Nvidia: Duan Yongping Ends the Game

The NVIDIA options market on Tuesday can be summed up in one sentence: various bottom-fishing tactics. Among all the large-scale bottom-fishing trades in the past two days, the most reassuring one is Duan Yongping's sell put strategy.

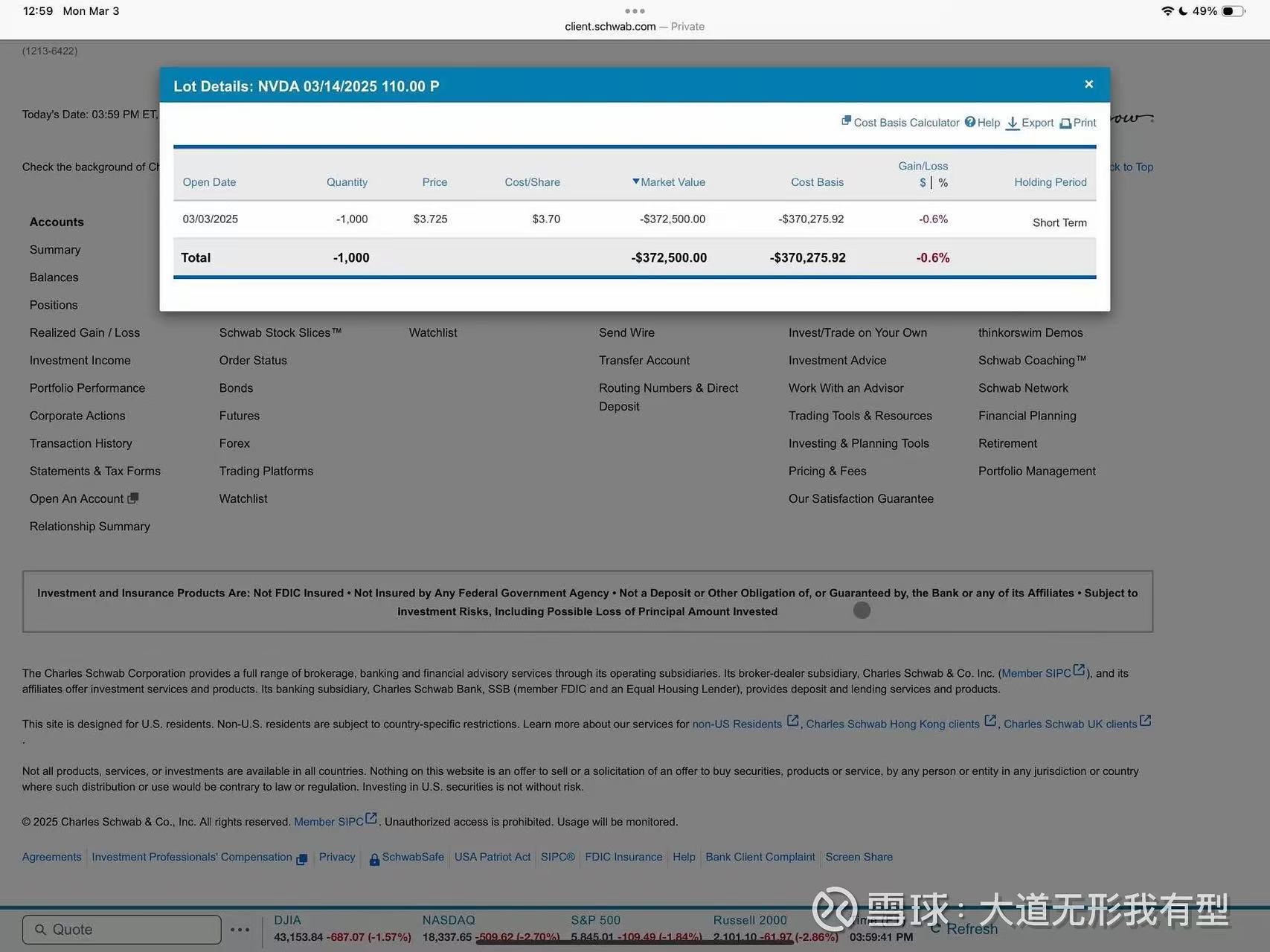

