Is It Time to Short DJT as Trump's Inauguration Approaches?

As the January 20 inauguration date draws near, traders are becoming increasingly vigilant. Last week, Trump privately told congressional Republicans that he plans to issue over 100 executive orders on his first day in office, targeting priorities like border security, immigration enforcement, and energy development. Trump reportedly expressed his desire to "make a splash" on day one, leveraging executive powers on a greater scale and at a faster pace than during his first term.

The advent of “Trump 2.0” is certain to jolt the market. Historically, inaugural speeches often outline a "100-day plan" of policy priorities. During Trump’s first term, policies like immigration controls, withdrawal from the Trans-Pacific Partnership (TPP), expanding energy exploration, and tariff investigations—actions achievable through presidential authority—rolled out swiftly. Meanwhile, tax cuts and other initiatives requiring congressional approval took longer to implement.

What to Expect in Trump's Upcoming 100 Days

Analysts predict that deregulation, immigration policies, and tariffs targeting specific nations could be enacted via executive orders in Trump's first 100 days. Legislative measures related to energy and defense, with relatively minor partisan disagreement, are also likely to gain traction. However, tax cuts and spending reductions may face longer timelines in Congress.

The Outlook for “Trump Trades”

The first wave of "Trump trades" has nearly run its course, but a second wave could emerge with Trump’s return to office. In the current environment of high inflation and interest rates, the inflationary effects of immigration and tariff policies are particularly noteworthy.

At the individual stock level, the companies most influenced by Trump trades are Tesla, led by Elon Musk, and Trump Media & Technology Group (DJT).

Dan Ives, a prominent Tesla bull and Wedbush Securities analyst, suggests that Tesla and other companies could face less regulatory pressure under a Trump administration. Musk, a staunch advocate of autonomous driving, has reportedly supported Trump partly because of plans to establish federal approval processes for self-driving vehicles. Musk’s relationship with Trump could position Tesla to thrive in the next wave of Trump trades.

Meanwhile, Trump Media & Technology Group (DJT) has seen a resurgence in trading activity after a long period of dormancy. In recent days, both stock volume and options activity have spiked, with an uptick in bullish bets. Call options with strike prices of $40 and $50 have been particularly popular, hinting at a potential new rally.

Bear Call Spread: A Case Study in Shorting DJT

A bear call spread is an options strategy suited for traders who anticipate the underlying asset’s price will decline within a defined risk range. Here's an example using DJT, currently trading at $40.83, where the trader expects the price to drop to around $30 by February 21:

Step 1:

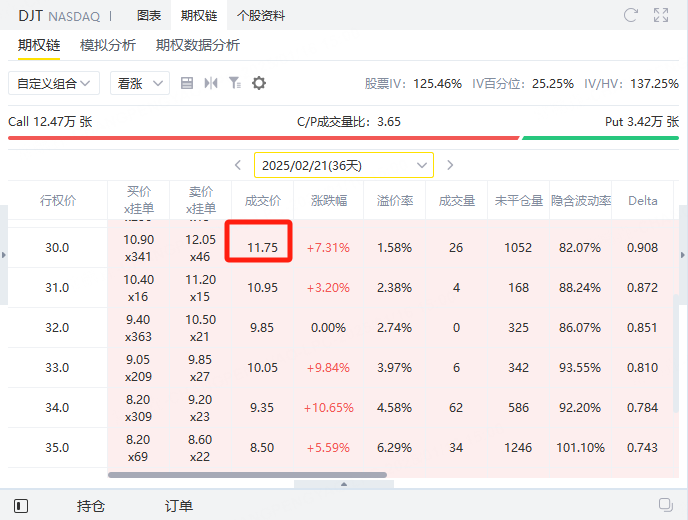

Sell a call option expiring on February 21 with a $30 strike price, receiving $1,175 in premium.

Buy a call option with the same expiration date and a $50 strike price, costing $360 in premium. The bear call spread is now established.

Key Details:

Underlying Price: $40.83

Sold Call Option: Strike price $30, premium $1,175

Bought Call Option: Strike price $50, premium $360

Net Premium Income: $1,175 - $360 = $815 (maximum potential profit)

Maximum Profit:

Occurs if DJT’s price stays at or below $30. Both options expire worthless, and the trader retains the net premium.

Maximum Profit = $815

Maximum Loss:

If DJT’s price rises above $50, the spread widens to $20, resulting in a loss:

Maximum Loss = ($50 − $30) × 100 − $815 = $2,000 − $815 = $1,185

Breakeven Point:

Occurs when the net premium equals the intrinsic value of the sold option:

Breakeven Point = $30 + $8.15 = $38.15

This strategy is ideal for traders expecting DJT’s price to decline but remain above $30. If the price surges significantly, the losses could be substantial.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.