A Familiar Shorting Pattern Is Back

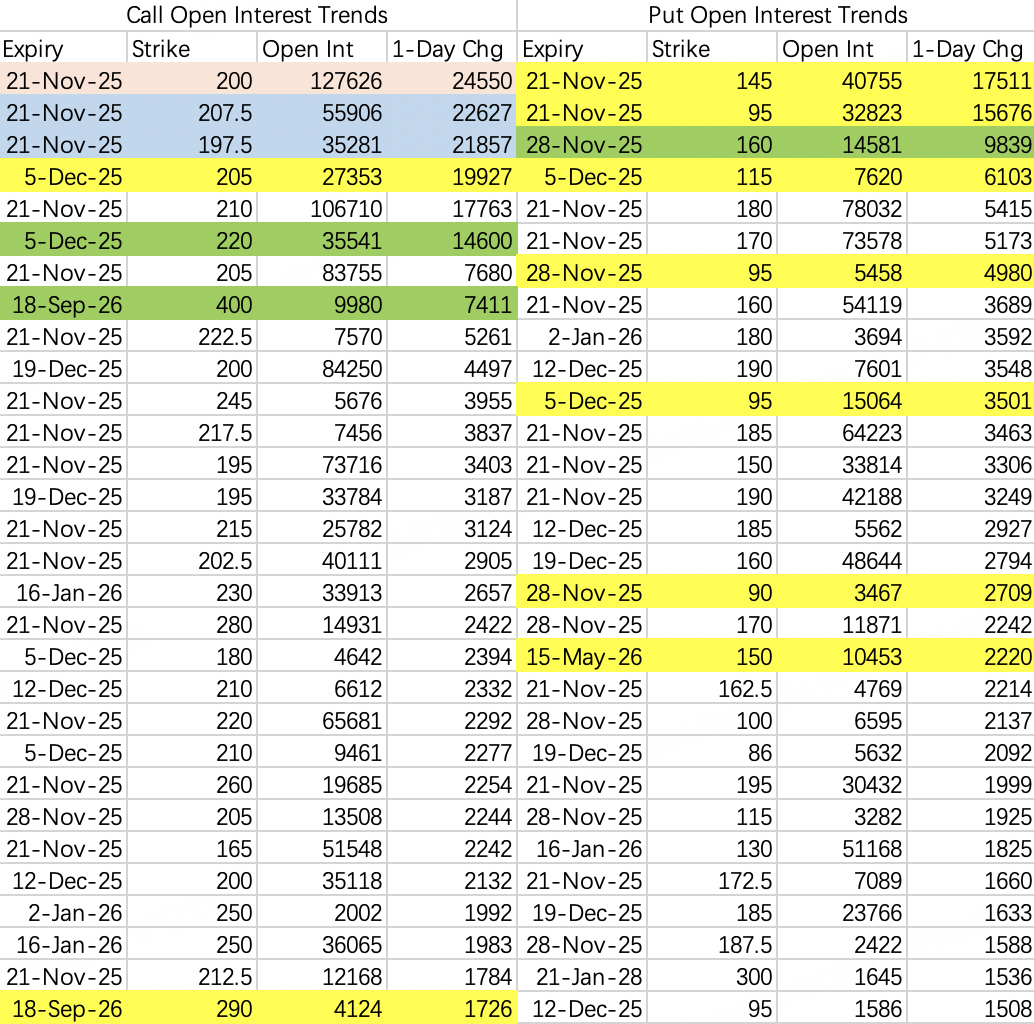

NVIDIA reports earnings this week. Analyst reports give favorable expectations, and the valuation looks attractive, but the options opening activity is extremely poor.

Long-time followers of my articles should find this put opening activity familiar. It's the same pattern we saw during the sharp plunge in March and April this year, where cliff-like strike prices topped the opening rankings.

Unlike Tesla, NVIDIA rarely sees extreme, lottery-ticket style shorting openings due to its stable valuation. When such openings do appear, it generally signals that risk appetite is likely increasing, and the overall market is tilting towards a risk-off stance, which could correspond with a sharp spike in the VIX.

Put openings can roughly be divided into two categories: extreme bearish bets anticipating a sharp drop, for example, opening the 95 strike puts like $NVDA 20251205 95.0 PUT$ $NVDA 20251128 95.0 PUT$ $NVDA 20251121 95.0 PUT$ . Although the transaction volume is very low, simultaneous openings like this are a danger signal.

