Another 3% Drop?

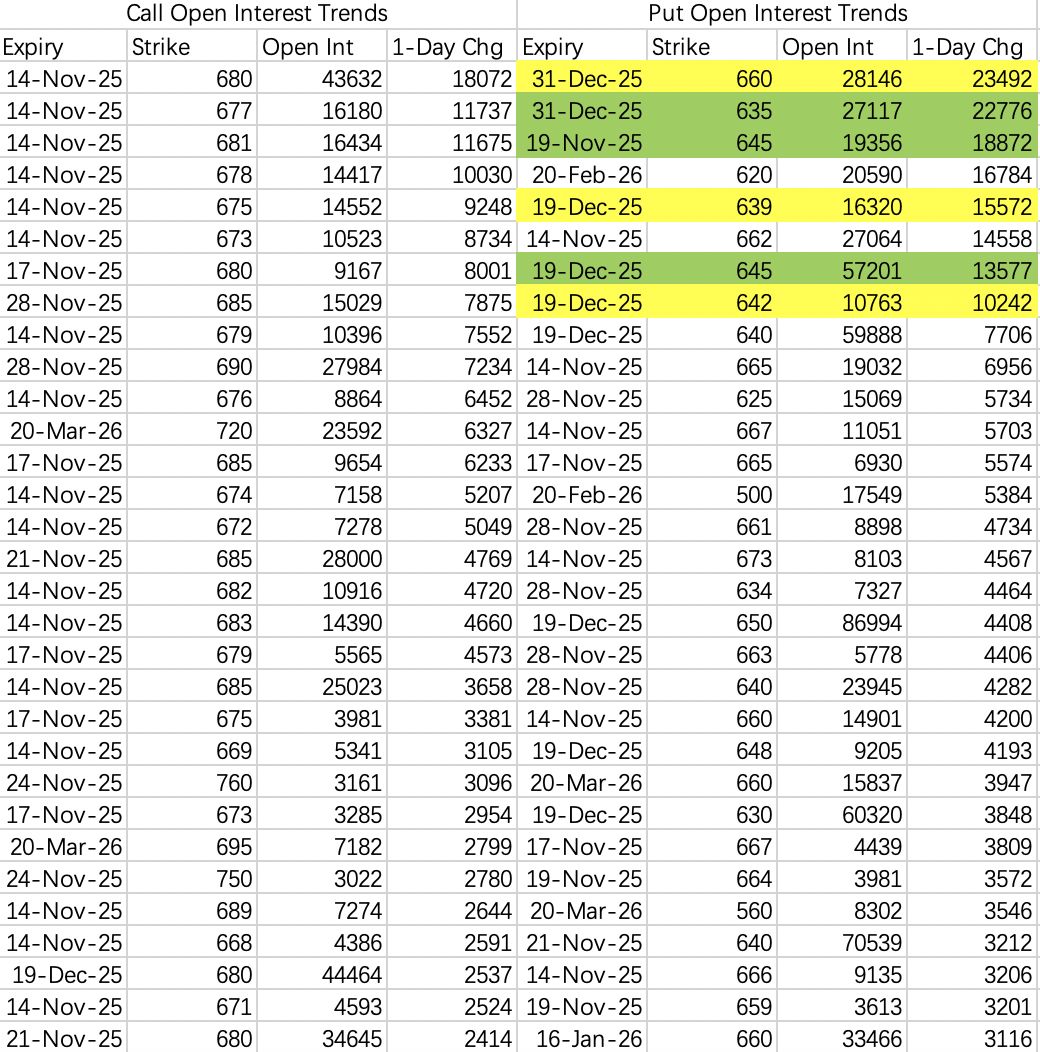

At the start of the week, many large bearish orders were observed targeting around 650, and newly opened large bearish orders yesterday also support this view. If it drops near 650, follow if large orders start buying the dip.

The primary bearish spread opened is: Buy 660put $SPY 20251231 660.0 PUT$ , Sell 635put $SPY 20251231 635.0 PUT$ , targeting SPY falling below 660 but above 635 by year-end.

