Summary

- The one question we're all asking now is if the market has bottomed or not. My answer is unfortunately no.

- The current market situation resembles the 2000 dot.com bubble in wicked ways - history always rhymes.

- Amazon and Netflix can illustrate many key issues common to the overall market and provide insights into the next steps.

- Both have over-hired and over-invested assuming the “COVID boost”, and the Fed's easy monetary policy will continue indefinitely, leading to a bubble.

- The bubble’s burst will not be complete until the overcapacity has turned into actual profits and ultimately a productivity boost.

Thesis

More often than not, focusing on a few individual trees can actually help us see the forest better. And under the current market conditions, Amazon (NASDAQ:AMZN) and Netflix (NASDAQ:NFLX) can illustrate many of the key issues common to the overall market and provide insights into where it's headed next.

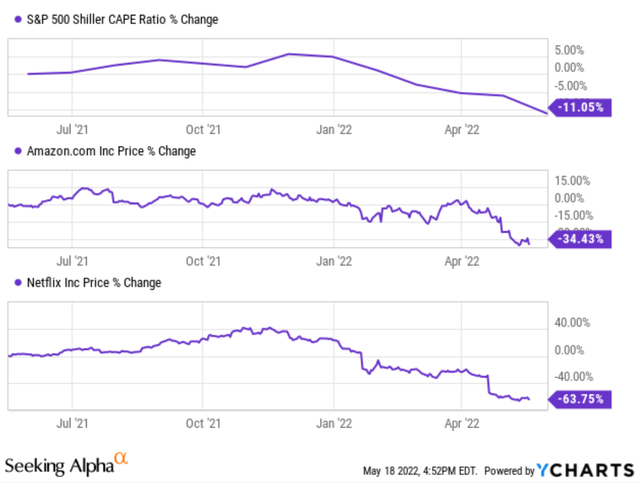

We all know what has happened in the past six months or so, as recaptured in the chart below. All major indices have suffered some of their worst losses in market history. The Dow suffered losses exceeding 1,000 points during several trading days and the Nasdaq losses were near or more than 5%. Leadings stocks like AMZN and NFLX fared even worse - and for good reasons as to be seen later. AMZN stock price contracted by more than 1/3 YTD and NFLX by almost 2/3.

Has the market bottomed yet? This article will look for the answer by examining the similarities between our current market conditions and the 2000 dot.com bubble through the lenses of AMZN and NFLX. And my answer is an unfortunate no. The key reasons, as to be elaborated on next, are:

- The bubble has not fully deflated yet. The market has developed substantial excess capacity in the one or two years or so aided by the "COVID boost" and Fed's generous monetary policy. And the market has willingly priced the excess capacity into their current valuations. Despite the large corrections thus far, the market and its leading components such as AMZN and NFLX are still at an elevated valuation.

- The complete deflation of the bubble will complete either in a beautiful way by turning the overcapacity into profitability and increased productivity or the ugly way. The typical sign of the ugly way of the bubble bursting is not a large price contracting only, but a large price contracting caused by a large valuation contraction together with a profit decrease at the same time. The current conditions for the overall market and its leading stocks (e.g., AMZN, NFLX, and the rest of the FAANG pack) have not shown this sign yet.

The bubble in 2000 vs. 2022

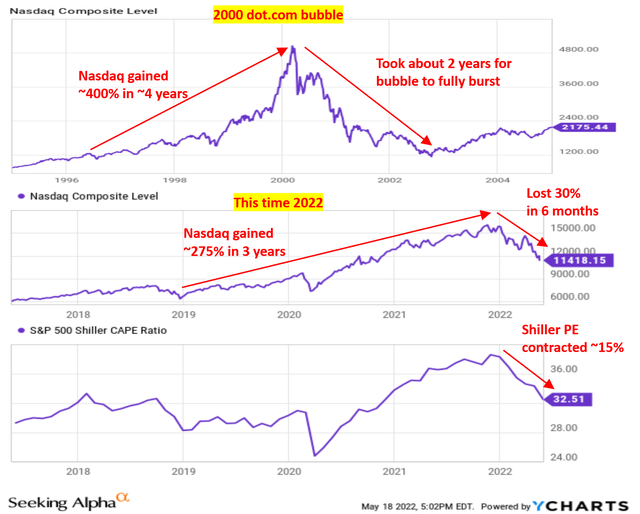

As a quick refresher, the top panel of the following chart shows the major timelines of the 2000 bubble. The bubble was fueled by irrational optimism regarding technology-related equities in the late 1990s. The media attention and euphoria around future projected revenues are quite similar to those surrounding the dot.com stocks of our own time. The Nasdaq Composite Index increased by almost 400 percent in a short four-year period between 1996 and 2000, primarily driven by the nascent Internet companies. The bubble inevitably burst in 2000. It took about two years for the bubble to completely deflate - air comes out quicker than it goes in. The Nasdaq index lost about 80% and went back to its 1996 level.

