$NVDA$

New bearish narratives are gradually gaining traction.

Narrative A: An analyst claims that the circular financing within the AI supply chain resembles a Ponzi scheme and constitutes fraudulent activity.

Narrative B: Another analyst refutes the "Ponzi scheme" claim as nonsense, arguing that stock volatility and financial data reflect normal valuation adjustments and standard industry practices. However, this narrative introduces a new bearish element: the $500 billion in orders through 2026 – does this represent genuine computing demand or overbuilding of infrastructure?

Frankly, Narrative B might be more damaging. Orders from overbuilding can "evaporate," potentially triggering a bubble burst. Cisco faced a similar situation back in 2000 – the stock chart tells the story.

For now, maintaining the view for a pullback toward $170. Will reassess if/when it reaches that level.

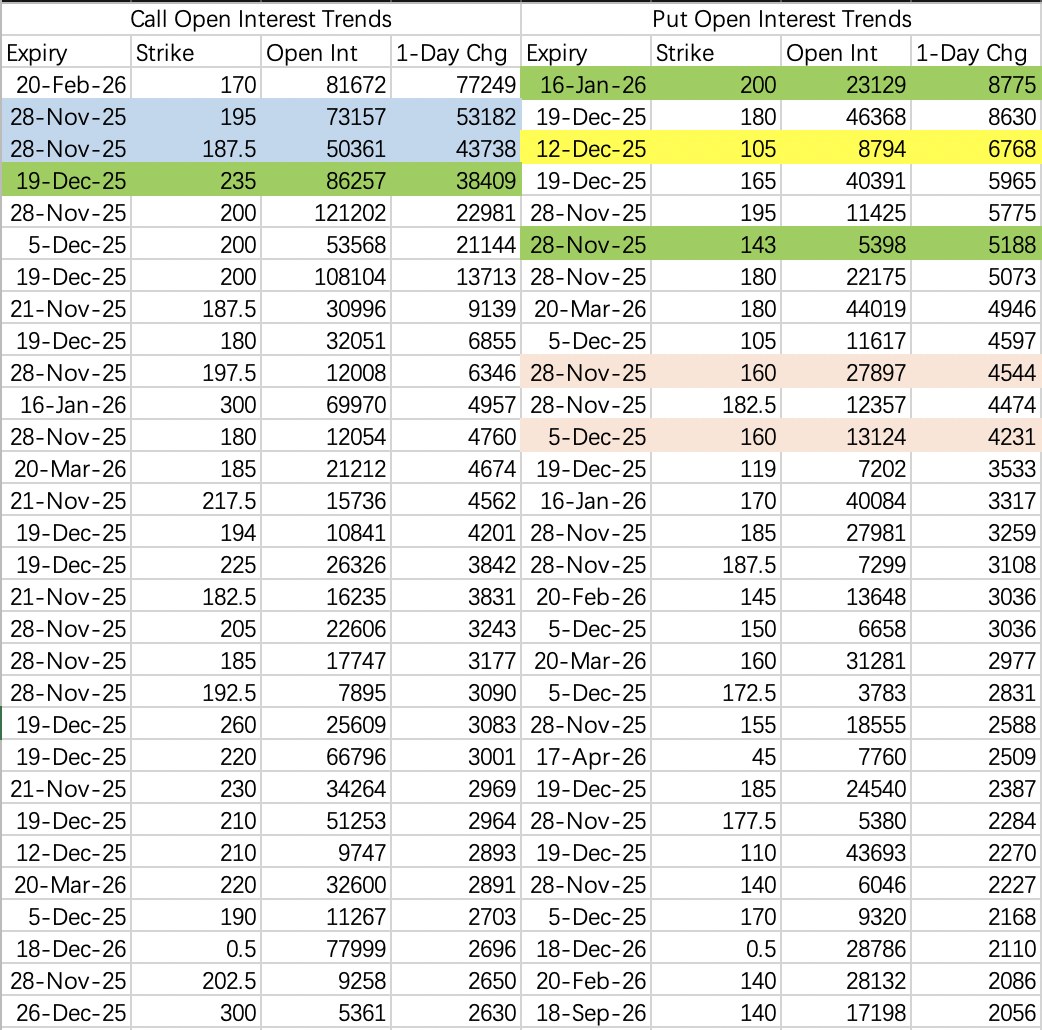

Post-earnings, large November positions are being rolled, with more cautious strike selection. The 180 call $NVDA 20251121 180.0 CALL$ was closed and rolled to the Feb 170 call $NVDA 20260220 170.0 CALL$ .

Institutions are positioning for next week with a call spread between 187.5 and 195 $NVDA 20251128 187.5 CALL$ $NVDA 20251128 195.0 CALL$ .

