+12% Surge, How META Makes AI Cash Machine REAL?

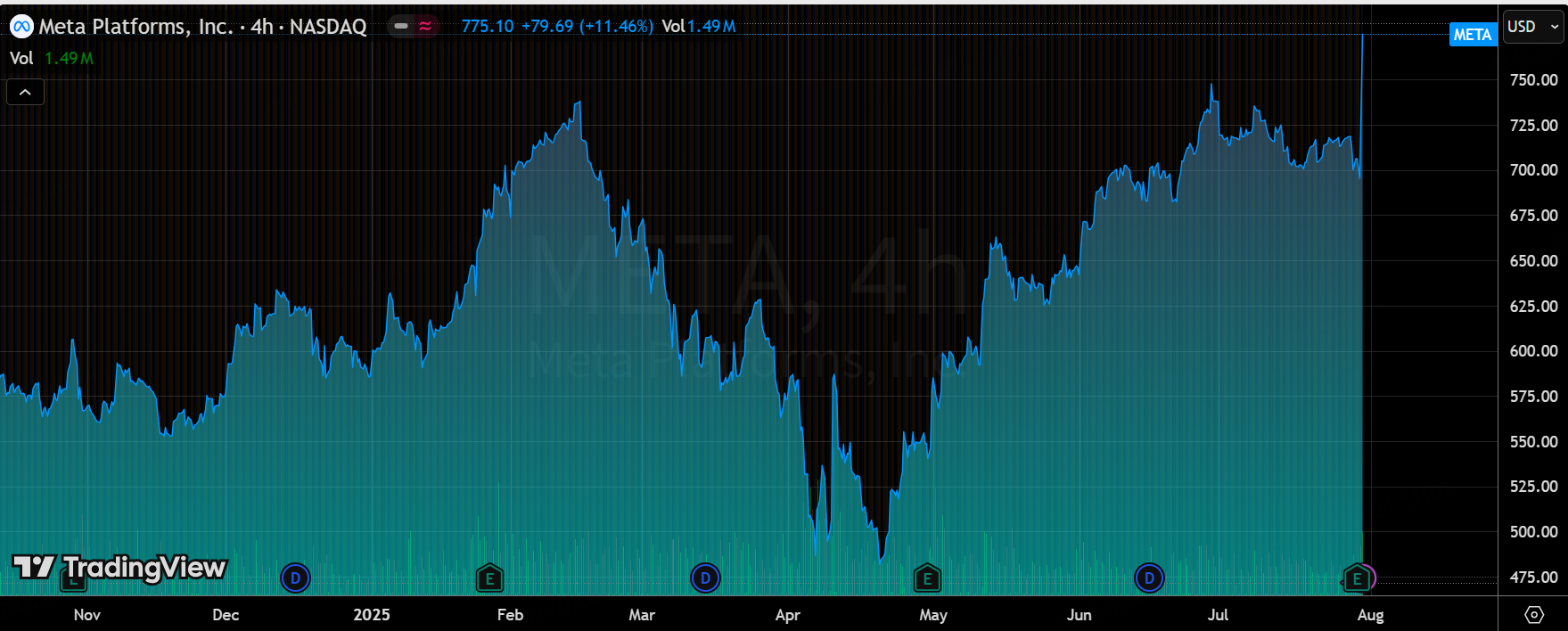

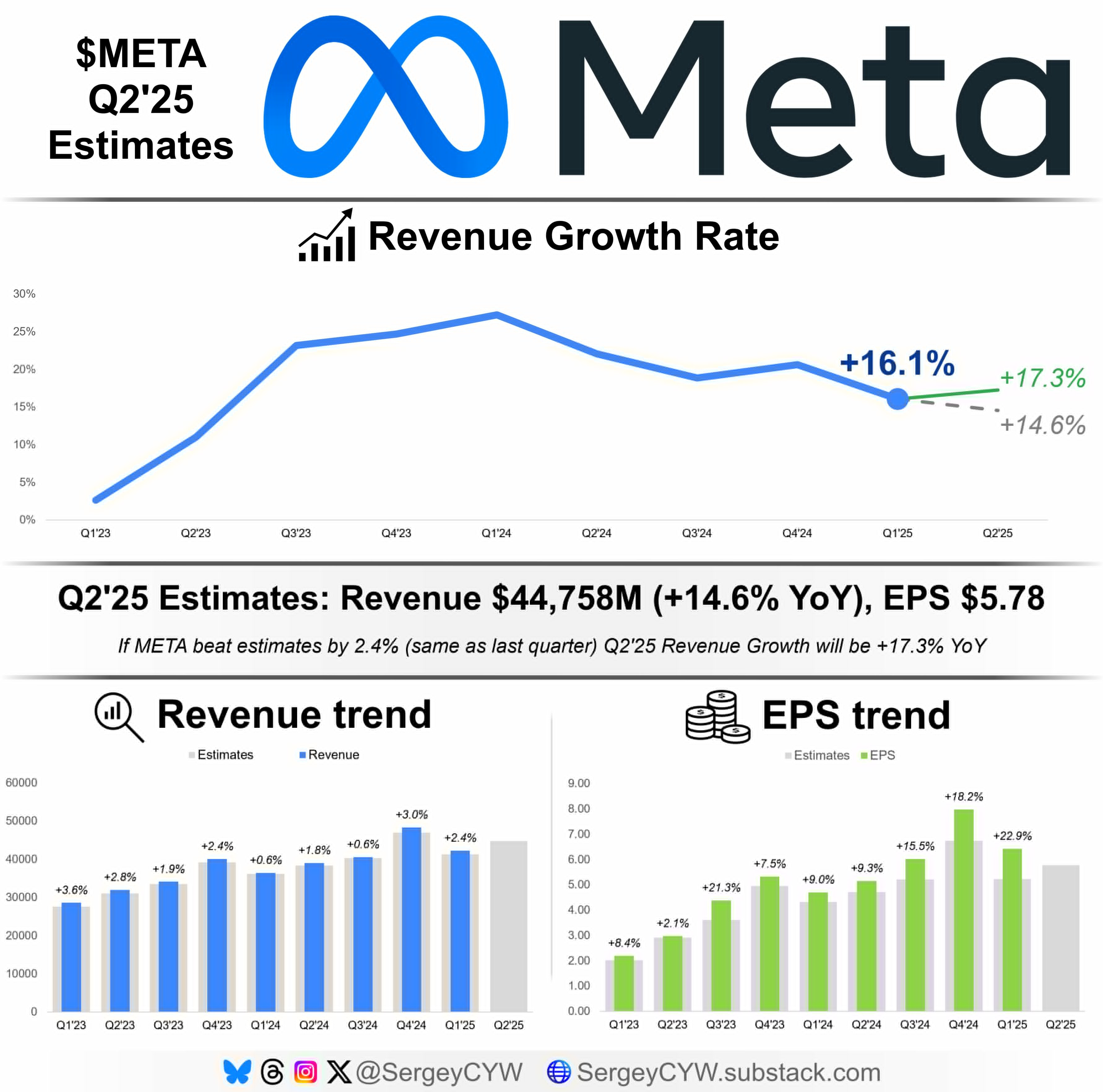

$Meta Platforms, Inc.(META)$ shocked the market with its Q2 earnings report released on July 30th after-hours, as the blowing up of its main business (advertising revenue +21.5% against the trend, operating profit +38%) far exceeded the expectations, and the raising of the lower end of the Capex ($66B-$72B vs. previous $64B-$72B) boosted the market sentiment for AIMETA's after-hours surge was 12%, as the company raised its guidance for the next quarter ($47.5B-$50.5B vs. previous $46.3B), boosting AI sentiment.

One of the key reasons for META's surge is that the market was previously worried about it (e.g., tariffs, EU antitrust, AI grabbing, corporate culture revelations, etc.), while the market's Q2 earnings expectations were relatively conservative, hence the urgent valuation re-pricing (25x PE in 2026) after the earnings report.

