An Earnings Season with Tempered Expectations

A combination of pre-positioning for macro tailwinds on Friday and Jensen Huang's speech on Tuesday has created a strong rebound momentum.

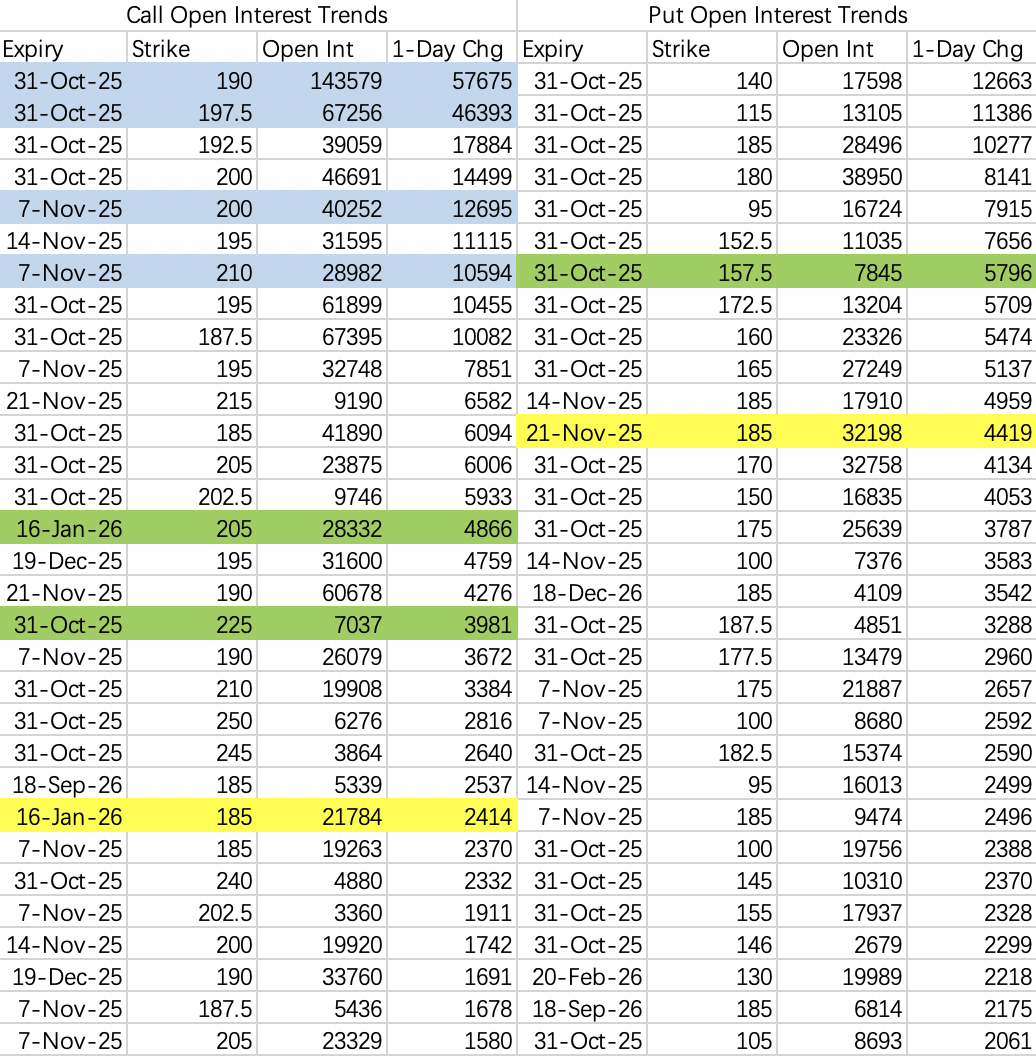

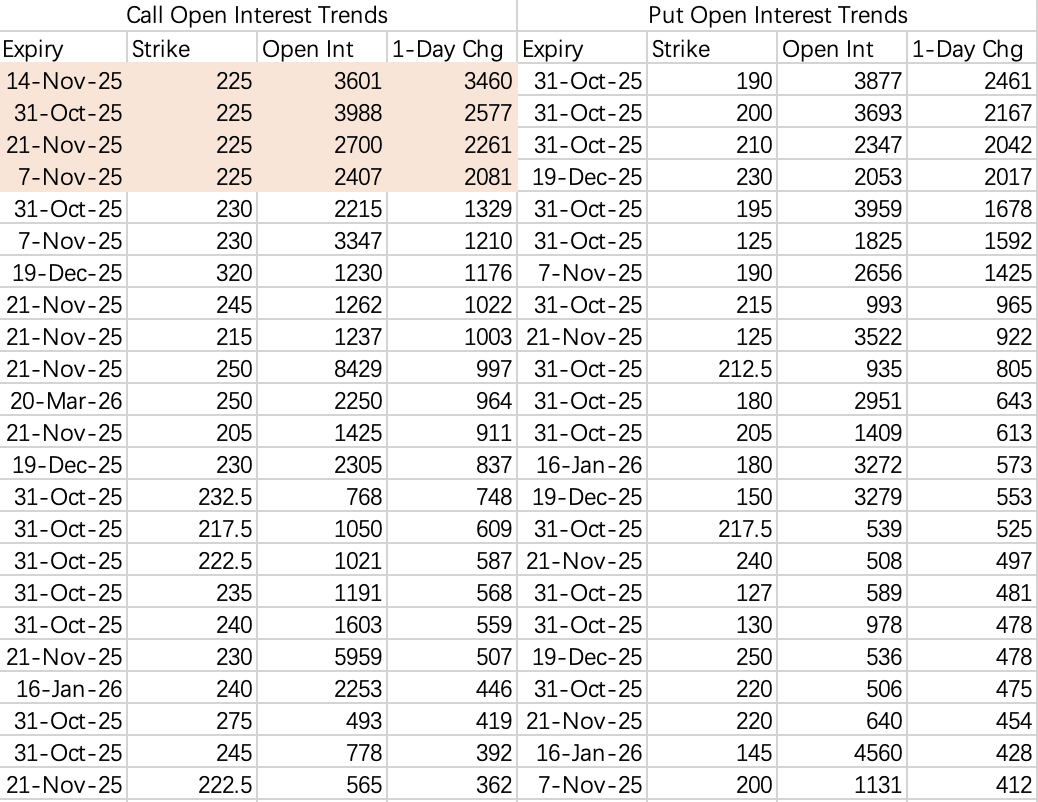

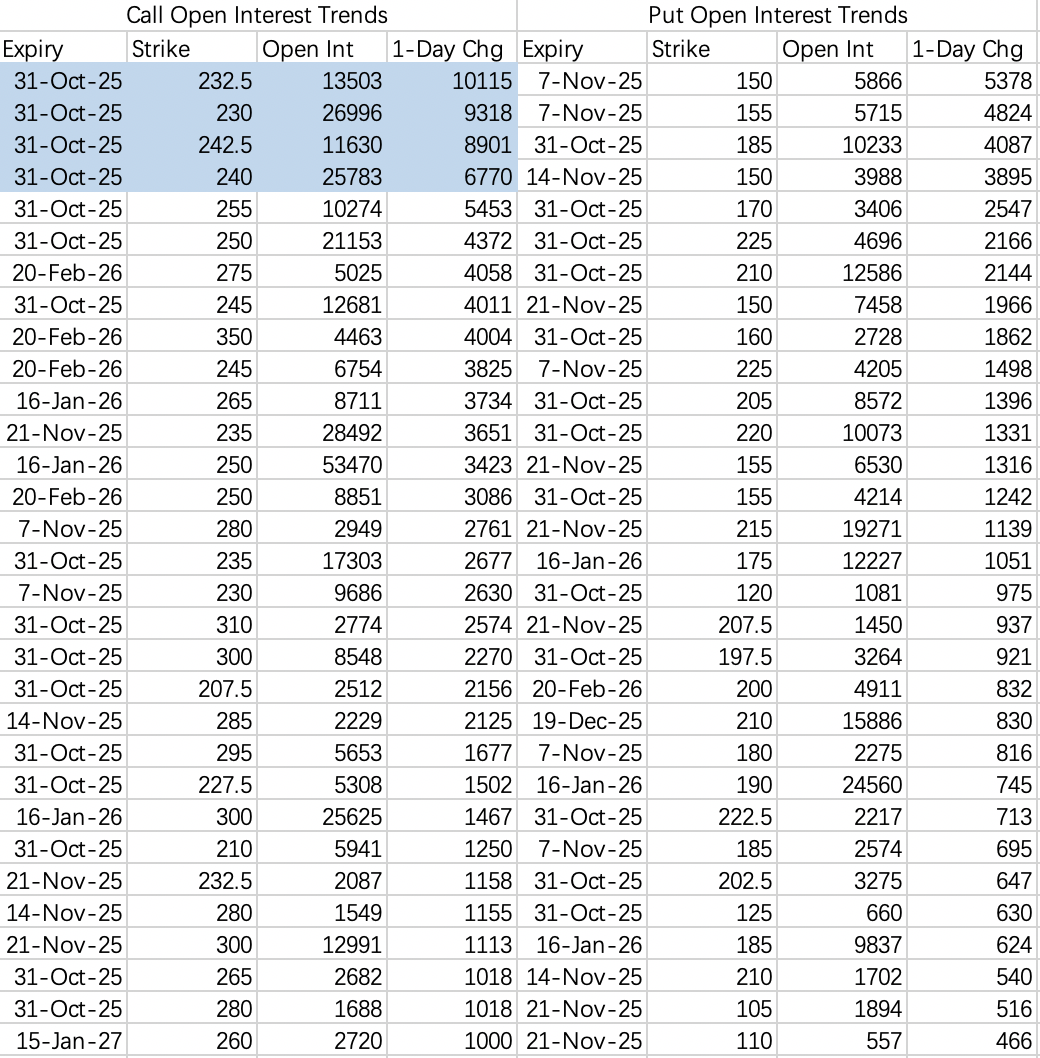

The institutional spread range for Friday was 190~197.5: sell $NVDA 20251031 190.0 CALL$ , buy $NVDA 20251031 197.5 CALL$ . However, a continued rebound to 195 or even higher towards 200 cannot be ruled out, as there's a 200-210 spread set up for next week. It depends on what Jensen Huang says in his speech tomorrow.

