Big-Tech Weekly | GOOG Gemini 3.0 Breaking the Internet! NVDA's Options Under Pressure!

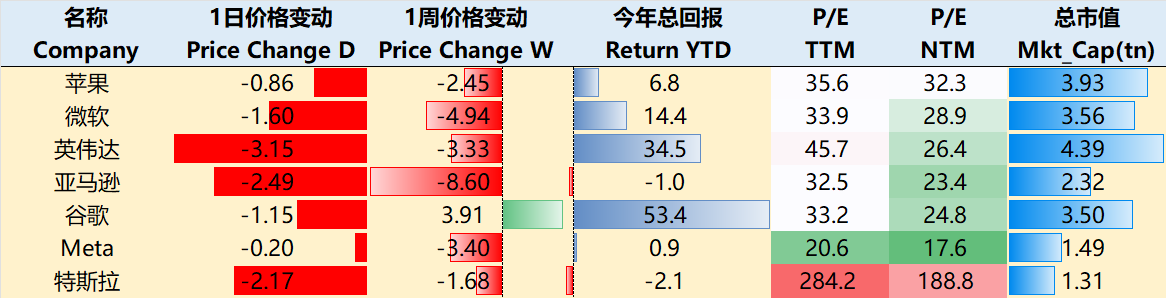

Big-Tech’s Performance

Macro Headlines This Week:

A flood of delayed economic data finally hit the markets, while clear divisions emerged inside the Fed on whether to cut rates again in December. Confidence in a "soft landing" took a hit, and US stocks swung wildly. The early "Trump trade" euphoria gave way to sober reality: the end of the government shutdown unleashed the data backlog, but the numbers were soft + Fed hawkishness escalated, completely shattering the near-certainty of a December rate cut.

The Fed's policy path is now the biggest source of uncertainty. The minutes from the October FOMC meeting (released Nov 19-20) revealed obvious splits on a December move. The delayed September jobs report (finally out on Nov 20) showed weaker-than-expected payroll growth, with the unemployment rate ticking up to 4.4%, raising fresh concerns about labor market cooling. Fed Governor Cook flagged "potential vulnerabilities in asset valuations," putting the spotlight on credit risks in private credit markets.

Stocks followed a classic "pump then dump" pattern with massive intraday volatility. The Nasdaq spiked early on Nvidia earnings hype, only to reverse hard after the soft jobs print and hawkish Fed minutes. The S&P 500 gapped up >1.4% at the open but closed in the red – a move that's only happened twice since 2020. CTA trend-following funds are sitting on extremely elevated long exposure, already hitting short-term unwind thresholds, which has invited shorts back in.

Big Tech mostly pulled back after Nvidia's report, but with clear winners and losers. As of Nov 20 close (past 7 days): $Apple(AAPL)$ -0.86% $Microsoft(MSFT)$ -4.94% $NVIDIA(NVDA)$ -3.33%; $Amazon.com(AMZN)$ -8.8% $Alphabet(GOOG)$ +3.91% $Meta Platforms, Inc.(META)$ -3.4% $Tesla Motors(TSLA)$ -1.68%

Big-Tech’s Key Strategy

Gemini 3.0 Officially Launches Alongside Nano Banana Pro Hype – Has Google Finally Turned the Corner?

As of November 21, 2025, Alphabet (GOOG/GOOGL) is squarely in its strongest AI cycle ever. In the last three days alone, Google dropped Gemini 3.0 (Nov 18) and Nano Banana Pro (Nov 20) – its Gemini 3 Pro-powered image generation/editing suite. Early feedback is overwhelmingly positive: both products are beating rivals on key benchmarks and instantly driving real user excitement. GOOGL bulls now argue AI has flipped from existential threat to search/ad revenue into the company's most powerful growth driver.

Does Gemini 3.0 Reclaim the AI Performance Crown?

Official and third-party benchmarks show Gemini 3.0 Pro as the clear leader in reasoning right now:

LMSYS Arena (blind user votes): 1501 Elo – ahead of Grok 4.1 and GPT-5.1

Humanity’s Last Exam (PhD-level complex reasoning): 37.5% (no tools) / 41.0% (Deep Think mode) – crushing GPT-5.1 (26.5%) and Claude Sonnet 4.5 (13.7%)

GPQA Diamond (graduate-level science): 93.8% – tops everything

ScreenSpot Pro (screen understanding / agent capabilities): 72.7% – obliterating Claude (36.2%) and GPT-5.1 (3.5%)

Multimodal & coding: #1 on MMMU-Pro, WebDev Arena, Terminal-Bench, etc. – massive leap in coding agent performance

Launched day-one into Gemini App, Search AI Mode, and Vertex AI. Paid users get instant access to "Thinking" mode. Compared to OpenAI's GPT-5.1 (conversation-focused), Anthropic's Claude 4.5 (safety-first), and xAI's Grok 4.1 (real-time edge), Gemini 3.0 dominates deep reasoning, multimodal understanding, and agent execution.