There's disagreement around 640. Bearish orders include buying the 639put $SPY 20251219 639.0 PUT$ . Bullish orders include selling the Nov 19th expiry 645put $SPY 20251119 645.0 PUT$ . Notably, Nvidia earnings are after the close on Nov 19th.

Theoretically, a gap down pre-market Friday is possible, but open interest for this week's expiry doesn't rule out a rebound at the open. If there's a rebound, recommend selling calls or hedging; it doesn't signify a reversal. While everyone might prefer a sharp, quick drop over two days.

Nvidia earnings might not have major highlights, so focus more on the stock's price level heading into the report.

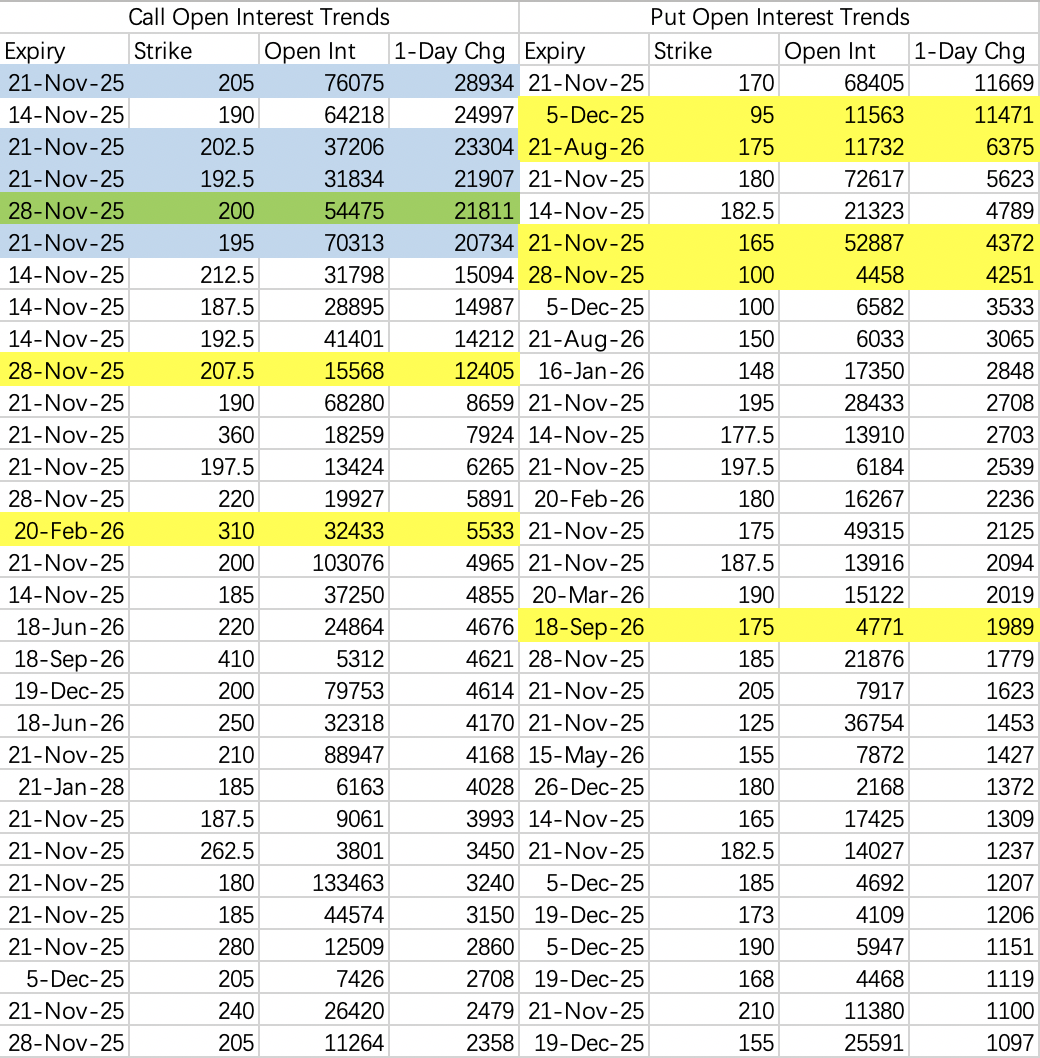

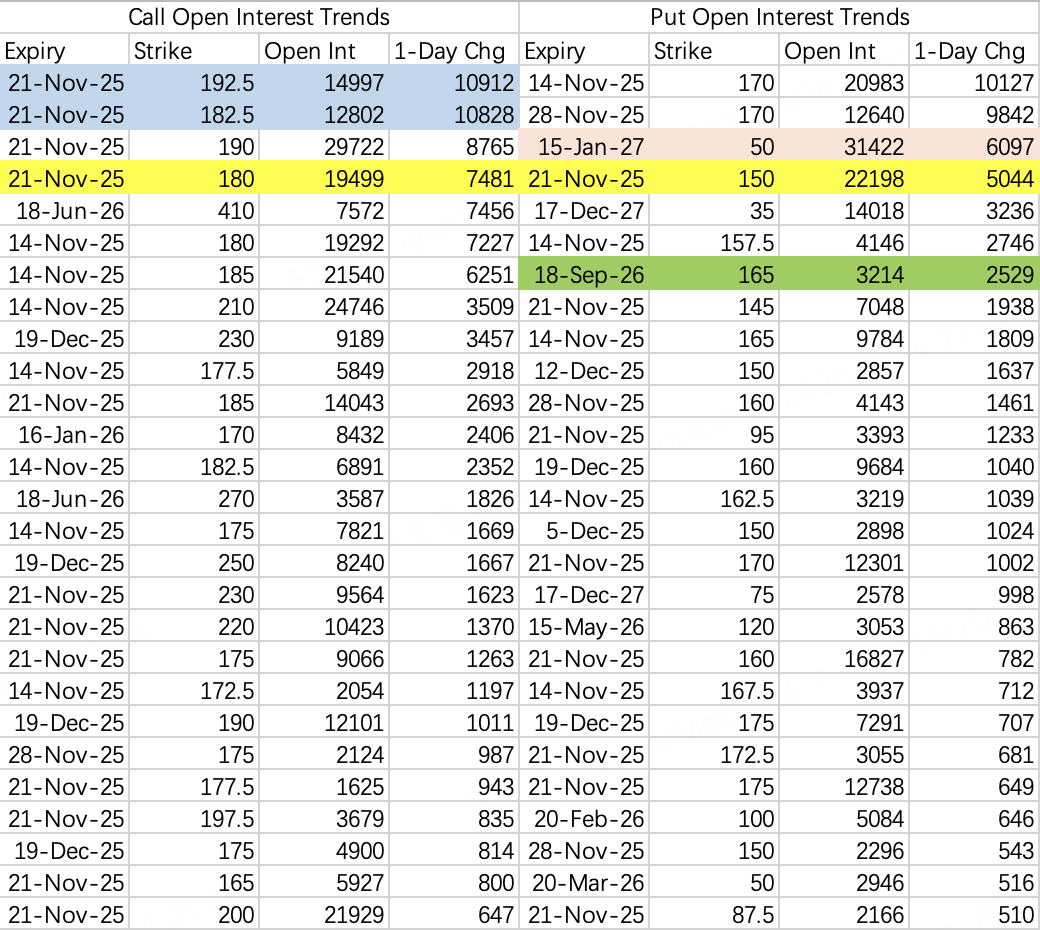

Overall, institutional sell calls suggest expectations similar to this week: Sell 195 call $NVDA 20251121 195.0 CALL$ hedged by buying the 205 call $NVDA 20251121 205.0 CALL$ , likely staying below 192.5-195.

Bearish option opinions are divided, similar to April. Generally, the main target is 170-175 $NVDA 20260821 175.0 PUT$ .

There are large bullish orders, but buying calls at this price seems meaningless $NVDA 20251128 207.5 CALL$ .