The lower bound is viewed around 185: $NVDA 20251031 185.0 PUT$

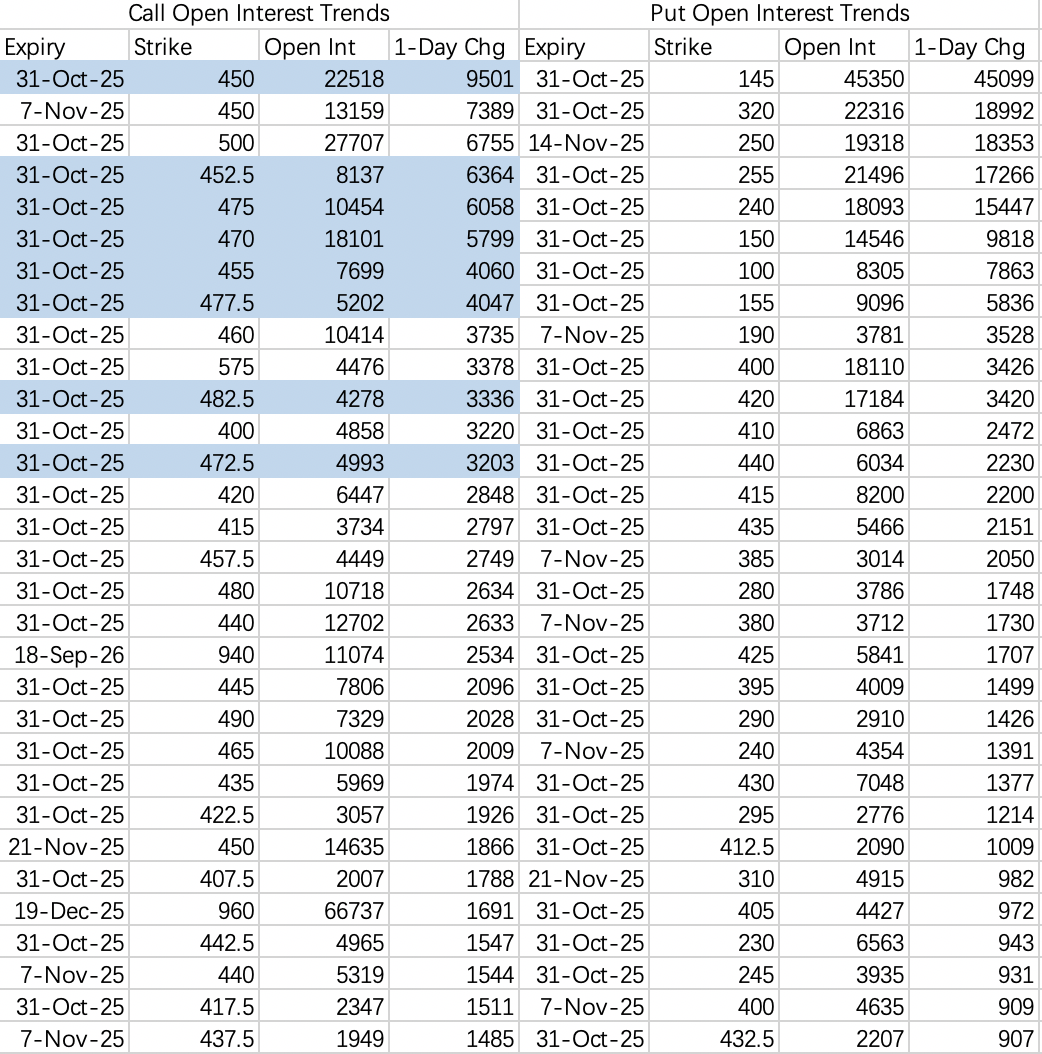

Continues within its usual choppy range. This week, we can continue collecting premium from both sides: sell call $TSLA 20251031 480.0 CALL$ , sell put $TSLA 20251031 420.0 PUT$

Judging from the preliminary talks over the weekend, the two countries likely reached a basic consensus, with disagreements seeming minor. Now it's just waiting for the two leaders to meet.

Generally, there's a tendency for a pullback around late October.

