Gotta say, Michael Burry's timing for this short is actually somewhat impressive. He specifically filed two weeks early to hit this exact window – he's got both timing and conditions on his side. This was also discussed in previous articles.

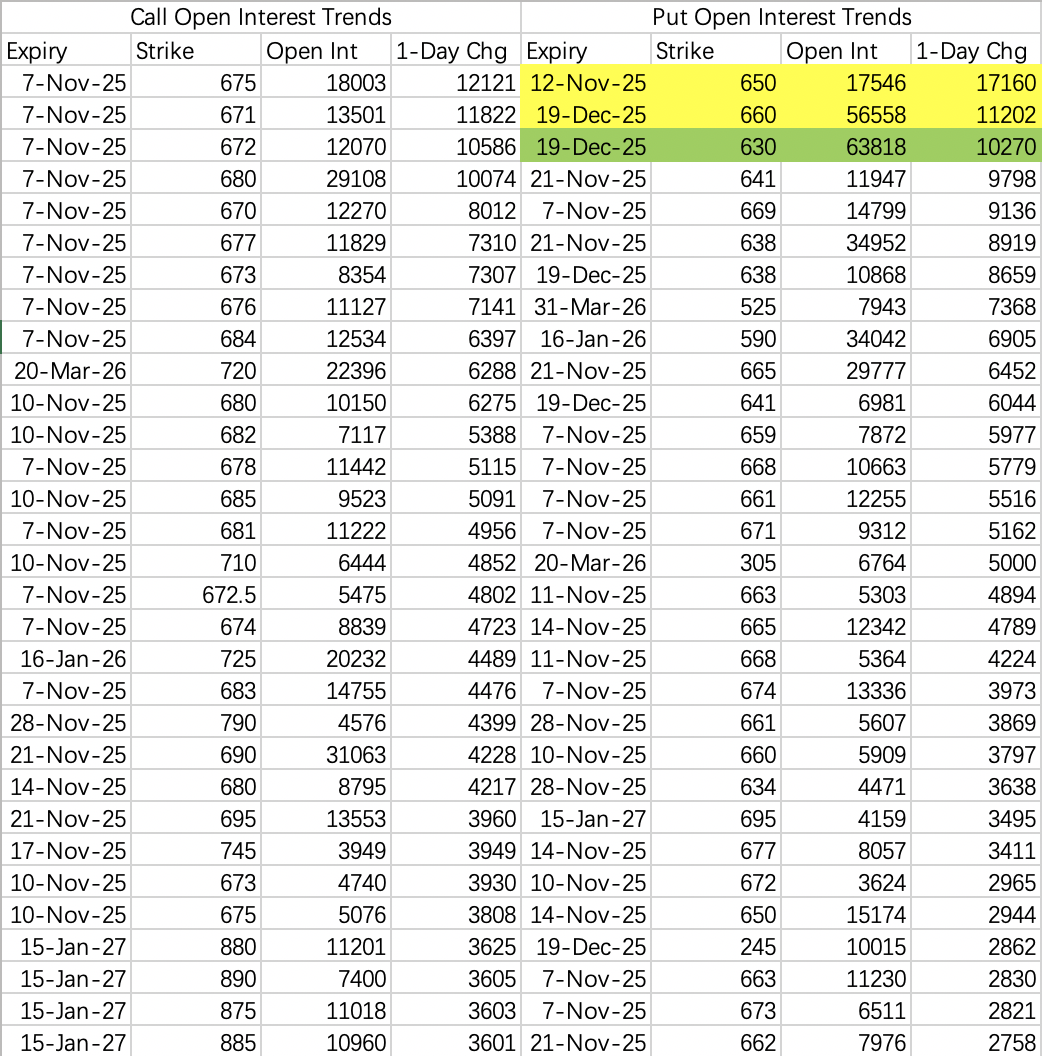

Barring any surprises, the current pullback is expected to reach the previous low around 650, with a smaller probability of hitting 640. This drop would be enough for him to break even, but turning a profit might still be tough.

