What extra cost are investors paying, if Trump wins?

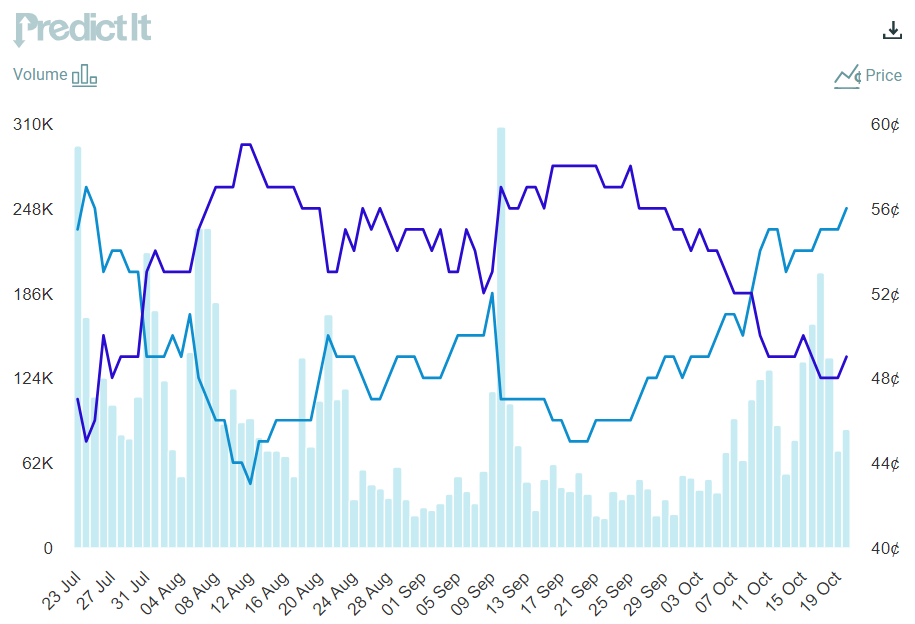

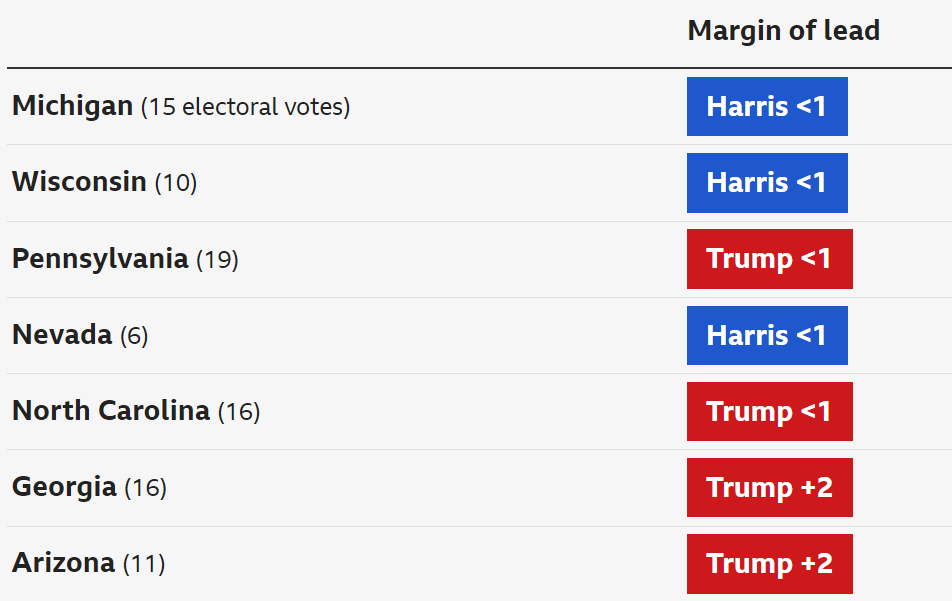

Why has Trump's campaign momentum turned sharply upward since October?The reasons include

During the vice presidential debate, Trump's deputy, Republican candidate J.D. Vance, was more than Harris's deputy, Democratic candidate Volz;

The Biden administration's poor performance in response to the hurricanes caused mass discontent and managed to be seized upon by the Republicans to strike back;

Obama was seen as giving Trump points for his inappropriate calls on the black community because he was in a hurry to win the election;

Harris more black material was unearthed, resulting in the middle of the electorate in the "exclusion of aversion" choice more favourable to Trump.

Although the polls may have a certain degree of tendency, always also not accurate, and spinach sites are required to bet through the digital currency, this group of people would have preferred a more friendly to the digital currency Trump, but have to admit, Trump's probability of winning the election is indeed up a lot.The impact of "Trump's policies" should be further emphasised.

Key policies of Trump 2.0:

Tougher immigration policies, advocating deportation of illegal immigrants.

Trump advocates abandoning the green transition and for increased indigenous oil extraction.But Tesla may be the exception.

Reduce the size of government, limit its power and reduce intervention.Note: Wall Street is very receptive to the idea of de-regulation, and industries such as banking and finance, health insurance, and oil extraction are expected to benefit.

Continuing tax cuts and "making permanent" the previous first-term tax cuts.

Foreign tariffs, with a base tariff of 10 per cent on goods entering the United States and a 60 per cent tariff on goods from China, and even "specific taxes" on certain regions or industries.

Diplomatic isolationism, pressure on allies, halting aid to Ukraine and scaling back military spending.

One of the most relevant to overseas investors in China is the escalation of the trade war

Trump 1.0 tariffs: at the beginning of 2018, the Trump administration imposed tariffs on imported goods based on the provisions of 201, 232 and 301, while the industry was basically retained after the Biden administration came to power in 2021, while instead strengthening the technological blockade.Of these, Section 301 has had the greatest impact, affecting $322 billion in goods, or 61.2 per cent of U.S. imports from China.As of July 2024, the average rate of duty on Chinese exports of dutiable goods to the United States will be about 21 per cent.

Trump 2.0 tariffs:

Impose a 10% baseline tariff on all imports;

Elimination of China's "Permanent Normal Trade Partnership" (PNTR), which imposes a 60 per cent tariff on Chinese goods; and, in response to re-exports, a 100 per cent tariff on Chinese automobiles produced in Mexico;

reciprocal tariffs on goods from specific countries;

While higher tariffs in the United States would certainly be paid for by United States consumers, the overall United States economy could be more negatively impacted, dragging down GDP by anywhere from 0.5 to 2 percentage points, while at the same time pushing up the CPI, which in an extreme scenario could rise to over 5 per cent.

At the same time, the cancellation of China's permanent normal trade partnership, and perhaps even the cancellation of China's "most-favoured-nation" status, will have an impact on various industries.

For non-U.S. investors, it is important to file a Form W-8BEN for withholding tax relief, as without this benefit, you may face up to 30% withholding tax on dividends, as well as capital gains tax.

$.SPX(.SPX)$ $.DJI(.DJI)$ $Energy Select Sector SPDR Fund(XLE)$ $Financial Select Sector SPDR Fund(XLF)$ $iShares 20+ Year Treasury Bond ETF(TLT)$ $US20Y(US20Y.BOND)$ $US30Y(US30Y.BOND)$ $Cboe Volatility Index(VIX)$ $iShares 0-3 Month Treasury Bond ETF(SGOV)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.