Meta earnings report is here! How to play the short-selling wide straddle strategy?

$META Platforms, Inc. (META) $The financial report will be released after the market closes on July 30, Eastern Time. The agency expects to achieve revenue of US $44.794 billion in 2025Q2, a year-on-year increase of 14.65%; Earnings per share are expected to be $5.896, a year-on-year increase of 14.27%.

Before Meta, Google had just handed over a second-quarter financial report that exceeded market expectations, and at the same time raised capital expenditures for the next quarter. So can Meta's second quarter report also exceed market expectations and boost its stock price to a new high? For this second quarterly report, what will the market focus on?

Needless to say, almost all of Meta's revenue comes from advertising revenue. The company's 2025Q1 advertising revenue was US $41.39 billion (accounting for 98%), a year-on-year increase of 16%, while other services (such as subscriptions and commercial platforms) accounted for about 2%, with a growth rate of 63%.

Deutsche Bank predicts that the AI-driven advertising bidding system "Deep Auction Dynamics" will fill the gap of China's e-commerce advertising loss and drive advertising revenue to grow by 15%-16% (approximately US $44 billion) year-on-year.

Deutsche Bank's advertising research shows that,In the second quarter, the growth rate of advertising revenue on the Meta platform increased by about 1 percentage point from the previous quarter, and there was a trend of further acceleration in the third quarter。 This is in sharp contrast to Wall Street's forecast that advertising growth in the United States and Canada will decline by 3 percentage points year-on-year in the second quarter and a further decline of 1.5 percentage points in the third quarter.

The core driver of this strong performance is the application of AI technology-Meta's Advantage + tool, while emphasizing that this will be a lasting source of growth for Meta in the future, as it is significantly improving advertisers' return on ad spend (ROAS).

Although changes in U.S. tariff policies have led to a significant decline in advertising spending from Chinese e-commerce-Meta expects this revenue business to be about $18 billion, overall industry spending remains strong. And since mid-May, with the easing of the US tariff system, some advertising revenue has begun to flow back. If this trend continues, it may support Q2 advertising revenue to exceed expectations. In addition, whether Meta's advertiser budget is further transferred to Europe, Latin America and other regions will also become the focus of the market.

AI talent competition, strategic investment, expenses and costs have become the new focus of the market

Although the trend of Meta's revenue side is improving, Meta's aggressive expansion in the AI field has made Meta's fee side the focus of market attention.

CEO Zuckerberg made bold statements in the second quarter:Invest hundreds of billions of dollars to build the strongest computing power and team at all costs, and set out to create a "super intelligent laboratory". For this reason, the company spared no expense to poach unprecedented AI talents from rival companies such as Google, Apple, OpenAI, and Microsoft. At the same time, it completed the acquisition of PlayAI, a company focusing on AI voice technology, and acquired the AI startup "Scale" with a huge investment of US $14 billion. AI "49% equity.

Meta's "fee guidance reduction" originally expected by the market has changed to "maintaining at current levels and possibly even raising". Deutsche Bank expects Meta may offset R&D spending (such as the battle for AI talent) by cutting general and administrative expenses, butThe savings are also very likely to be reinvested to accelerate data center construction rather than returned to investors。 Therefore, Deutsche Bank predicts that Meta's capital expenditure in 2025 is still expected to be as high as US $69 billion (a year-on-year increase of 85%), close to the upper limit of the guidance range.

Deutsche Bank summary: Meta's future growth will entirely depend on whether AI investment can continue to translate into overwhelming revenue growth.Whether these expense pressures are controllable and whether capital expenditures can be effectively translated into future revenue growth will be the focus of investors' attention.

