Moody's, a rating agency, downgraded the credit rating of the U.S. government by one level from the highest "Aaa" to "Aa1", mainly because of the sharp rise in government debt in the past decade and the fact that the current proportion of interest payments is significantly higher than that of countries of the same level. Although the rating is still high, this change has caused some volatility in the market.

However, market experts believe that the impact this time is far less than the market turmoil when S&P first downgraded the U.S. rating from AAA to AA + in 2011. In those days, institutional investors were unsure of how to adjust their positions according to their investment authorization, causing the stock market to react violently. Charles-Henry Monchau, chief investment officer of Syz Group, pointed out, "Investors are calmer now because the market has experienced similar situations."

Data show that on August 5, 2011, the first trading day of the S&P downgrade, trackingS&P 500The technology sector's Technology Select Sector SPDR Fund (XLK.US) fell 6.2%, while the technology-dominated Nasdaq index plunged 7.8%. In the following month, technology stocks continued to fluctuate.

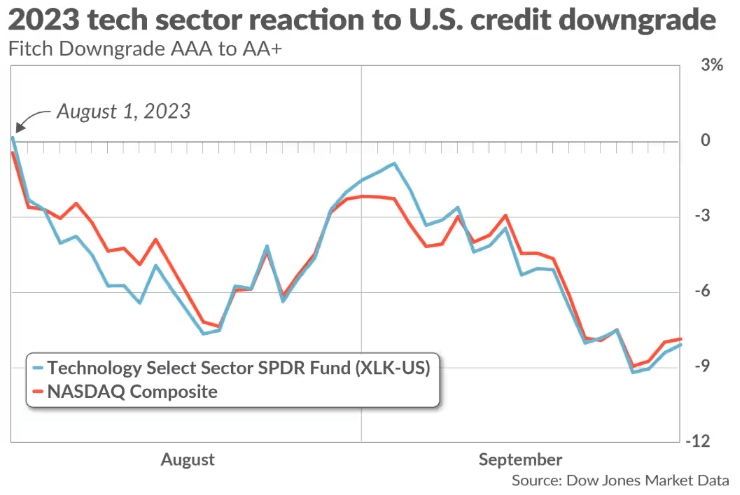

On August 1, 2023, after another rating agency Fitch downgraded the U.S. rating, XLK fell by 2.3% the next day, with a cumulative decline of about 4% in a week; The Nasdaq fell 2.6% the next day and 3% in the week. Both rating adjustments have triggered significant fluctuations in technology stocks in the short term.

In contrast, Moody's's downgrade this time is not surprising. As early as November 2023, the agency had lowered the credit rating outlook for the United States from "stable" to "negative", and the market was mentally prepared. Therefore, after the ratings were released last Friday, the market reaction was relatively mild.

Although the S&P 500 index fell 0.9% and the Nasdaq index fell 1.4% at the opening of the market on Monday, both major indexes recovered their losses and achieved gains that day. XLK fell 0.8% in early trading of the day and ended roughly flat as well.

Although the impact of this downgrade itself is limited, the rise in U.S. bond yields is the greater risk facing technology stocks. In intraday trading on Monday, the 10-year U.S. bond yield once hit 4.57%, and the 30-year bond yield exceeded 5%, and eventually fell back to 4.45% and 4.91% respectively.

Rising yields mean more attractive returns on government bonds, undercutting the appeal of high-growth assets such as tech stocks. Even if the credit rating is downgraded, government bonds are still regarded as "risk-free" assets, and the annualized return of 4.5%-5% is more attractive than that of technology stocks with uncertain future returns.

Despite upward pressure on yields, tech stocks are not all without bright spots. The artificial intelligence boom is providing a "tailwind" to the tech sector. Large cloud computing service providers still plan to increase investment in AI infrastructure.

In addition, there are five companies among the "Big Seven" technology giants,Amazon(AMZN.US),GoogleParent company Alphabet (GOOG.US, GOOG;. US),Apple(AAPL.US), Meta (META.US) andMicrosoft(MSFT.US), handed over a brilliant report card in the first quarter financial report. Chip giantNvidia(NVDA.US) will also announce its financial report this week, and the market is highly concerned.

Although many companies are conservative in financial forecasts, investor confidence has picked up, partly because President Trump announced a temporary reduction in tariffs imposed by the United States and China, which has brought additional boost to technology stocks.

However, on the whole, the performance of the "Big Seven" is still inferior to that of the broader market. As of now,Roundhill Magnificent Seven ETF(MAGS.US) is still down about 3.5% for the year.

Despite this,Goldman SachsIn a report released on May 16, it was pointed out that based on the future profit growth expectations of the seven major technology companies, they are expected to continue to outperform the broader market in 2025, but the excess returns may not be as significant as in the past few years.