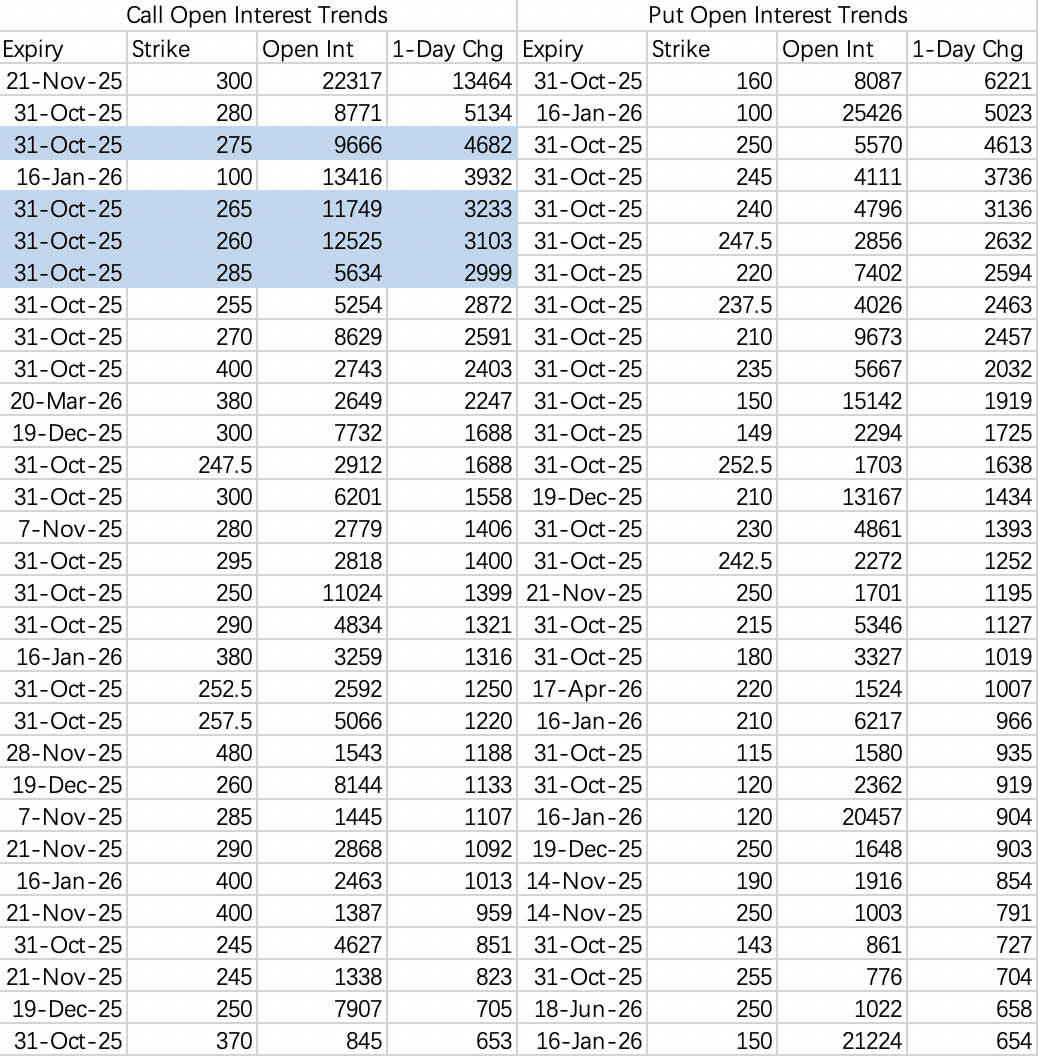

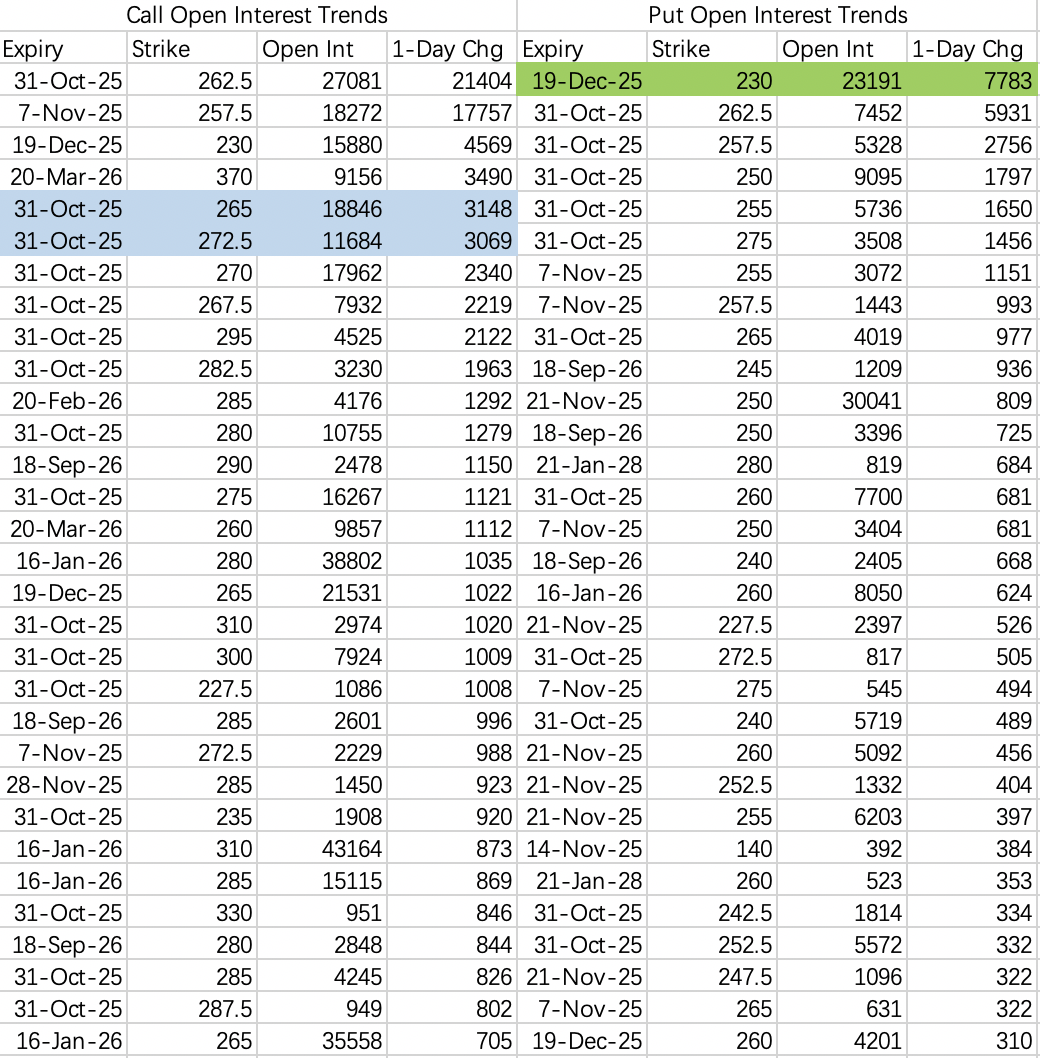

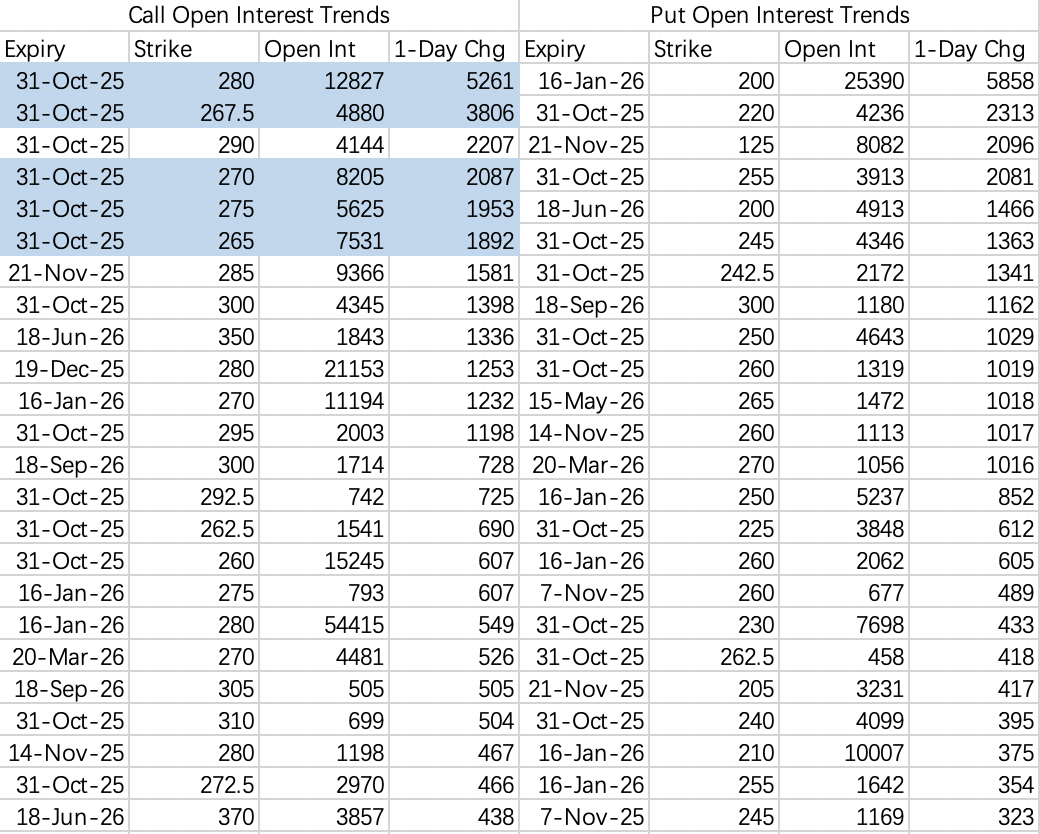

On Friday, institutions were selling calls at 265 $AMD 20251031 265.0 CALL$ and 260 $AMD 20251031 260.0 CALL$ , hedging by buying 275 $AMD 20251031 275.0 CALL$ and 285 $AMD 20251031 285.0 CALL$ .

For selling puts, consider tracking today's large order: $AMD 20251031 237.5 PUT$

Memory chip prices have been rising consistently, providing a driver for the stock price. However, concentrated option open interest at 225 creates some resistance $MU 20251031 225.0 CALL$ . For selling puts, 200 is an option $MU 20251031 200.0 PUT$ .

Apple also isn't given high expectations this week. The stock price will likely stay below $AAPL 20251031 270.0 CALL$ , but the probability of falling below 250 is very low. Consider selling puts: $AAPL 20251031 250.0 PUT$

