Big-Tech Weekly | 5 Titans, One AI Race: CapEx Meets Cash Flow, Who's Amplifying Risk?

Big-Tech’s Performance

Macro Headlines This Week:

October FOMC meeting left the door open to a rate cut but delivered a hawkish tone. Chair Jerome Powell noted that while employment-data flashes some weakness, inflation risks remain elevated — which left investors questioning the path ahead. The latest initial jobless claims (Oct 25) showed a modest softening in the labour market: the unemployment rate held at 4.3%, and non-farm payrolls added only 22 k jobs, far below expectations, further supporting the Fed’s “pre-emptive” easing stance.

Trade developments were intense this week. On the 25th the U.S. announced a pause in negotiations with Canada and slapped a 10% tariff, stoking concerns about North American supply-chains. Meanwhile, U.S.–China talks showed movement. The Senate, however, rejected the tariff agenda three times, exposing rifts within the Republican Party. While this eased near-term trade-war fears (avoiding a potential 100% tariff outcome), it was fundamentally a “tactical concession” — protectionism under Donald Trump remains the dominant policy.

Equities new highs, but tech stutters. U.S. major indices reached fresh highs, largely driven by strong tech profits and the AI theme. Yet, while AI and tech remain central, the market is increasingly sensitive to earnings sustainability, valuation justification and external risks (e.g., policy, trade, supply-chain). Some high-fliers are seeing trimmed growth forecasts, which has triggered sector divergence. The market mood shifted from “upward momentum” to a “wait-and-see” stance: with cuts already priced in, data uncertainty high and policy risk elevated, sentiment moved from euphoric to cautious.

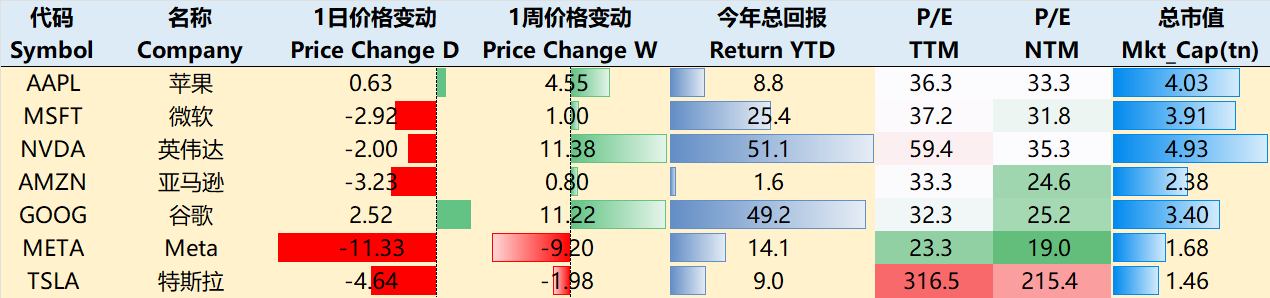

Big Tech earnings diverged this week. Earnings from five major tech companies revealed a split. As of the close Oct 30: $Apple(AAPL)$ +4.55 %, $Microsoft(MSFT)$ +1.0 %, $NVIDIA(NVDA)$ +11.38 %, $Amazon.com(AMZN)$ +0.8 %, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ +11.22 %, $Meta Platforms, Inc.(META)$ –9.2 %, $Tesla Motors(TSLA)$ –1.98%.

Big-Tech’s Key Strategy

Earnings season: key strengths and risks.

This week all five major tech firms released earnings and the market reaction was quite polarized. Beyond focusing on stable, low-surprise core businesses, investors remain centred on AI and increasingly evaluating investment efficiency (e.g., ROIC).