On Thursday, someone opened 17,000 contracts of the 650 put expiring on the 12th $SPY 20251112 650.0 PUT$ . Half of this position was closed around 9:43 AM ET today (Friday), already fully recouping the initial cost. The remaining contracts are betting on further downside.

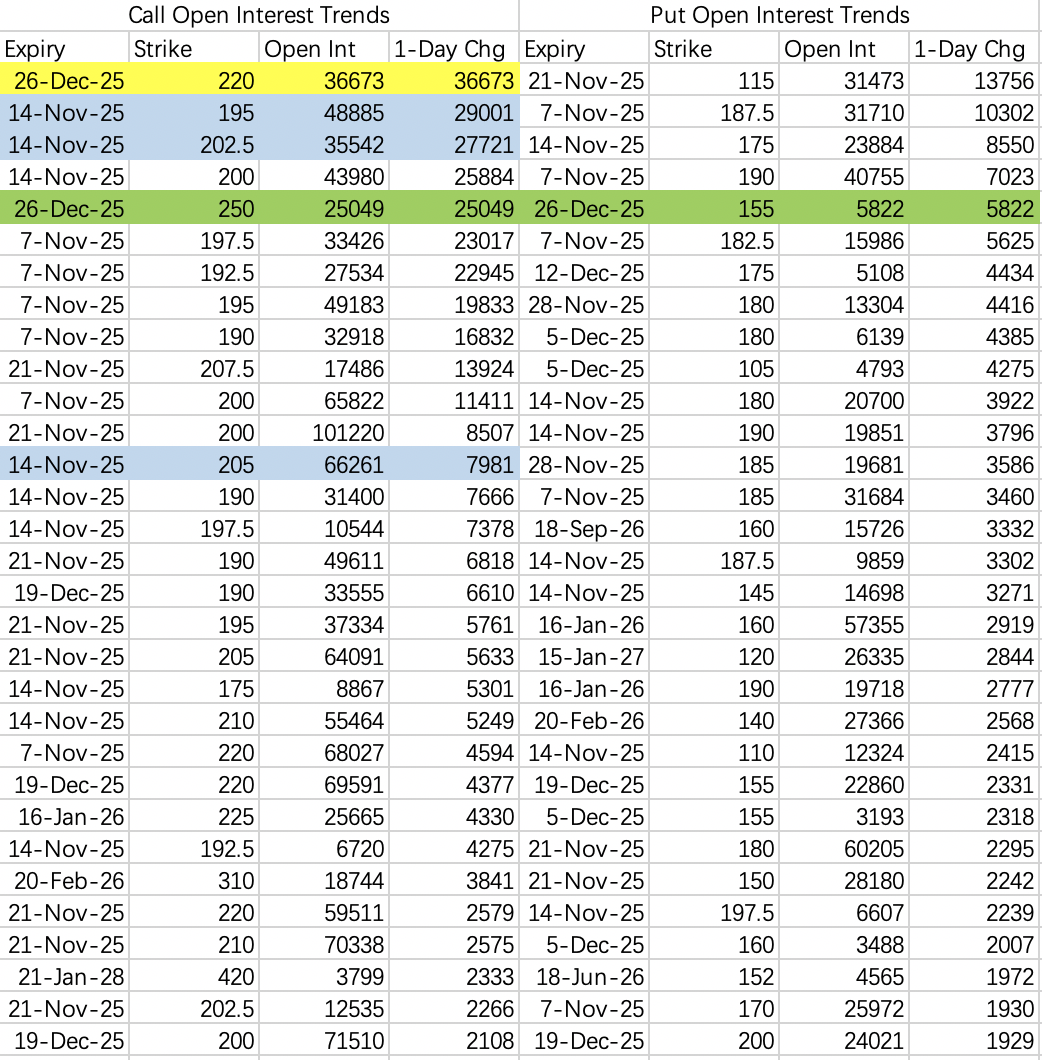

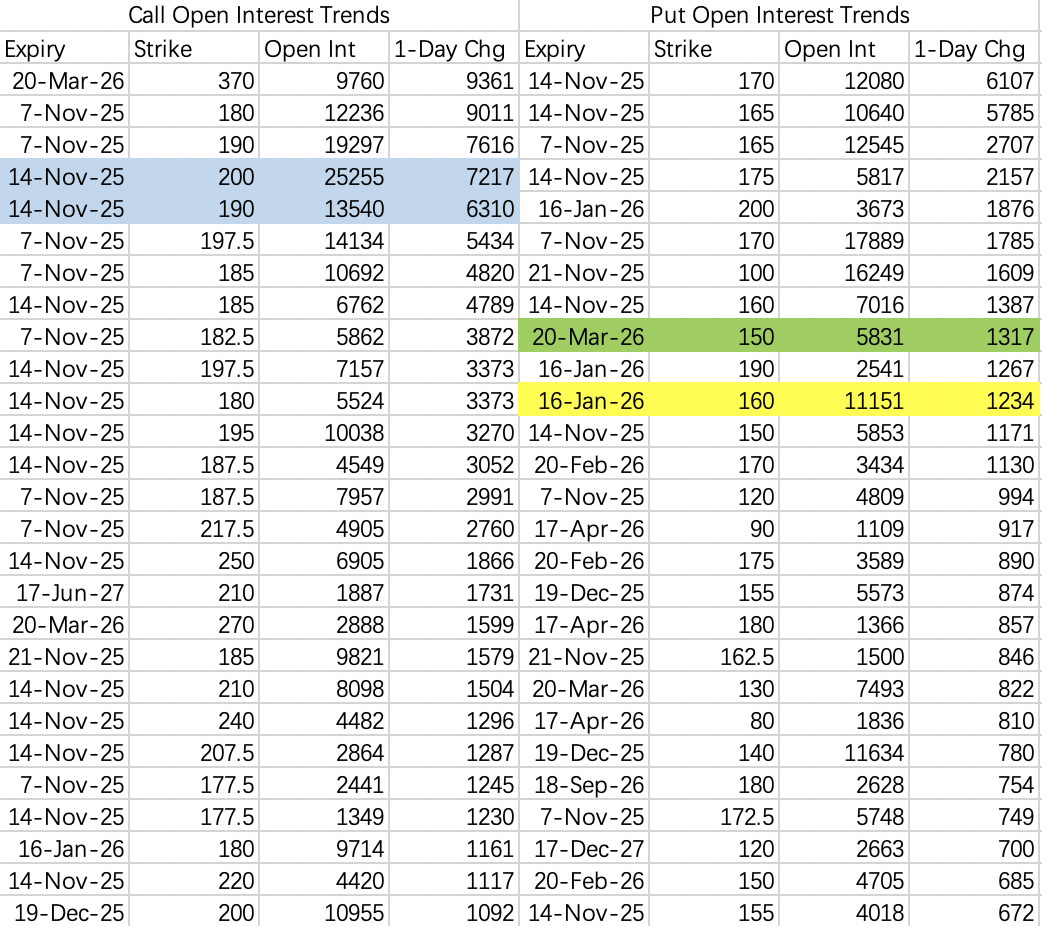

Institutions are opening bullish call spreads, expecting the stock to stay below 195 next week $NVDA 20251114 195.0 CALL$ , and buying the 202.5 for hedge $NVDA 20251114 202.5 CALL$ .

It's worth noting on the bearish side: currently, institutions aren't positioning for a large-scale break below 180. If that level fails, the next target looks to be 160.

I'm wondering why the big short (Burry) didn't target AMD and instead focused on NVDA. Of course, reputation effect plays a part – directly shorting the number one player instead of picking on the softer number two sounds better for publicity.