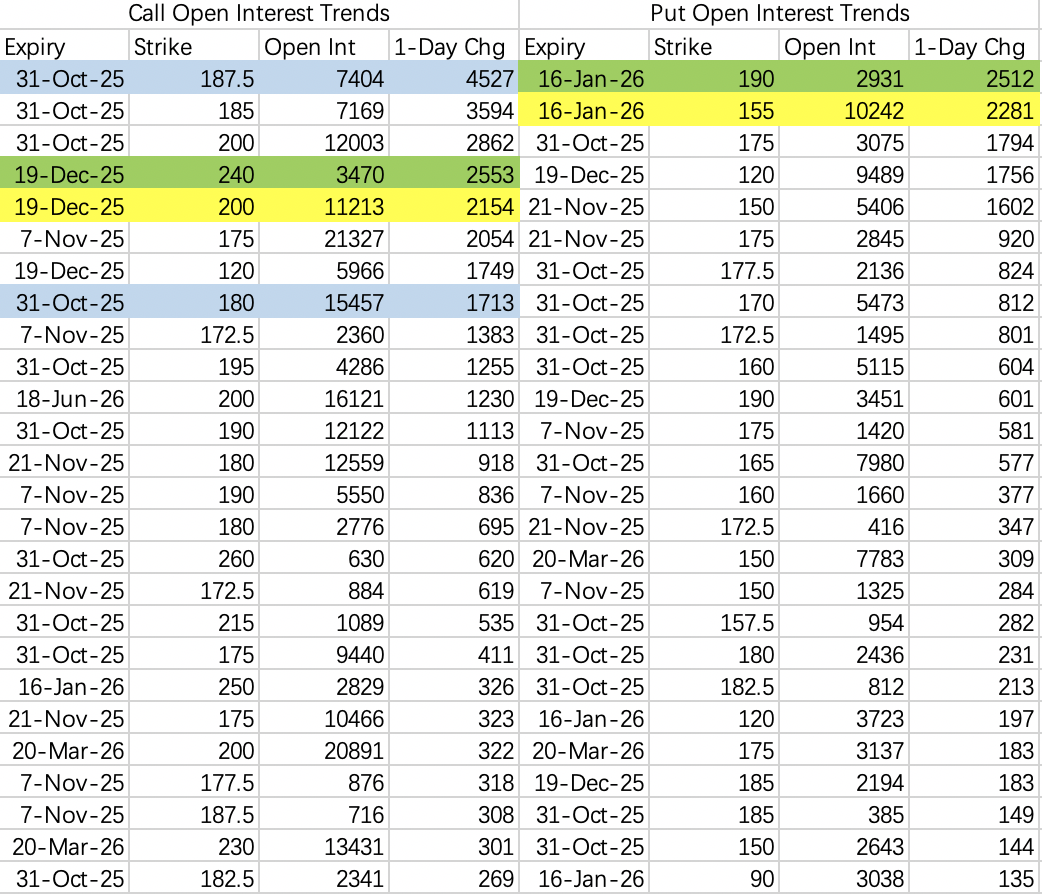

There is a large long-dated put sell order: $AAPL 20251219 230.0 PUT$

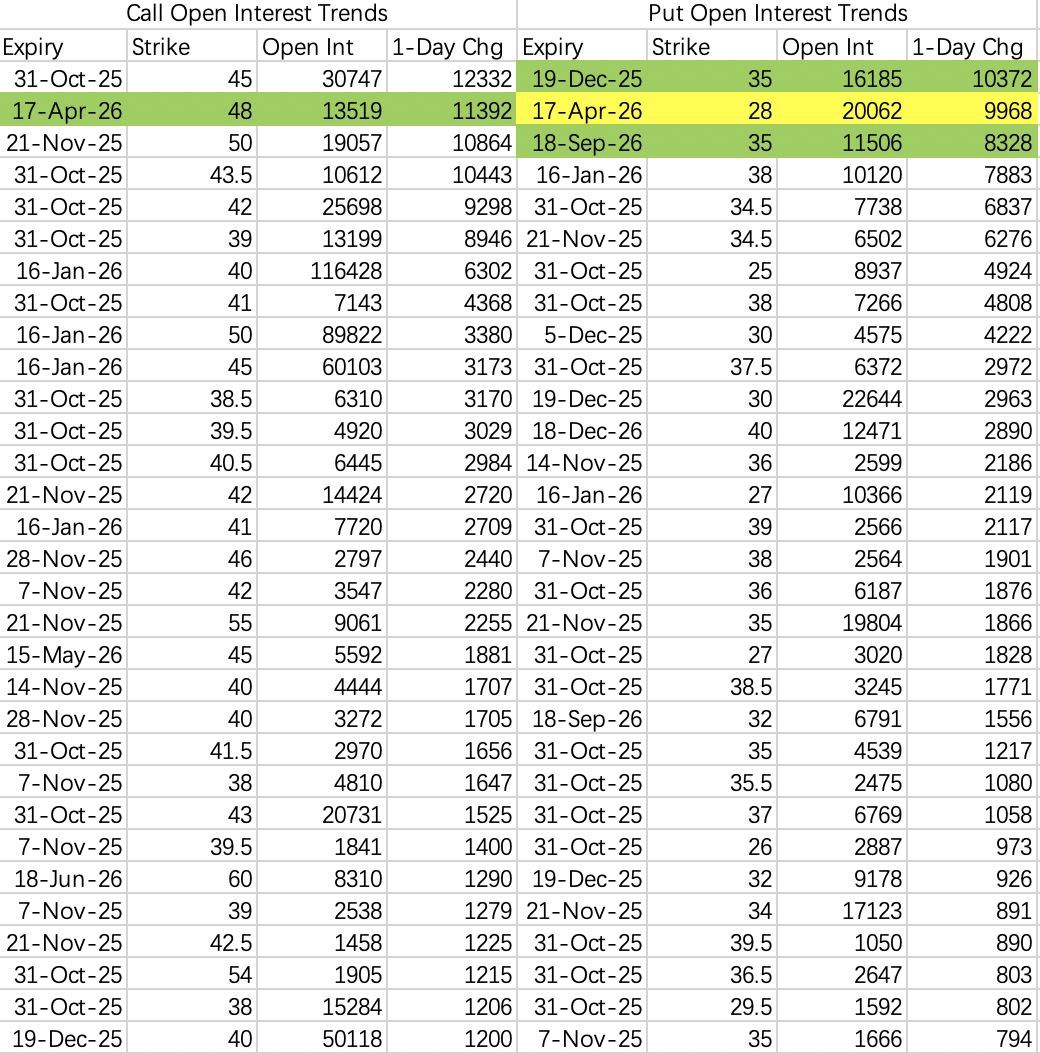

Breaking through 40 is the key question. Currently, put selling leans towards 35, like the large orders $INTC 20251219 35.0 PUT$ $INTC 20260918 35.0 PUT$ .

