Which Will Break the Round Number First: AMD or Tesla?

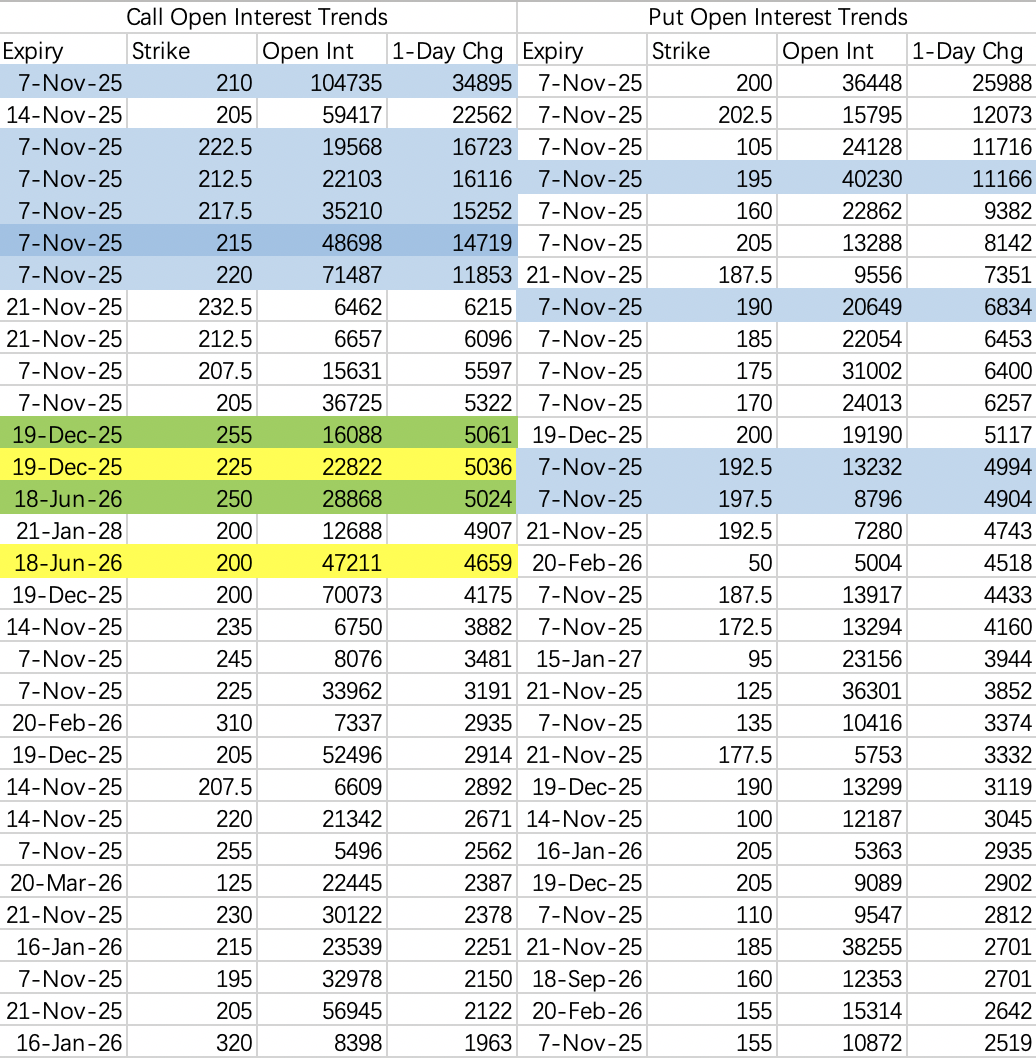

It has recently stabilized within the range of 190-220. Very stable, just harvest the premium. The blue sections indicate institutional spread strategy option openings. Both call and put spreads have escalated a level compared to strategies from the week before last.

For sell calls, reference strike 215 $NVDA 20251107 215.0 CALL$ . For sell puts, reference strike 195 $NVDA 20251107 195.0 PUT$ .

