It's the last trading day of the second quarter, and what a run it's been, even if things have been a bit quiet of late.

The S&P 500 has climbed 8% in the second quarter, extending its five-quarter advance to an incredible 66%. For all the worries about megacap tech stocks in the face of rising bond yields, the Nasdaq Composite has surged 10% to take its five-quarter run to 89%. "I think the drivers are pretty well known at this point. It's the recovery story," says Joseph Little, chief global strategist at HSBC Asset Management, pointing to the global economic recovery, rollout of vaccines and both the fiscal and monetary policy support.

Little, however, doesn't expect the party to last much longer. "I do think there's an important transition taking place in the macro economy and in markets," he says, adding it looks like we're past the peak of growth in the U.S., China and most of the industrial Asian countries. Policymakers are getting "itchy feet on the brake pedal," not just in the U.S. where Federal Reserve officials are discussing tapering bond purchases but also in Asia, he said: "And I think for markets, this might mean that things get a little trickier."

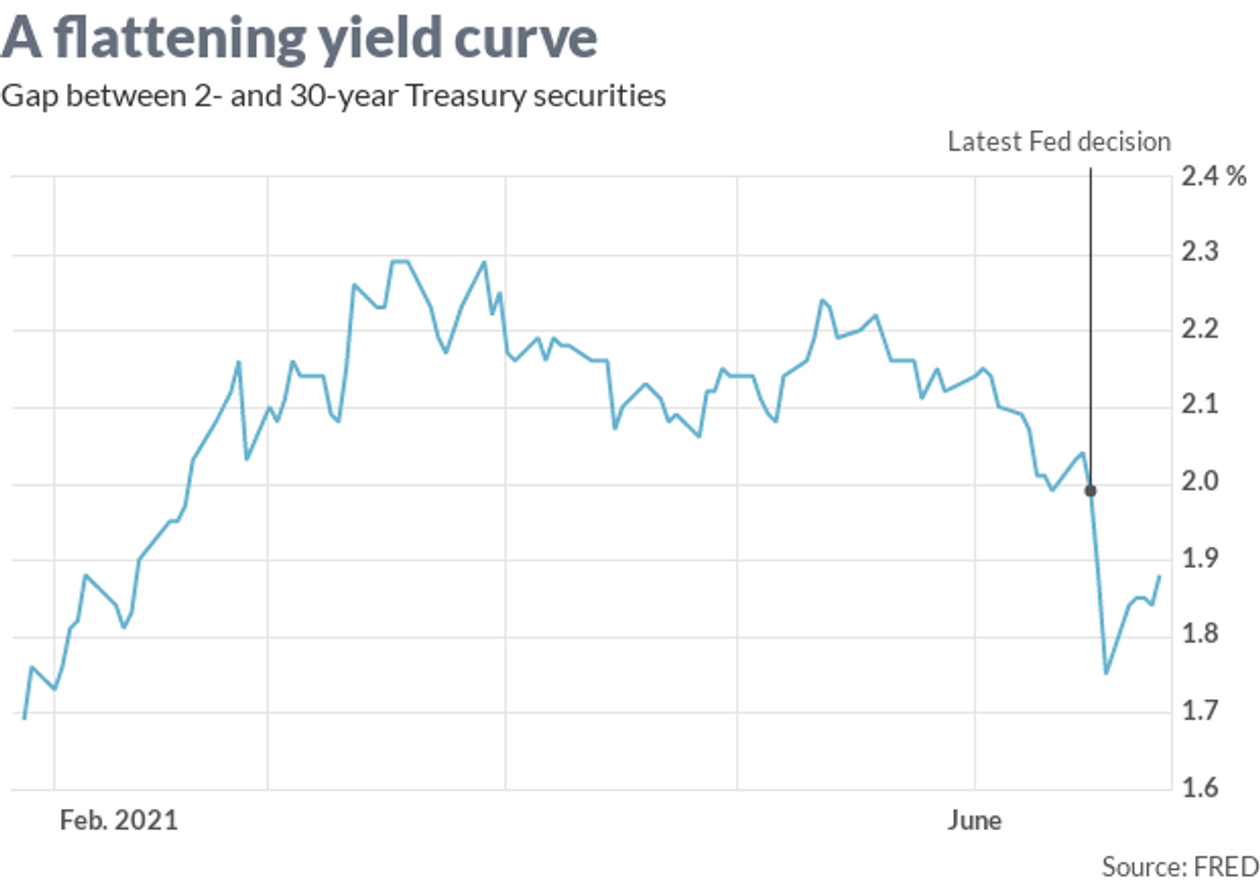

Historically, in the expansion phase of the economic cycle, profits are still good but multiples start to come lower, Little said. He also noted the "pretty abrupt" flattening of the yield curve after the recent Fed decision, which he says is another indicator that elements of the reflation trade have really run their course. The upcoming earnings report season will be particularly important now as they will be the driving force of market direction.

