I deeply miss the washout from August 5th last year. It's so difficult now.

$NVDA$

Let me first review last Friday - Wall Street was particularly crafty and didn't follow the usual playbook.

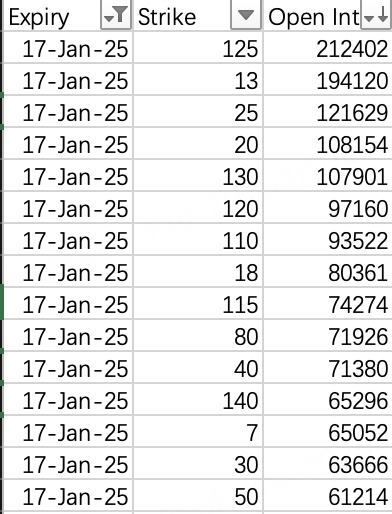

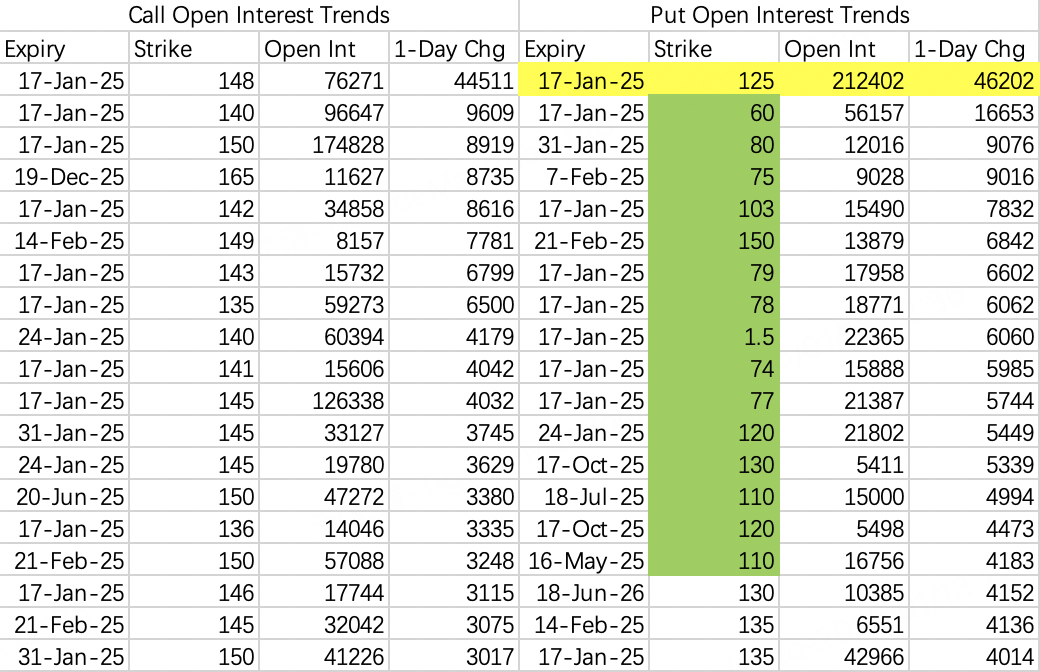

Last Friday January 10th, due to large opening positions in 125 put $NVDA 20250117 125.0 PUT$ , considering time decay's impact on option value, I thought there might be a short squeeze in the opposite direction - a sharp drop Friday followed by a gap down Monday, so I bought 125 puts waiting for intraday decline.

However, shortly after market open there was a deep V-shaped recovery. The rebound caused call volume to disperse put volume - option trading didn't become one-sided. At 12PM I saw no opportunity for the second half, so I closed my position.

Then something interesting happened - in the second half, 125 put $NVDA 20250117 125.0 PUT$ saw another large opening of 46,000 contracts. The advantage of opening positions in the second half is shown in the chart - avoiding peak volatility at market open for better execution prices.

So will the stock price fall to 125 this week? As shown, today's volume was 185,000 with open interest of 212,400. The 125 puts opened last week were likely closed.

Based on last Friday's open interest details, if 125 puts are closed, the highest open interest put strike this week will become 130 or 120.

