A $10 million notional put block targets KWEB – is the risk not over yet?

Spent the weekend reviewing the tape, feeling like we might witness history again.

The key to understanding this pullback is understanding the bears' rationale for shorting $SPY to 600.

Some might ask, didn't Trump have his "Taco" moment over the weekend? That's precisely the issue. The focus this round isn't on Trump, but on our side.

Currently, the offensive/defensive dynamic has shifted. The US side verbally conceded too quickly. And we haven't responded regarding the weekend events. So the real negotiations haven't even properly begun.

One particularly concerning point: after AI escalated to a matter of national foundation, our side's objectives might be different from back in April.

The TikTok resolution created some misdirection; everyone already assumed a deal was struck between the two sides.

But after a series of events – the Nvidia ban, the blocked Nvidia acquisition on antitrust grounds, Qualcomm violating the antitrust ban – this rare earths issue probably isn't simple. If the geopolitical landscape shifts again, the probability of $SPY returning to 600 might be higher.

Of course, we can't rule out the dream scenario where the US side backs down completely, negotiations proceed smoothly, and everyone's happy. In any case, the window for the market to react is very short – only three weeks until the meeting on the 31st. Time is tight, the task is heavy. This week and next will decide the outcome.

$KraneShares CSI China Internet ETF(KWEB)$

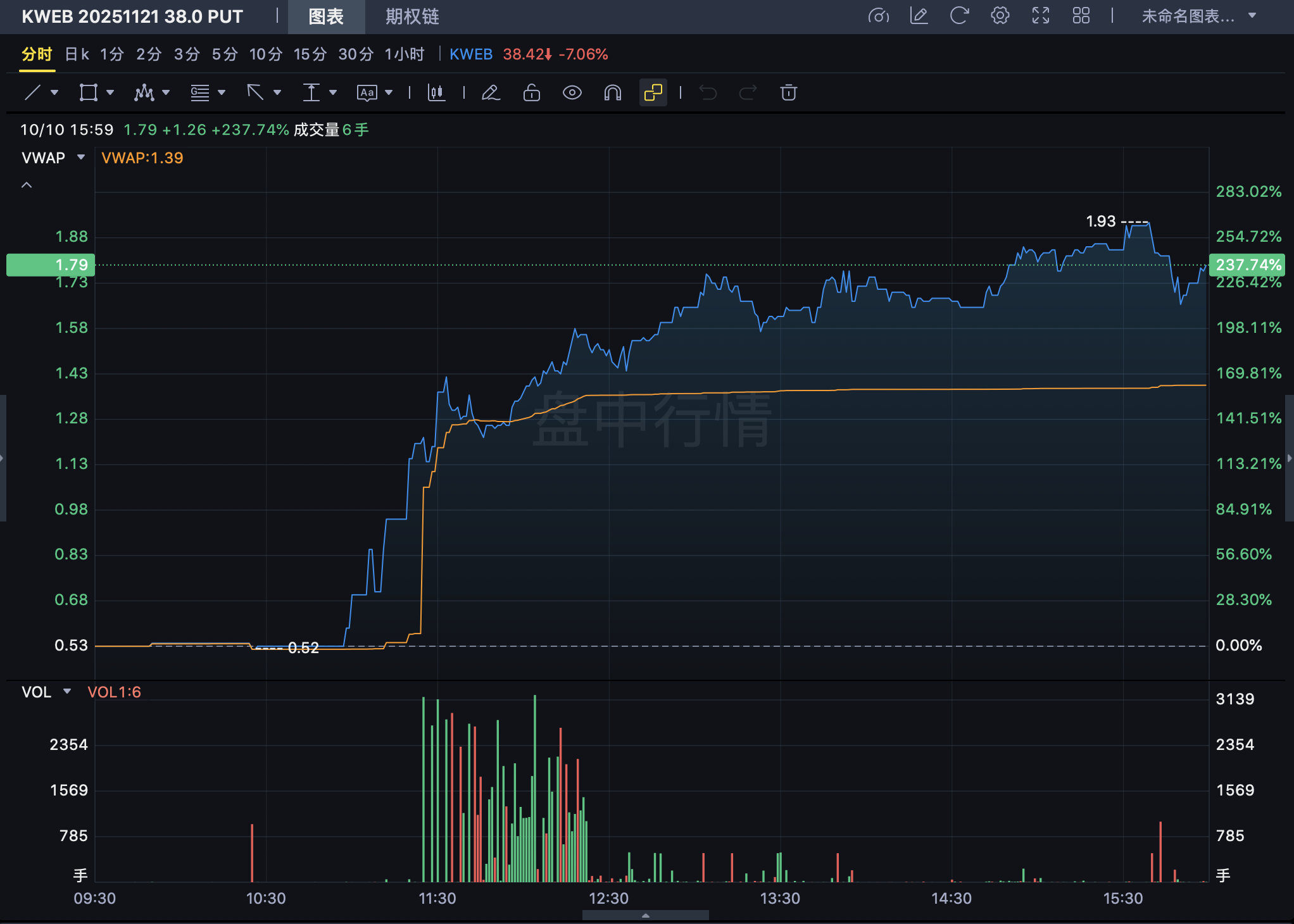

With macro shifts, both sides' major indices are affected. On the Friday selloff, October 10th, KWEB saw 80k contracts of the Nov 21st '25 38 Put traded $KWEB 20251121 38.0 PUT$ , notional value ~$10M.

$iShares China Large-Cap ETF(FXI)$

On the same day, FXI also saw a large put block opened, also expiring Nov 21st, the 39 Put $FXI 20251121 39.0 PUT$ , volume ~50k contracts, notional value ~$8.8M.

$ProShares UltraPro Short QQQ(SQQQ)$

Speculative bearish flow included near-dated calls on SQQQ $SQQQ 20251017 16.0 CALL$ , volume 25k contracts, notional ~$1.8M.

$Taiwan Semiconductor Manufacturing(TSM)$

As the first major chip stock to report earnings in October, TSM's performance is crucial – though anything can happen.

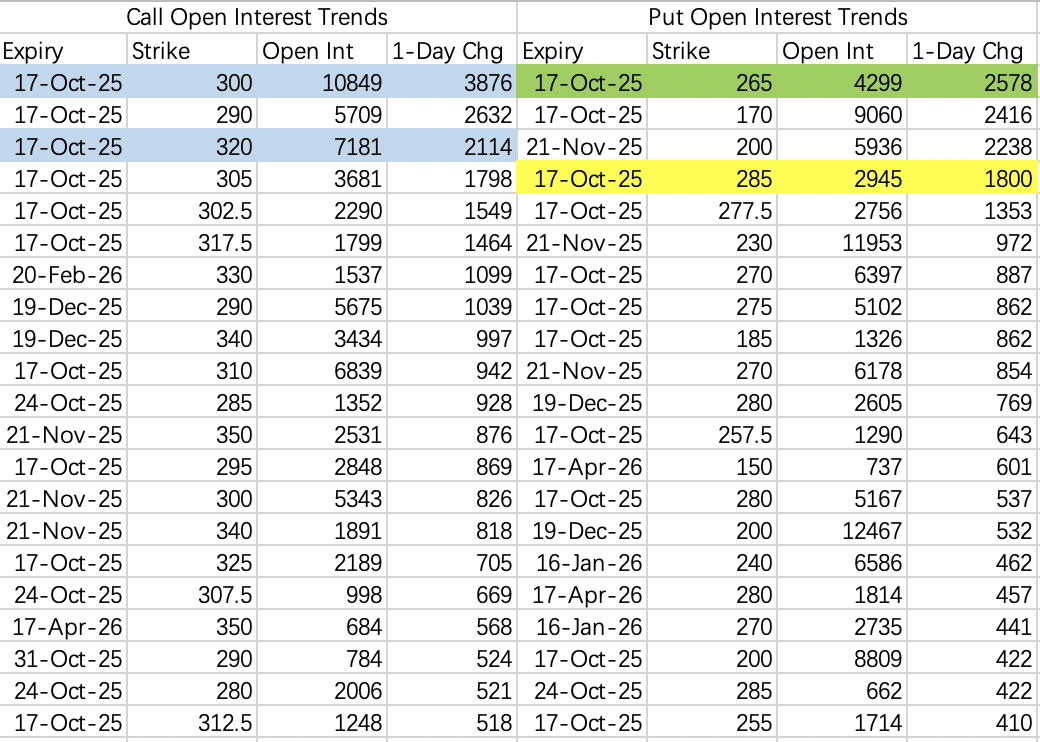

The large position is a bull call spread: Buy the 300 Call $TSM 20251017 300.0 CALL$ , Sell the 320 Call $TSM 20251017 320.0 CALL$ . Given it was opened during Friday's selloff, it should already be profitable.

