Trump's Youngest Son Shorts QQQ, Big Short Bet Against NVDA and PLTR – What's Going On?

This afternoon, there was news that Trump's youngest son, Barron, bought over 20,000 contracts of QQQ 570 puts on November 3rd $QQQ 20251231 570.0 PUT$ , worth approximately $10.9 million.

This trade is clearly recorded on the volume chart. Given the low demand for such deep out-of-the-money options, it's almost certain that specific volume spike was Barron's doing.

What does a drop to 570 imply? Roughly a 10% market-wide correction.

There's much speculation about Barron's motive. Previously, rumors suggested Barron runs a stock trading group with a $1 million entry threshold. This group has had some successful trades, often coinciding with Trump's policy announcements.

Essentially, Barron's moves often align with policy-driven market moves, leading to the inference that this short bet might be similar. The intriguing part is that Trump appeared quite pragmatic during the recent negotiations, unlike someone who would resort to rhetoric that could trigger a sell-off. So, the origin of this bearish bet is particularly interesting.

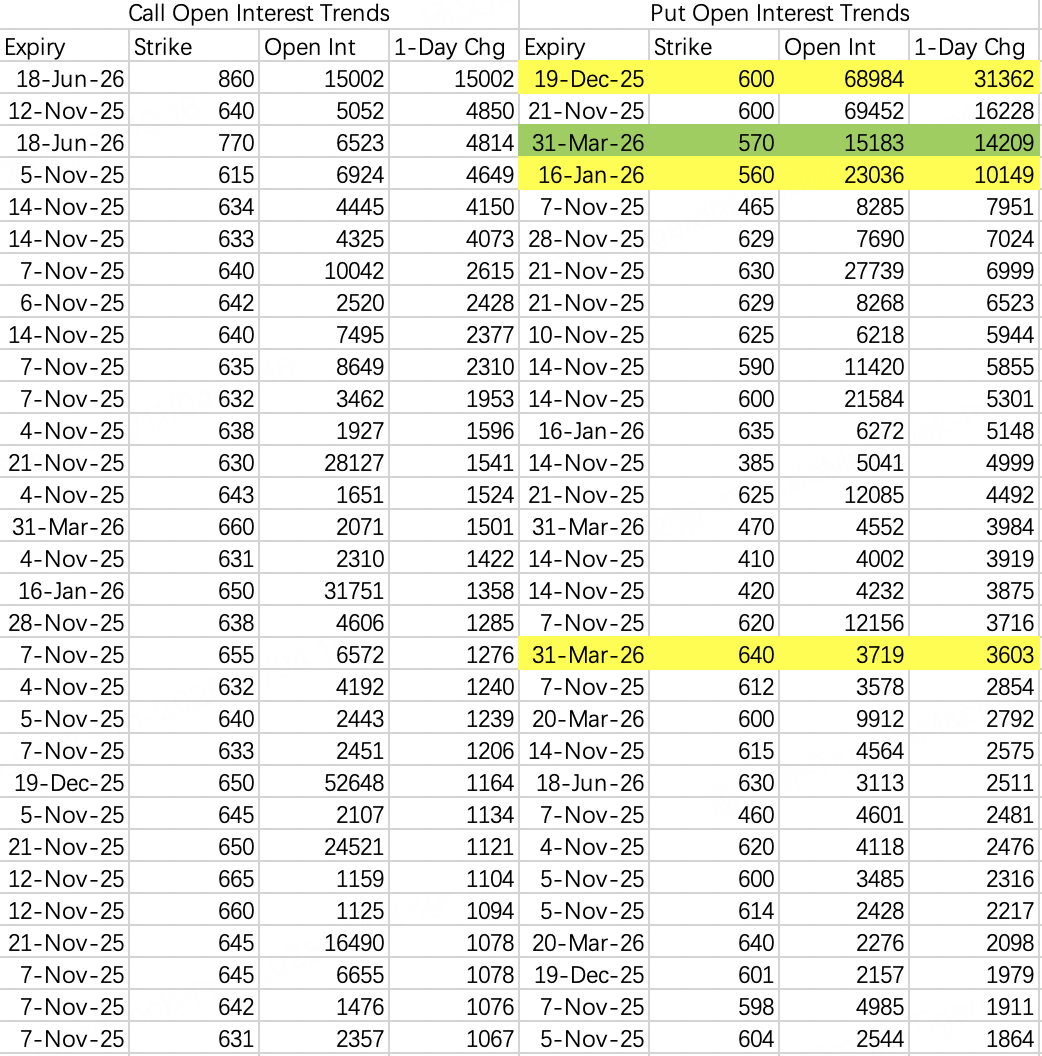

Interestingly, looking at QQQ option open interest from Friday, October 31st, we can see bearish positioning targeting 570. One was a single-leg put purchase $QQQ 20260116 560.0 PUT$ .

