Bearish Block Trades Bet on Continued High Volatility Through Year-End

We're back in a macro pressure phase. Unsurprisingly, after the US government reopens, it will have to face a bunch of dismal employment and inflation data.

Theoretically, NVIDIA should be the easiest stock to navigate in the current phase, but a bearish Sword of Damocles hangs over its head.

Michael Burry plans to release more details about the overvaluation of AI-related companies on November 25th, timed after NVIDIA's earnings report, aiming to combine with weak macro data to deliver another blow to the market.

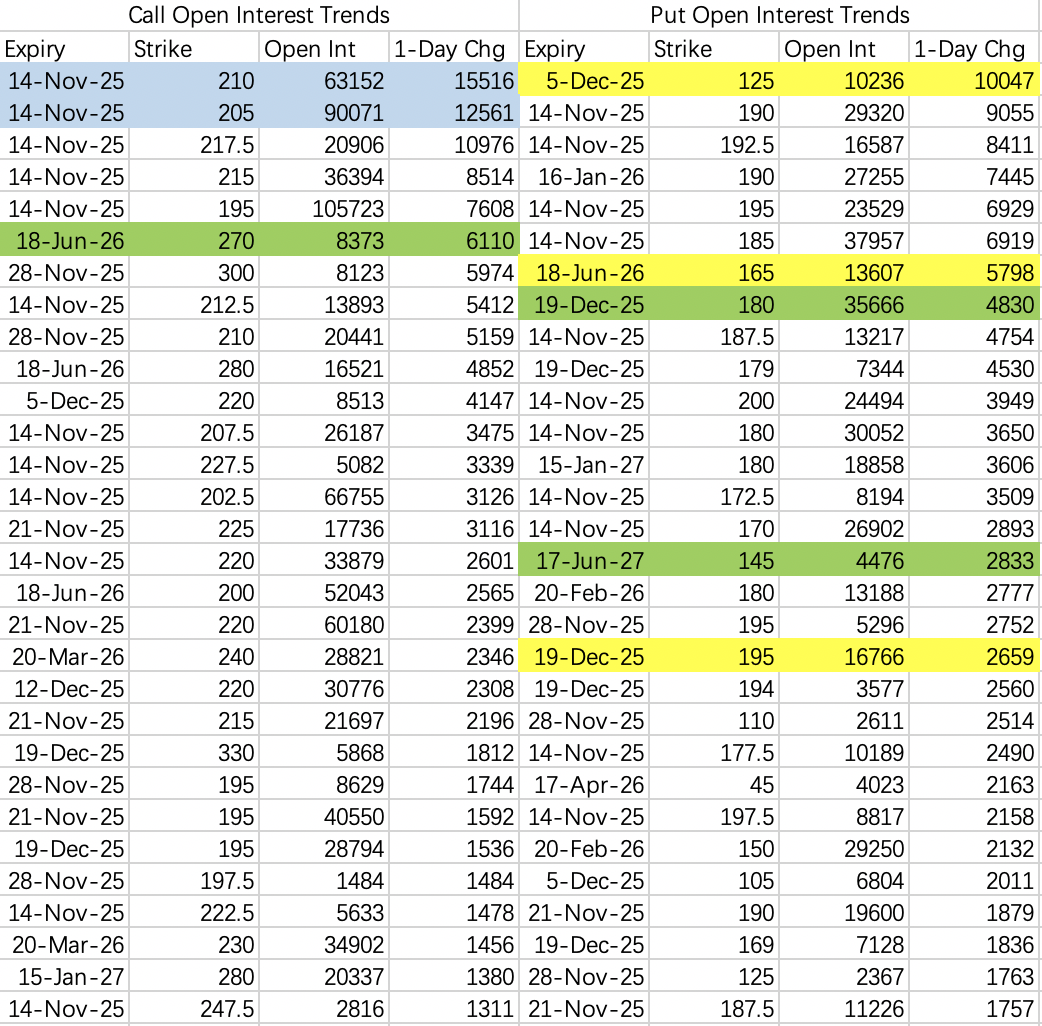

However, the systemic willingness to short NVIDIA isn't very strong at the moment. The top ranked bearish opening trade is a halving/slash large short block $NVDA 20251205 125.0 PUT$ , though its transaction value is only around 150k, leaning speculative.