While it's unclear when it will rise, the current bias is that further downside is limited.

The target price is 200, making it very suitable for selling puts.

This week's institutional spread strategy is sell 180 $BABA 20251031 180.0 CALL$ , buy 187.5 $BABA 20251031 187.5 CALL$ .

For selling puts, consider strikes below 170: $BABA 20251031 170.0 PUT$

Additionally, there's a large long-dated call spread 200-240: buy $BABA 20251219 200.0 CALL$ , sell $BABA 20251219 240.0 CALL$

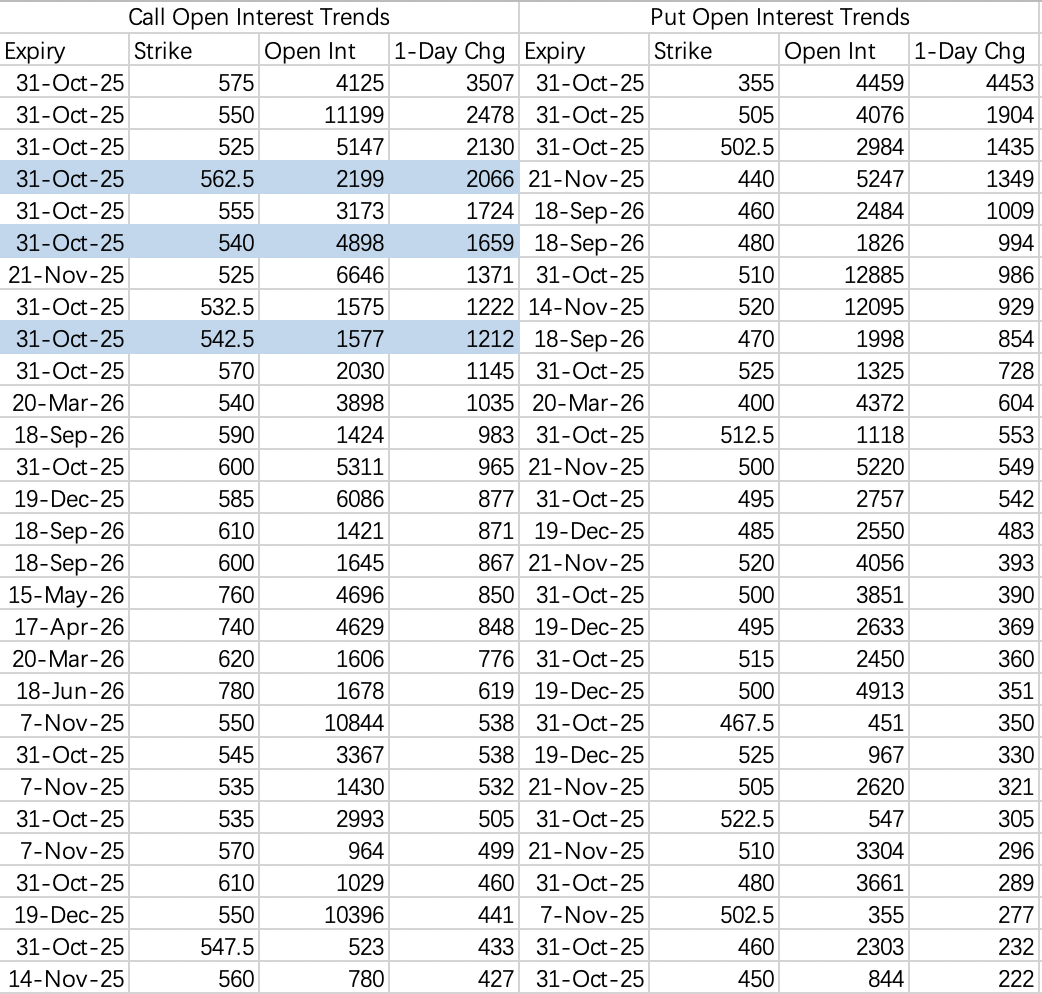

Earnings expectations are decent. The institutional spread strike prices involve selling 540 and hedging by buying 562.5 $MSFT 20251031 540.0 CALL$ $MSFT 20251031 562.5 CALL$ . For a safer put sell, consider $MSFT 20251031 505.0 PUT$ .