Now, the mid and bottom panels show our current market conditions, which resemble the 2000 dot.com bubble in wicked ways. History does not always repeat, but it certainly rhymes. The Nasdaq Composite Index increased by almost 300 percent this around in a short three-year period between 2019 and 2022. In addition to the typical ingredients of a bubble (excessive optimism surrounding the next big new thing, Fed's easy monetary policy, et al), the formation of the bubble was unexpectedly accelerated by the COVID epidemic. The epidemic brought about dramatic changes in shopping habits, telecommuting, telemedicine, et al. Under this background, many companies over-hired and over-invested assuming the COVID boost will stay permanently, as we will illustrate next by the examples of AMZN and NFLX.

However, things turned out differently. The market share of e-commerce, streaming, and telecommuting now either stopped rising or even begun to decline as the COVID boost began to fade. And the bubble began to deflate. However, despite the sizable market correction so far, the bubble has not fully deflated yet. The Nasdaq index has "only" lost about 30% in the past six months or so, and the Shiller PE has only contracted by about 15%. The overall market valuation is still at an elevated level. To put things under perspective, the historical average Shiller PE is about 20x and it is now still at 32.

We will use AMZN and NFLX next to examine the problem more closely. But the problem is not only limited to AMZN and NFLX, it's a market-wide problem. The same pattern can be seen in a range of other leading stocks such as Shopify (SHOP), Zoom (ZM), et al.

What has happened to AMZN and NFLX?

AMZN probably is the best example, but definitely not the only example, of the bubble formation and its acceleration by the COVID pandemic. When the pandemic broke out in early 2020, almost overnight, millions of people switched from offline to online shopping which drove AMZN's spectacular growth. In the following year, its annual sales growth maintained a range of 20%-40%. Such levels of growth are truly unheard of for a business whose annual sales are already approaching $300 billion and whose market cap approaching $1T (and approached $2T shortly after the pandemic).

To meet the growth need, the company overinvested also in an unprecedented manner. As commented by CEO Andy Jassy (the emphases are added by me):

"The pandemic and subsequent war in Ukraine have brought unusual growth and challenges. With AWS growing 34% annually over the last two years, and 37% year-over-year in the first quarter, AWS has been integral in helping companies weather the pandemic and move more of their workloads into the cloud. Our Consumer business has grown 23% annually over the past two years, with extraordinary growth in 2020 of 39% year-over-year that necessitated doubling the size of our fulfillment network that we'd built over Amazon's first 25 years-and doing so in just 24 months."

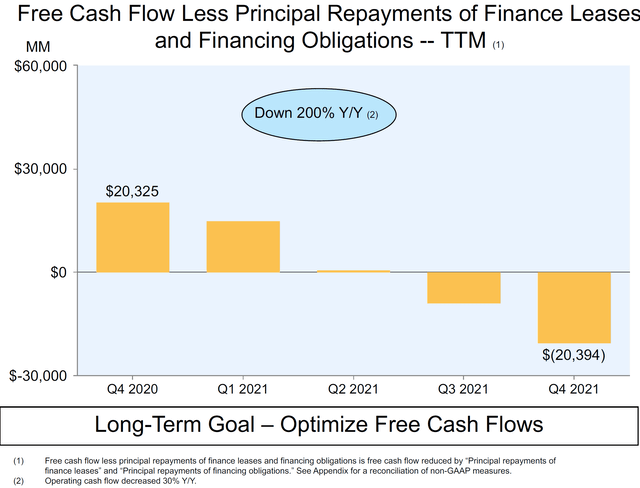

Fast forward to now, AMZN is facing the aftermath of overcapacity and strapped flow problems. In the first quarter of this year, Chief Financial Officer Brian Olsavsky commented that AMZN's transportation network has excess capacity. The company will now lower its capex for the quarters ahead. But the current overcapacity is so substantial that it will take a long time to digest. At the same time, the overinvesting has stretched its cash flow. As reported in its earnings presentation:

- Free cash flow less principal repayments of finance leases and financing obligations decreased to an outflow of $29.3 billion for the trailing twelve months, compared with an inflow of $14.9 billion for the trailing twelve months ended March 31, 2021.

- Free cash flow less equipment finance leases and principal repayments of all other finance leases and financing obligations decreased to an outflow of $22.3 billion for the trailing twelve months, compared with an inflow of $16.8 billion for the trailing twelve months ended March 31, 2021.

The situation for NFLX is very similar. The pandemic also boosted NFLX's growth and also misled its investment and expansion decisions. As admitted by CEO Reed Hastings, the COVID boost has created noise for NFLX to read the situation. Its shareholders' letter went on to say (emphases were added by me):

In the near term though, we're not growing revenue as fast as we'd like. COVID clouded the picture by significantly increasing our growth in 2020, leading us to believe that most of our slowing growth in 2021 was due to the COVID pull forward. Now, we believe there are four main inter-related factors at work.

Among the four key issues, NFLX admitted that it does not have control over many of the key components. The adoption of on-demand entertainment and costs are among the top two. And for both issues, COVID provided a temporary boost and now the effects are fading, leading to its reporting of the first-ever subscriber drop in its latest earnings report.

