US Comps Slow: Is Costco Hitting The Stagflation?

$Costco(COST)$ performance in fiscal Q4 2025 (ended August 31) came in as neutral overall, showing resilience with positive undertones despite some pressures. The company achieved double-digit growth in both revenue and net income, with EPS beating expectations and membership fees remaining a core profit driver. However, underlying concerns include slightly underwhelming U.S. comparable sales growth, a sequential slowdown in comp sales, and emerging signs of pressure on membership renewal rates.

In the short term, valuations are under strain as the market holds high growth expectations, leading to a cautious after-hours stock reaction. If Costco can deliver on membership upgrades, site expansions, and e-commerce transformations, its long-term value remains appealing.

From a valuation perspective, Costco's stock has long carried a premium for its "high-growth retail model." If performance and growth pace continue to fall short of expectations, downside risks could mount; but if it further widens its moat amid competition, the valuation could hold firm.$Wal-Mart(WMT)$

Key Earnings Metrics

Here's a breakdown of Q4's core indicators, including data/growth, underlying drivers/observations, and whether they beat expectations/market reactions:

Metric | Data / Growth | Underlying Drivers / Observations | Beat Expectations / Market Reaction |

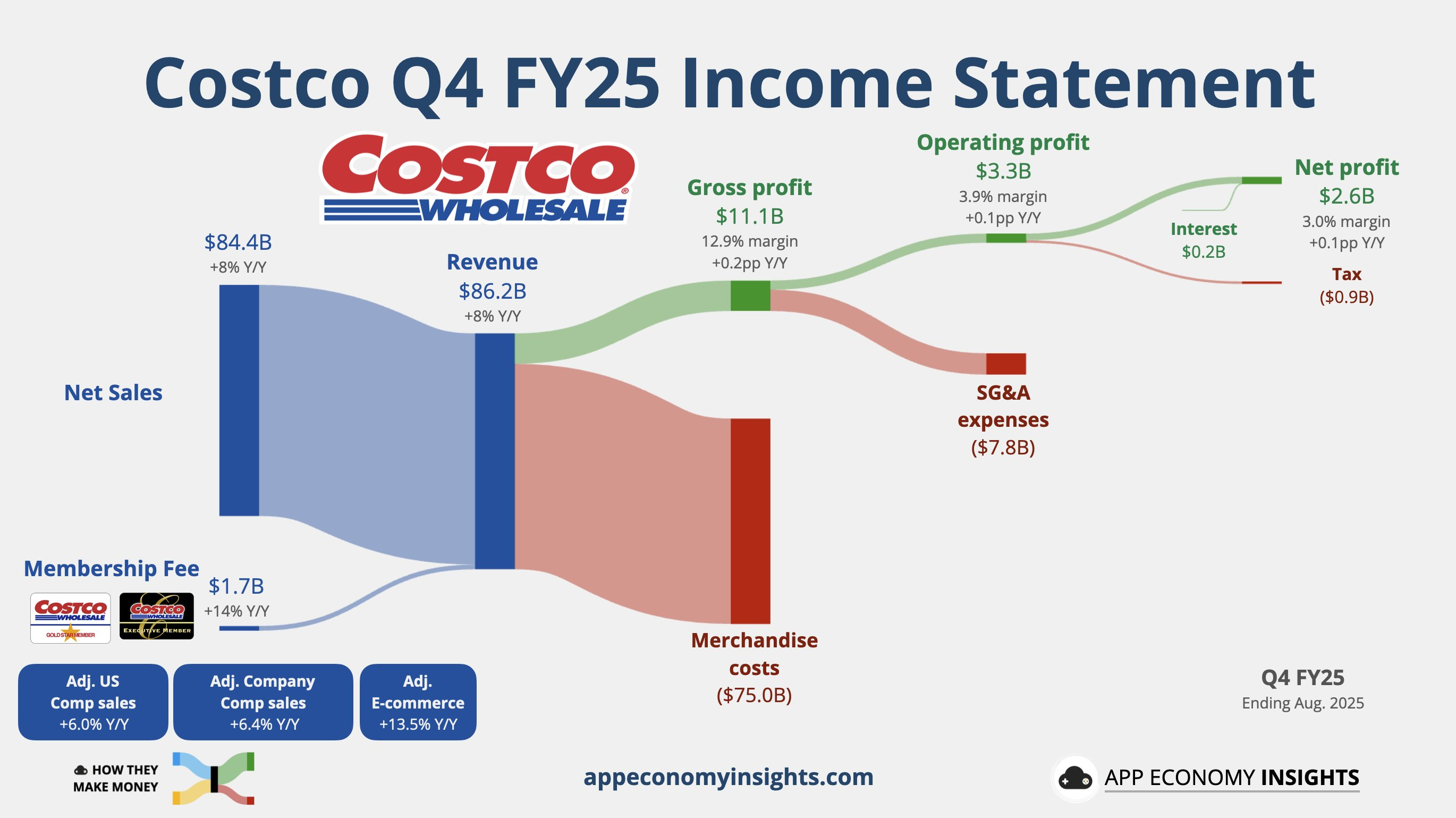

Net Income & Earnings Per Share (EPS) | Net income $2,610 million, +10.9% YoY; Diluted EPS = $5.87 (vs. $5.29 last year) | Driven by +8% revenue growth, operating leverage, and elevated membership fee income | EPS beat consensus around $5.80 (by about $0.07) |

Total Revenue / Net Sales | Net sales $84,432M, +8.0% YoY; Total revenue $86,156 million (incl. membership fees) | Powered by merchandise sales and membership fees; stable cost, depreciation, and expense controls | Revenue slightly better than expected ($86,060–86,100M range) |

Comparable Sales (ex-fuel & FX impacts) | Total company: +5.7%, adjusted +6.4%; U.S.: 5.1% (adjusted 6.0%); Canada: 6.3% (adjusted 8.3%); Other International: 8.6% (adjusted 7.2%) | U.S. showed some softness, possibly due to post-inflation consumer pressures and new member onboarding not fully converting to sales; stronger in Canada and international markets | U.S. comps slightly below some expectations (~6.0%); overall comps decelerated sequentially (from Q3's ~8.0% adjusted) |