Position closing doesn't mean downtrend is stabilizing. Overall put opening still leans bearish - current trend remains very dangerous.

Four conclusions from the 125 put situation:

Large positions in next week's options don't necessarily trigger a short squeeze on Friday.

Market open isn't the best entry for betting on a squeeze.

Deep V in first half, stable trend in second half - no need to bet on doomsday (to be verified)

Second half put opening suggests bearish Monday attack (same logic for calls)

NVIDIA's trend this week likely closely tied to TSMC's earnings Thursday. Worth watching today's position opening.

$TSLA$

Some may wonder why Tesla remains so resilient.

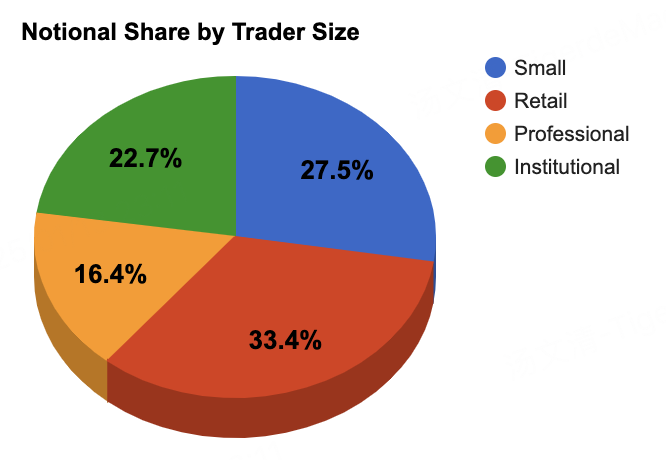

The answer is surprisingly simple - institutions aren't shorting. Professional trading is 16.4%, institutional trading 22.7%, with retail and small trades dominating at 33.4% and 27.5% respectively.

Truly a presidential concept stock - the flattery is so loud I can hear it from home.

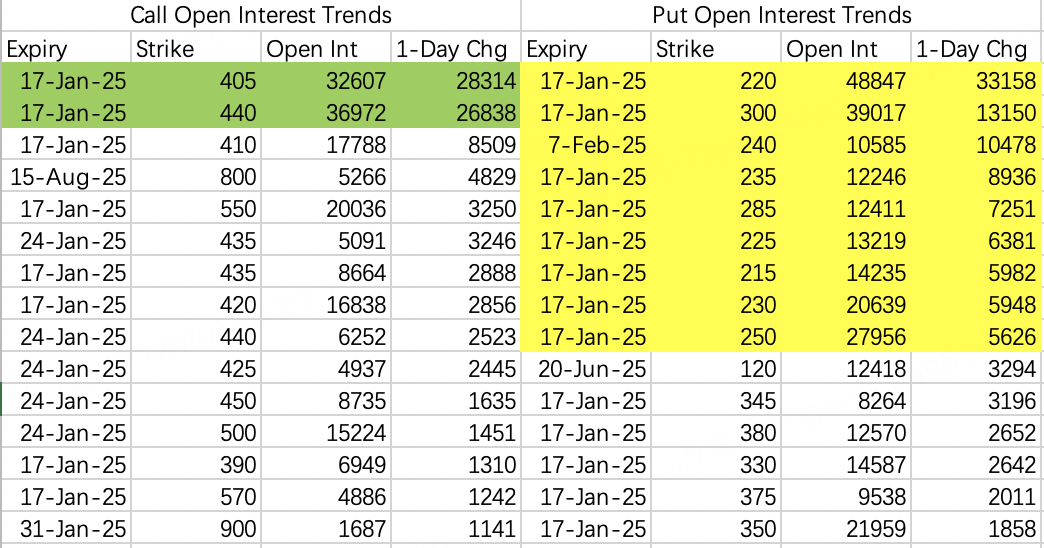

Limited institutional presence shows in put strike prices being unrealistic - forget 220, even 300 is impossible this week.

But Tesla isn't exactly safe - a pullback will come eventually.

Institutions selling 405 calls this week, hedging with 440. In this trend, bear spread strategies are most comfortable.