From the results, AMZN stood out; GOOG and AAPL followed; MSFT showed a modest pull-back; META fell significantly on cumulative headwinds. Considering since their last earnings: AMZN (cautious on AWS growth re-acceleration, rising macro consumer uncertainty) and META (lacking cloud support, AI investment reportedly chaotic) have seen the smallest gains; GOOG (due to market-share rebound for Gemini) and AAPL (iPhone 17 series tracking ahead of expectations) are strongly catching up; MSFT (with large pre-earnings hype around its deal with OpenAI) has already priced in much of the upside. So, from the perspective of AI-driven returns we view the Q3 earnings pecking-order as:

AMZN > GOOG = AAPL = MSFT > META

Cloud-business snapshot.

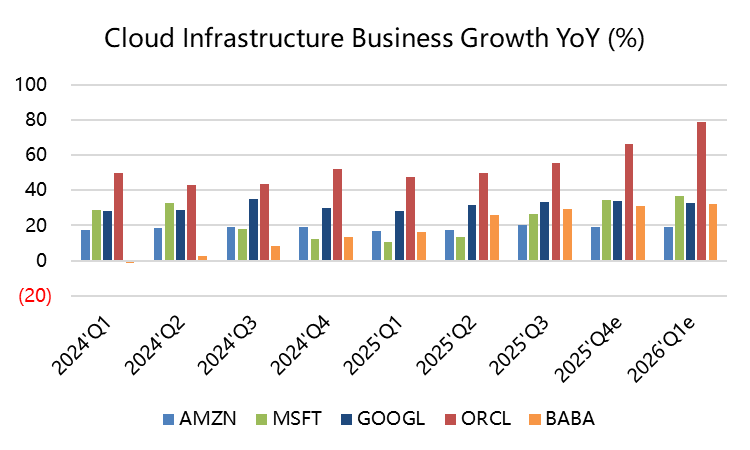

AI-demand is driving a rebound across the three major cloud providers, yet Azure and GCP are growing faster than AWS, signalling market share shifts. According to Synergy Research and Canalys for Q3 2025, over the past eight quarters Azure and GCP have captured ~3-4 pp of share from AWS. With the market growing ~35% in 2025, the shifting share suggests Azure/GCP are stronger bets in generative-AI.

Azure: over the past 8 quarters accelerated from 28% to 40%, aided by AI integrations (e.g., Copilot) and major enterprise contracts (e.g., OpenAI). Demand outpaces supply, and capacity constraints have capped growth upside.

GCP: accelerated from 22% to 34%; AI-products (e.g., Gemini) have made meaningful contributions; in the past two years it has signed more multibillion-dollar contracts. Q3 2025 backlog surged 46% to US$155 bn (including OpenAI and Meta contracts), pointing to future acceleration.

AWS: growth rose from a trough of 12% to 20.2%, but remains slower versus Azure/GCP. Q3’s acceleration benefited from AI (Trainium chip usage +150% QoQ) and backlog growth, yet competitive pressure remains intense.

AAPL Services: Growth steady at 11-16%; iCloud’s contribution is limited (Services are more reliant on App Store/music/video), so it is not directly comparable as a cloud player.

CapEx trends.

All firms have increased CapEx in Q3 / FY26 Q1, reflecting supply-catching-up with AI demand. Forecasts for 2025 have been raised, 2026 looks even higher (excluding AAPL which remains more conservative). This quarter’s total CapEx is over US$100 bn; the six major players may together invest over US$570 bn in 2025, and 2026’s expected total already exceeds US$660 bn (on the upside). These are truly real-cash outlays.