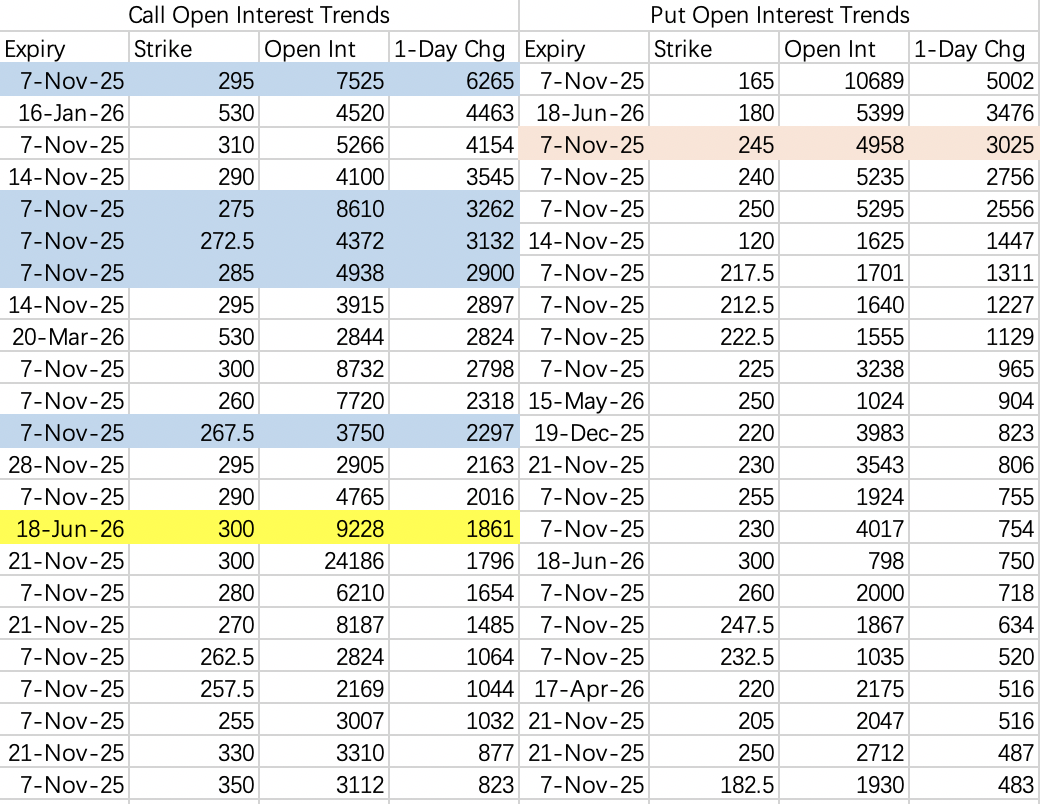

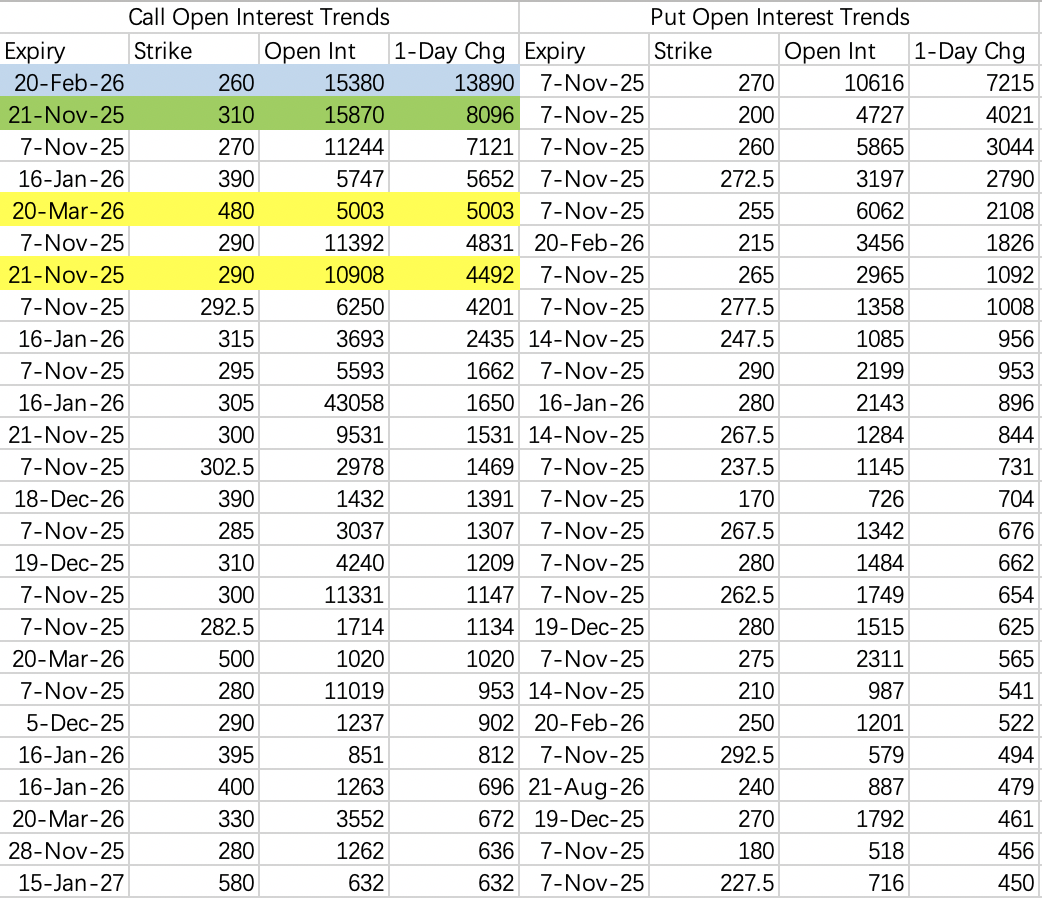

Earnings this week are expected to beat expectations. The institutional strategy's expected strike price range is very wide, 260 $AMD 20260116 260.0 CALL$ to 295 $AMD 20260116 295.0 CALL$ , not reaching 300.