Institutions are selecting the 197.5 strike for selling call spreads weekly: selling the 197.5 strike $NVDA 20251121 197.5 CALL$ and hedging by buying the 207.5 strike $NVDA 20251121 207.5 CALL$ .

However, the bullish side believes the stock price could rise above 205: buying the 205 call $NVDA 20251205 205.0 CALL$ and selling the 220 call $NVDA 20251205 220.0 CALL$ .

It should be difficult for NVIDIA's stock price to break above 200 this week, as weekly expiration has a buildup of 127,000 contracts in open interest. Although the put openings are extreme, I think it might also be hard for the price to fall below 170. If a sharp drop does occur, it would be a good buying opportunity. Of course, buying at current levels is also suitable, but who would complain about a lower entry price?

Therefore, the current situation is more suitable for selling puts at lower levels and selling calls at higher levels: sell puts on price dips $NVDA 20251121 170.0 PUT$ , and sell calls on price rallies $NVDA 20251121 210.0 CALL$ .

$Palantir Technologies Inc.(PLTR)$

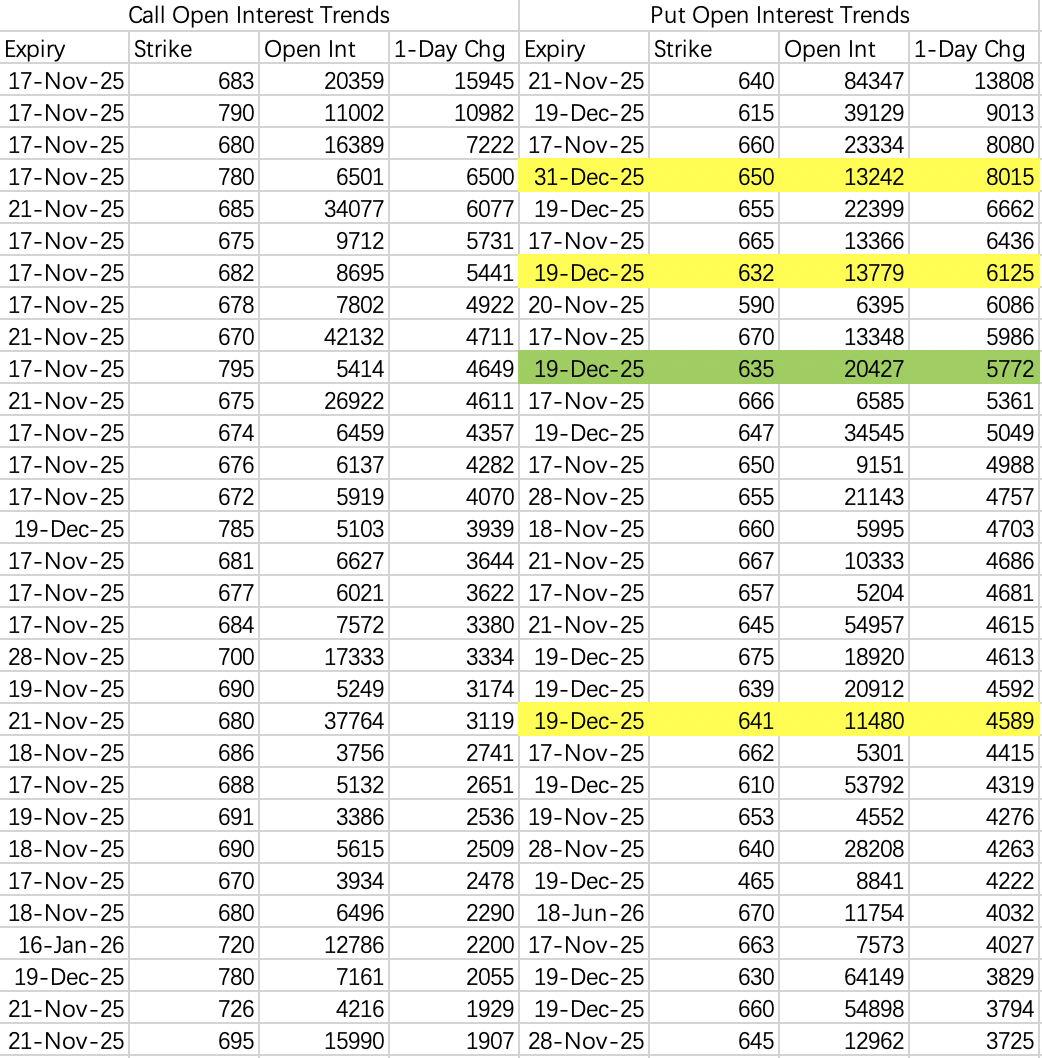

If NVIDIA shows a tendency for a sharp drop, then PLTR must follow closely behind.