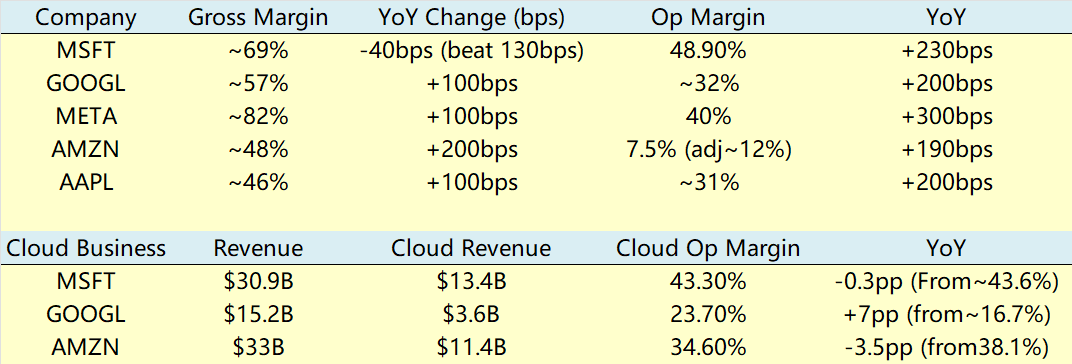

Margin pressure.

The three major cloud segments boast strong margins, yet the divergence is telling — GOOG’s GCP margin is expanding fastest (AI ROIC is showing), MSFT remains stable (its efficiency offsets investment), AMZN’s margin is shrinking (due to heavy re-investment in AI infrastructure). Adjusted for this, AI demand is generating scale-economies, but persistent CapEx could further squeeze margins (for example, MSFT’s supply-constraint may extend into late FY26).

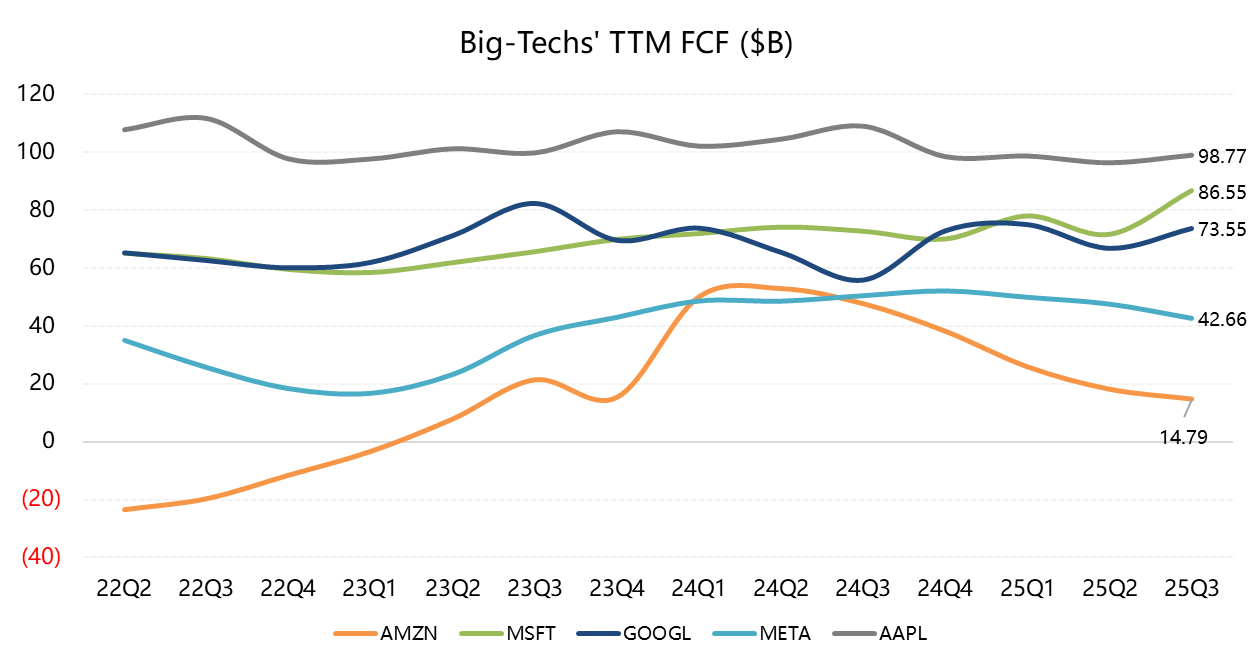

Why focus on FCF?

