"Hoarding coins" has become popular! Short time?

"Hoarding coins" may be the hottest trading strategy this summer.

Companies from all walks of life are raising huge sums of money to buy cryptocurrencies. From Japanese hotel operators and French semiconductor makers to Florida toy makers, nail chains and e-bike makers are pouring cash into digital tokens, pushing various cryptocurrencies to new highs, according to the latest Wall Street Journal report.

Since June 1, 98 companies have announced plans to raise more than $43 billion to buy Bitcoin and other cryptocurrencies, according to data from crypto consulting firm Architect Partners. Since the start of the year, nearly $86 billion has been raised for this purpose.

This figure is more than double the amount raised by U.S. IPOs in 2025. The news of any company's announcement of plans to buy cryptocurrencies is enough to send its share price soaring, which in turn spur others to consider joining the craze.

The craze has attracted participation from high-profile bankers, investors and others. Mutual fund giant Capital Group, hedge fund D1 Capital Partners and investment bank Cantor Fitzgerald, among others, are supporting companies to raise huge sums of money to buy cryptocurrencies.

Former Barclays CEO Bob Diamond said: "If you blink an eye, you will miss a few of these deals."

Last week, Atlas Merchant Capital, the investment firm Diamond co-founded, said it was working with Paradigm, D1, Galaxy, 683 Capital and other big investors to form an entity that would spend $305 million on a seven-month-old crypto token called Hype.

These new entrants are following suit$Strategy (MSTR) $Company, whose CEO Michael Saylor pioneered the so-called "crypto asset treasury strategy" in 2020.

The company has been selling stock and debt for years to buy Bitcoin. Currently, the company is now worth more than $115 billion, and its stock price is up 153% in the past year and 3371% in the past five years.

And this may be inseparable from the background of the deregulation of cryptocurrencies in the United States. This year, US President Trump took the initiative to embrace cryptocurrency and vowed to turn the United States into the "cryptocurrency capital of the earth". He has appointed a group of crypto-friendly cabinet members, and Congress has moved forward with legislation that could bring cryptocurrencies into the mainstream financial system.

Risks and doubts coexist

Recently, some companies have gone beyond what Saylor recommends-they buy unknown or lesser-known digital currencies, not to diversify their portfolios, but to make direct bets on risky tokens.

Even Saylor himself wasn't sure it was wise. Saylor said in the email:

Applying money management strategies to other crypto assets carries different risks and is often speculative. I have yet to see a compelling reason to do so.

According to the analysis, even in the best times, cryptocurrencies fluctuate. If a company's token price plummets after putting all its eggs in one basket, it may hold worthless assets.

Last week, e-bike maker Volcon raised $500 million in just seven days to launch its Bitcoin funding strategy. On the day the news was released, as speculators flocked to buy,$Volcon Inc (VLCN) $Shares soared from $9.22 to more than $44. Since then, shares have declined daily, closing Friday at $13.40.

For investors who want to hedge after a big rise, they can consider the bear market spread strategy to short coin-hoarding companies such as MSTR.