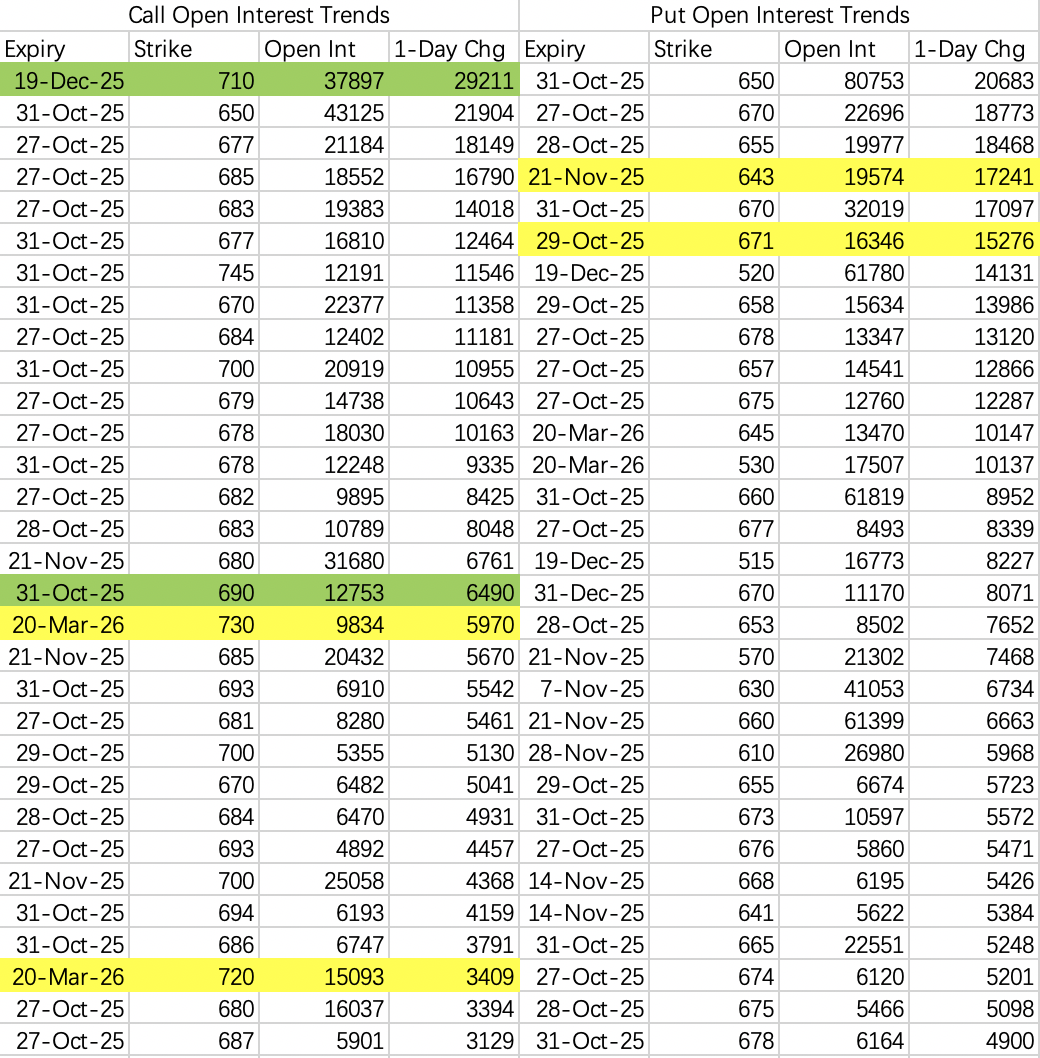

Earnings are this week. This quarter's EPS expectations are poor due to a fine. The institutional sell call spread strategy, with its strike prices, anticipates relatively low post-earnings movement, selling 265 $GOOGL 20251031 265.0 CALL$ and 267.5 call $GOOGL 20251031 267.5 CALL$ , hedging by buying 275 and 280 calls $GOOGL 20251031 280.0 CALL$ .

Also worth noting, a large bearish order appeared today: $GOOG 20260417 250.0 PUT$ , volume 10k contracts, premium close to $15 million.

Earnings are this week. The market hasn't set high expectations. The institutional spread strategy involves selling 230 and 232.5 calls $AMZN 20251031 230.0 CALL$ , hedging with 240 and 242.5 calls $AMZN 20251031 240.0 CALL$ .

No wonder the market expectations are low. I think the biggest earnings risk is management's commentary – sometimes nothing's wrong, but their stated outlook can be overly unrealistic.

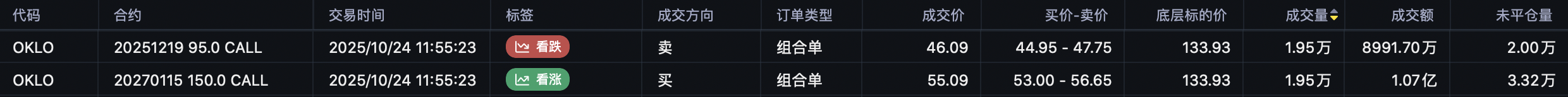

A large order closed: $OKLO 20251219 95.0 CALL$ , and rolled to open a long-dated 150 call: $OKLO 20270115 150.0 CALL$

It's noteworthy that a large order on Sept 22nd $OKLO 20251121 95.0 CALL$ was also rolled once, opening the same $OKLO 20270115 150.0 CALL$ option. So currently, the long-dated large orders are very concentrated.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Juju710·10-28Good 🌟🌟🌟LikeReport

- Brando741319·10-28GoodLikeReport

- YueShan·10-28Good ⭐⭐⭐LikeReport