Sell $TSLA 20250117 405.0 CALL$

Buy $TSLA 20250117 440.0 CALL$

$SPY$

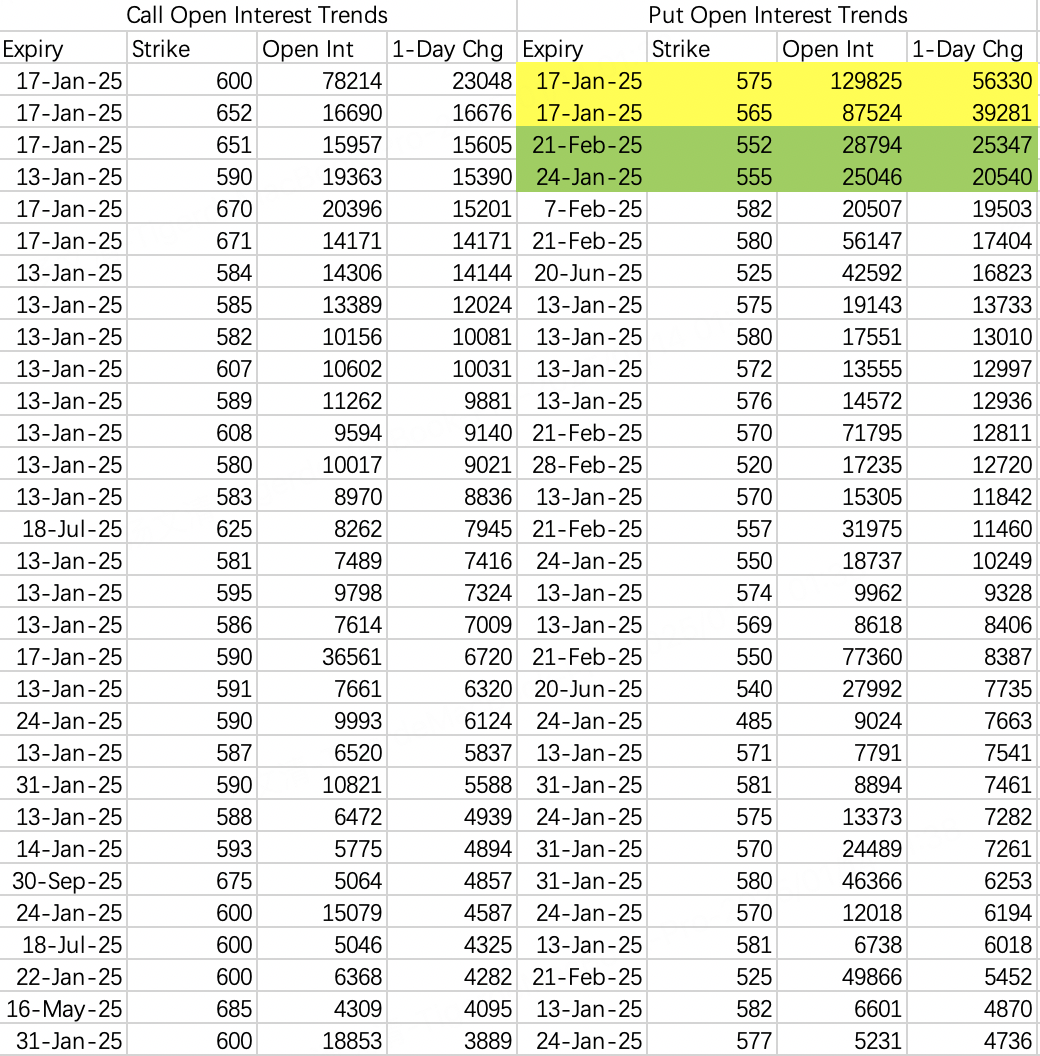

Friday's opening details. Highlighted $SPY 20250117 575.0 PUT$ and $SPY 20250117 565.0 PUT$ have rolled to January 31 $SPY 20250131 575.0 PUT$ $SPY 20250117 565.0 PUT$ .

This is painful - as mentioned at the start, bears found they couldn't win quickly this week, so they're extending the timeline.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.