Best Buy FY26 Outlook: driving opportunity for services, but market worries about recession

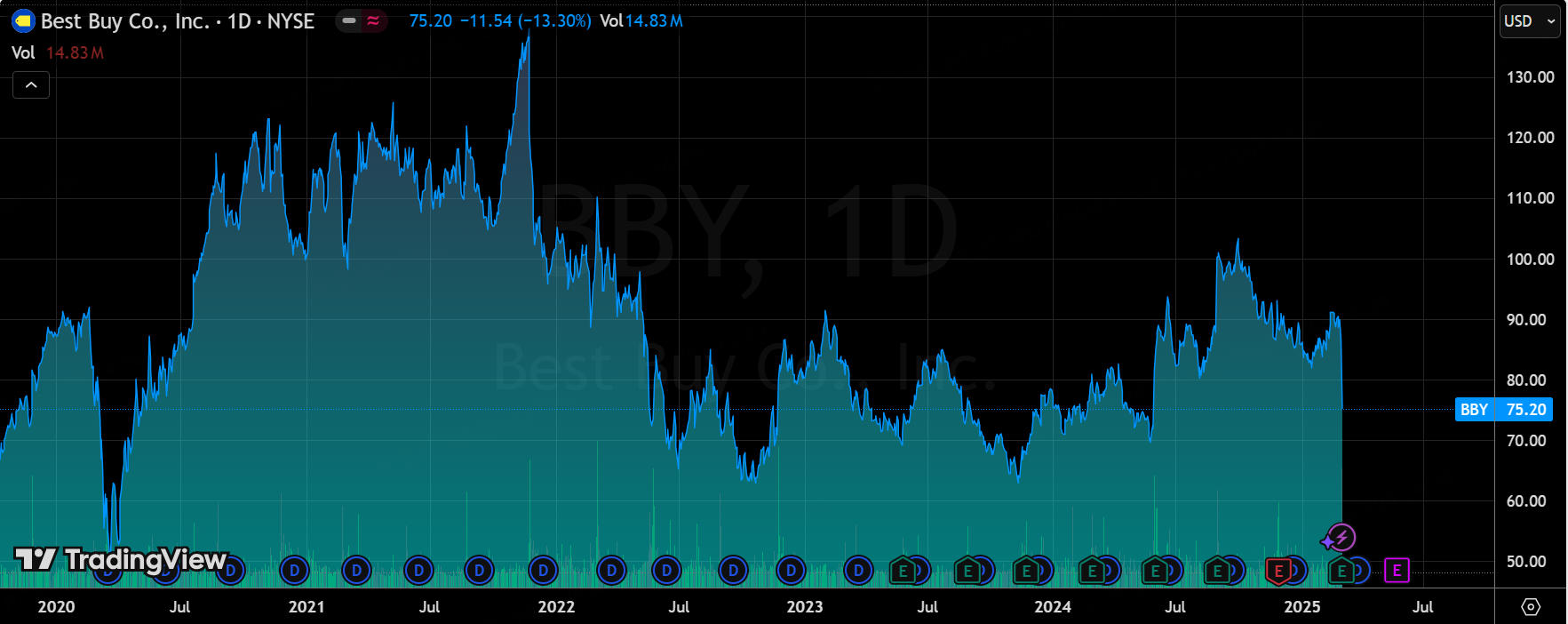

$Best Buy(BBY)$ plunged 13% after its earnings report, which honestly didn't look too bad, but because of the decline in same-store sales, it will have investors combining that with the previous weaker-than-expected guidance from $Wal-Mart(WMT)$ that retail sales are sluggish and recession risks areincrease. $Target(TGT)$

Takeaways

Tariff uncertainty: China/Mexico tariffs are the biggest risk variable, initially estimated to drag sales by 1% (if maintained at 10%), but management emphasizes flexibility (SKU adjustment/supplier negotiation).

New business layout: Marketplace (SKU expansion) and Ads (agency cooperation) are future profit engines, FY26 investment period, but is expected to improve margins in the medium to long term.

Revenue differentiation: computing/gaming share increase (differentiated services + new product cycle), home appliances still weak (industry promotion + housing market downturn).

Cost impact: inflation offset by AI customer service/procurement system optimization, FY26 capex $700-750M (flat y/y)

Health Business Impairment: $475M Best Buy Health Impairment (less long term growth than expected), but maintains home healthcare strategy.

Performance and market feedback

Performance

FY25 results: revenue 14B (+0.52.58 (-5% YoY); operating margin 4.9% (-10bps).

FY26 guidance: revenue 41.4-42.2B (same store 0-26.20-6.60 (+140-156% YoY); operating margin 4.2-4.4%.

Comparable sales: same-store -0.5% YoY, higher than the company's estimate of -3%; including domestic US comparable sales of +0.2%;

Market reaction: despite the earnings beat, Best Buy shares fell 13.3% after the release, likely due to concerns about future growth

Investment highlights

Tariff Impact

Impact of 10% China or Mexico tariffs (or rising to 20%) on sales and EPS: would drag full year comparable sales by ~1% (mainly impacting Q2-Q4) and EPS impact of ~$0.20. Mexico tariffs, if implemented (20% of purchases), could impact private label TVs and appliances.

Supply chain flexibility and collaboration with suppliers will mitigate the impact, and current guidance does not include tariff variables

Sales momentum and share

Q4 comparable sales +0.5%, flat share in the industry

Full year share gains in computing/gaming category (game console share at 30-year high), but appliances/home theater under pressure

FY26 is expected to see continued growth in computing (Win10 upgrades + AI capabilities) and a narrowing decline in appliances.New Switch and GTA6's pull on FY26 sales is expected to be more pronounced in H2 growth

Margin improvement

U.S. domestic online sales increased 2.6% year-over-year, with progress in digital transformation favoring margins;

The Company's gross margin increased 40bps to 20.9%, driven by improvements in the services category;

FY26 gross margin guidance (flat to +20bps) is driven by services (membership) and advertising business support, with flat and slightly lower product margins. flat SG&A (efficiency optimizations offsetting new business investments)

Cost discipline: inflation offset by AI customer service/procurement system optimization, FY26 capex of $700-750M (flat y/y), dividend upgraded for 12th consecutive year (+10.95/share dividend).

New Strategy Execution

The company's Omni-Channel strategy and new profit streams such as Best Buy Marketplace and advertising will be key to future success;

U.S. Marketplace will be more focused on new product SKUs (not refurbished) and is expected to go live mid-year, with limited initial contribution but long-term margin and share enhancement. best Buy Ads has signed up a large ad agency and is expected to grow revenues over the next few years, but will require resources (e.g., New York office).

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- JimmyHua·03-06These are interesting topics to watch! Great job!LikeReport

- zippyzo·03-05Great insights, absolutely love the analysis!

![[Wow]](https://c1.itigergrowtha.com/community/assets/media/emoji_027_wasai.bc2354fb.png) LikeReport

LikeReport