A trading range of $160-$190 seems reasonable for next week.

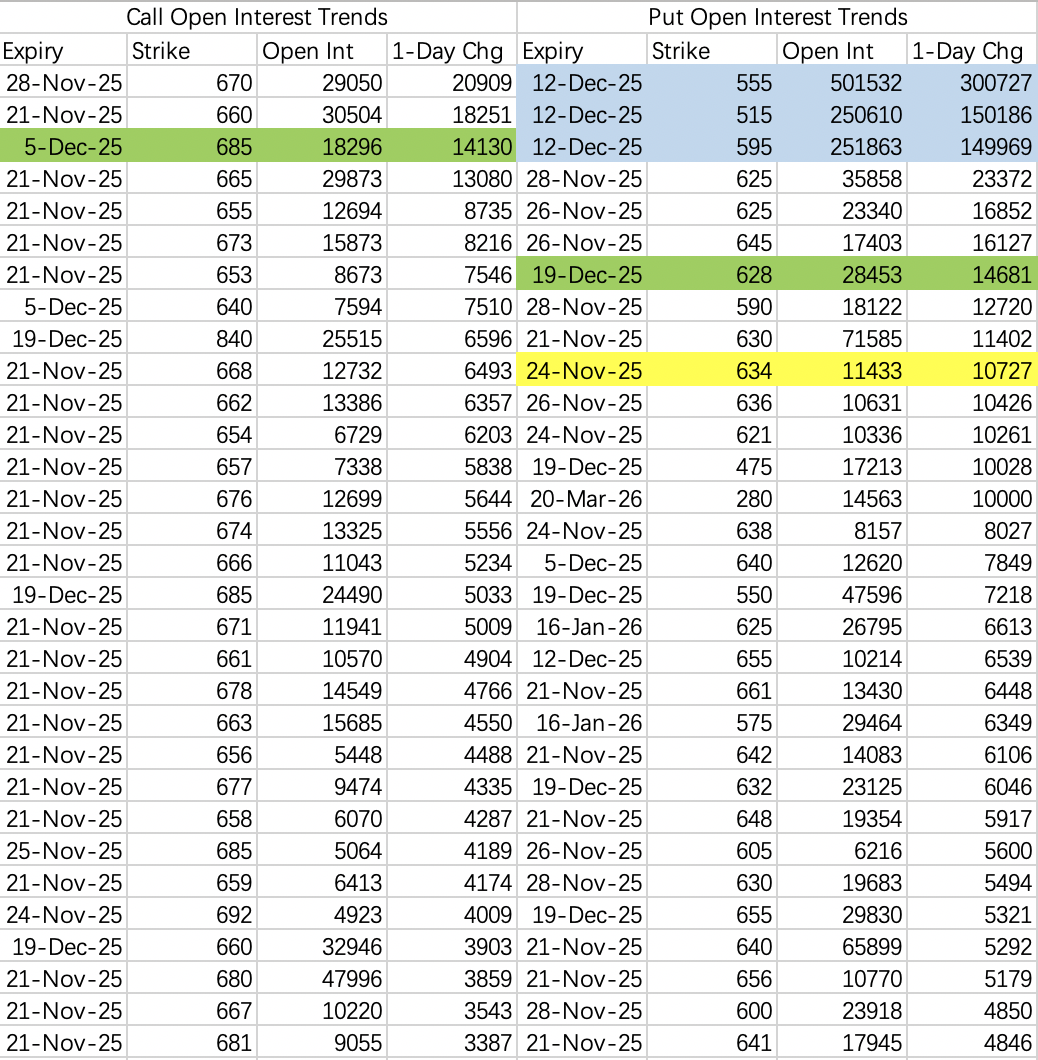

$SPY$

The potential for a sharp drop below 640 remains for next week. Notably, someone opened a 600k-contract put butterfly, betting on an unexpected plunge below 595 before the FOMC meeting.

$TSLA$

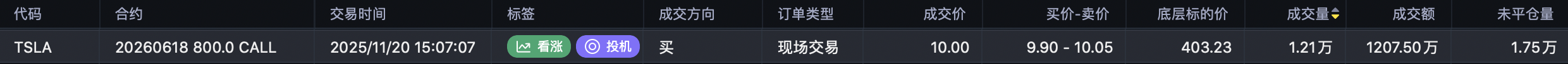

Amidst the broad market pullback, Tesla saw a sizable opening of 30k contracts in the June 18th 800 call $TSLA 20260618 800.0 CALL$ , with a total premium of approximately $300 million.

With investor Duan Yongping also recently mentioning a position in Tesla, it raises questions about what potentially significant catalysts might be anticipated for next year, prompting such aggressive long-dated call buying at this risky juncture.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.