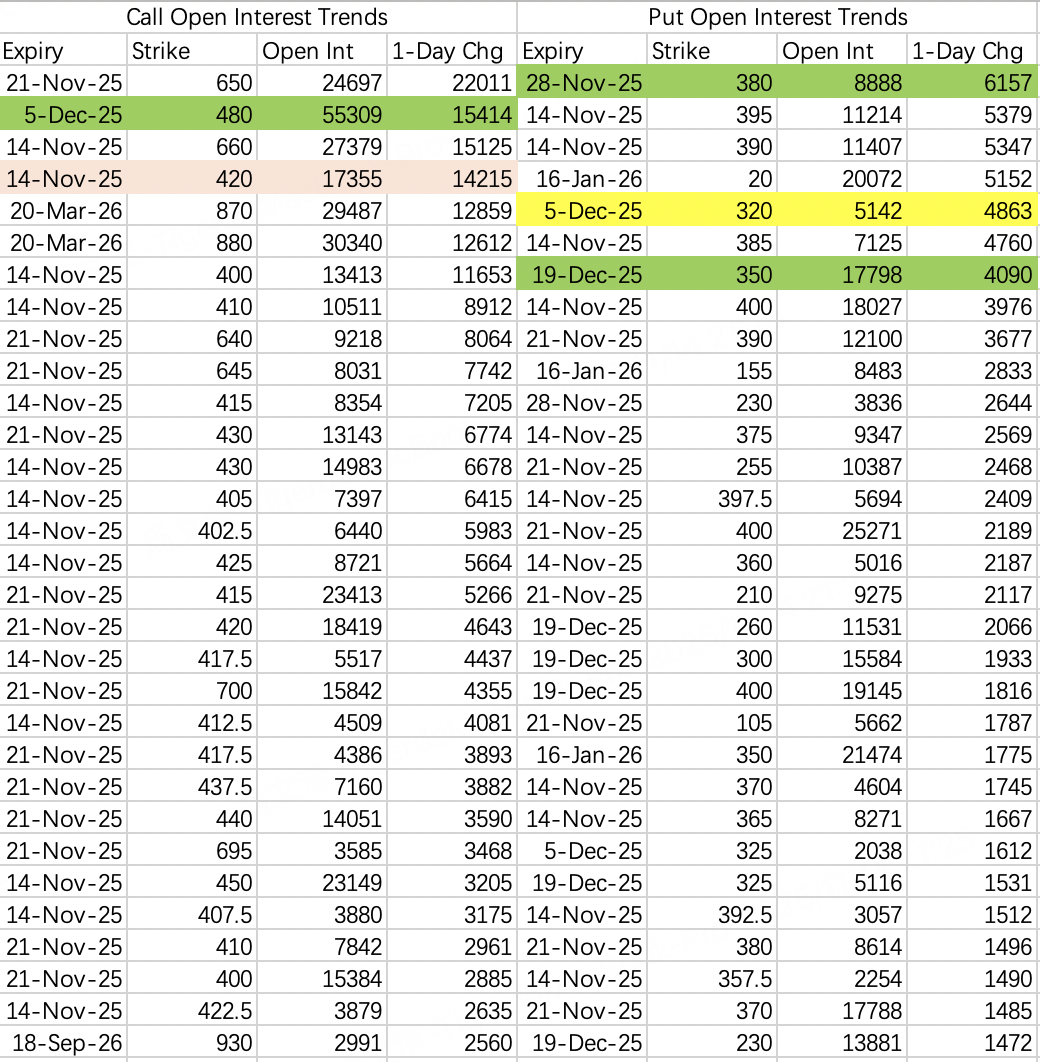

Didn't expect Tesla to lead this pullback, possibly related to pessimistic economic outlook.

A large sell call order at 480 $TSLA 20251205 480.0 CALL$ seems conservative, but don't get greedy selling calls during a downtrend to avoid squeezes.

Various bearish option opinions; major bearish target is 380: buy 380put $TSLA 20251128 380.0 PUT$ .

But consider 320 for extreme cases $TSLA 20251205 320.0 PUT$ .

A medium-term large sell put order chooses 350 $TSLA 20251219 350.0 PUT$ .

