Where will the yield of the 10-year US Treasury bond lead the market?

At the latest Federal Reserve meeting last week, policymakers unsurprisingly chose to maintain the status quo on interest rates. The relatively dovish tone of the communication improved market sentiment slightly, yet significant uncertainty remains over the future trajectory of monetary policy.

Opinions are split: some believe that former President Trump's anti-globalization policies might lead to inflation or stagflation, preventing the Fed from cutting rates, while others anticipate that recession risks will compel the Fed to implement aggressive monetary easing to stabilize the economy. Examining bond market data can help determine which of these scenarios is more plausible.

Recent Trends in 10-Year Treasury Yields

Since peaking at over 5% during the previous U.S. rate-hiking cycle, the 10-year Treasury yield has formed a W-pattern over the past year and a half. This trend coincided with various events, including the Fed's quantitative tightening (QT) efforts, adjustments to its rate-cut schedule, and shifts in U.S. presidential leadership. Each yield fluctuation has aligned closely—or slightly preceded—Fed policy changes. Based on these observations, last week's Federal Open Market Committee (FOMC) meeting effectively confirmed the elimination of further rate hikes unless unforeseen circumstances (e.g., a "black swan" event prompted by Trump) arise. As a result, attention now shifts to the timing and pace of future rate cuts.

Fed's Planned Rate Cuts

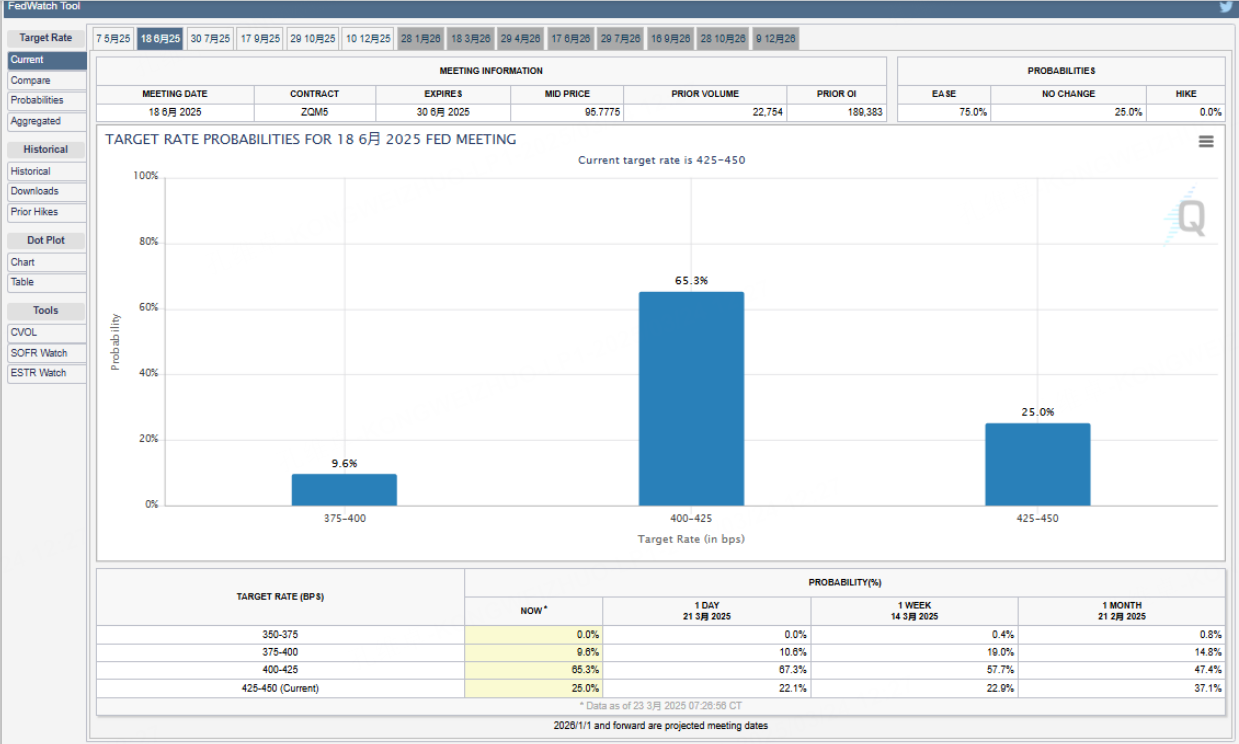

The Federal Reserve's own projections suggest two rate cuts in 2025, each amounting to 25 basis points. However, data from the FedWatch tool indicates that market participants currently assign over a 60% probability to a rate cut in June.

Scenarios where cuts are delayed until July or even September are also plausible. This uncertainty is a significant driver of market volatility. Generally, earlier rate cuts are perceived as a positive catalyst, while delays tend to exert temporary pressure on asset prices.

It is also important to consider how markets price in expectations after rate decisions are formally announced.

Analyzing Yield Levels for Market Signals

The 10-year Treasury yield·s ability to test levels around 4.12%–4.15% might provide valuable insights. Using the model of "yield decline equals earlier rate adjustment," a break below this support range in the next month or two could signal a trajectory toward monetary easing and improved risk sentiment for the first half of the year.

Conversely, if yields fail to breach this region and subsequently form higher highs and lows, it would suggest that rate cuts might not happen until after June.

Given the current lack of significant trend-driven movements in the bond market, the likelihood of either a pause or aggressive rate cuts this year appears slim. In other words, the long-debated predictions of a U.S. economic recession or collapse are unlikely to materialize in 2025.

Fed's Communication Strategy

Under Jerome Powell’s leadership, the Federal Reserve has excelled in managing market expectations. While the Fed's economic forecasts remain imperfect, policymakers typically provide markets with a 3-6 month lead time for any major policy shifts. Should an unexpected development compel the Fed to take drastic measures, Powell is unlikely to imitate Ben Bernanke’s approach of delivering abrupt, unanticipated announcements that leave investors scrambling. For the near to medium term, monetary policy and overall market dynamics are expected to remain relatively stable and predictable. In the absence of external sector-specific catalysts, most assets will likely experience broad-range volatility or consolidation. However, strong-performing assets or those driven by direct news events represent exceptions to this trend.

$E-mini Nasdaq 100 - main 2506(NQmain)$ $E-mini S&P 500 - main 2506(ESmain)$ $E-mini Dow Jones - main 2506(YMmain)$ $Gold - main 2504(GCmain)$ $WTI Crude Oil - main 2505(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- longlive100·03-26Great insights! This is a must-read! [WOW]LikeReport