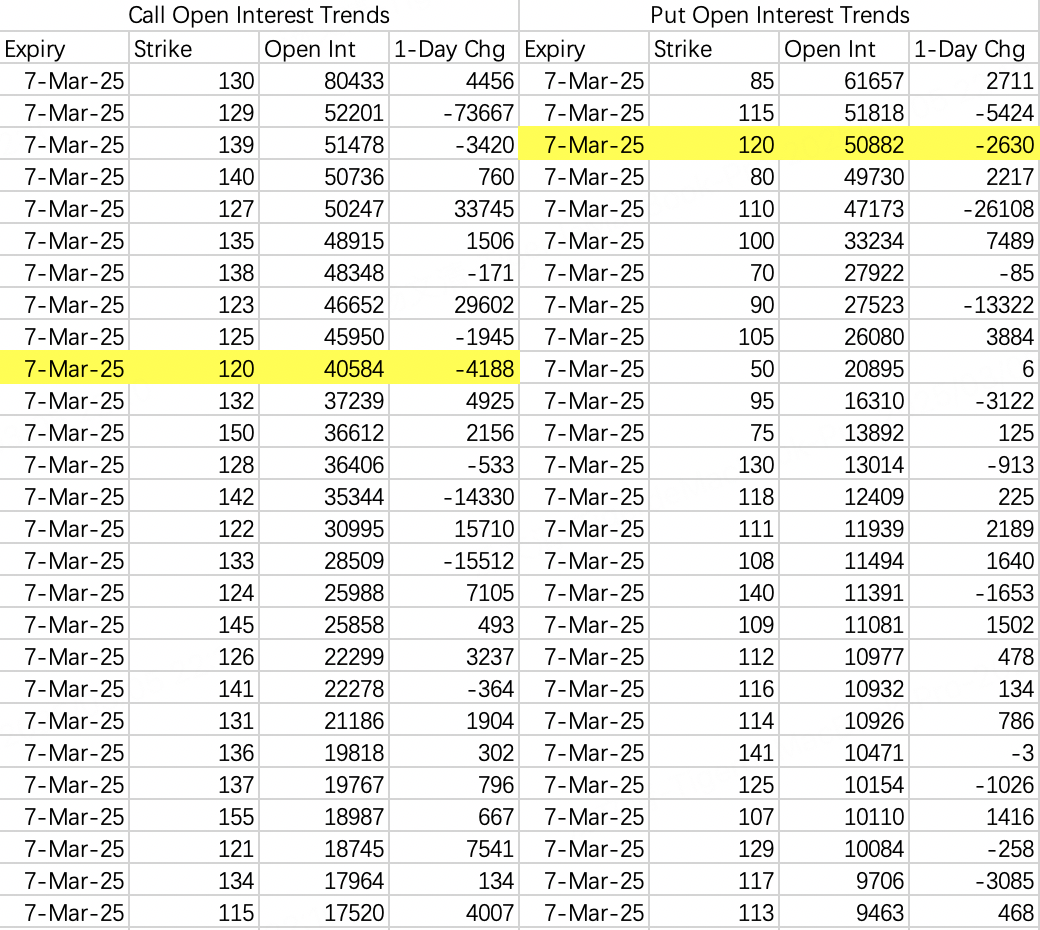

Duan Yongping’s sale of the 110 put $NVDA 20250314 110.0 PUT$ greatly simplifies the task of identifying the bottom this time.

The 110 strike price carries significant weight and credibility.

Let’s take a look at Tuesday’s major bottom-fishing trades:

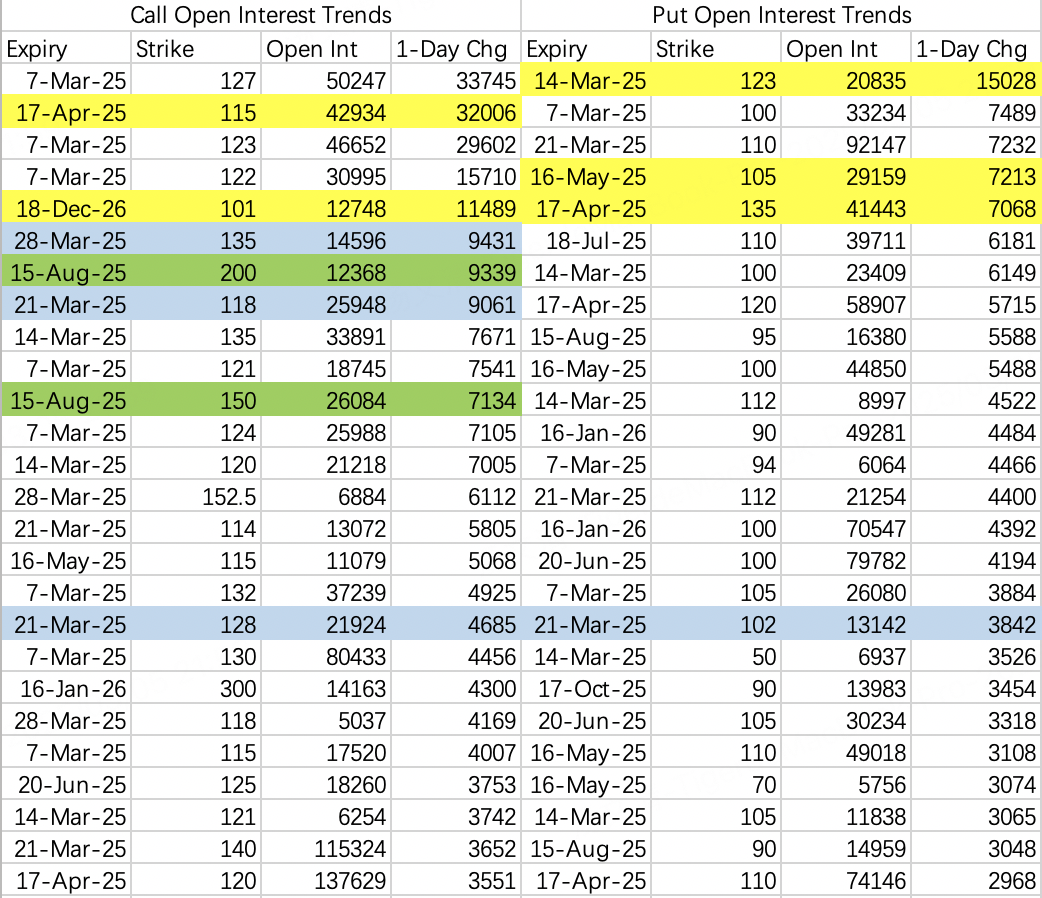

$NVDA 20250417 115.0 CALL$ : This is a long call roll. The strike price was adjusted downward from 130 to 115 during the roll.

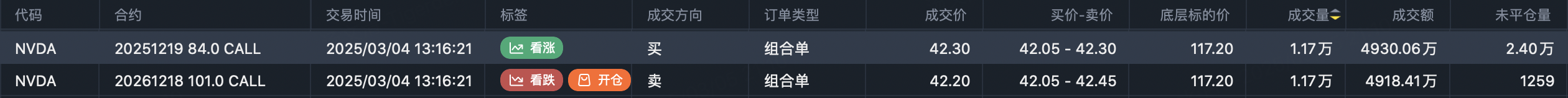

$NVDA 20261218 101.0 CALL$ : Another long call roll. Half of the $NVDA 20251219 84.0 CALL$ position was closed and rolled forward to the 101 call. Notably, the 84 long call was opened on August 6 last year, representing a precise bottom-fishing move.

Long-term bullish vertical spread: Buying $NVDA 20250815 150.0 CALL$ and selling $NVDA 20250815 200.0 CALL$ . Nothing much to say here—this is a straightforward long-term bullish strategy.

The large short-term bullish trade marked in blue is a very complex strategy. While it is complicated, it’s also reliable. However, don’t set overly high expectations for a near-term rebound. Be mindful of options decay:

Sell $NVDA 20250321 128.0 CALL$ ,

Sell $NVDA 20250321 102.0 PUT$ ,

Sell $NVDA 20250328 135.0 PUT$ .

On the bearish side:

Long-term bearish 120 puts $NVDA 20250321 120.0 PUT$ were rolled closer to $NVDA 20250314 123.0 PUT$ .

Large sell orders on $NVDA 20250516 105.0 PUT$ .

