Gold's Surge Faces Volatility Test — Is the Short-Term Correction an Opportunity?

Last week, multiple Federal Reserve officials, including Powell, expressed their views, which were generally dovish. Powell mentioned considering ending the balance sheet reduction, further strengthening market expectations for an interest rate cut in October. This caused a temporary rebound in risk assets. However, later in the week, renewed problems in the US banking system emerged, leading to a decline in market risk appetite and a pullback in US stocks. This weighed on copper prices to some extent, followed by a profit-taking correction in gold.

Market Review

Observations from COMEX and SHFE Copper Markets

COMEX copper prices fluctuated, seeking direction: dovish comments provided short-term support, but banking risks became a drag. Last week, several Fed officials’ comments leaned dovish. Powell’s remarks about considering ending balance sheet reduction reinforced October rate cut expectations, briefly boosting risk assets and copper prices. However, renewed issues in the US banking system late week revived risk aversion. US stock pullbacks pressured copper prices, leading to consolidation amid mixed bullish and bearish factors.

Regarding the term structure, COMEX copper futures curve shifted upward with the curve maintaining a contango structure. COMEX copper stock transfers continue, with inventories surpassing 340,000 tons and last week’s transfer volume rising significantly week-on-week. Cumulative COMEX copper inventory growth is approximately 220,000 tons. Comparing with main US copper import sources and registered COMEX brands, considering restocking capacity within US companies, it is estimated that about 100,000 tons of copper remain "invisible." Attention should be paid to possible transfer activity in other North American warehouses.

Last week, the SHFE copper curve shifted downward compared to previously; the near-term curve still slightly backwardated. With spot premiums continuing to fall during the peak season, upside potential for monthly price spreads looks limited. Additionally, imports are likely to increase significantly, with preliminary estimates indicating monthly imports could return to around 330,000 tons. Even if smelter maintenance concentrated in September and October offsets some of this import increase, overall supply pressure will not ease, limiting space for strength in monthly price spreads.

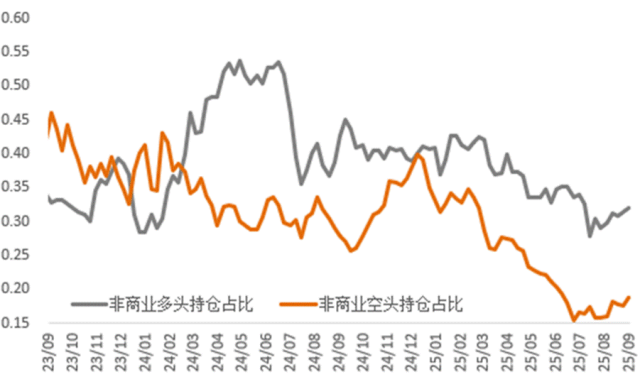

Regarding positions, due to the US government shutdown, CFTC’s position statistics and publication have been temporarily halted, making the latest position data unavailable.

Ratios and Volatility

Last week, gold prices rose more strongly than silver, causing the gold/silver ratio to rebound. Gold increased while copper declined, pushing the gold/copper ratio sharply higher. Oil prices continued to fall, leading to a notable spike in the gold/oil ratio.

Gold VIX volatility continued to surge, reaching a near five-year high. Risks embedded in the US banking system have increased market demand for safe havens, causing gold volatility to rise significantly.

Recently, the impact of the RMB exchange rate has strengthened compared to before. Last week, gold’s domestic and international price spreads and ratios continued to decline, with similar declines observed for silver.

COMEX Precious Metals Inventory

Inventory data show that last week COMEX gold inventories were 39.11 million ounces, down about 830,000 ounces week-on-week. COMEX silver inventories were about 509.46 million ounces, down approximately 13 million ounces week-on-week. SHFE gold inventories were around 84.6 tons, up 13.9 tons week-on-week. SHFE silver inventories were about 920 tons, down about 249 tons week-on-week.

Market Outlook

Though the traditional peak season is nearing its end, consumption has yet to show significant revitalization. One reason is that previously strong copper prices have restrained downstream purchase demand, which may partly be replenished through price declines. However, most industry demand remains fundamentally weak, which is the main reason for the lukewarm peak season consumption. From this perspective, even if prices drop, the stimulus effect on consumption may be temporary. Copper prices will likely remain in a consolidation phase.

In the short term, volatility is high and long positions are overly concentrated, suggesting a possible gold price correction, especially with economic data releases coming after the US government restarts, bringing potential macroeconomic uncertainties. However, considering that there is no change in the long-term narrative for gold prices, such corrections could actually offer better buying opportunities.

$NQ100指数主连 2512(NQmain)$ $SP500指数主连 2512(ESmain)$ $道琼斯指数主连 2512(YMmain)$ $黄金主连 2512(GCmain)$ $白银主连 2512(SImain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Ron Anne·2025-10-23Gold VIX at 5-yr high — isn’t a deep correction coming first?LikeReport

- Phyllis Strachey·2025-10-23100k tons “invisible” copper — will it crush COMEX premiums?LikeReport

- Jo Betsy·2025-10-23COMEX gold inventories down 830k oz — safe-haven demand’s real!LikeReport

- BartonBecky·2025-10-23Great insights here! Love your analysis! [Heart]LikeReport