Call spreads are concentrated around 272.5, 275-295: $AMD 20260116 275.0 CALL$ $AMD 20260116 295.0 CALL$ . Currently, it appears the stock price might be below 280 after earnings.

But good earnings don't necessarily mean the stock price will rise. However, for sell puts, one can boldly select 240 $AMD 20251107 240.0 PUT$ , because there is an Analyst Day on the 11th.

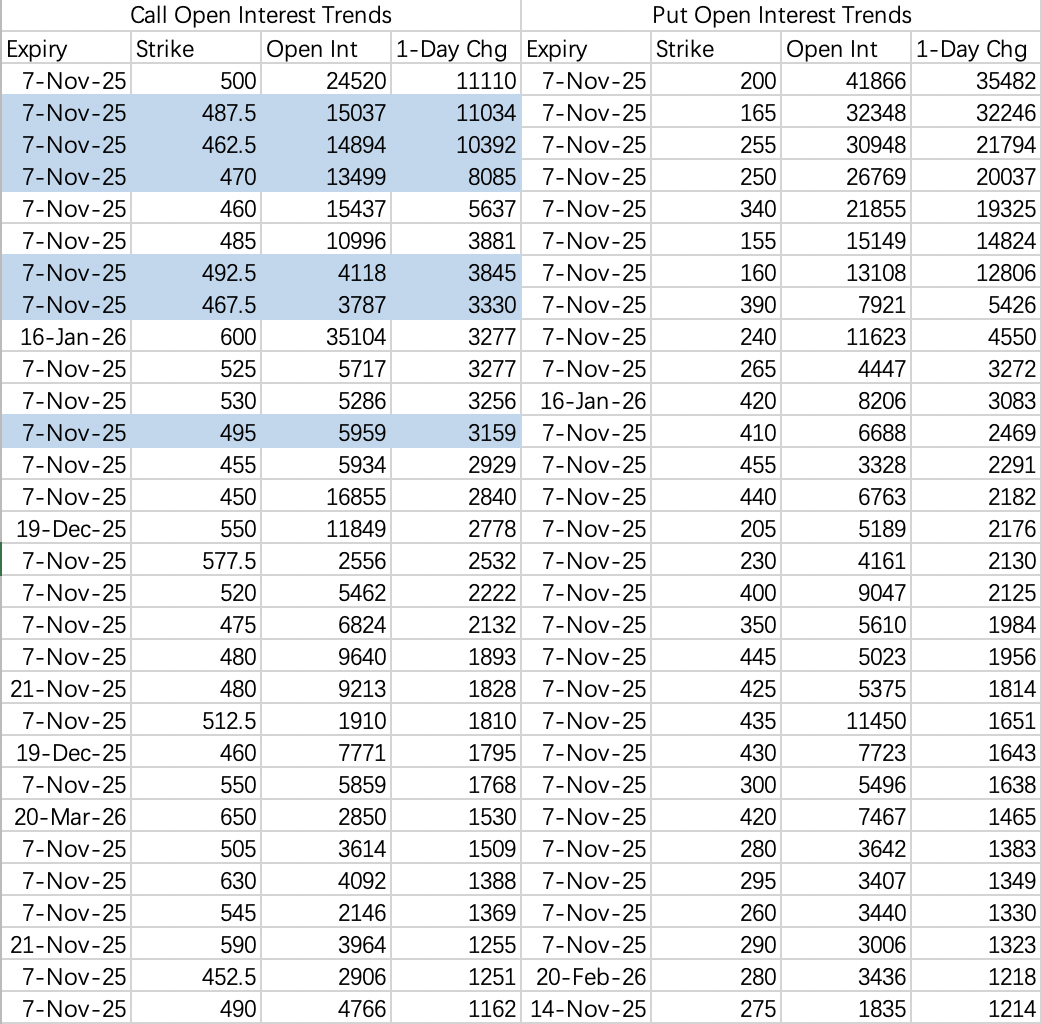

Like AMD, it faces potentially breaking a round number level. This week's main call spread involves selling 470 $TSLA 20251107 470.0 CALL$ and hedging by buying 495 $TSLA 20251107 495.0 CALL$ .