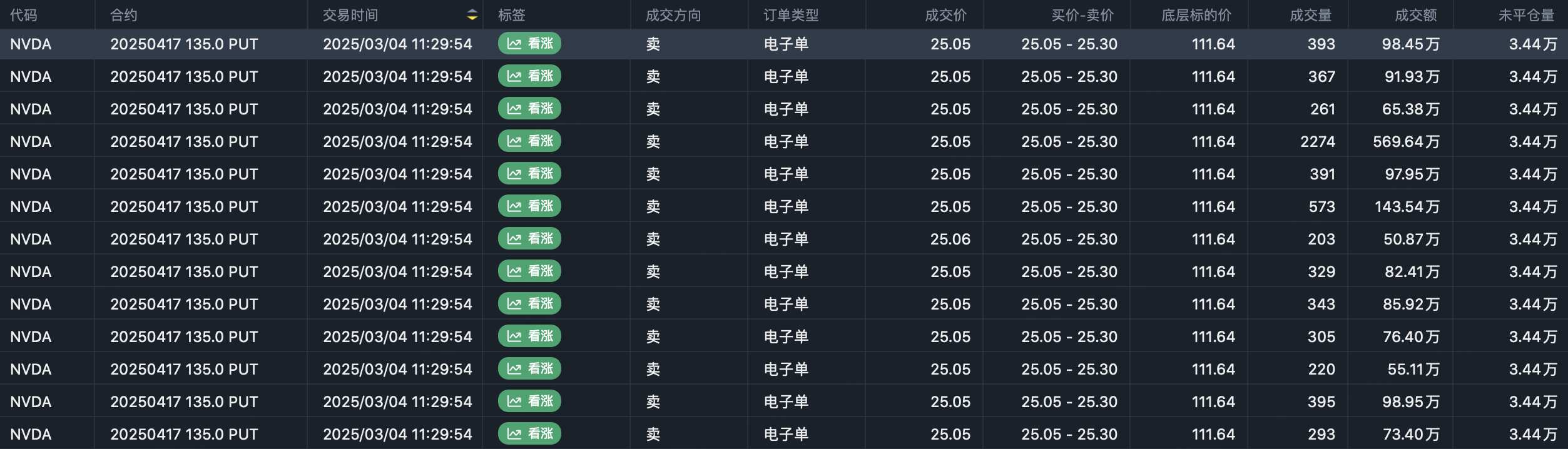

Large sell orders on $NVDA 20250417 135.0 PUT$ , with 8,100 contracts sold. This is an unusual strategy. While selling in-the-money puts can indicate a bullish outlook, experienced traders managing large accounts typically avoid this approach. Nonetheless, it still signals a broadly optimistic attitude.

For NVIDIA, a close at 120 this week would be an ideal scenario. Market sentiment remains fragile, and additional black swan events could push the price below 110—similar to the cascading events of August 5 last year. However, if you truly want to bottom-fish, there’s no need to overthink it. Just follow Duan Yongping’s trade.

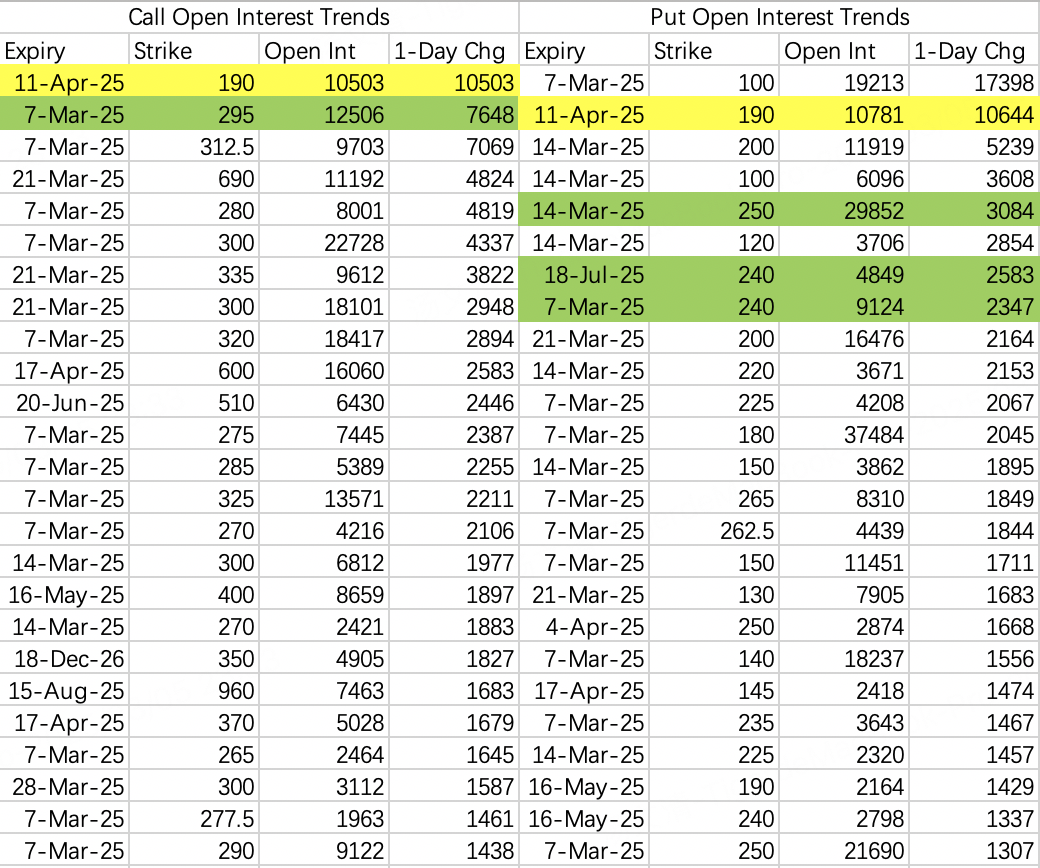

Two large bearish trades remain unclosed: $TSLA 20250620 370.0 PUT$ and $TSLA 20251219 250.0 PUT$ . It’s still not the right time to bottom-fish.

The at-the-money straddle trade $TSLA 20250411 190.0 CALL$ and $TSLA 20250411 190.0 PUT$ indicates a capitulative strategy that is cautiously bearish-leaning bullish, with a target price still locked around 200.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Adril·03-06Great article, would you like to share it?LikeReport