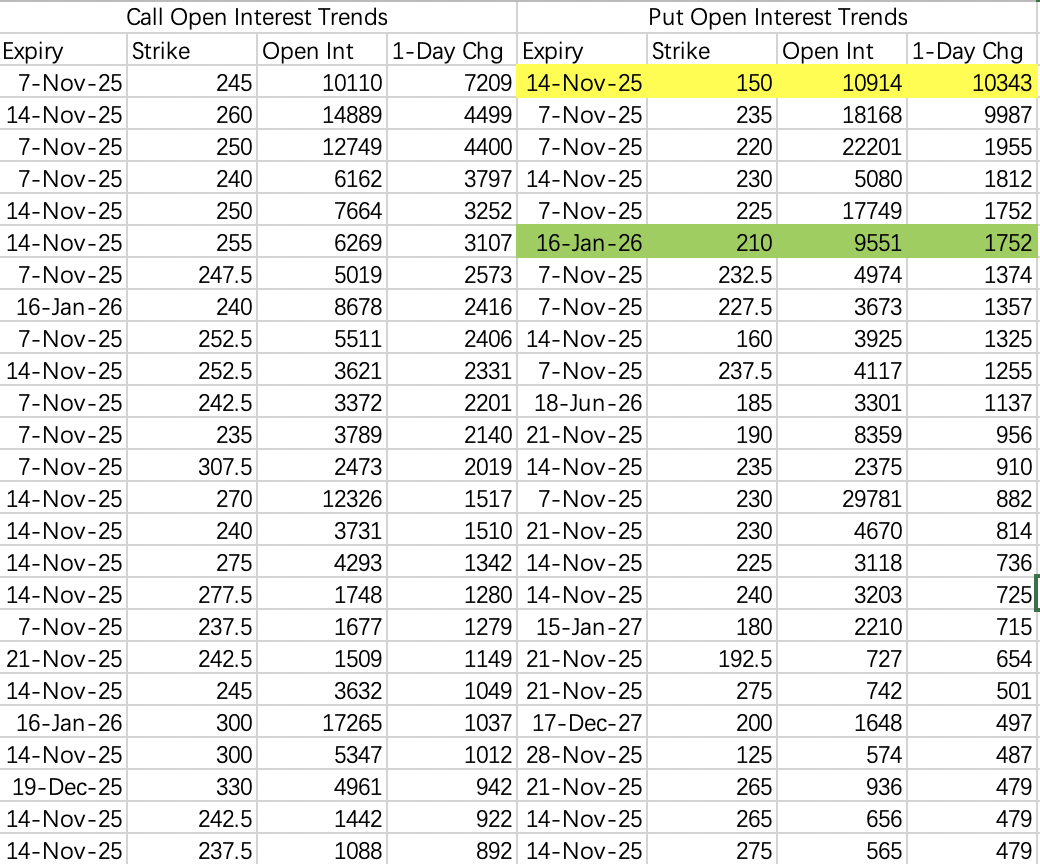

Theoretically, if NVDA breaks below 180, coupled with another wave of sporadic panic, a less probable event like AMD pulling back to fill its gap – even down to 150 – doesn't seem entirely impossible. Someone is betting on exactly that for next week $AMD 20251114 150.0 PUT$ .

However, excluding extreme scenarios, put options suggest the expected price floor remains above 220-230. Also, with Analyst Day on Monday, everyone is still waiting for CEO Lisa Su to paint a bright future.