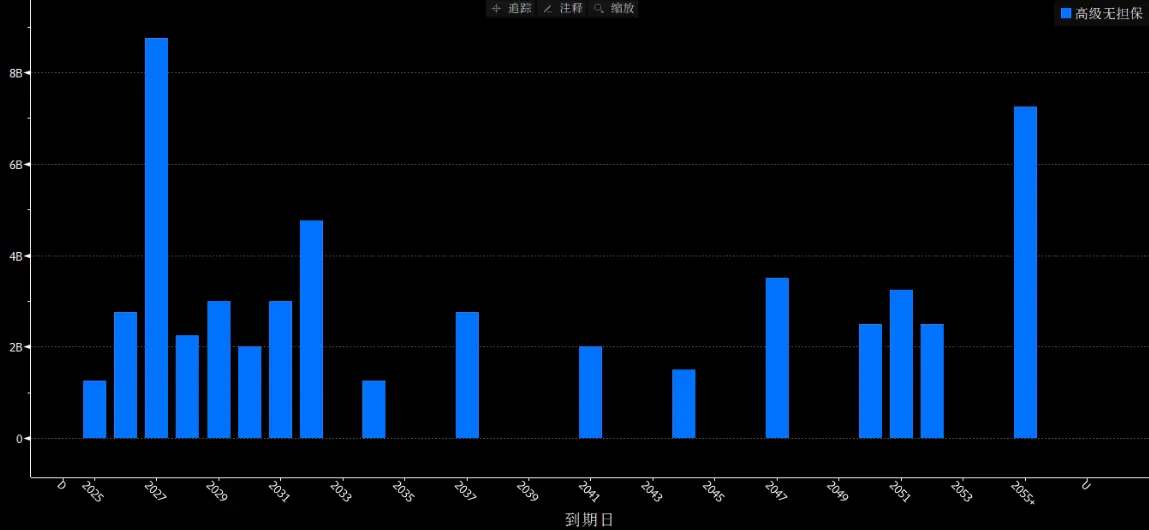

Because major tech firms have signalled accelerated CapEx in 2026, strong cash-flows are critical to support this. META has already started issuing debt (which was well-received), and more may follow.

As of Q3 2025, the trailing 12-month free cash flows:

AAPL $98.8 bn > MSFT $86.5 bn > GOOG $73.5 bn > META $42.7 bn > AMZN $14.8 bn.

When CapEx approaches—or exceeds—FCF, free cash flow gets severely compressed, which raises pressure on operations or buybacks. Against the CapEx outlook, AAPL and MSFT appear relatively stable and controllable; GOOG and META face greater pressure due to heavier CapEx; AMZN is most constrained. Given that AMZN has a large tranche of debt maturing 2026–2030, the company may next move to issue further debt financing.

Big Tech Options Strategies

This week we highlight: Did NVDA steal the spotlight?

Though it was not earnings week, Nvidia’s ∼GPU Technology Conference (GTC) overshadowed other big tech companies and drew heavy capital inflows. The conference theme “Blueprint for the AI Century” emphasised a shift from software tools to an “AI-factory” industrial revolution, with multiple hardware, software and ecosystem announcements reinforcing Nvidia’s dominance in AI infrastructure. Crucially, Nvidia updated its shipment projections, bluntly telling the market: your prior expectations were too low!

Key highlights: Blackwell GPU is now in full production at the Arizona domestic factory, 6 million units shipped, 14 million units ordered; next-gen Rubin GPU order launch has backlog > US$500 bn, covering 2025-26 (≈20 million GPUs, versus consensus ~30 million); open-source NVLink architecture supports GPU + quantum-chip fusion; partnership investments include a US$1 bn joint venture with Nokia and T-Mobile to develop AI-native 6G base-stations; US DOE contracts building 7 AI supercomputers; Uber partnership deploying 100,000 self-driving cars from 2027; RoboForce TITAN robot fielding 11,000 letters of intent. The conference expanded over 40 partnerships covering telecom, robotics, quantum, healthcare, etc., and projected global data-centre spend of US$3 trillion.

