Luigi's effort has paid off, UNH Q4 plunge as MCR surge

The murder of an executive, an asymmetric cyberattack, an embattled pharmacy benefit manager, and rising healthcare costs mark a tumultuous year for $UnitedHealth(UNH)$

On Thursday, the company reported fourth-quarter 2024 results, a rare case of quarterly revenue falling short of expectations while healthcare costs rose.While earnings still beat expectations amid improved operational efficiencies, the stock fell more than 6% and brought down the entire health insurance industry.

UnitedHealth's revenue miss came just weeks after Brian Thompson, the chief executive of its insurance unit, was shot and killed in New York in December minutes before he was due to speak at the company's last investor conference.Business practices in the broader insurance industry came under public scrutiny after the shooting, which was blamed on a gunman named Luigi Mangione.

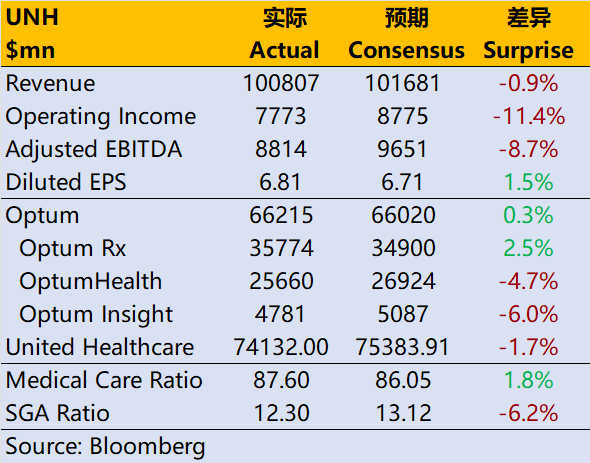

Q4 Financials

The company's fourth-quarter revenue rose about 6.8% year-over-year to $100.8 billion, missing the market consensus estimate of $101.7 billion, and its insurance unit, UnitedHealthcare, reported $74.1 billion in revenue, compared with the market's general estimate of $75.4 billion.

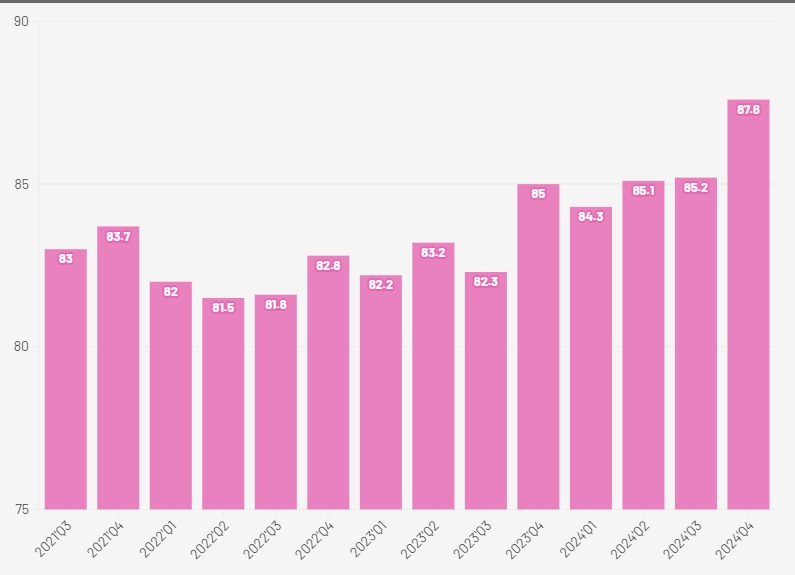

Meanwhile, UnitedHealth's Medical Cost Ratio, a closely watched metric in the managed care industry that reflects the percentage of premium dollars spent on healthcare, reached 87.6% in Q4, well above the market's already elevated estimate of 86.05% in the aftermath of the Luigi debacle, and 85.5% for the full year of 2024, up from 83.2% in 2023.The company attributed the cost increase to reduced Medicare funding and several other factors including member mix.

On the optimistic side, UnitedHealth's pharmacy benefits unit, Optum Rx, outperformed, with Q4 growth of about 15% to $35.8 billion, beating the market's general estimate of $34.9 billion, while its health services unit, OptumHealth, reported revenues of $25.7 billion, a year-on-year increase of about 5%, compared with analysts' forecasts of $26.9 billion.

On the profit front, the company's quarterly Non GAAP EPS came in at $6.81, implying a year-over-year increase of about 11% and beating the market consensus estimate by $0.07, even though its operating margin fell to 7.7% from 8.4% a year earlier.

The margin improvement was mainly a result of lower operating expense rates, and it's possible that the company was aware of the pressure on the revenue side in the quarter and was able to lower its operating expense rates.

Earnings Outlook

The company reaffirmed its 2025 outlook disclosed at last month's investor event, expecting full-year revenues of $450 billion to $455 billion, ahead of market expectations of $447.3 billion, and Non-GAAP EPS of $29.50 to $30, with the median slightly below the market's estimate of $29.86.

Discussion is about MCR surge

The following factors are critical at this point in time

The Luigi outbreak has affected the reputation of the health insurance industry, and public pressure has further increased insurers' payout rates.

Rising medical costs: Insurers faced higher costs for medical claims due to the increased demand for medical services after the outbreak.Especially among the elderly population, healthcare utilization has risen significantly, leading to higher expenditures; at the same time, price increases for medical items have also increased healthcare costs.

Decrease in Medicare Funding:Decrease in Medicare funding from the Centers for Disease Control and Prevention (CMS) has negatively impacted UNH's financial performance.This led to a decline in the company's revenue when dealing with older patients, which pushed up the MCR.

Changes in business and membership mix: there have been changes in UNH's membership structure and business mix, which have also impacted the MCR. for example, fluctuations in Medicaid membership and an increase in the percentage of high-risk members can lead to an increase in the overall cost of health care.

Medical Reserve Development Impact: In Q3 2024, UNH failed to realize any pro-earnings medical reserve development, which meant the company did not have enough reserves to offset some of its costs as it processed claims, leading to an increase in the MCR.

Increased operating costs: total operating costs increased by approximately 10% year-on-year in Q4 2024, largely due to rising medical expenses and product costs.This increase exceeded market expectations and exacerbated the rise in MCR.

Overall, UNH's 2024 revenue expectations may not necessarily be a slam dunk, but the company's position in the industry and the impact that Trump's ascension to power may have on the healthcare industry may further add to the company's uncertainty.

As one of the major weights in the $.DJI(.DJI)$ UNH has strong defensive attributes, but its defensive attributes could decline to some extent if the company's own performance becomes more uncertain.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- TZA·01-17Innocent until proven guilty?1Report