Overall, expectations see the bottom around 180. Because earnings expectations make it hard for the stock price to fall significantly, bears aren't wasting money unnecessarily. Therefore, for selling puts, a strike price of 180 can be selected $NVDA 20251114 180.0 PUT$ .

In such an atmosphere, call options also find it difficult to break through previous highs. One can wait for a stock price rebound and choose to sell calls with a strike price above 220.

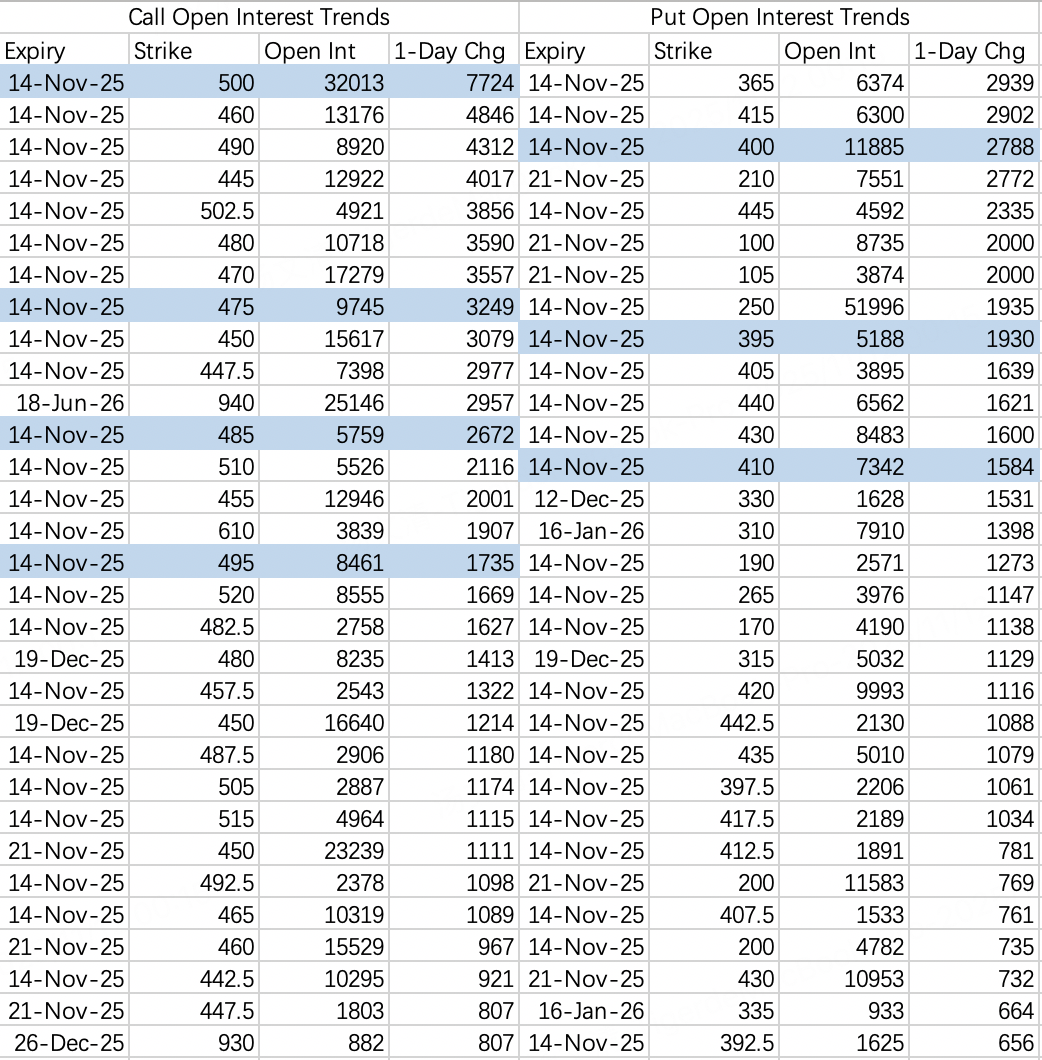

Because Tesla's rise this year has been quite restrained, it's less involved in the downturn. For conservative put selling, 400 or 410 can be selected; it's unlikely to break below this week $TSLA 20251114 410.0 PUT$ .

