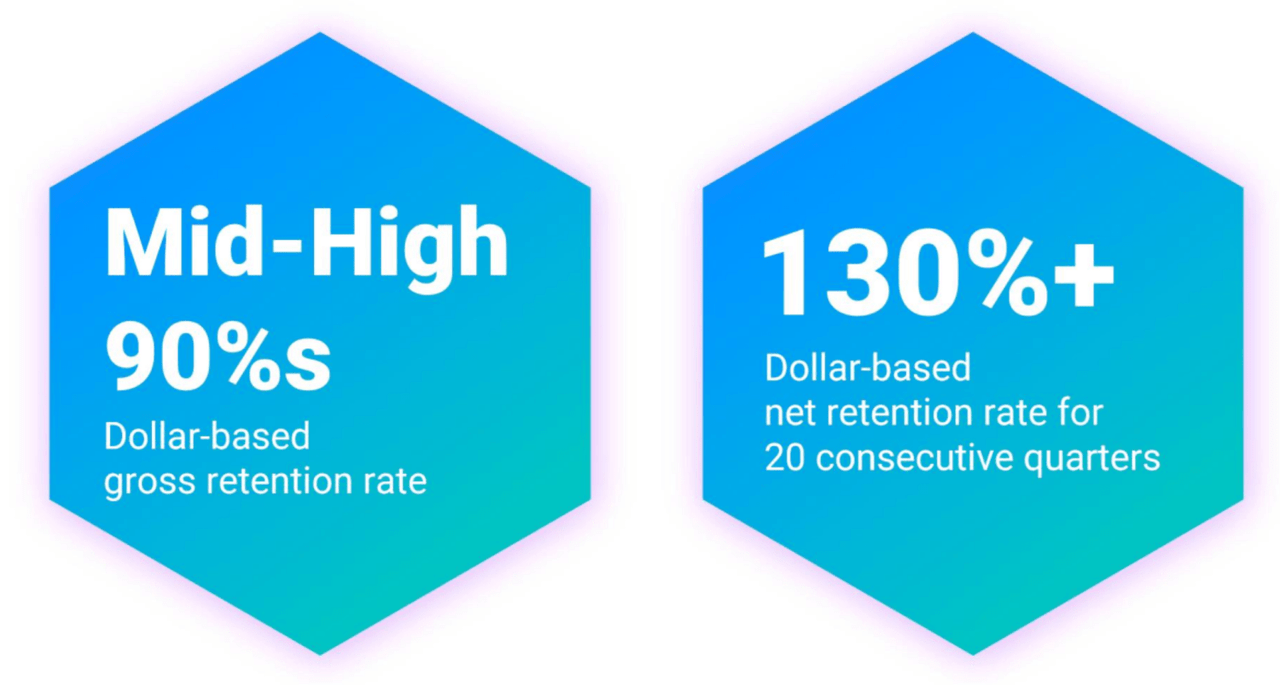

Also, Datadog has high customer retention rates (also very good for continuing growth, see below).

Datadog Investor Presentation

And again, its valuation has come way down over the last year (for example, both its price and price-to-sales ratios are significantly below their 52-week highs, as you can see in our earlier table), but its high revenue growth remains intact as it moves closer to GAAP profitability (all good things). We'll have more to say about Datadog in the conclusion of this report.

The Trade Desk(TTD)

The Trade Desk is another high-growth stock that has recently sold off very hard (it's down more than 30% this year).