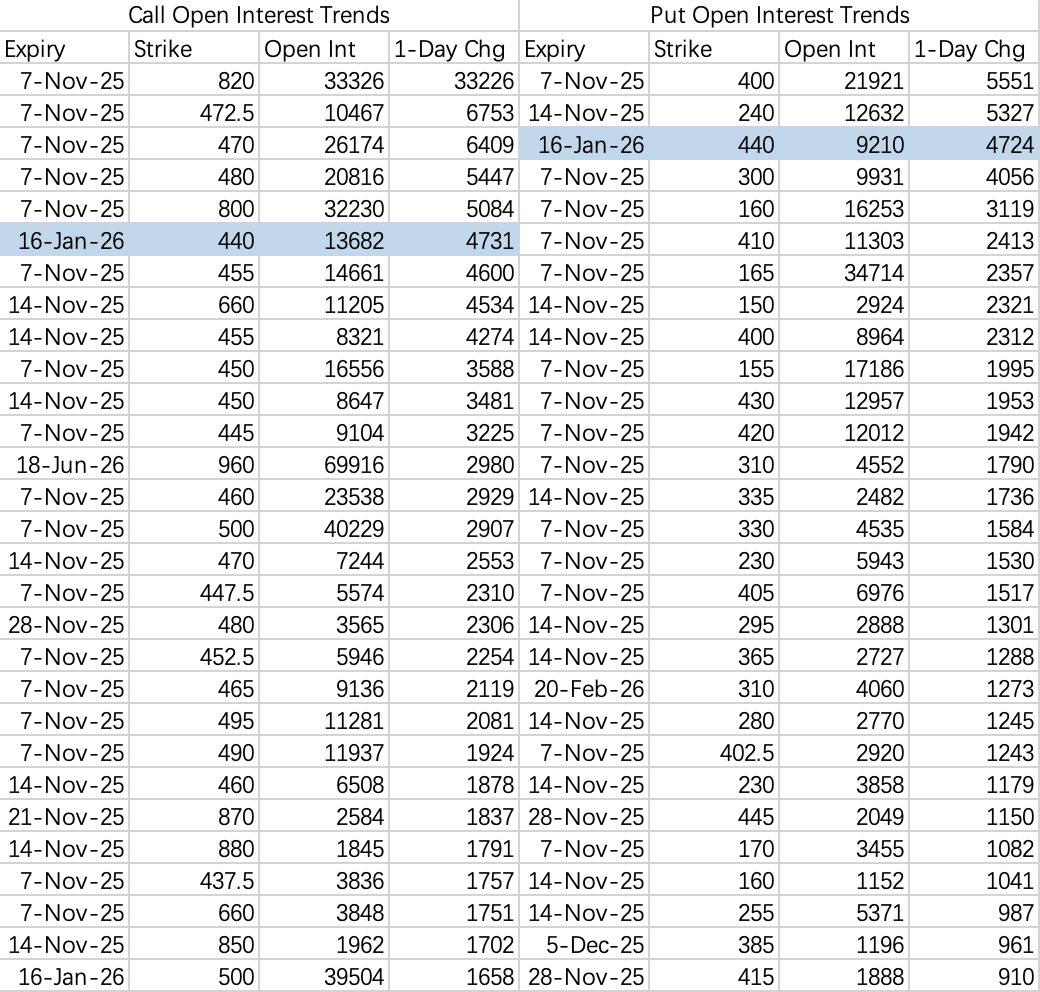

The entire November is expected to be relatively sluggish. This week, someone sold a large volume of 48,700 contracts of the 480 call expiring Dec 5th $TSLA 20251205 480.0 CALL$ .

Unlike chip and AI concept stocks, the most significant bearish large order seen for Tesla recently is this sell call. The stock is expected to oscillate above 400.

$Palantir Technologies Inc.(PLTR)$

Currently, a pullback to 165 seems inevitable, with 160 also possible. We've seen consistent opening of the Jan 160 put recently $PLTR 20260116 160.0 PUT$ .

On Oct 31, someone bought 10,000 contracts of the 525 put expiring Dec 5th $MSFT 20251205 525.0 PUT$ , with a transaction value of approximately $160 million that day. The position remains open – it'll be time to watch for a roll to gauge when the play might be winding down.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Captain Ashford·11-08Great summary, thanks.LikeReport