Massive NBIS Options Bet Preceded 17.4B Microsoft Windfall: Smart Money Knew?

On September 8, after-market hours, the AI infrastructure space saw a bombshell announcement: $NEBIUS(NBIS)$ signed a $17.4 billion long-term contract with $Microsoft(MSFT)$

This deal fundamentally resets market consensus on Nebius and underscores Microsoft’s “capital discipline + resource security” dual-track strategy in AI.

For Nebius: From uncertainty to certainty

Until now, Nebius was viewed as just another “emerging European AI compute player,” with its valuation driven largely by future expectations. This contract instantly elevates it into the global AI infrastructure oligopoly alongside $CoreWeave, Inc.(CRWV)$

Financially, the $17.4B contract translates to roughly $3.5B in annual revenue—far exceeding its pre-2025 ARR forecast (~$1B). That pushes Nebius’ 2026 ARR toward $6B. For a still-expanding firm, this is a genuine cash flow moat.

Investor concerns about Nebius’ heavy CapEx burn and liquidity crunch now look mitigated. With Microsoft’s endorsement, its credit rating and fundraising capacity are effectively upgraded. The market will be willing to assign a richer multiple, potentially benchmarking CoreWeave—or even $Snowflake(SNOW)$ More importantly, Microsoft’s choice is essentially a “qualified supplier certification.” That dramatically lowers the psychological barrier for other hyperscalers— $Amazon.com(AMZN)$ $Alphabet(GOOG)$ $Meta Platforms, Inc.(META)$ —to onboard Nebius. The potential customer pool just expanded.

Microsoft’s calculus: Leasing is smarter than buying

Some investors wonder: with Microsoft already deploying tens of billions in CapEx to buy GPUs, why lock in a “financial lease” style contract?

The rationale is clear: capital discipline, flexibility, and supply-chain security.

Microsoft’s CapEx is already running at a $50B+ annualized pace. Adding more GPUs outright would depress ROIC and raise investor concerns around free cash flow. By structuring it as a financial lease, Microsoft shifts spending toward OpEx rather than CapEx, keeping reported financials cleaner.

On risk: AI compute demand could fluctuate significantly over the next five years. Leasing shifts idle GPU risk to the supplier, while Microsoft keeps flexibility. Nebius, in turn, becomes a leveraged bet on compute demand.

On pricing power: as a hyperscale anchor customer, Microsoft can push favorable terms and secure lower unit compute costs versus direct procurement. Nebius, hungry for orders, concedes.

On security: with GPU supply chains extremely tight, Microsoft must lock in sources. Players like Nebius and CoreWeave can rapidly build out capacity and stockpile GPUs, providing Microsoft with plug-and-play scalability. This ensures Azure doesn’t face compute bottlenecks.

Investment takeaways: Who wins?

Post-announcement sentiment frames this as a win-win.

For Nebius:

Near term, expectations will spike, likely triggering a valuation rerating. But medium term, concentration risk looms—Microsoft may account for >70% of forward revenue. Any contract delays or demand adjustments could hit hard. Execution is also critical: the contract stipulates Microsoft can cancel if delays exceed 60 days—leaving virtually no margin for error.For Microsoft:

Financially flexible, but the revenue impact is negligible. The real value lies in ensuring continuous Azure + AI services supply, reinforcing its moat in AI cloud. The key risk is supplier execution. If Nebius stumbles in buildout or operations, Azure and the OpenAI ecosystem could face compute gaps. Additionally, Nebius’ Russian origins may draw scrutiny from U.S. regulators.

This is less a cozy partnership than a high-pressure bargain: Microsoft secures compute safety, Nebius secures survival and growth, but both sides must execute flawlessly.

Bigger picture: The AI arms race

This deal is a textbook case of strategic complementarity. Within the broader AI arms race, it’s essentially a redistribution of resources: Microsoft leverages capital power to secure upstream supply, while Nebius uses a giant’s endorsement to leapfrog into industry heavyweight status.

For Nebius: This contract is its coming-of-age moment, upgrading both valuation and positioning.

For Microsoft: It’s a double win—financial optics + strategic moat, locking in compute without overloading CapEx.

The only wildcard is flawless execution. If delivered, this could become a classic case study in AI infrastructure partnerships. If not, it risks becoming a cautionary tale of overreliance on outsourced supply chains.