Options Strategy: Shorting MSTR with Bear Spread Strategy

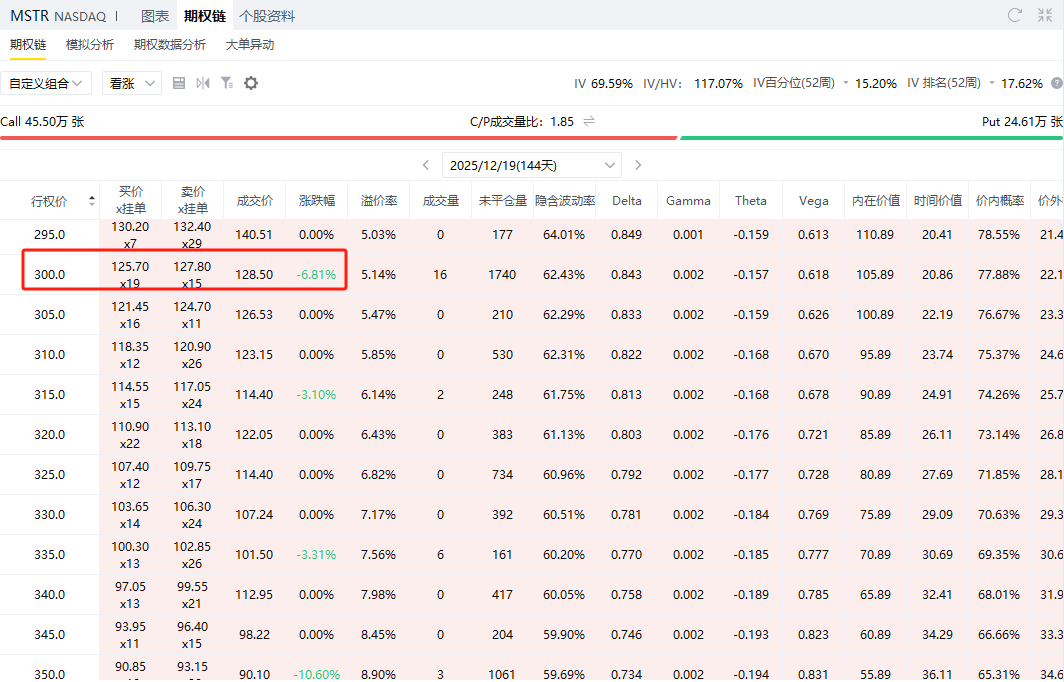

The current MSTR current price is $418, and we can short MSTR by selling a call option expiring on December 19, 2025, with an exercise price of 300 and a premium of $12,850.

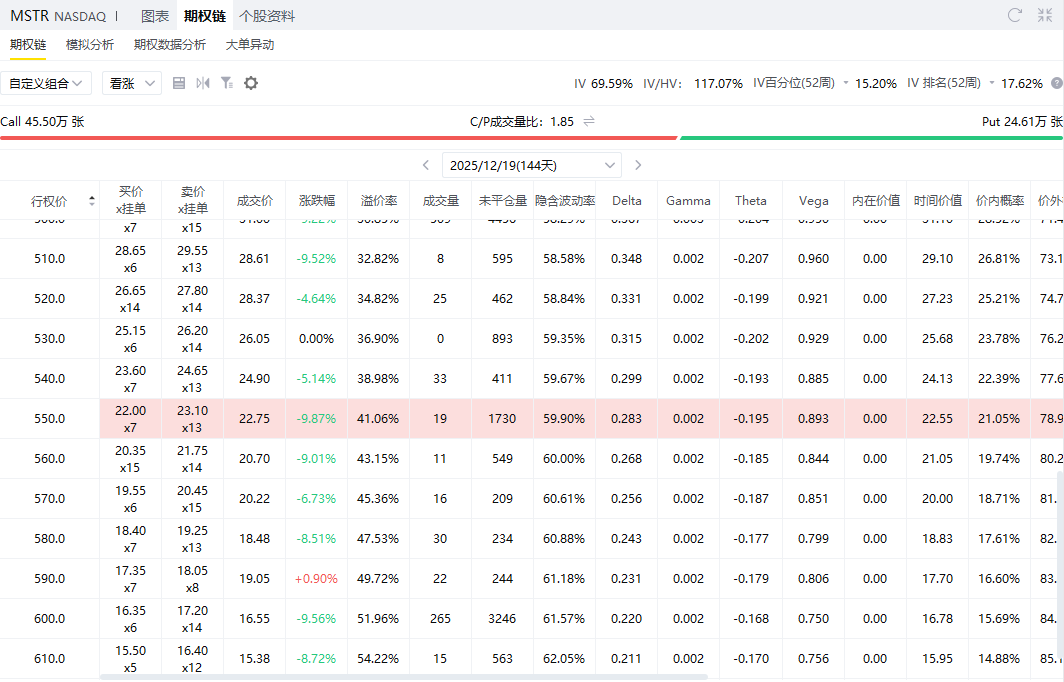

Because we are worried that the huge surge of stocks will cause huge losses to investors, we can also buy a call option with an exercise price of 550 and spend $2,275 to limit the maximum loss.

With the current MSTR stock price at $418, investors can construct a Bear Call Spread strategy to short MSTR:

Sell a call option with an exercise price of 300 expiring on December 19, 2025 and get $12,850 from premium

At the same time, buy a call option with an exercise price of 550 and pay premium $2,275

Net income is: 12,850-2,275 =US $10,575

Profit and loss structure:

Maximum benefit:If the MSTR share price is below 300 at expiration, neither option is exercised, and the investor retains the entire net income, with a maximum gain ofUS $10,575

Maximum loss:If the MSTR share price is higher than 550, both options are exercised and the loss is (550-300) × 100-10,575 =US $14,425

Break-even point:300 + (10,575 ÷ 100) =$405.75

Summary:This strategy applies to investors who are bearish on MSTR, believing that its share price will not break above $405.75 in the next nearly 17 months. If the stock price rises sharply by more than $550, the maximum loss for the strategy is $14,425. By buying a protective call option, the risk in the event of an extreme rise is effectively limited.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.