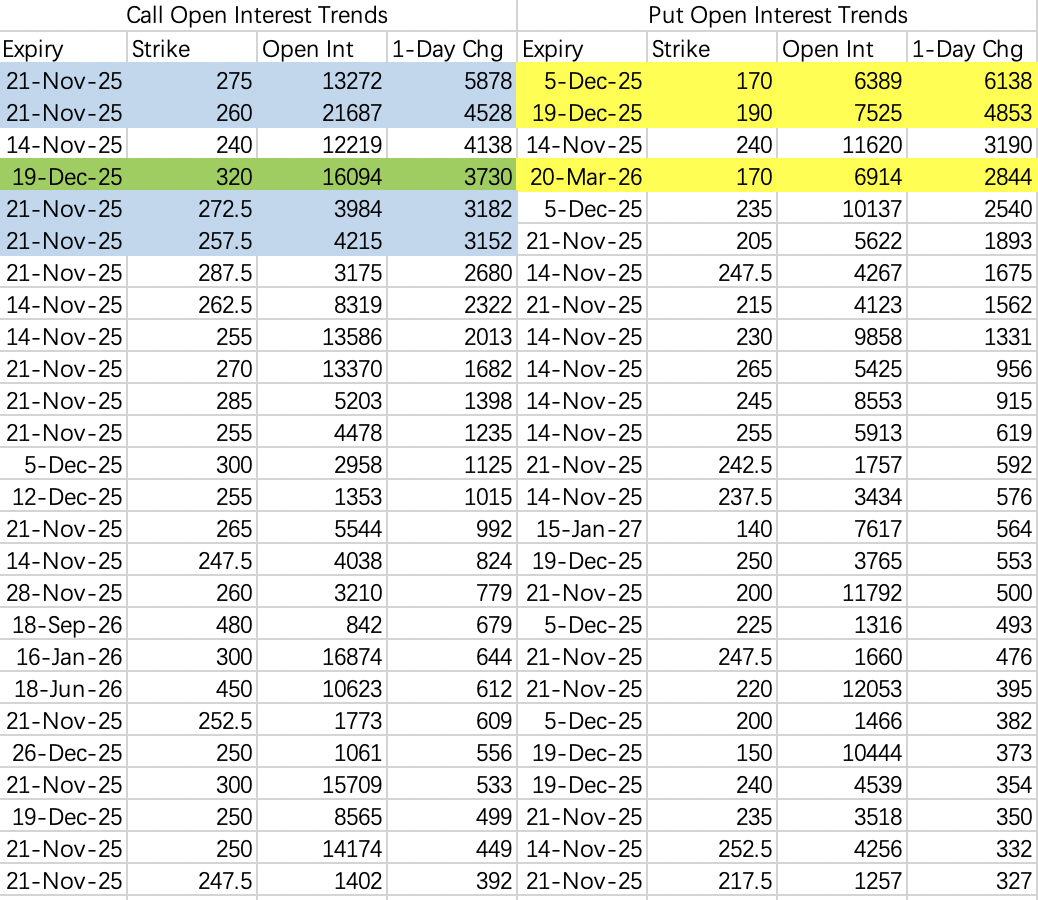

Institutional bullish spread: Sell 260 call $AMD 20251121 260.0 CALL$ , Buy 270 call $AMD 20251121 270.0 CALL$ , showing caution, not recklessly lowering strikes.

Due to a previous gap up, many gap-filling bearish orders exist: $AMD 20251205 170.0 PUT$ $AMD 20251219 190.0 PUT$ $AMD 20260320 170.0 PUT$ .

But 230 should hold support; most bears believe it can hold.

$Palantir Technologies Inc.(PLTR)$

Bearish target 165 $PLTR 20260918 165.0 PUT$ . Pre-market already hit 165, possibly probing 150.

Institutional sell call 182.5 $PLTR 20251121 182.5 CALL$ hedged with buy call 192.5 $PLTR 20251121 192.5 CALL$ .

Also, long straddle positions: Buy 180 call $PLTR 20251121 180.0 CALL$ and 150 put $PLTR 20251121 150.0 PUT$ .

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Look