CrowdStrike's Earnings Alert: Too much AI cost?

$CrowdStrike Holdings, Inc.(CRWD)$ Q4 FY2025 earnings report, released on March 4, 2025, presented a two-sided picture of solid revenue growth but weaker-than-expected earnings guidance.

Continued strength in core growth metrics (ARR, platform penetration), but aggressive investments led to short-term earnings pressure.

The share price correction reflects the market's re-pricing of the "high growth and high spending" model, and we need to pay attention to whether the ARR growth rate can hedge the rising expenses and the progress of commercialization of the AI product line.

In the long run, if the $10B ARR target is reached, the platform effect will significantly improve margin elasticity.

Performance and Market Feedback

Solid core numbers for the quarter:

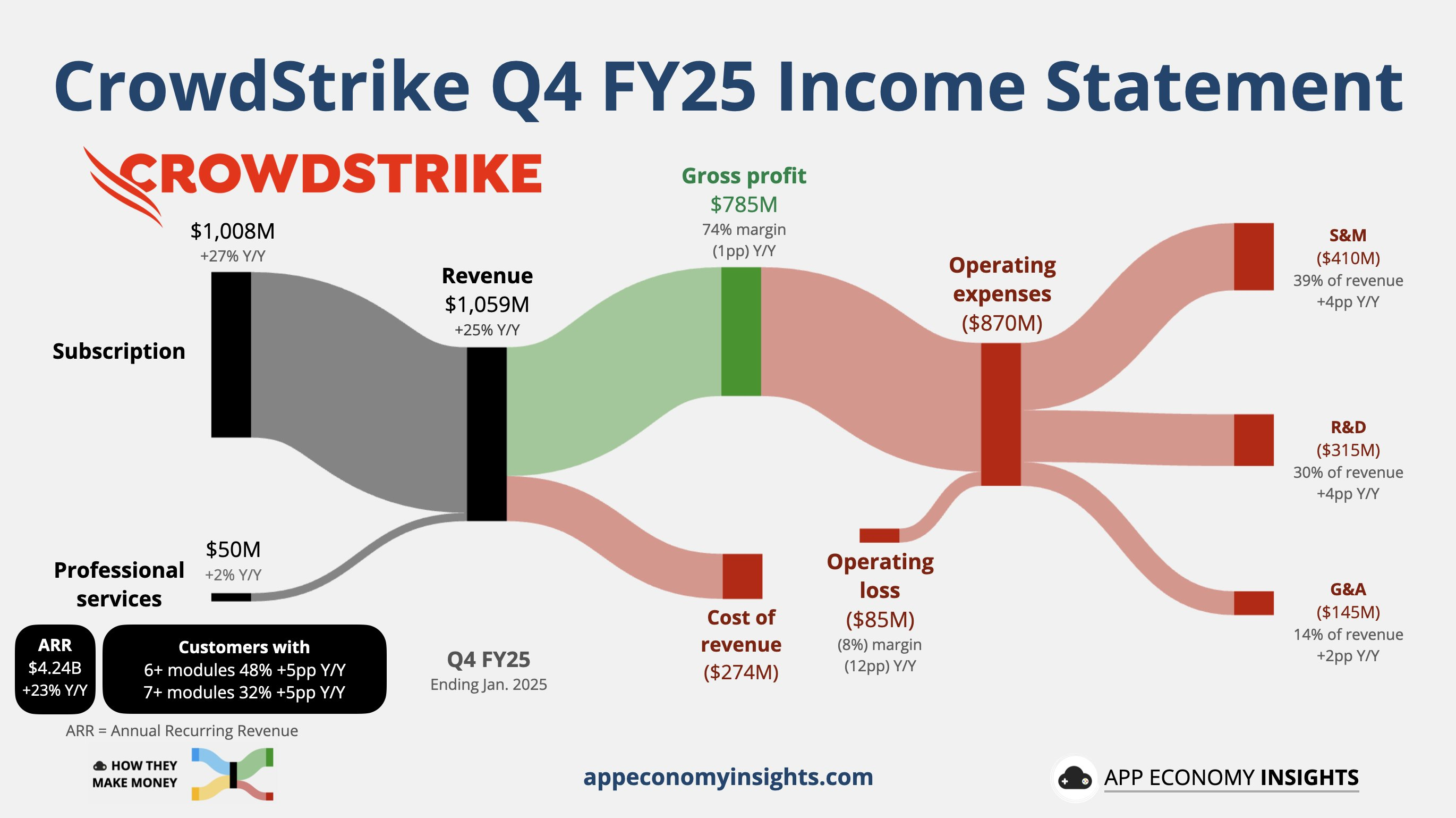

Total revenue reached $1.06B (+25% yoy), beating market expectations by 2.4% ($1.03B), with subscription revenue of $1.01B (+27% yoy), accounting for 95% of total revenue

Annual Recurring Revenue (ARR) of $4.24B (+23% yoy) with net new ARR of $224M

Profitability: non-GAAP operating profit of $217M (+2% yoy), corresponding to a margin of 20.5%; GAAP operating loss of $85M (vs. profit of $30M in the same period last year), mainly due to a surge in R&D and selling expenses (R&D expenses +47% yoy, selling expenses +41%)