Another was a ratio put spread: buying the 640 put $QQQ 20260320 640.0 CALL$ and selling three times the number of 570 puts $QQQ 20260320 570.0 PUT$ for hedging. This strategy clearly indicates the bearish investor doesn't anticipate the price falling to 570.

So, what's the target price? The largest put open interest is the December 600 put $QQQ 20251219 600.0 PUT$ , with 30,000 contracts opened, implying about a 5% pullback – essentially back to pre-negotiation market levels.

Also noteworthy, Michael Burry, the famed "Big Short," filed his Q3 13F two weeks early, revealing short positions against $Palantir Technologies Inc.(PLTR)$ and $NVIDIA(NVDA)$ . The short position against PLTR reached $912 million, and against NVDA, $186 million.

Key point: the early filing, two weeks ahead of schedule, reasonably suggests the anticipated downturn might be over within those two weeks – though U.S. stocks can drop rapidly anyway.

If the decline is expected within two weeks, theoretically by late November, choosing December expiration for options makes sense.

Crucially, there has been recent open interest in December puts for both PLTR and NVDA:

For NVDA, it's the December 200 put $NVDA 20251219 200.0 PUT$ , with concentrated recent opening – 13,000 of the 19,000 open interest were recently opened.

For PLTR, it's the December 180 put $PLTR 20251219 180.0 PUT$ , also showing concentrated recent opening – 13,000 of the 17,000 open interest were recently opened.

I suspect these options might represent part of the short positions, not all, but they offer a glimpse into the target prices. Perhaps the Big Short's target is also a return to pre-negotiation levels.

Overall, looking at this potential pullback, SPY might retreat to 665, with a possibility of panic driving it further to 650. Other stocks would likely see similar retracements. In short, as I mentioned before: if there's no room for a pullback, create room for one.

I initially thought AMD's earnings reaction would be muted, but it now appears likely to lead the downturn.