The Trade Desk Investor Presentation

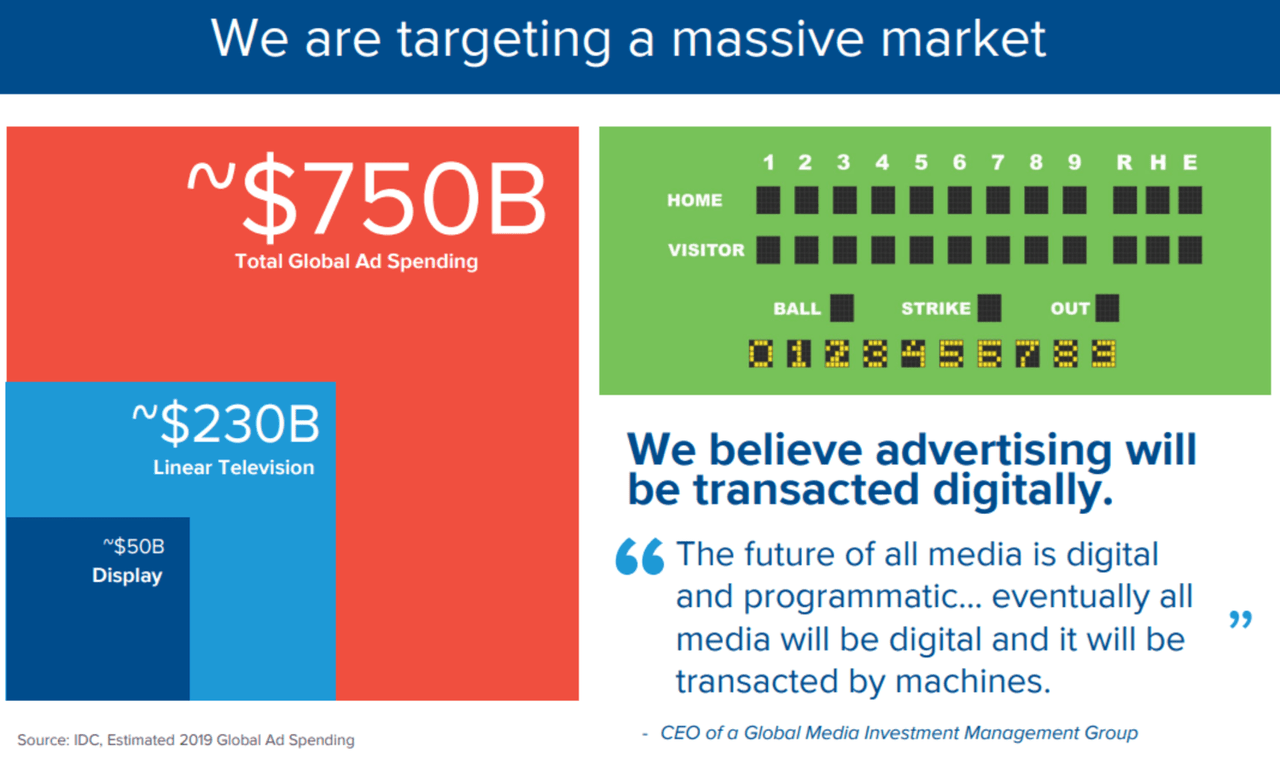

And like the other growth stocks we have highlighted in this report, it is an attractive founder-led business (Jeff Green is co-founder and current CEO), with very high revenue growth (see graphic above), and a very large TAM (see the graphic below).

The Trade Desk Investor Presentation

If you don't know, The Trade Desk is basically a self-service omni-channel advertising platform that allows ad buyers to pick from over 500 billion digital ad opportunities a day (including targeted ads across connected TV, mobile, video, audio, display, social, and native). We recently wrote about The Trade Desk in detail last month (where we correctly predicted that it would resume its steep share price declines in the short term), and we'll have more to say about The Trade Desk in the conclusion of this report.

Conclusion

The market is ugly. Very ugly. Aside from the sky-high valuation levels many top growth stocks achieved last year (a bubble that continues to burst), macroeconomic conditions are bad (as described in this report). And unless you are in a position to buy-and-hold for the next decade, it would probably be a terrible idea to dump 100% of your nest egg into high growth stocks as described in this report (you might instead want to consider our recent report: Top 10 Big-Dividend Preferred Stocks).

On the other hand, if you are a long-term investor, you have a distinct advantage. That is to say, long-term compound growth is one of the most powerful wealth-creating machines in the history of the world, but only if you have the ability to hang on (to high-growth secular leaders like Palantir, The Trade Desk and Datadog) through years of very high volatility (like we are experiencing now). In fact, this year's steep price declines may get even worse (for reasons described in this report), but if you truly are a long-term investor you might also want to consider our expanded list of 150 top growth stocks down big (which also includes a few more top growth stock ideas in particular) especially because we strongly believe the market will eventually get better.

No one knows where the market will be next week, next month or even next year. But over the long-term, it's likely eventually going much higher (especially top growth stocks, like Palantir). And over the long-term, top-quality dividends stocks are also likely to keep paying big, steady, growing dividends. Choose an investment strategy that is right for you, based on your unique situation and goals. We believe disciplined, long-term, goal-focused investing will continue to be a winner.