Earnings profile and market feedback

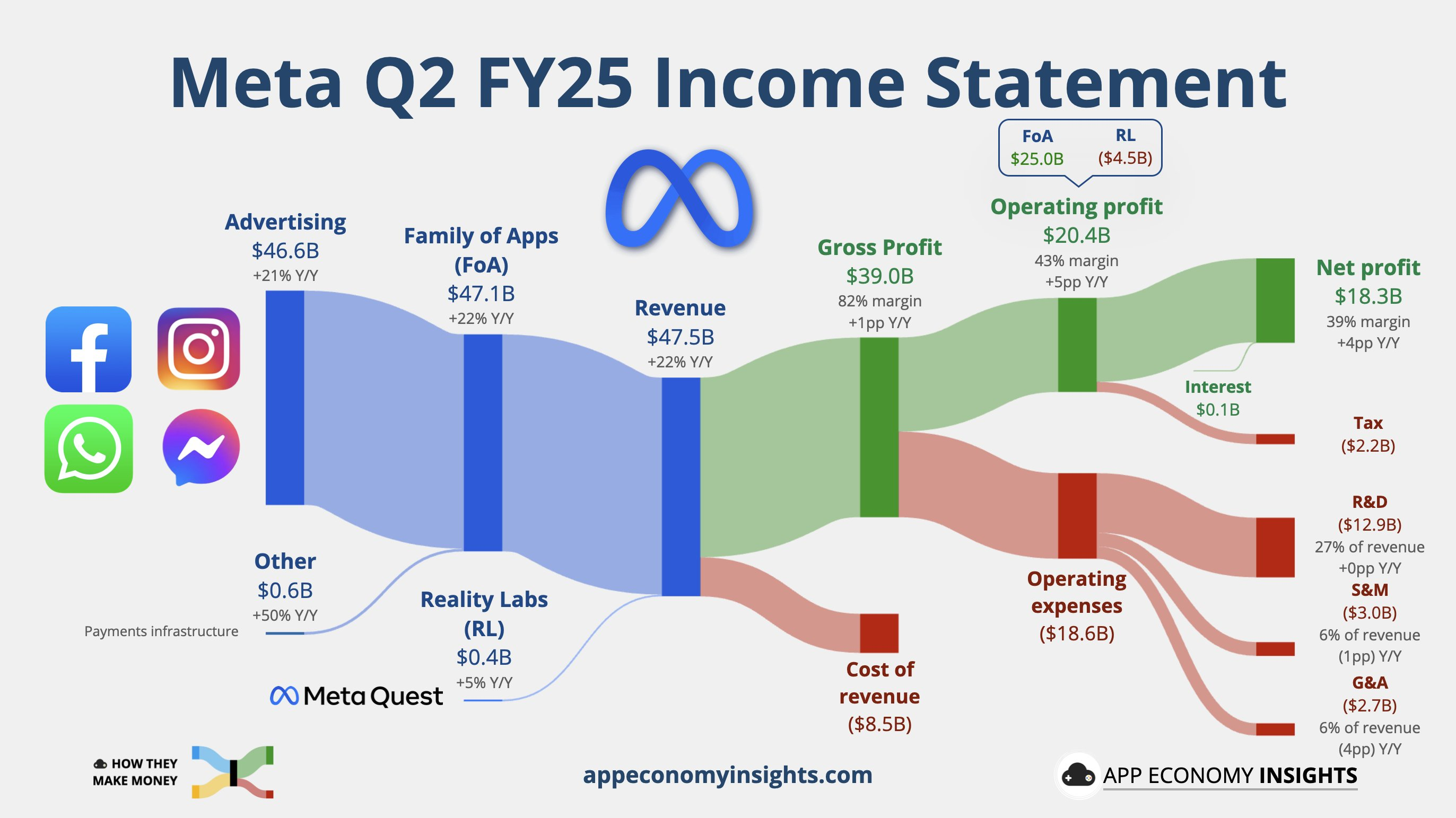

Meta 25Q2 core results significantly exceeded expectations with key metrics as follows:

Total revenue of $47.5 billion, up 22% year-over-year (also 22% on a constant currency basis), exceeding general market expectations (~$47 billion).Advertising revenue of $46.6 billion increased 21% year-over-year, driven primarily by the online commerce vertical, with ARPU (average revenue per user) up 24% in Europe and 23% in the rest of the world.

Net income of $18.3 billion and EPS of $7.14 exceeded market expectations (~$6.90.) Family of Apps generated $25 billion in operating revenue with an operating margin of 53%, demonstrating the strong profitability of its core business.In contrast, Reality Labs had revenue of $370 million, up 5% year-over-year, but an operating loss of $4.5 billion, reflecting the meta-universe business is still in a high investment phase.

Capital expenditures of $17 billion were primarily for server, data center and network infrastructure investments.Free cash flow of $8.5 billion, demonstrating the company's solid cash generation capabilities.Quarter-end cash and marketable securities of $47.1 billion and debt of $28.8 billion for a healthy financial position.

Investment Highlights

1. Strong growth in advertising business drove the overall outperformance, offsetting external risks.

Ad revenue +21.5% yoy (accelerated YoY), volume-price disaggregation shows: ad display expansion accelerated (driven by Reels' penetration in Facebook), but unit price growth slowed slightly (Reels' low unit price dilution + macro stability).Limited impact of tariffs (e.g. Temu/Sein ad inventory gaps were filled quickly), Advantage+ and AI optimization boosted ad ROAS (positive advertiser feedback).The deeper logic is still Meta's AI algorithms (e.g. recommendation engine) to enhance platform stickiness and user hours growth (TikTok ban dividend) to support endogenous growth.

