Target's Q4 Highlights: Strong Digital Growth, Cautious 2025 Outlook

$Target (TGT)$ have not been too volatile since the release of its Q4 results.Despite the same "tariff threat" and potential consumer downgrade, its Q4 profit beat and clear 25-year plan, combined with the effectiveness of its current omni-channel strategy, make it a good medium- to long-term watch. $Wal-Mart(WMT)$ $Costco(COST)$

Performance situation and market feedback

Q4 core financial metrics paper, margins beat expectations

Revenue: $30.9B (-3.2% yoy), slightly exceeding market expectations of $30.77B (+0.48%).Since Q4 2023 has one more week than Q4 2024, excluding this effect, full year revenue growth on a comparable basis is ~1%;

Earnings per share (EPS): GAAP and adjusted EPS were both $2.41, -19.1% yoy, but exceeded market expectations of $2.25 (+7.11%); full-year EPS was $8.86, -0.9% yoy, but up nearly 3% under comparable caliber;

Margin: Q4 gross margin 26.2% (-0.4pct yoy), mainly driven by digital fulfillment costs and promotions; full year gross margin 28.2% (+0.7pct yoy), thanks to product optimization and advertising revenue growth. q4 operating margin 4.7% (-1.1pct yoy), full year operating profit $5.6B (-2.5%)yoy)

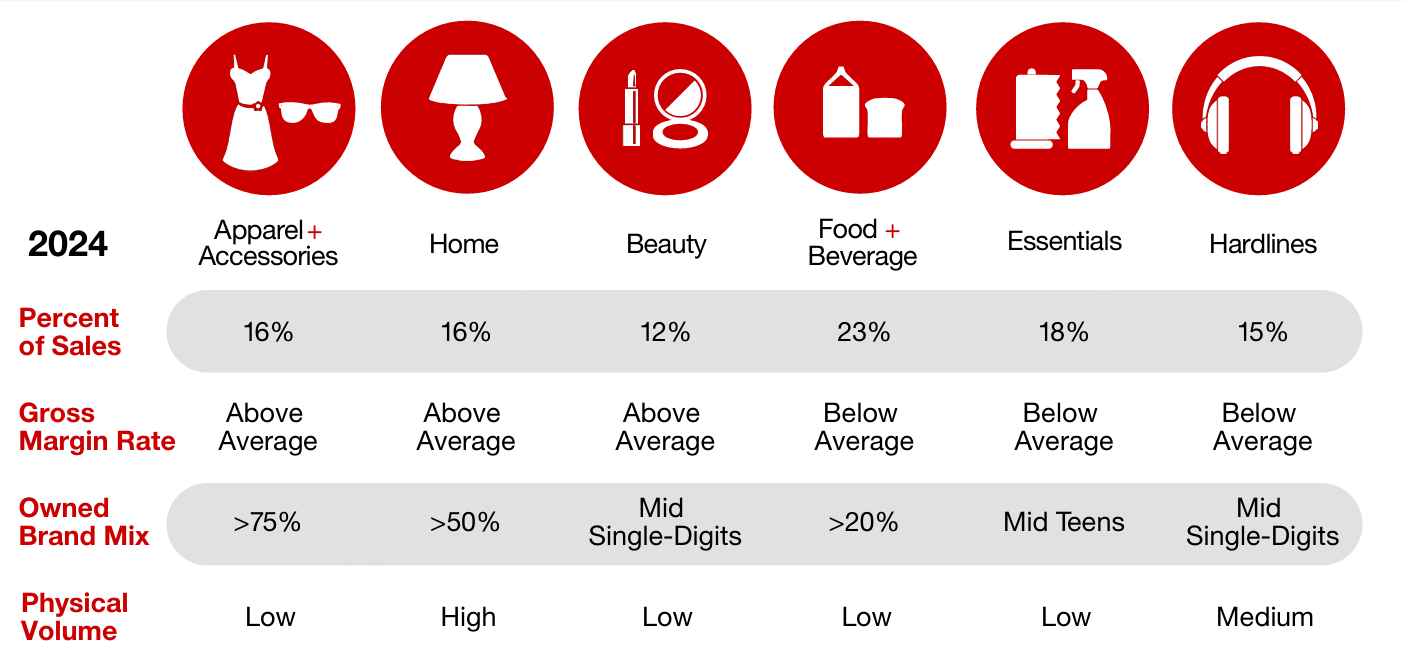

Comparable sales were relatively strong, with variations in performance of strategized categories

Q4 same-store comparable sales growth of +1.5%, driven by traffic (+1.4% yoy) and digital channels; digital sales of +8.7%, with same-day delivery service (Target Circle 360) growing by >25

Toys, electronics, and apparel sales exceeded expectations, with apparel and hardline merchandise growth improving nearly 4 pct from Q3; beauty and food & beverage categories continued to grow throughout the year;

Own brand All in Motion sales exceeded $1B (+10% yoy), Target Plus third-party platform GMV reached $1B (double-digit growth); same-day delivery orders exceeded 40%, Drive Up service utilization rate +20% yoy.

Cost control: cumulative cost savings over the past two years exceeded $2B, but Q4 SG&A expense ratio rose to 19.4% (+0.6 pct yoy)

Market Reaction:

Shares were less volatile after hours following the earnings release (specific numbers not disclosed), but the revenue may support short-term sentiment with the EPS beat and clear 25-year plan.Investor concerns may center on margin pressure (e.g., rising supply chain costs) and a 2025 tariff risk warning.

Investment highlights

Results exceeded expectations but margins were under pressure

Q4 revenue and EPS exceeded expectations, reflecting the company's resilience in a weak environment, especially the significant impact of digital transformation (e.g. same-day delivery) on customer traffic.

Gross margin declined year-on-year, mainly due to increased promotions and high digital fulfillment costs, but the full-year gross margin improvement shows that long-term cost optimization is paying off.

Category differentiation and growth momentum

High-growth categories: toys, electronics, and apparel were the highlights of Q4, showing seasonal demand and supply chain improvement; beauty category saw mid-single-digit growth throughout the year, reflecting differentiated product selection strategies.

Potential risks: Demand for hard-line goods (e.g., household) remains to be seen, and consumer non-essential spending trends need to be watched;

February sales decline was mainly due to weakness in non-essential consumer goods (e.g., home/electronics), but beauty (+7% yoy) and apparel (third consecutive quarter of market share gains) remained strong.Risks are hedged through a "limited time exclusive co-branding" strategy.

2025 Guidance and Risk Warning

Company did not specify specific 2025 targets, but emphasized concerns about tariff impacts, which could impact gross margins; incremental revenue $15B+ over next five years, 2025 EPS guidance $9.5-$10.2 (Non-GAAP)

Capital expenditures of $4-$5B in 2025, focused on

Opening 20+ new full-size stores (23 already opened in 2024), current new store ROIC of over 15%, to reach 75% of Americans in a 10-mile radius;

Supply chain: 15% improvement in inventory turnover efficiency (through store warehouse and distribution integration)

Digital: AI search optimization + social e-commerce integration to drive $20B digital business (Q4 growth +9%)

Membership system monetization: Target Circle membership grew by 13M annually, key realization paths: paid subscription to Target Circle 360 (including same day delivery service), co-branded card spending share increased to 25% (daily 5% rebate), $2B ad revenue from media business Roundel (plan to double in 5 years)

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- tiger_cc·03-05Thank you for sharing!LikeReport

- JimmyHua·03-06it performs wellLikeReport