'Markets are priced for perfection and vulnerable,' says the CIO of Morgan Stanley Wealth Management

Morgan Stanley's optimistic view of the economy isn't keeping it from warning about a looming correction in the U.S. stock market.

"The issue is that the markets are priced for perfection and vulnerable, especially since there hasn't been a correction greater than 10% since the March 2020 low," said Lisa Shalett, chief investment officer of Morgan Stanley Wealth Management, in a note Tuesday. The bank's global investment committee expects a stock-market pullback of 10% to 15% before the end of the year, she wrote.

"The strength of major U.S. equity indexes during August and the first few days of September, pushing to yet more daily and consecutive new highs in the face of concerning developments, is no longer constructive in the spirit of 'climbing a wall of worry,'" said Shalett. "Consider taking profits in index funds," she said, as stock benchmarks have dismissed "resurgent COVID-19 hospitalizations, plummeting consumer confidence, higher interest rates and significant geopolitical shifts."

She suggested rebalancing investment portfolios toward "high-quality cyclicals," particularly stocks in the financial sector, while seeking "consistent dividend-payers in consumer services, consumer staples and health care."

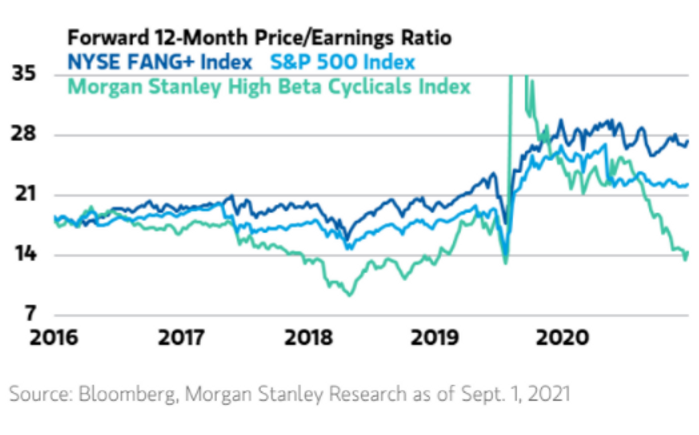

Megatech stocks have been defying the transition that stocks typically make mid-cycle, with their price-to-earnings ratios remaining elevated despite declining in other areas of the market, such as cyclical and small-cap stocks, the Morgan Stanley report shows.

"As business and market cycles move through recession, recovery, repair and on to expansion, interest rates typically begin to normalize and price/earnings (P/E) ratios compress as stock gains are increasingly powered by profit growth as opposed to policymakers," wrote Shalett. But dominant megacap tech leaders in the stock market have not followed that "playbook."

Although Morgan Stanley remains "sanguine on the economic outlook," with Shalett citing "solid prospects for capital expenditures and strengthening labor markets," the bank's global investment committee is increasingly worried about market valuations, according to her note.

The tech-laden Nasdaq Composite index ended Tuesday at another all-time closing high as the Dow Jones Industrial Average and the S&P 500 benchmarks for U.S. stocks retreated. The Dow, a blue-chip gauge of the U.S. stock market, and the S&P 500, an index that is top-heavy with tech exposure, remain near their recent peaks.

Meanwhile, the yield on the 10-year Treasury note rose almost 5 basis points Tuesday to 1.37%, the highest since July 13, according to Dow Jones Market data. Bond yields and prices move in opposite directions.

"Real interest rates are finally grinding higher not only because Fed tapering is expected to officially commence by the end of the year, but as global economies rebound and 'safe haven' foreign liquidity moves out of overpriced U.S. Treasuries," Shalett said. "Higher interest rates should pressure price/earnings multiples, which are already well above historic norms, especially when taking into account current levels of measured and realized inflation."

Investors appear to be putting their "faith" in the Federal Reserve, with its "masterfully nuanced communications," to achieve its policy goals, according to Shalett. Fed Chair Jerome Powell "has seemingly convinced investors that he and his policymaking colleagues are capable of delicately threading the policy needle without making mistakes," she wrote.

For example, markets appeared encouraged after the central bank reiterated its view at the Jackson Hole, Wyo., economic policy symposium in late August that inflation is temporary, the eventual tapering of its asset purchases is not policy tightening, and that "actual rate hikes are tied to the very high bar of their new criteria of 'maximum' employment," according to Shalett.

"Both stock and bond investors cheered," she said, "leaving asset bubbles and financial stability concerns be damned."