Way to Bet on NFLX Earnings in the Short Term

In the early hours of January 22nd (Beijing time), after the U.S. stock market closes, streaming giant $Netflix(NFLX)$ will officially release its FY2024 annual report. Analysts expect Netflix’s Q4 2024 revenue to reach $10.118 billion, representing a year-over-year increase of 14.55%, with earnings per share (EPS) estimated at $4.19, a year-over-year increase of 98.7%.

Netflix's stock price has declined about 10% over the past month, reflecting the broader market sell-off driven by macroeconomic uncertainty. However, Netflix has performed exceptionally well in 2024, with its stock price trending upwards overall. The stock gained 83.07% over the year, hitting an all-time high of $941.75 on December 11, 2024.

Netflix Earnings Season Performance Review

According to Market Chameleon, over the last 12 quarters, Netflix’s stock price has fluctuated an average of ±12.2% on earnings day. The largest single-day gain was +35.1%, while the smallest movement was a decline of -1.5%.

Currently, Netflix’s implied move is ±8.8%, indicating that the options market is pricing in a post-earnings single-day move of 8.8%. Historically, the average expected post-earnings move is ±9.6%, but the actual average absolute move has been 12.2%. This suggests that Netflix’s earnings-induced price swings are often more significant than the options market anticipates.

To capitalize on the upcoming Netflix earnings volatility, investors may consider using a strangle strategy.

What Is a Strangle Strategy?

In a long strangle options strategy, investors simultaneously purchase out-of-the-money (OTM) call and put options. The strike price of the call option is above the current market price of the underlying asset, while the strike price of the put option is below it. This strategy offers significant profit potential, as the call option theoretically has unlimited upside if the asset price rises, while the put option profits if the price falls. The risk is limited to the premium paid for both options.

In a short strangle options strategy, investors sell one OTM call option and one OTM put option. This is a neutral strategy with limited profit potential. If the stock price trades within a narrow range between the breakeven points, the short strangle strategy can be profitable. The maximum profit equals the premiums received from selling both options, minus transaction costs.

Netflix Short Strangle Strategy Example

Netflix stock is currently trading at $862. Investors can implement a short strangle strategy with the following steps:

Sell one call option with a strike price of $950, receiving a premium of $938.

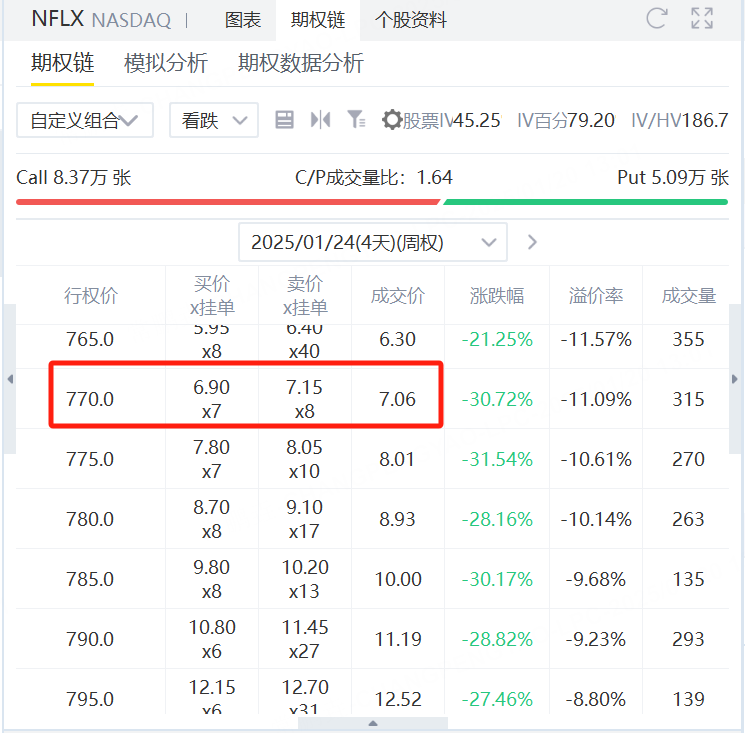

Sell one put option with a strike price of $770, receiving a premium of $706.

Premium Income:

Call option premium: $938

Put option premium: $706

Total premium income: $1,644

Breakeven Points:

Upper breakeven: $950 + $16.44 = $966.44

Lower breakeven: $770 - $16.44 = $753.56

Maximum Profit:

If the stock price remains between $770 and $950, the maximum profit is $1,644, which is the total premium received.

Maximum Loss:

Theoretically, the loss is unlimited.

Conclusion:

Maximum profit: $1,644.

If Netflix's stock price stays between $770 and $950, investors will earn the full premium.

If the stock price exceeds $950 or drops below $770, losses will begin to accumulate.

This strategy suits investors who expect limited volatility in Netflix’s stock price post-earnings but are willing to bear significant risk if the stock moves sharply beyond the breakeven points.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.