This performance exceeded market expectations (+18% est.), strengthening the valuation basis, as advertising contributes ~98% of revenue, future WhatsApp/Threads realizations are expected to increase $100B revenue annually (+5-10%), providing upside for valuation repricing in 2026 (P/E 23-25x support).

2. Manageable Opex and efficient Capex ROI to ease market concerns

Total opex +22% YoY to 25B, high increase in R&D expenses (post-Llama4 rush to build AI labs), but structural adjustments stabilized total expense ratio.Full year guidance slightly adjusted to 114B-118B (formerly 113B-117B), +20-2466B-72B y/y (formerly 64B-72B), 2B increase in floor, but logic different from Google: Meta Capex focuses on internal business optimization (e.g., AI to improve ad efficiency) rather than external cloud services, more controllable ROI (Reality Labs loss increased to $-4B, but is small (<10% of expenses) and has limited impact.This partially removes the market's concern about "spending madness" and supports earnings over-expectations (App Services operating margin +3pct to 53%), and if spending discipline is maintained, valuation suppression can be avoided.

3. AI strategy has become the core driver, and performance guidance is impressive, providing valuation support.

Meta's investment and progress in AI is the biggest highlight of this quarter's results.The company announced the formation of Meta Superintelligence Labs, led by Alexandr Wang, with Nat Friedman in charge of AI products and Shengjia Zhao as Chief Scientist, with the goal of developing superintelligent AI that surpasses human intelligence.The Prometheus cluster (expected to go live in 2026, the world'sfirst Gigawatt+ cluster) and Hyperion cluster (scaling to 5 Gigawatts in the next few years) show Meta's ambitions for AI infrastructure.

AI is already directly driving core business growth:

Advertising efficiency gains: AI-powered ad recommendation models (e.g., Andromeda and Lattice) have led to a 5% increase in Instagram ad conversion rates and a 3% increase in Facebook.Generative AI ad tools (e.g., Advantage+) attracted nearly 2 million advertisers and significantly reduced ad delivery costs (median cost-per-buy for omni-channel ads was reduced by 15%).

User engagement growth: AI recommendation systems drove 5% and 6% growth in time spent on Facebook and Instagram, respectively, with more than 3.4 billion daily active users globally. meta AI surpassed 1 billion monthly active users, demonstrating strong user stickiness.

Valuation Impact: The short-term returns of the AI strategy are already visible, and the long-term potential could drive valuation repricing.Market expectations for Meta's transformation from a social media platform to an AI-driven tech company have strengthened, but the progress of generative AI realization needs to be watched.

Q3 revenue guidance of +17-24% yoy (including 1% exchange rate tailwind) is higher than the market +15% est. indicating a continuation of the high boom.Management tone optimistic, although prompted the EU antitrust risk (affecting paid de-advertising products), but did not lower expectations.Deeper logic is AI-driven (e.g. Llama optimization) to improve operational efficiency, coupled with accelerated commercialization of new platforms (Threads/WhatsApp), with incremental medium-term revenues up to $100B. This underpins 2025-2026 valuation (neutral expectation of 26-year post-tax operating profit of $80B), and if there is no significant deterioration in the macro, the guidanceIf there is no major macro deterioration, guidance may trigger valuation revision (current market cap $1.75T, P/E 22x vs industry 25x, upside).

4. Healthy cash flow and solid shareholder returns

Free cash flow of 8.6B (+101.3B YoY, 10B in buybacks, 15B depleted by ScaleAI acquisition).Cash reserves of 47B (minus 23B YoY), mainly invested in Capex and M&A.Annualized shareholder return of 50B+, yielding 31.75T), 4% below tech giants' average, may dampen short-term valuation enthusiasm; however, cash flow coverage is adequate (FCF margin ~21%), and if buybacks accelerate, investor confidence could be boosted.Market Focus:

AI return on investment: analysts previously focused on the sustainability of AI capex and the timeline for realization.The earnings report showed strong returns on core AI (e.g., ad recommendations), but generative AI is still several years away, partially easing market concerns.

Regulatory Risk: EU data privacy and advertising regulation is a long-term concern, and clear risk cues in the earnings report heightened market concerns about European revenues.

Meta 25Q2 earnings report reinforces AI growth expectations.Current forward PE NTM is 27x, valuation may be revised up to 25x if Q3 guidance materializes (2026 forward)

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- squishx·2025-07-31Exciting developments for METALikeReport

- Trevelyan·2025-07-31Great insightsLikeReport