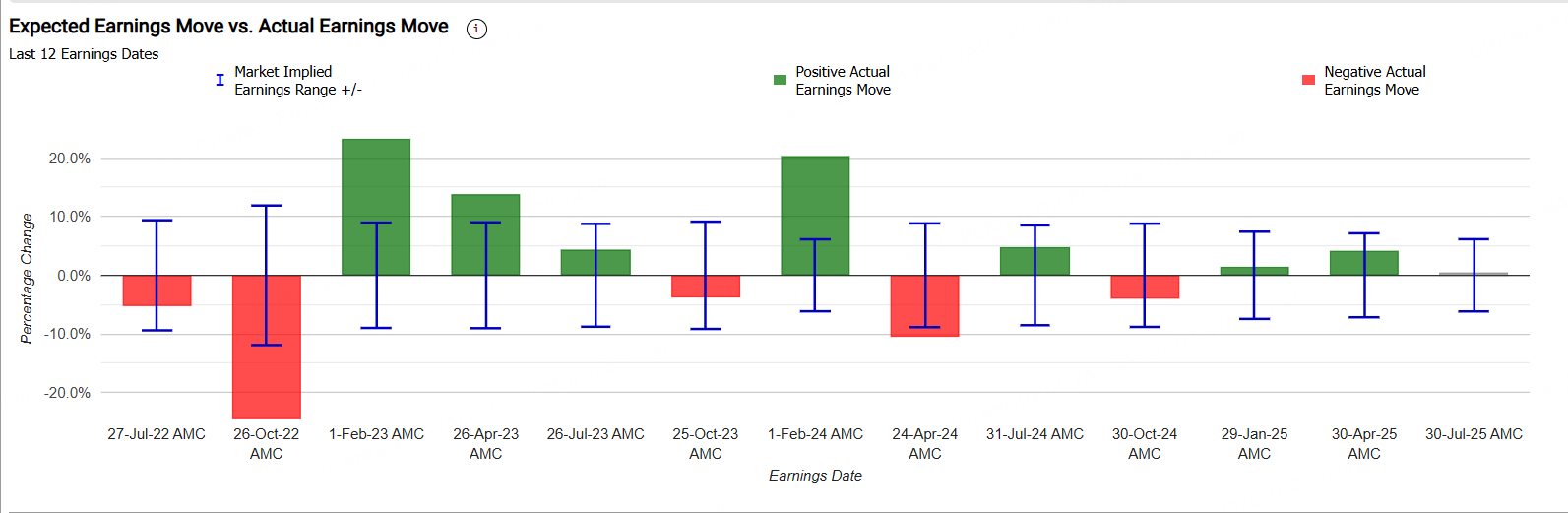

How has Meta performed on its earnings day history?

Currently, the implied change of Meta is ± 5. 98%, indicating that the options market has bet on its single-day rise and fall of 5.98% after its performance; In comparison, Meta's post-performance average stock price change in the first four quarters was ± 3. 7%, indicating that the current option value of the stock is overvalued.

On the first four results release dates, Meta rose and fell by +4.8%,-4.1%, 1.6%, and 4.2%.

Double Sell Straddle Bet on Earnings

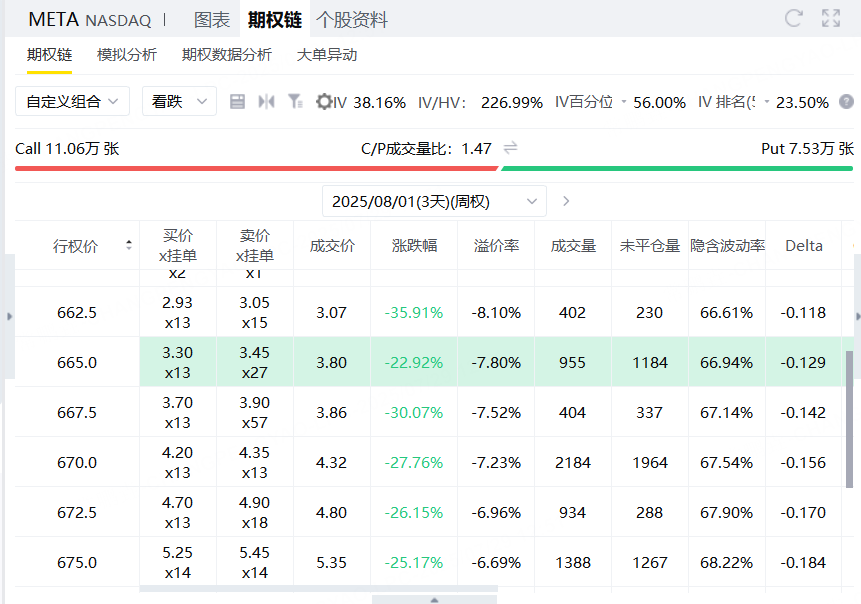

Meta's current price is 717, and investors can sell a call option with an exercise price of 770 to get a $510 premium.

Investors can sell a put option with an exercise price of 665 and receive a $380 premium.

Strategy structure: Build a Short Strangle

Sell 770 Call, Collect premium $510

Sell 665 Put, Collect premium $380

Total revenue: $890

Profit and loss range:

Profit range: When Meta closes between 665 and 770 at expiration, investors receive full premium, totaling $890

Break-even point:

Up: 770 + 8.9 =$778.90

Down: 665 − 8. 9 =$656.10

Maximum benefit: When Meta expires between 665 and 770, the maximum gain is$890

Maximum loss:

Upward: After Meta rises above 778.90, the theoretical loss is unlimited (due to selling bullish)

Down: After Meta fell below 656.10, the loss was | Meta close price of − 665 | by $100 − 890 premium

Applicable prerequisites: This strategy is suitable for investors to judge that Meta will remain range-bound before expiration, with limited volatility.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.