Sure enough, PLTR also has put openings with strike prices halved from the current level. Looking closely, the top position is one disclosed by a major short seller: an opening of 8,309 contracts of $PLTR 20270115 50.0 PUT$ . I suspect it might be him adding to his position again.

Other bearish positions include: $PLTR 20260618 80.0 PUT$ $PLTR 20260220 145.0 PUT$ .

Institutions are selling calls, judging it unlikely to surpass 182.5 this week, with a hedge at 192.5: $PLTR 20251121 182.5 CALL$ $PLTR 20251121 192.5 CALL$ .

The same caution as with NVIDIA applies: remember not to sell calls during a price pullback; wait for a price rebound before shorting.

$SPDR S&P 500 ETF Trust (SPY)$

Expectations for the AI sector are poor, but expectations for SPY aren't that bad. The likely target for this pullback is probably around 650.

Call openings even leave plenty of room for a short squeeze.

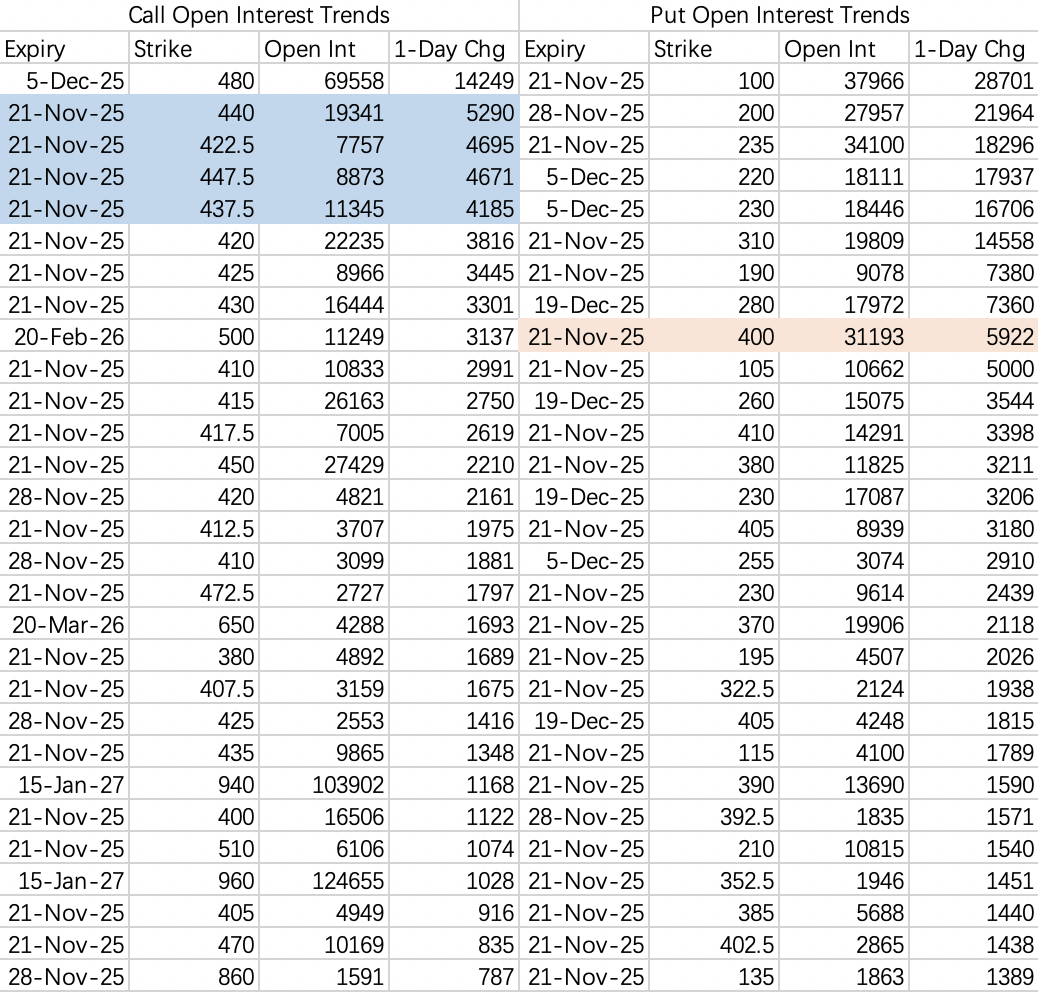

Institutions are selling the 422.5 call $TSLA 20251121 422.5 CALL$ , hedging by buying the 447.5 call $TSLA 20251121 447.5 CALL$ , expecting the stock to trade between 380 and 450 this week.

$Advanced Micro Devices Inc (AMD)$

Also has extreme put openings $AMD 20251205 160.0 PUT$ .

Barring a flash crash, the overall expectation is still for a narrow range between 230 and 260.

The institutional bullish spread involves selling the 260 call $AMD 20251121 260.0 CALL$ and hedging by buying the 272.5 call $AMD 20251121 272.5 CALL$ .

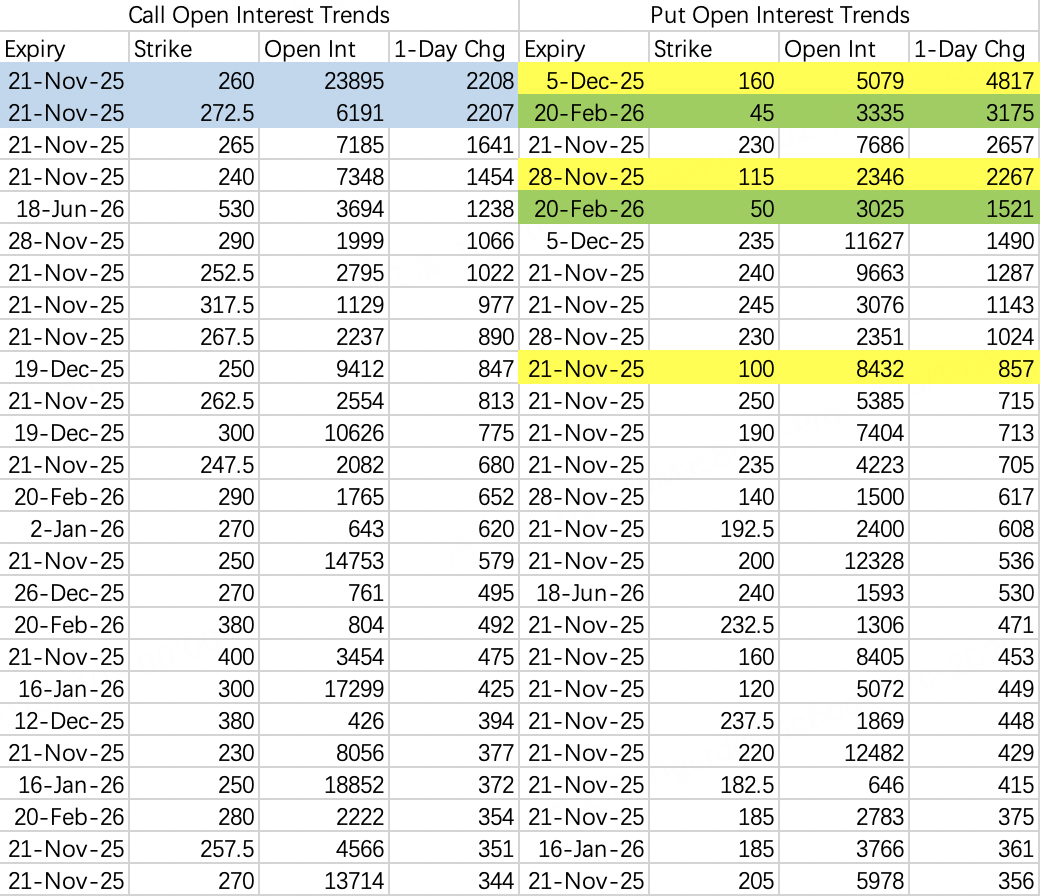

Amid the market volatility, there are two rather inexplicable large bullish orders:

$APLD 20251128 25.0 CALL$ opening 32,000 contracts.

And $EOSE 20260116 25.0 CALL$ opening 13,000 contracts.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great article, would you like to share it?