On a rebound, consider selling the 470 call $TSLA 20251114 470.0 CALL$ .

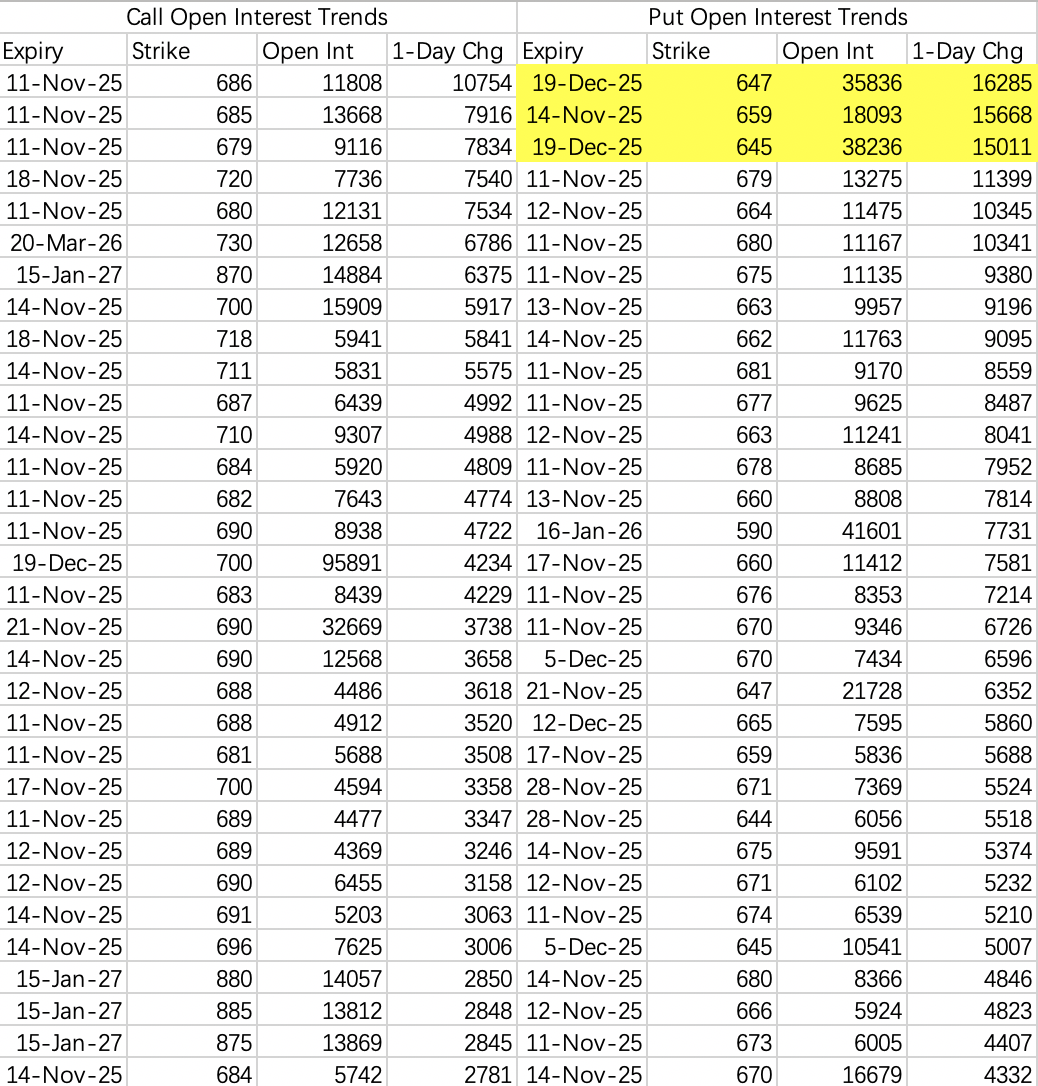

Three large bearish blocks:

