Institutional Big Order Sets Tone at 110, NVIDIA's Rebound Has a Long Way to Go

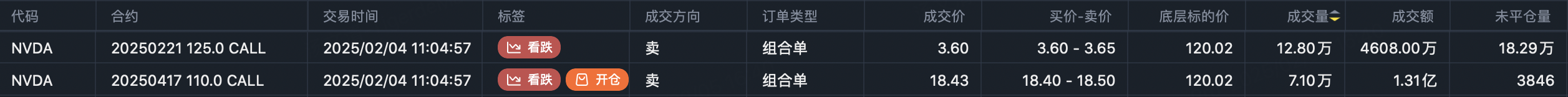

The "200M Bro" rolled over positions on Tuesday, indicating poor expectations for NVIDIA's Q1:

Closed $NVDA 20250221 125.0 CALL$ , with volume of 128,000 contracts

Rolled into buying $NVDA 20250417 110.0 CALL$ , with volume of 71,000 contracts

Let me briefly introduce "200M Bro" - it's a nickname for an institution I track. I don't know which institution it is, but their trading style suggests they operate under performance agreements. I gave them this nickname after first tracking their 200 million dollar NVIDIA call option purchase, making it easier to track and reference them.

They don't just trade NVIDIA; they have long calls on popular tech stocks. For example, the 15,000 contracts of $TSLA 20250516 400.0 CALL$ from two days ago was likely their move.

Since it's not purely a bullish strategy, the buying details matter more than bullish implications.

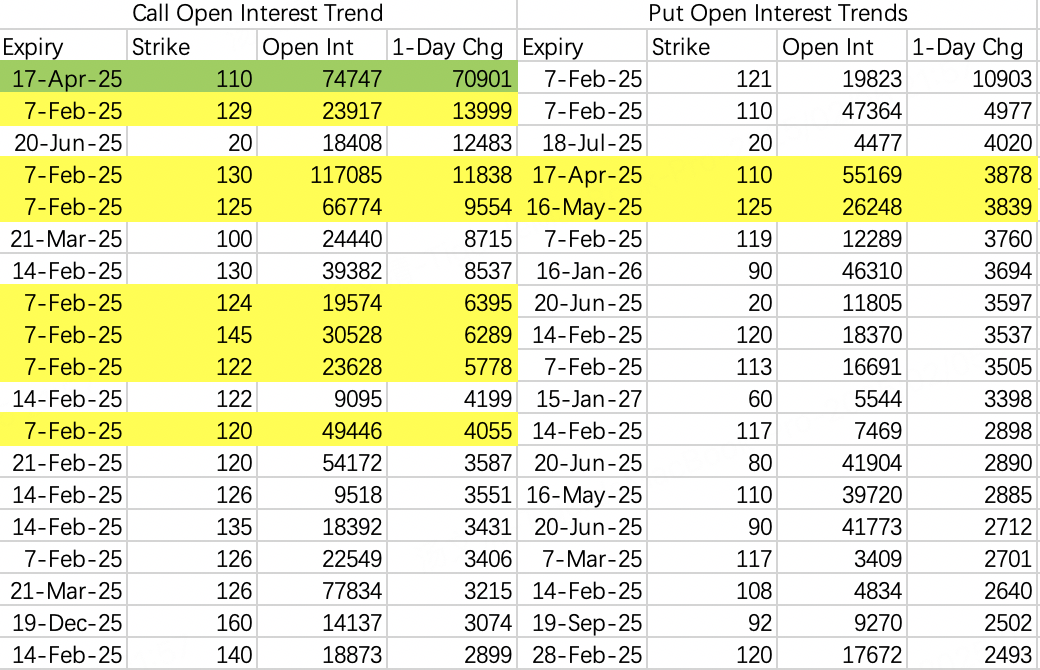

Based on long-term observation, stock prices tend to exceed their long call strike prices in bull markets, while in bear or choppy markets, prices fluctuate around their option strike prices, which serve as strong reference points.

Additionally, changes in rolling volume indicate risk control expectations. Increasing volume suggests bullishness, while decreasing volume suggests possible significant price corrections.

In this roll-over, not only was the strike price lowered from 125 to 110, but the volume also decreased - closing 128,000 contracts but only opening 71,000 new ones.

Based on previous experience, NVIDIA's pre-earnings trading range is roughly between 100-130.

Another detail: "200M Bro" typically maintains or extends expiration dates by about a month before earnings, with another roll after earnings. Choosing April instead of March and lowering the strike price post-earnings suggests they're not optimistic about the earnings rebound strength.

This implies uncertainty about whether the price can return to 140 after earnings.

Will NVIDIA's earnings be poor? Is it affected by Deepseek?

Looking at tech companies' earnings reports, capital expenditure has actually increased rather than decreased. For example, Google's capital expenditure increased to 75 billion USD, above the expected 60 billion. This debunks the Deepseek bearish case.

However, recent tariff concerns affect all large-cap stocks, including NVIDIA. While Deepseek isn't actually negative news, it has shattered the unique AI valuation filter for U.S. stocks, meaning NVIDIA no longer has immunity during market downturns.

Tuesday's options opening details show "200M Bro's" 110 call as the top unopened bullish position. Call options are trying to push the price back to 130 this week; put options are positioning for key future levels, showing less interest in this week.

Theoretically, selling this week's 120 puts could work (I took a small position), but to avoid catching falling knives, one should only consider strikes below 100, given the ongoing tariff concerns. Option positioning should be less forward-looking.

Common Questions Answered:

Why do combination order buy/sell directions differ from the image?

Program-determined directions are based on transaction prices relative to bid-ask spreads. However, not all options trading is electronic, and price deviation doesn't always accurately reflect transaction direction, especially for floor trades between traders.How to identify floor trading large orders?

Options have much lower liquidity than stocks. Orders over 10,000 contracts executing as a single line are likely floor trades.Are large order screenings useless if directions are wrong?

Direction is just auxiliary - calls are calls, puts are puts. Opening calls indicate bullishness, opening puts indicate bearishness. Expiration dates and strike prices are also crucial clues.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.