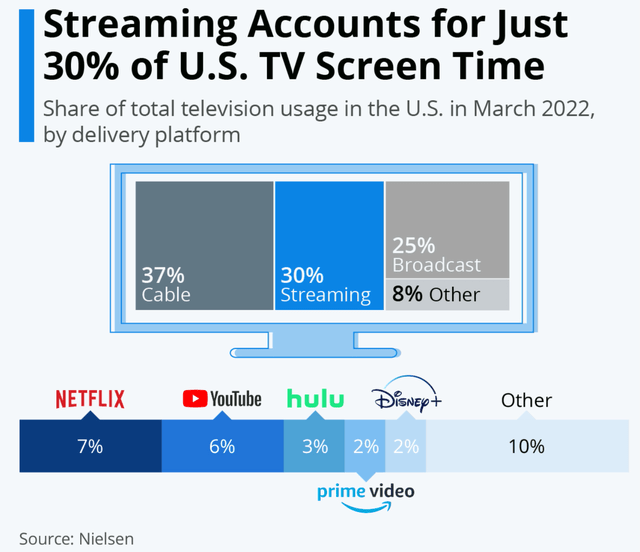

Despite all the hot air and high expectations, the reality is that streaming is still a minor part of U.S. total TV screen time. As shown in the chart below, streaming-only accounts for about 30% of U.S. TV screen time, and the majority (70% of it) is still dominated by traditional cable (37%) and broadcast (25%).

As growth subsides in the post-pandemic era, competition is intensifying at the same time. It used to primarily compete with Google YouTube, Hulu, and AMZN prime video in the past. However, now many new entrants are emerging and becoming established, as commented in its shareholder letter (emphases were added by me):

Third, competition for viewing with linear TV as well as YouTube, Amazon, and Hulu has been robust for the last 15 years. However, over the last three years, as traditional entertainment companies realized streaming is the future, many new streaming services have also launched. While our US television viewing share, for example, has been steady to up according to Nielsen, we want to grow that share faster.

Notably, Disney+ has established itself as a solid No. 5 in this space. The streaming space is crowded. Breaking down the 30% of the total TV screen time shows that the streaming space is so fragmented now, and it's questionable if NFLX can keep its leading position. At 7%, NFLX is still the leader of the streaming pack, but only by a smaller margin compared to YouTube's 6 percent share.

Can AMZN and NFLX tell us what's coming next?

Looking forward, the deflation of the bubble and the digestion of the overinvestment need more time. Admittedly, the overall market and its leading stocks (not only AMZN and NFLX, but other major stocks too) have suffered sizable corrections already and the bubble has deflated to some degrees. In NFLX's case, following its most recent earnings report and subscriber loss, its stock price has come down more than 70% from its peak value. And AMZN also has lost more than one-third of its stock price from its peak value.

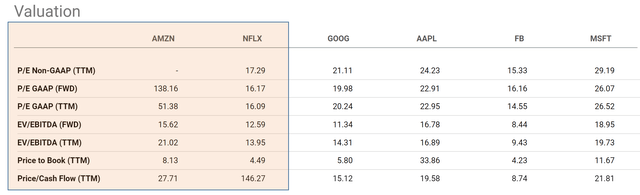

However, with a Shiller PE ratio near 32, the overall market valuation is still at an elevated level. And the major component stocks such as AMZN and NFLX are still at an elevated level. The bubble still has more room for further deflation. As seen in the chart below, AMZN is still valued at an unsustainable level in terms of PE multiples (138x in GAAP and 51x in non-GAAP terms). Its price to cash flow is near 28x, and its free cash flow is in the negative after correcting for lease obligations as mentioned above. NFLX's valuation is more reasonable in terms of PE multiples. However, cash flow is an issue, which is likely to become even worse with rising production costs and talent costs to create original content.

Ultimately, the sign that I'm looking for a complete bubble bursting is not only a large price contraction. We've seen some price contraction so far, but not enough. The sign I'm looking for is a large price contraction because of valuation contraction AND profit decrease at the same time. The current market and its leading stocks (again, not only AMZN and NFLX, but also others such as those listed in the table above) have not shown this sign yet. They're all still traded at an expensive valuation (with the exception of FB) and many of them are not reporting profit decline (yet).

Final thoughts

Finally, I want to clarify that I'm not predicting that the bubble will burst in an ugly way with a valuation contraction and a profit decline at the same time (the way the 2000 bubble ended). Although it's a very likely scenario considering the tough spot we are in (high inflation, near bottom interest rates, and major ongoing geopolitical instability). What I'm saying is that IF I see both symptoms, then I'm confident that the bubble has fully burst. And I am not seeing these symptoms now.

As mentioned at the beginning, it's also possible for the bubble to deflate in a beautiful way too. I see it as a less likely scenario. The sign to watch in this case is the translation of the overcapacity into real profitability and, eventually, increased productivity.