As a result, Nvidia became the first company this week to surpass US$5 trillion market-cap.

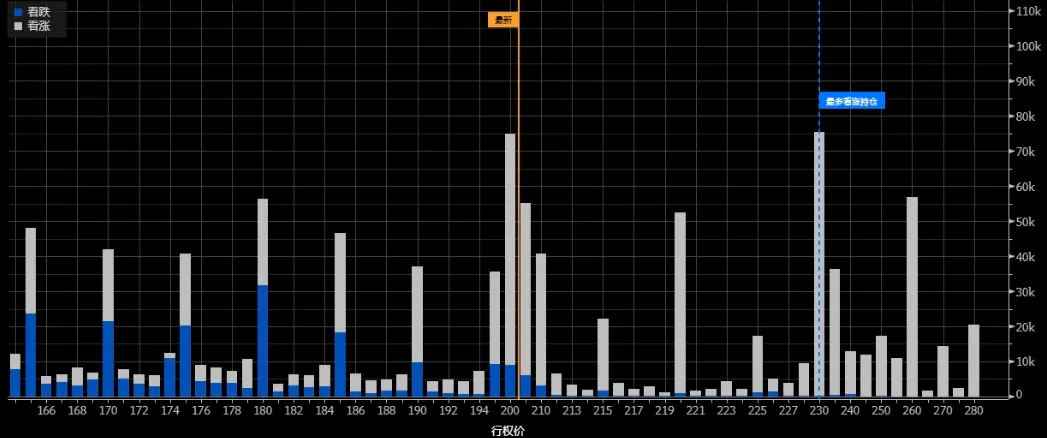

In the options market, although near-term (Nov) option distribution hasn’t changed much, the earnings week of Nov 21 sees heavy Call concentration at strike < 200. But December-expiry option markets already price expectations above 230, reflecting investors’ hopes for a year-end rally.