Conversely, if friction arises in this week's talks, the stock could pull back further below 285 $TSM 20251017 285.0 PUT$ , or above 265 $TSM 20251017 265.0 PUT$ .

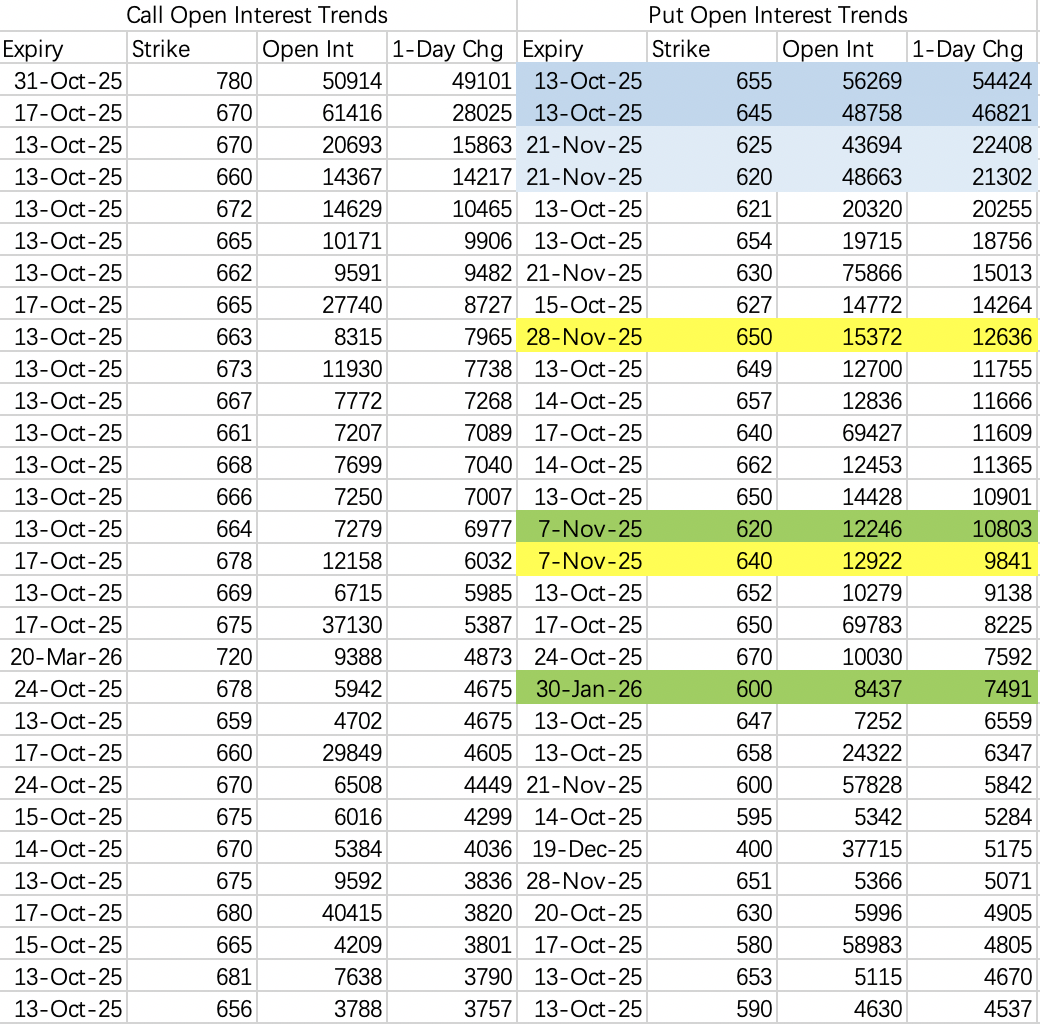

Friday's opening was relatively clear; market expects a pullback towards 640.

Bears are betting on near-dated options, targeting 645 today as the "Trump Taco" premium faded.