Nano Banana Pro Blows Up the Image Generation Space – Another AI Monetization Win

Released Nov 20, Nano Banana Pro (Gemini 3 Pro Image) is hands-down the best AI image gen/editing tool out right now. Reviews are near-unanimous praise: supports up to 14 reference images, perfect 5-person consistency, native 4K, precise text rendering (multi-language, only 8% error rate vs. OpenAI's 38%). Pro-level controls for camera angle, lighting, depth of field, color grading – plus real-time search grounding for charts/posters with actual data.

Already rolled out across Gemini App, Google Ads, Workspace, NotebookLM, etc. Free tier has quotas; paid Plus/Pro/Ultra get unlimited. SynthID watermarking keeps everything verifiable. In just days it's gone viral on social – creators, advertisers, and devs are calling it a total productivity game-changer.

Why This Accelerates Google's Growth Flywheel

Q3 results ($102.3B revenue, Cloud +34%, ads back to 15% growth) already proved AI is expansionary, not cannibalistic. Gemini 3.0 + Nano Banana Pro are the real-time proof:

Search & Ads: Gemini 3.0's insane reasoning supercharges AI Mode and AI Overviews – queries already up 3x+, younger user stickiness exploding. Nano Banana Pro slashes ad creative production from hours to seconds → huge advertiser ROI boost.

Google Cloud: 70%+ of customers already using AI products, AI revenue +200% YoY. Gemini 3.0's benchmark dominance + home-grown TPU (Ironwood Gen 7 coming soon) + Nvidia GB300 dual-stack makes Google the default for 90% of top AI labs. Order backlog $155B – Cloud on track for 35%+ growth again in 2025.

Gemini 3.0 makes search richer and stickier – users keep coming back. Versus ChatGPT/Claude/Grok, Google's 10B+ daily active distribution moat is untouchable. Search/YouTube ads back to strong growth, Cloud as the clear #2 engine, subscriptions + new AI products adding incremental revenue. Short-term noise possible, but medium-to-long term GOOG remains the most undervalued pure-play AI name in Big Tech.

Forward PEG only 1.85x – well below Microsoft (2.36x), in line with Amazon (1.81x), only slightly above Meta (1.52x) – yet Google has faster AI monetization and a full-stack moat MSFT/AMZN can't match. 2025 CapEx guidance raised to $91-93B to capture the once-in-a-decade AI infrastructure supply crunch.

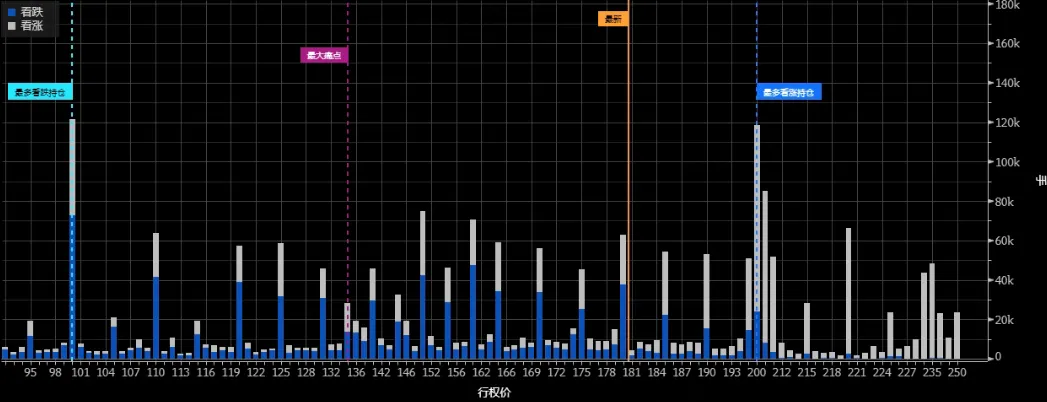

Big Tech Options Strategies

This Week's Focus: Google's "E-Commerce Space"?