Cash flow: Q4 operating cash flow $346M, free cash flow $240M; full year free cash flow $1.07B (record)

Market Reaction: Shares fell 9% in after-hours following the earnings release, mainly due to lower-than-expected earnings guidance for the next quarter:

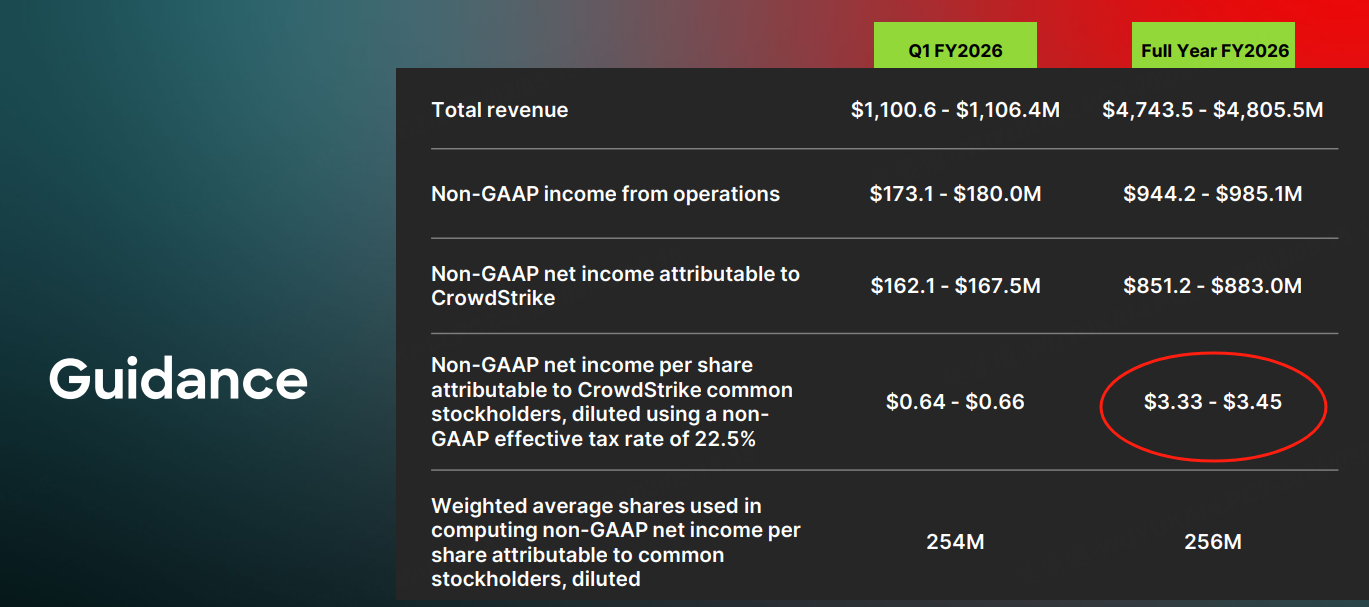

2026Q1 non-GAAP EPS guidance of $0.64-0.66, significantly lower than market expectation of $0.95; full year revenue guidance of $4.55-4.56B (+15% y/y), a significant slowdown in growth rate compared to +29% in FY2025

Investment Highlights

Platformization strategy shows results, continues to be a growth engine

Module stacking effect: ARR of cloud security, Next-Gen SIEM and identity protection business together exceeded $1.3B, up over 40% year-on-year.

Customer Stickiness: Customer retention rate remained high at 97%, with Falcon Flex solution contributing over $1B in transaction value in the current quarter.

Large customer penetration: 89 of the Fortune 100 and 75% of the Global 2000 have adopted its platform.

AI-driven efficiency improvement, dual optimization of threat detection and operating costs

Charlotte AI, a natural language security assistant, covers 35% of customers and generates $0.3B in direct revenue in Q4 (ARPU +15% YoY);

AI threat prediction underreporting reduced by 40%, response time shrunk from minutes to seconds (3rd party NSS Labs test validation)

Short-term margin pressure remains, long-term investment increases

R&D & Selling Expenses Surge: Q4 R&D expenses $315M (+47% yoy), Selling expenses $410M (+41% yoy), mainly AI platform & market expansion investment.

Gross margin resilience: subscription gross margin maintained 80% (non-GAAP), but opex ratio climbed to 78% (GAAP caliber), dragging down GAAP earnings.

Guidance less than expected, market divergence

ARR target: reaffirmed target of $10B ARR by FY2029 (current CAGR needs to be maintained at ~20%)

Weak earnings guidance: next quarter's EPS guidance is 30%+ below market expectations, which may raise concerns about high cost of growth

Cash reserves of $4.32B, providing ample ammunition for M&A and technology investments

Operating efficiency: 27% free cash flow margin ($1.07B/$3.95B) for the year, confirming the health of the business model.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Valerie Archibald·03-05They are the industry leader! Don’t fight it!1Report

- Twelve_E·03-05

![[Miser]](https://c1.itigergrowtha.com/community/assets/media/emoji_003_caimi.53908f82.png)

![[Strong]](https://c1.itigergrowtha.com/community/assets/media/emoji_039_qiang.91ef6183.png) insightful, have you bought CRWD?1Report

insightful, have you bought CRWD?1Report