Membership Fee Income | $1,724M, +14% YoY (vs. $1,512M last year) | Boosted by membership growth, upgrades, and fee increases (adjusted in September 2024) | Beat expectations (~$1,690–1,700M range) |

Store Expansion / Network | 914 warehouses globally at Q4 end (net +9 in the quarter) | Ongoing push for new openings and international layouts | Positive market view on the expansion pace |

Balance Sheet / Cash Flow / Capex | Total assets $77,099M (vs. $69,831M last year), liabilities $47,935M, equity $29,164M; FY operating cash flow $13,335M, capex $5,498M (annual) | Strong cash flow quality, with capex sustained for expansions and upgrades | Robust cash flow supports future growth & investments |

Market Feedback / Stock Reaction

Even with most key metrics beating expectations, Costco's shares dipped slightly in after-hours trading (about -0.8% to -1%). The main culprits: sequential slowdown in comp sales growth (especially in the U.S.) and broader worries about future growth momentum.

Overall, this quarter's results signal steady progress with solid growth drivers intact. But sustaining the pace and rebounding in softer regions like the U.S. will be key market focuses.

Earnings Guidance & Management Commentary

In the release, Costco didn't provide hard numerical guidance for the next quarter, but the earnings report and call offered directional insights:

The company plans to open 35 new warehouses in fiscal 2026 (including 5 relocations).

Management highlighted that "extended operating hours" contributed about 1% to sales lift (particularly in the U.S.).

In Q&A, on concerns about declining renewal rates and digital membership impacts, the CFO discussed ramping up auto-renewals, targeted communications, and member education; the CEO noted rising digital adoption could yield long-term benefits.

They also signaled plans to optimize product mixes, introducing lighter/heavier categories and expanding outdoor/home goods (e.g., backyard sheds, saunas) for greater resilience.

On balance, management's tone was steady and measured, avoiding overly optimistic quantitative commitments. This reflects caution around macro and consumer uncertainties, as well as a conservative stance on internal expansion, supply chains, and costs. From a signaling standpoint:

The 35 new warehouses suggest a relatively aggressive expansion pace;

Extended hours and membership upgrades show confidence in mining existing assets;

Openly addressing renewal rates and digital shifts indicates awareness of potential issues, rather than dodging them.