Nov 19 report absolutely crushed:

Revenue $57B (beat by $2.8B)

Data Center $51.2B (+56% YoY)

Q4 guide $65B (another +$2.6B beat)

Gross margin guide 75% (back to peak levels)

Management dropped bombs: 2025/26 Data Center demand "> $500B with upside," Rubin mid-2026 on track, even 6-year-old Ampere nodes still ~100% utilized, 2026 GM holding mid-70s%.

Nov 20 price action was textbook emotional dump (open $196 → low $180.64, close -3%): premarket "once-in-a-decade beat," but institutions took profits, hedge funds de-grossed, retail feared the highs → smash. Volume wasn't extreme though – not capitulation, just classic "good news is sold" washout. Markets had partially priced the beat but few added exposure, more were hedged.

Current $180-186 zone = ~30x 2026 EPS – the lowest forward multiple in a decade.

Options flow: Dec 19 / Jan 16 expiries → total call OI ~1.8-2M contracts vs. put OI ~600-700k → put/call ratio 0.35-0.42 (extremely bullish skew historically). Post-earnings: massive bullish call sweeps (biggest Dec 200C, Jan 250C, Jan 300C – total premium >$1.2B). Then three waves of bearish flow mid-day (Jan 200P/195P buys + Dec 200C sell-to-close) flipped dealers from positive gamma to slightly negative → forced ~8-12M shares of delta hedging sales.

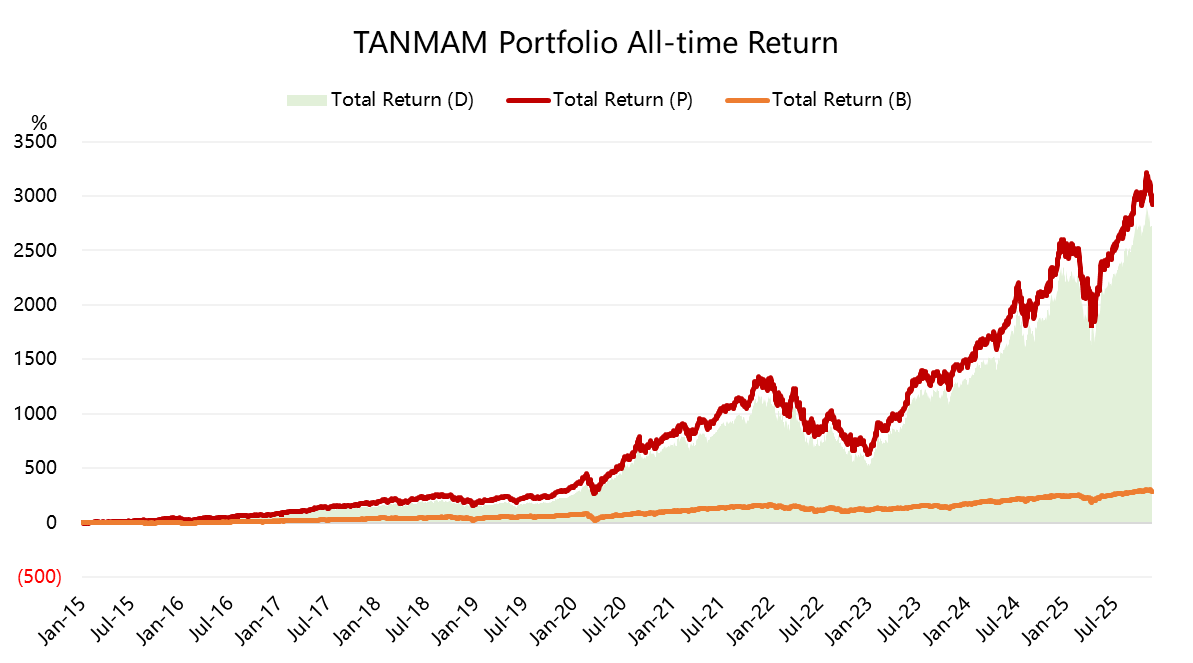

Big Tech Portfolio

The Magnificent Seven equal-weight, quarterly-rebalanced portfolio ("TANMAMG") has massively outperformed the $S&P 500(.SPX)$ since 2015: total return +3075% vs. $SPDR S&P 500 ETF Trust(SPY)$ +292%, alpha +2783% – and it's still near all-time highs.

YTD 2025: Big Tech basket +23.77% vs. SPY +15.37%. The AI tailwind isn't over yet.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

$400 incoming

Noted that the portion on Nvidia earnings is mis-labeled as Google.