A curious options market signal

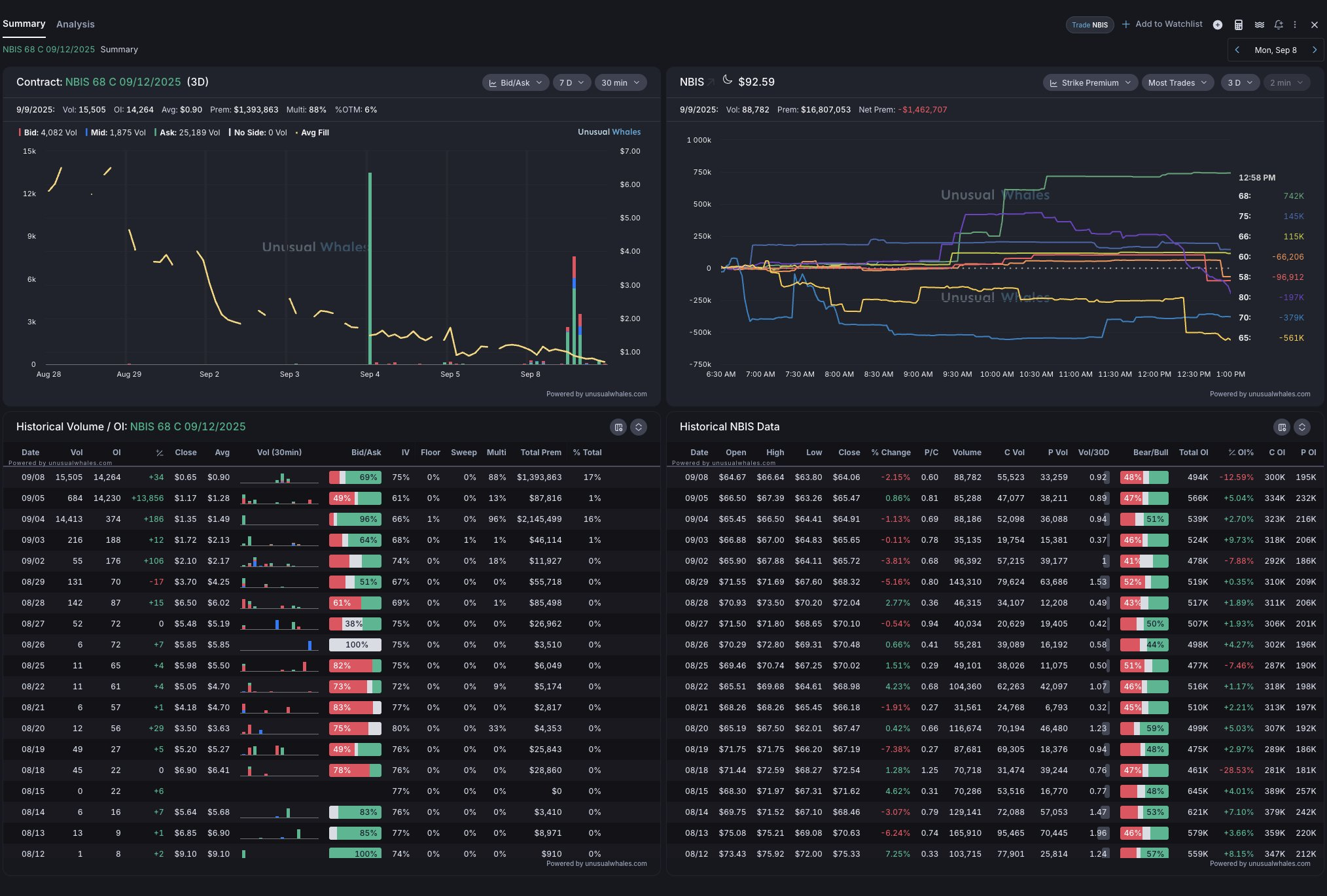

Interestingly, options activity hinted at this deal ahead of time. Last week, institutions aggressively sold $58 puts and bought $68 calls expiring this Friday.

This position, established on September 4 in a single block, was essentially a one-week bet on a >10% rally. Costing around $2M, it now stands to return over $30M—a staggering 1,500% gain in just three days.

Some players clearly caught a “lottery windfall.”

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Valerie Archibald·2025-09-09this is just the start, $300 next year2Report

- ClarenceNehemiah·2025-09-09It's fascinating how the options market can sometimes predict big moves.1Report

- Enid Bertha·2025-09-09Nebius is the fastest growing stock in the world right now.LikeReport