A noteworthy quote from the CEO:

“The 1% comp lift from extended hours is based on traffic analysis since implementation … we intend to continue emphasizing the visibility of those hours to members.”

This reveals that the company sees extra hours as a proven, replicable strategy for marginal traffic gains; management aims to amplify such "existing resource optimization" moves going forward.

Investment Highlights

Stable Moat from Membership Model + Revenue Structure Advantages

Costco's core membership-based warehouse operations and e-commerce channels represent sustainable long-term growth avenues. The former relies on high renewal rates (typically over 90%) and scale effects for defensive cash flows; the latter benefits from digital transformation, with 15% annual growth signaling platform potential. In contrast, U.S. native comp sales hinge on inflation/tariff-driven value positioning, which could be short-term thematic—if the economy rebounds and consumers shift upscale, pressures may arise. We believe international expansions (e.g., new warehouses in China and Europe) hold greater long-run promise, akin to Walmart's Sam's Club where international revenue tops 25% (vs. Costco's current ~30%), leaving room for more.

Sustainable vs. Sentiment-Driven Businesses

Sustainable Businesses: Membership fees, food/everyday essentials, Kirkland private labels, warehouse efficiency improvements, new site rollouts.

Sentiment-Driven/Short-Term Boosts: Promotions, extended hours, upgrade perks, member incentives, price arbitrage plays.

Ideally, Costco channels more resources into sustainable areas, using short-term tactics as enhancers rather than main drivers. From Q4's report, this balance holds: steady membership and revenue growth lead, with hours extensions and upgrades as add-ons.

Expansion Pace vs. Quality Control

The planned 35 new warehouses in 2026 is a brisk pace under current conditions. If openings, site selection, supply chains, staffing, and member onboarding lag, it could lead to diminishing returns, cost overruns, and depreciation pressures.

Thus, balancing "speed" and "quality" in expansions is crucial. Mature markets (U.S., Canada, Japan) may face saturation and fading marginal effects, while international pushes (China, Europe) offer more upside.

Digital/E-Commerce Integration

Q4 disclosed strong e-commerce sales growth (13.6%). Long-term, online-offline fusion is an irreversible retail trend.

While Costco is warehouse-centric, boosting digital member experiences, click-and-collect, logistics optimization could lift penetration, loyalty, and average ticket sizes.

Risks: Lagging behind pure e-com giants in investments, delivery networks, SKU variety could cede mid-to-high-end users to rivals.

Strategic Assessment & Competitive Risks

Management's current approach is generally sound, but watch for these potential pitfalls or focus areas:

Over-Reliance on Expansion: Heavy dependence on new stores for revenue could overlook deeper optimization of existing ones, risking a "front-loaded, back-pressured" scenario.

Membership Tier Fragmentation Risks: Exclusive perks like early shopping might alienate basic members, sparking churn (social backlash, brand hits).

Cost Escalations / Supply Chain Volatility: Inflation, logistics, labor, tariffs, or FX swings pose ongoing tests.

Competitive Imitation & Down-Market Moves: Rivals like Target or Walmart enhancing membership/subscription models could pressure Costco.

Strategically, I'd recommend deeper optimization in mature markets (e.g., hours mining, upgrades, digital services) while being more selective on international expansions and new site tempos to avoid "racing good sites too fast."

Valuations

Costco's current stock implies a trailing P/E around 54x and forward P/E ~47x, embedding 15-20% annual growth expectations—above historical 10-12% averages. Pricing feels full, especially with comp slowdowns, as after-hours dips reflect growth deceleration fears. Yet, versus peers like BJ's Wholesale (P/E ~20x) or Walmart (P/E ~45x), Costco's premium stems from superior membership loyalty and stable margins (~12% vs. Walmart's ~25% but less volatile). We see international and e-com segments potentially undervalued—if their contributions rise 10%, valuation expansion room exists. Conversely, persistent U.S. softness could amplify overpricing risks.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Enid Bertha·2025-09-27The market prices the shares at what it's worth. Might not be much but we should see a bounce up next week.LikeReport

- Venus Reade·2025-09-27I think the current management team needs to be replacedLikeReport

- chipzzy·2025-09-26Great insights! Really appreciate your analysis! [Heart]LikeReport