Big Tech Portfolio

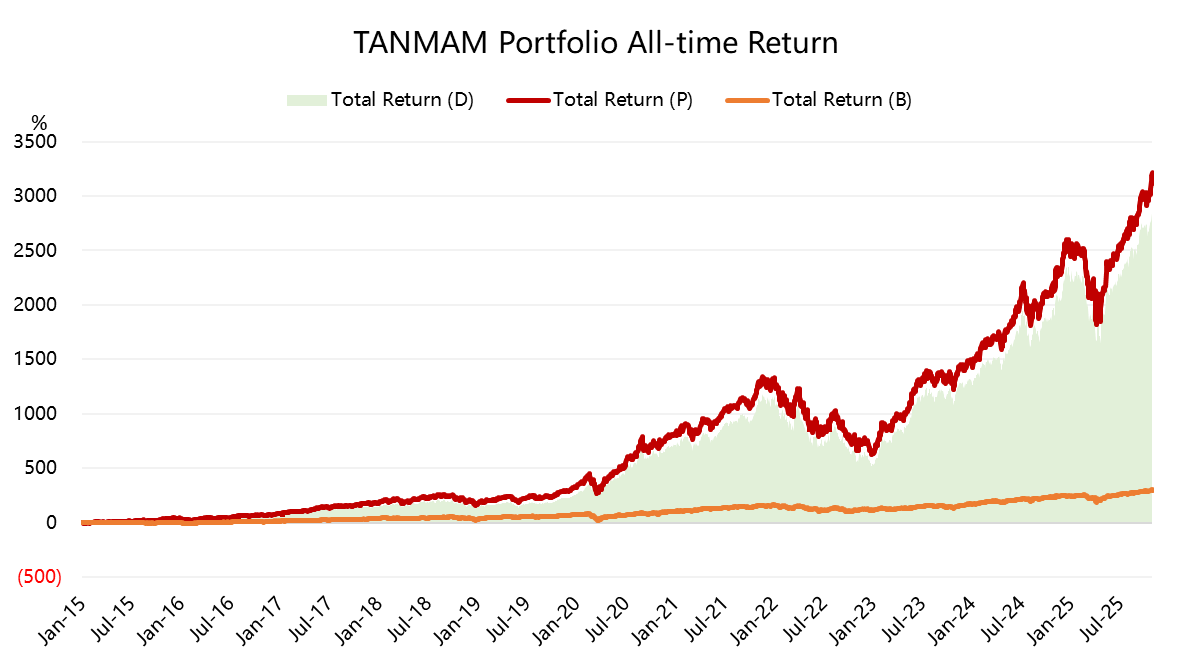

The “Magnificent Seven” tech stocks form an equal-weighted portfolio (ticker “TANMAMG”), rebalanced quarterly. Back-tested from 2015 onwards, it has dramatically out-performed the $SPDR S&P 500 ETF Trust(SPY)$ : total return ~2959.19% compared with SPY ~286.47%, giving excess return of ~2672.72%. It remains at a high level.

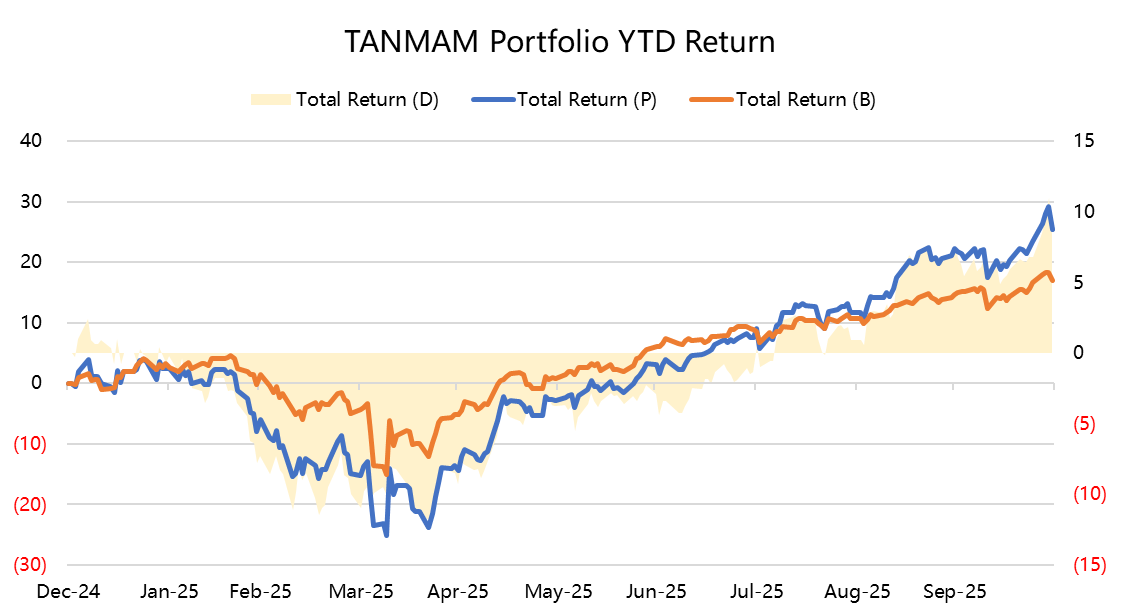

Year-to-date this year the Big Tech cohort has again hit new highs with a return of ~19.24%, ahead of SPY’s ~13.71%

$S&P 500(.SPX)$ $NASDAQ(.IXIC)$ $NASDAQ 100(NDX)$ $Invesco QQQ(QQQ)$ $ProShares UltraPro Short QQQ(SQQQ)$ $ProShares UltraPro QQQ(TQQQ)$ $Dow Jones(.DJI)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Venus Reade·2025-11-01Holding its ground while the rest of the market sells off. Amazon is roaring back.LikeReport

- MurrayBulwer·2025-10-31The current economic climate is definitely creating a balancing act for investors.LikeReport

- Valerie Archibald·2025-11-01AMZN & TLPH both today's winnersLikeReport