$SPY 20251114 659.0 PUT$ , transaction value ~$700k+ USD

$SPY 20251219 645.0 PUT$ , transaction value ~$7.5M USD

$SPY 20251219 647.0 PUT$ , transaction value ~$8M+ USD

This sufficiently illustrates how exaggerated the volatility could be from now until year-end. Additionally, based on the large bearish blocks, there's a probability of another pullback to the 660-670 range this week.

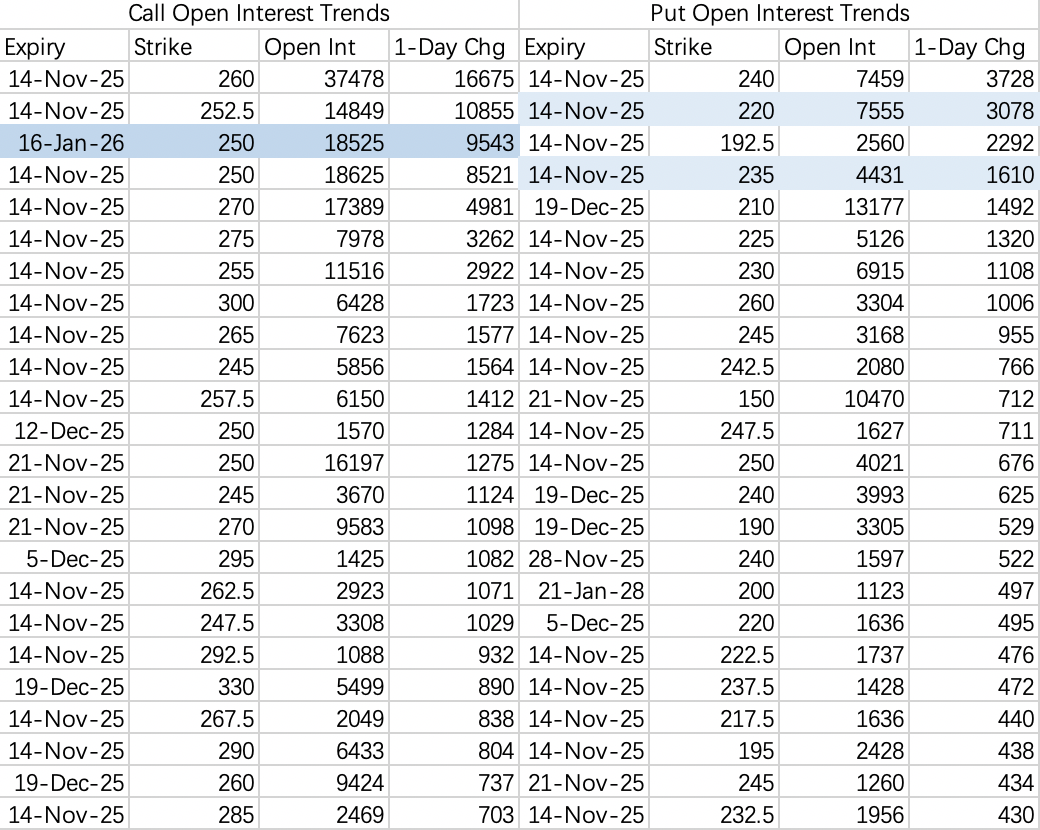

Institutions are rolling long call positions: closing the November 260 calls $AMD 20251121 260.0 CALL$ and rolling to January 250 calls $AMD 20260116 250.0 CALL$ . The strike price was lowered, anticipating potentially mediocre year-end performance.

This week, expect continued oscillation between 220-250. Consider selling calls above 250 $AMD 20251114 252.5 CALL$ ; for selling puts, 220 can be selected, but adding a buy put leg for protection is needed.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.