Expected asset returns, Little says, have fallen across nearly all asset classes. "It's a case of being realistic, accepting that message of lower expected returns and understanding the fact that you're in an environment where in the next phase of business cycle, profits are going to begin to come into some challenge and some stress," he says.

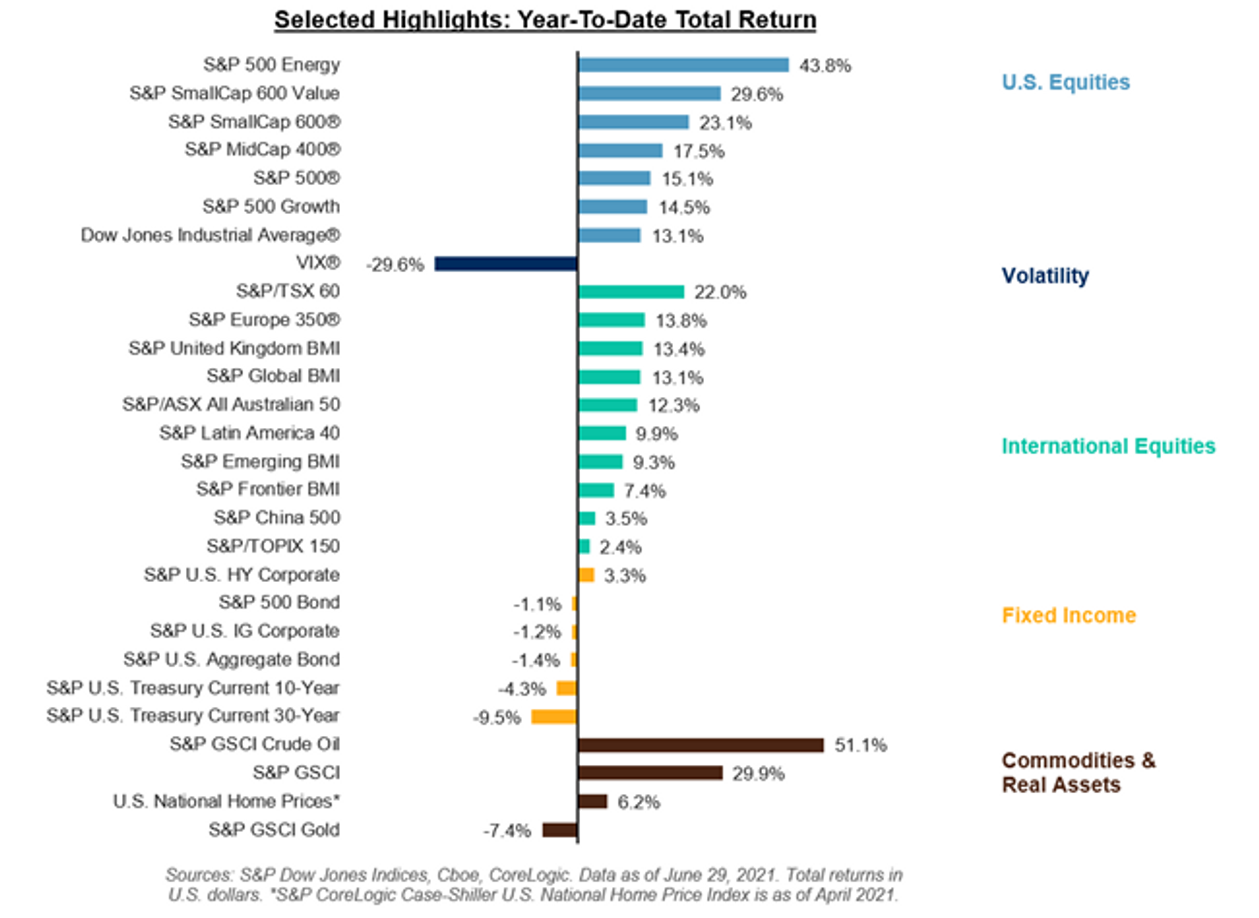

He still likes stocks over bonds due to relative valuation, but says investors should have more exposure to value stocks, particularly in a region like South Asia which could benefit from a broadening global recovery and rollout of vaccines. He noted that China has generated the only positive return in government bonds during the first half of the year. In corporate credit, he again pointed to Asia, as credit spreads aren't as compressed as in the U.S.

HSBC also has been recommending alternative asset classes, including infrastructure debt. In commodities, HSBC is recommending not just industrial commodities but in natural resources like timber.

Courtesy of Standard and Poor’s, here’s how different asset classes have performed this year.