Other bearish openings include:

Buy $SPY 20251121 625.0 PUT$ , Sell $SPY 20251121 620.0 PUT$

Buy $SPY 20251128 650.0 PUT$ , Sell $SPY 20260116 600.0 PUT$

Buy $SPY 20251107 640.0 PUT$ , Sell $SPY 20251107 620.0 PUT$

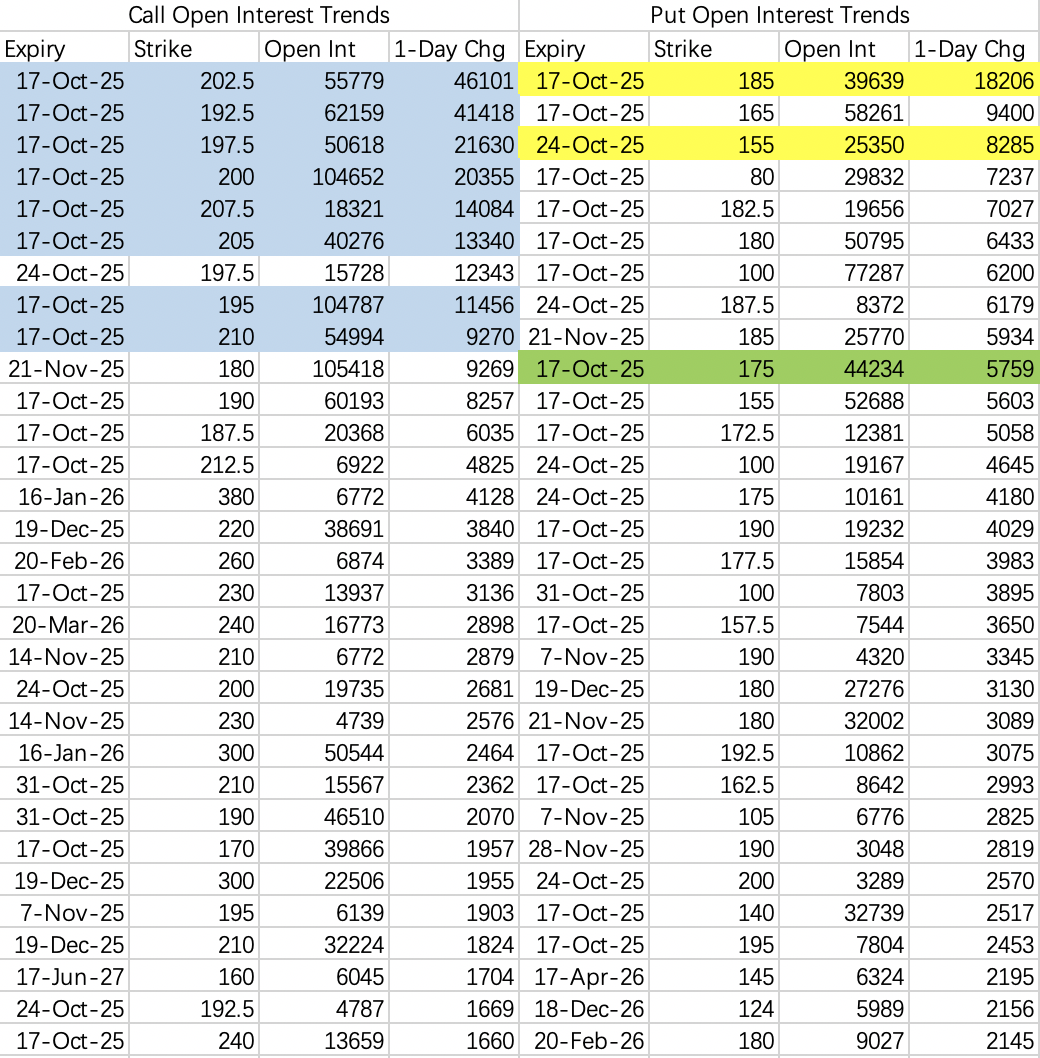

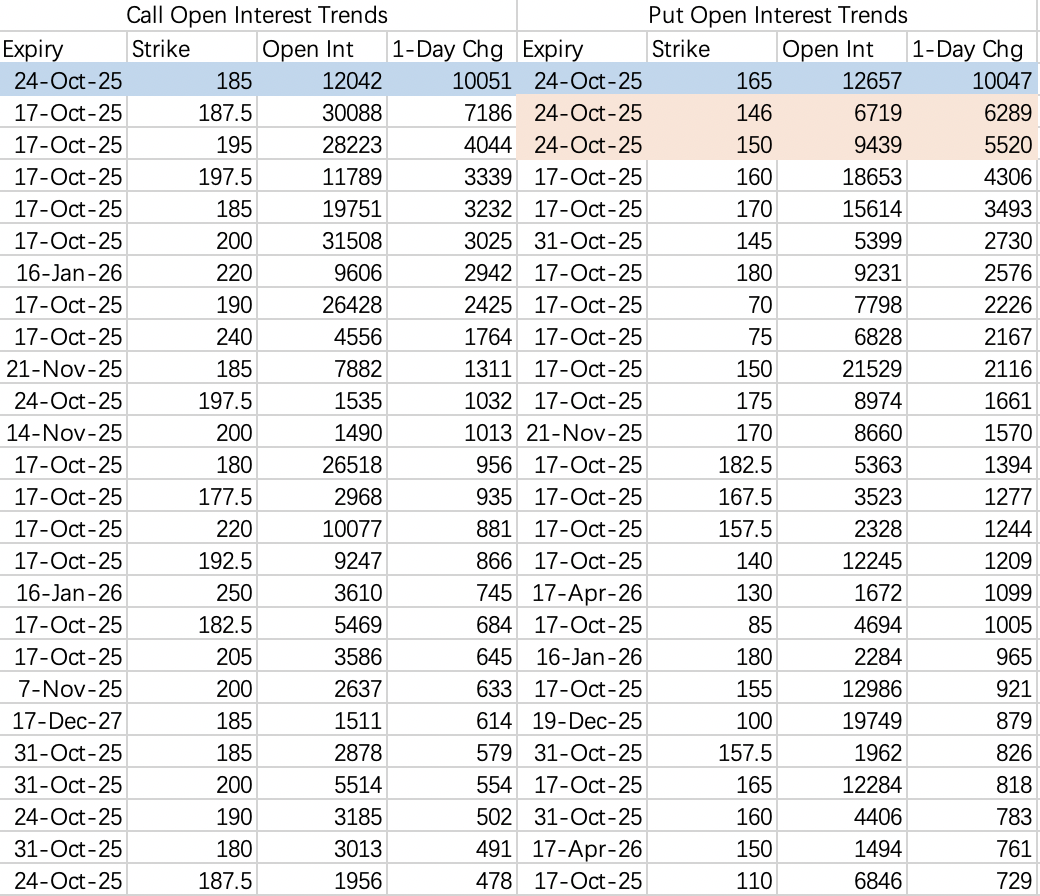

Institutional call spreads remain very restrained, same as last week, as selling low-strike calls during a pullback is risky – a bounce could cause instant blow-ups. Mainly expecting the stock to stay below 192.5 $NVDA 20251017 192.5 CALL$ .

A more neutral bearish view expects a pullback to 185-175 $NVDA 20251017 185.0 PUT$ $NVDA 20251017 175.0 PUT$ .

$Palantir Technologies Inc.(PLTR)$

PLTR's typical bearish positioning is concentrated pre-meeting, so the action over the next three weeks should be decisive.

Institutions are targeting a near-term range of 165-185 $PLTR 20251024 165.0 PUT$ $PLTR 20251024 185.0 CALL$ . Not sure why there's no structure for the week of the 17th.

The call spread strategy is also the same as last week: Sell the 187.5 Call $PLTR 20251017 187.5 CALL$ , Buy the 197.5 Call $PLTR 20251017 197.5 CALL$ .

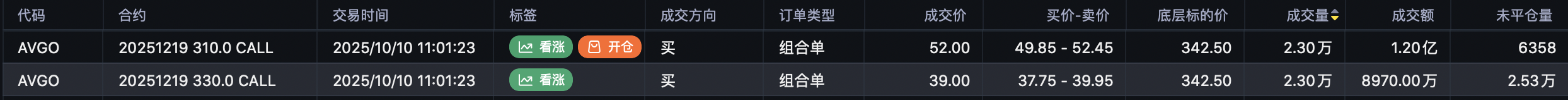

AVGO saw long call rolls, from the Dec 330 Call down to the 310 Call.

AVGO's price action and options flow are quite representative; most AI chip stocks will likely oscillate between positive and negative catalysts over the next three weeks.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.