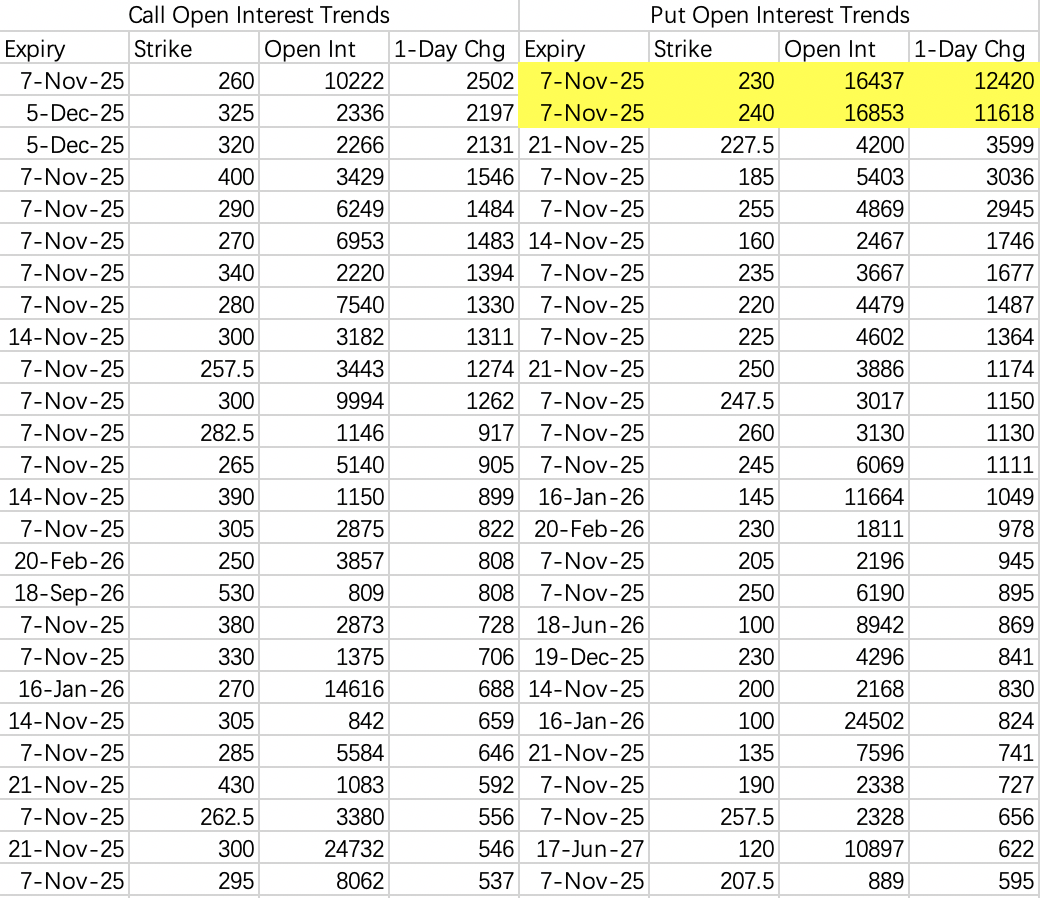

On Monday, there was opening in two weekly put options: the 230 put $AMD 20251107 230.0 PUT$ and the 240 put $AMD 20251107 240.0 PUT$ , both single-leg put buys, with 12,400 and 11,600 contracts opened respectively, valued at ~$2.5 million and ~$5 million. This level of opening in weekly options expiring soon suggests bullish hopes are slim.

Regarding NVDA put options, the notable anomaly is the excessive number of weekly puts opened, giving a sense of potential "gamma squeeze" to the downside.

Considering a broader market pullback, 180 is possible but seems relatively low probability. 180 would be a comparatively safer price level.

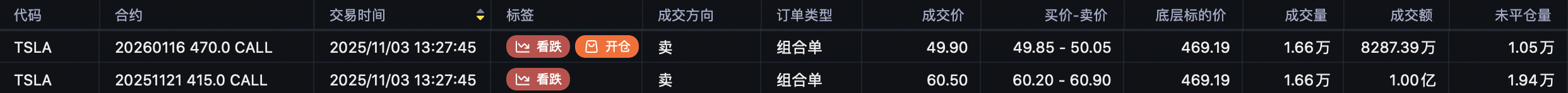

Long call roll: from November 415 call $TSLA 20251121 415.0 CALL$ rolled to January 470 call $TSLA 20260116 470.0 CALL$ .

Long call roll: from November 210 call $AMZN 20251121 210.0 CALL$ rolled to February 220 call $AMZN 20260220 220.0 CALL$ . Note the strike is below the current price; institutions are being very conservative, indicating low expectations.

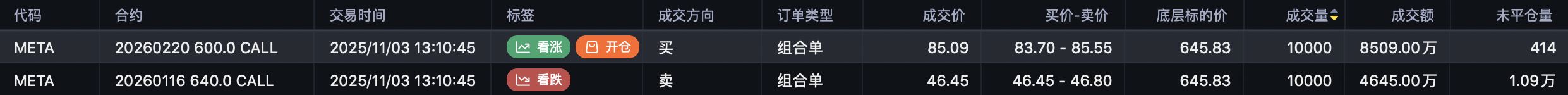

Post-earnings, Meta saw a roll: from the 700 call $META 20251121 700.0 CALL$ rolled to the 640 call $META 20260116 640.0 CALL$ .

However, the sudden deterioration in market conditions prompted another roll: from the January 640 call $META 20260116 640.0 CALL$ rolled to the February 600 call $META 20260220 600.0 CALL$ , lowering the strike price.

HOOD reports earnings this week; volatility is high, with both bullish and bearish positioning.

A common bullish call spread involves selling the 160 call $HOOD 20251107 160.0 CALL$ and buying the 175 call $HOOD 20251107 175.0 CALL$ as a hedge.

A straddle/strangle strategy involves buying both the 155 call $HOOD 20251107 155.0 CALL$ and the 135 put $HOOD 20251107 135.0 PUT$ , hedged by selling the 120 put $HOOD 20251107 120.0 PUT$ .

Additionally, there are bearish positions like buying the 140 put $HOOD 20251219 140.0 PUT$ . Judging by pre-market movement, the 140 put is likely already profitable.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.