Oil futures traded higher Wednesday, finding some support from a third straight drop in U.S. crude inventories, but the spread of COVID-19 cases globally continued to threaten energy demand, putting a lid on any price gains.

"A tick higher in refinery runs and a tick lower in imports has yielded a third consecutive draw to crude inventories -- dropping them to their lowest since late January 2020," said Matthew Smith, director of commodity research at ClipperData, in emailed commentary.

On Wednesday, the Energy Information Administration said U.S. crude inventories fell by 3 million barrels for the week ended Aug. 20.

On average, analysts polled by S&P Global Platts forecast a decline of 3.2 million barrels for crude stocks, while the American Petroleum Institute on Tuesday reported a 1.6 million-barrel decrease.

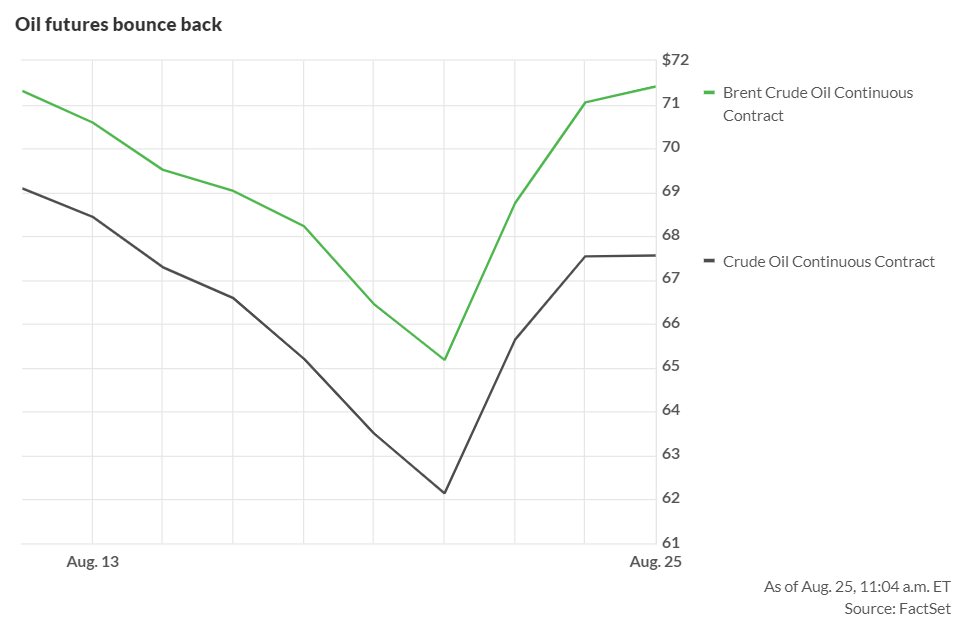

West Texas Intermediate crude for October delivery edged up by 8 cents, or 0.1%, to $67.62 a barrel on the New York Mercantile Exchange. If prices for the front-month contract notch a third straight gain, that would mark the longest streak of daily gains since the three-session rise ended on July 30, FactSet data show.

October Brent crude , the global benchmark, was up 34 cents, or 0.5%, at $71.39 a barrel on ICE Futures Europe.

The EIA also reported a weekly inventory fall of 2.2 million barrels for gasoline, while distillate stockpiles rose by 600,000 barrels. The S&P Global Platts survey forecast supply declines of 1.5 million barrels for gasoline and 400,000 barrels for distillates.

"Gasoline inventories have drawn as implied demand has rebounded, perhaps the last hurrah of summer driving season," said Smith. Distillates showed "a minor build amid a tick lower in implied demand."

The EIA report pegged last week's amount of finished motor gasoline supplied, a proxy for demand, at nearly 9.6 million barrels, up from 9.3 million barrels a week before.

On Nymex, September gasoline added 2.5% to nearly $2.24 a gallon and September heating oil tacked on 0.9% to $2.08 a gallon.

Natural-gas futures, meanwhile, headed higher with the September contract up 2.3% at $3.99 per million British thermal units, ahead of Thursday's weekly EIA update on domestic supplies of the fuel.

Crude stocks at the Cushing, Okla., storage hub edged up by 100,000 barrels for the week, while total U.S. petroleum supplies was unchanged for the week at 11.4 million barrels per day, according to Wednesday's EIA data.

Crude has found support so far this week after the U.S. Food and Drug Administration on Monday gave formal approval to the COVID-19 vaccine developed by Pfizer Inc. $(PFE)$ and BioNTech SE (BNTX), Fawad Razaqzada, analyst at ThinkMarkets, in a note ahead of the EIA supply data. That raised expectations that more people will get the shot as large businesses and government organizations make vaccinations for their employees mandatory, he said.

"As a result, traders have speculated that demand for oil should rise as more people are likely to travel if fully inoculated," he said.

Crude was buoyed after the American Petroleum Institute reported late Tuesday that U.S. crude supplies fell by 1.6 million barrels for the week ended Aug. 20, according to sources. The API report also reportedly showed inventory declines of 985,000 barrels for gasoline and 245,000 barrels for distillate supplies.

Crude stocks at Cushing, Oklahoma — the delivery hub for Nymex oil futures — edged down by 485,000 barrels for the week, sources said.

Official inventory data from the Energy Information Administration will be released Wednesday. On average, the EIA is expected to show crude inventories down by 3.2 million barrels, according to a survey of analysts conducted by S&P Global Platts. The survey also calls for supply declines of 1.5 million barrels for gasoline, and 400,000 barrels for distillates.