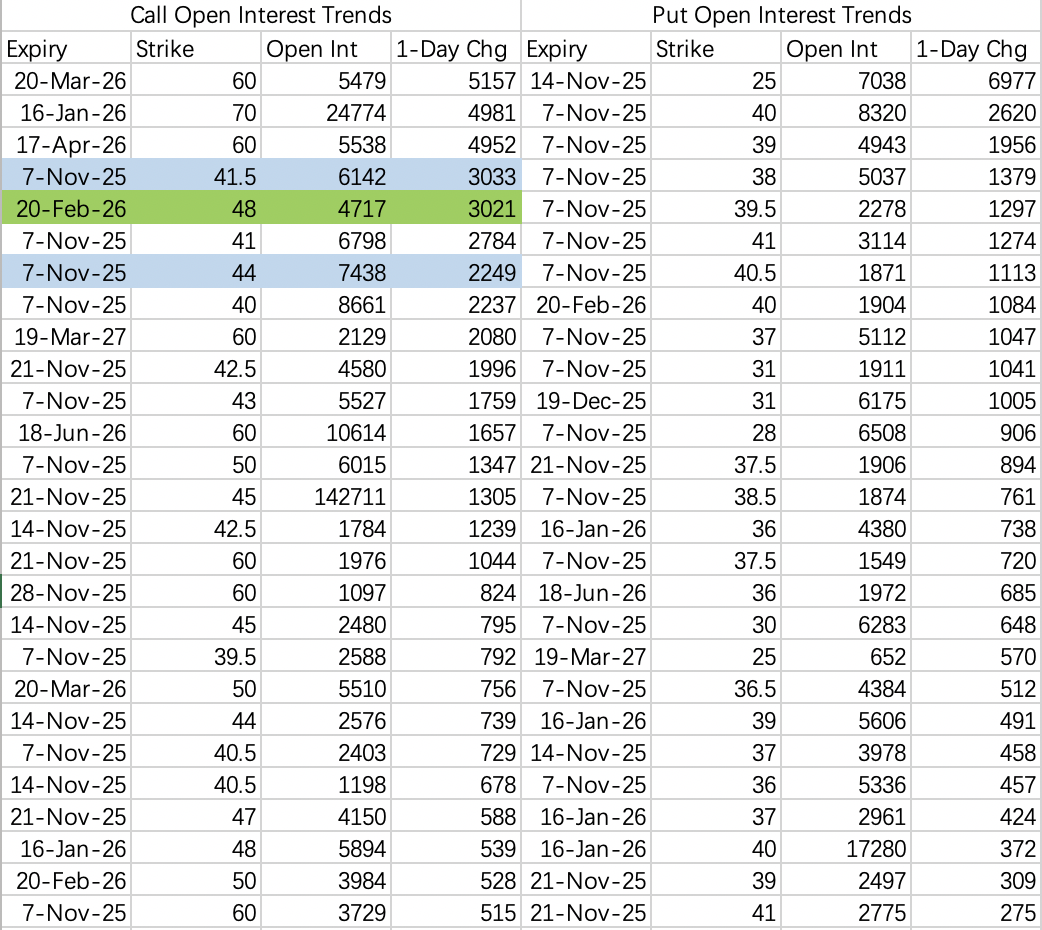

It's highly likely to be in a sideways trend this week. Institutions are selling calls $INTC 20251107 41.5 CALL$ and buying calls $INTC 20251107 44.0 CALL$ .

Additionally, many long-term out-of-the-money calls have been opened, with a bias towards selling.

For put selling, reference $INTC 20251107 38.0 PUT$ .

$Palantir Technologies Inc.(PLTR)$

Although there are long-term options being opened daily $PLTR 20280121 310.0 CALL$ , this earnings report might be somewhat problematic, with a gain of less than 5% or even a potential drop.

Firstly, this week's call spreads are priced very low, expecting the stock price to be below 212.5 $PLTR 20251107 212.5 CALL$ , hedged with 225 $PLTR 20251107 225.0 CALL$ .

Long-term puts are being opened $PLTR 20251219 180.0 PUT$ , the intent could be for speculation or hedging.

Of course, a drop would also be a buying opportunity.

Long calls have been rolled from November 190 to February 260 $GOOGL 20260220 260.0 CALL$ , a relatively conservative strike selection.

However, the long-term view remains bullish. More aggressive bulls have opened March 480 calls $GOOGL 20260320 480.0 CALL$ .

For sell puts, consider 270 $GOOGL 20251107 270.0 PUT$ .

Last week, institutions selected a range of 112-130.

This week's range: $CRWV 20251107 144.0 CALL$ $CRWV 20251107 124.0 PUT$ $CRWV 20251107 112.0 PUT$ . This suggests trading between 124-144, with a potential test of 112.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- AuntieAaA·11-04GoodLikeReport