Big Rally or Big Plunge

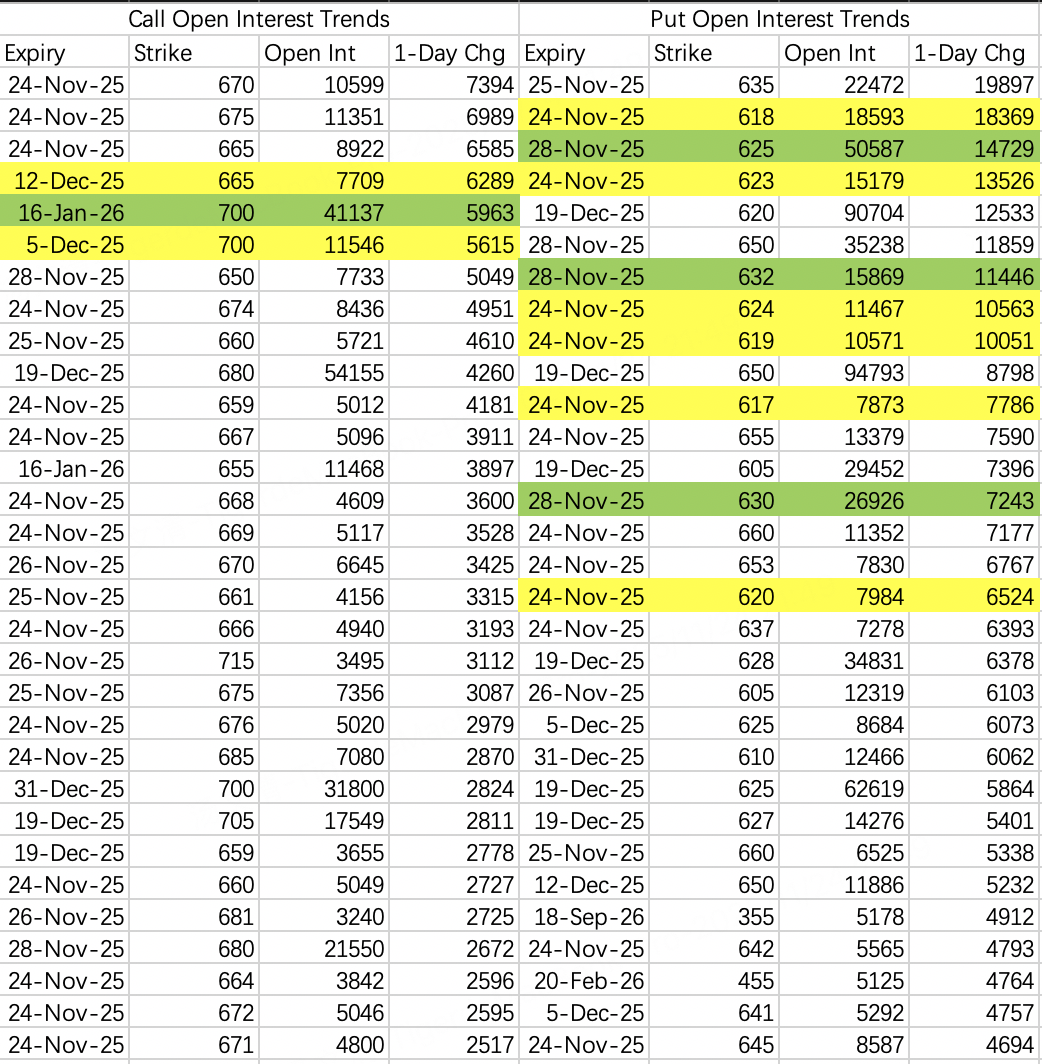

$SPY$

In short, tonight we'll either see a massive rally or a sharp selloff. And frankly, we might even get both within the same session.

If we do bounce, consider selling calls if it reaches 670 or 675.

Downside targets now point directly to 630 $SPY 20251128 630.0 PUT$ , possibly even 620. That's right – last week's 640-650 low expectations have been revised downward. Can't help it – the weekend option flow is all over these levels. Plans change; look at the bright side, a bigger dip means a better buying opportunity.

Generally, I don't recommend buying weekly options, but this week the odds might justify a couple of lottery tickets. Note: the probability of a plunge has increased, not that it's guaranteed.

Weekly options are extremely high-risk – never go heavy. Institutions can trade tens of thousands of contracts because they can afford the loss. If it doesn't drop this week, they'll reload next week. Retail traders should absolutely not heavy up.

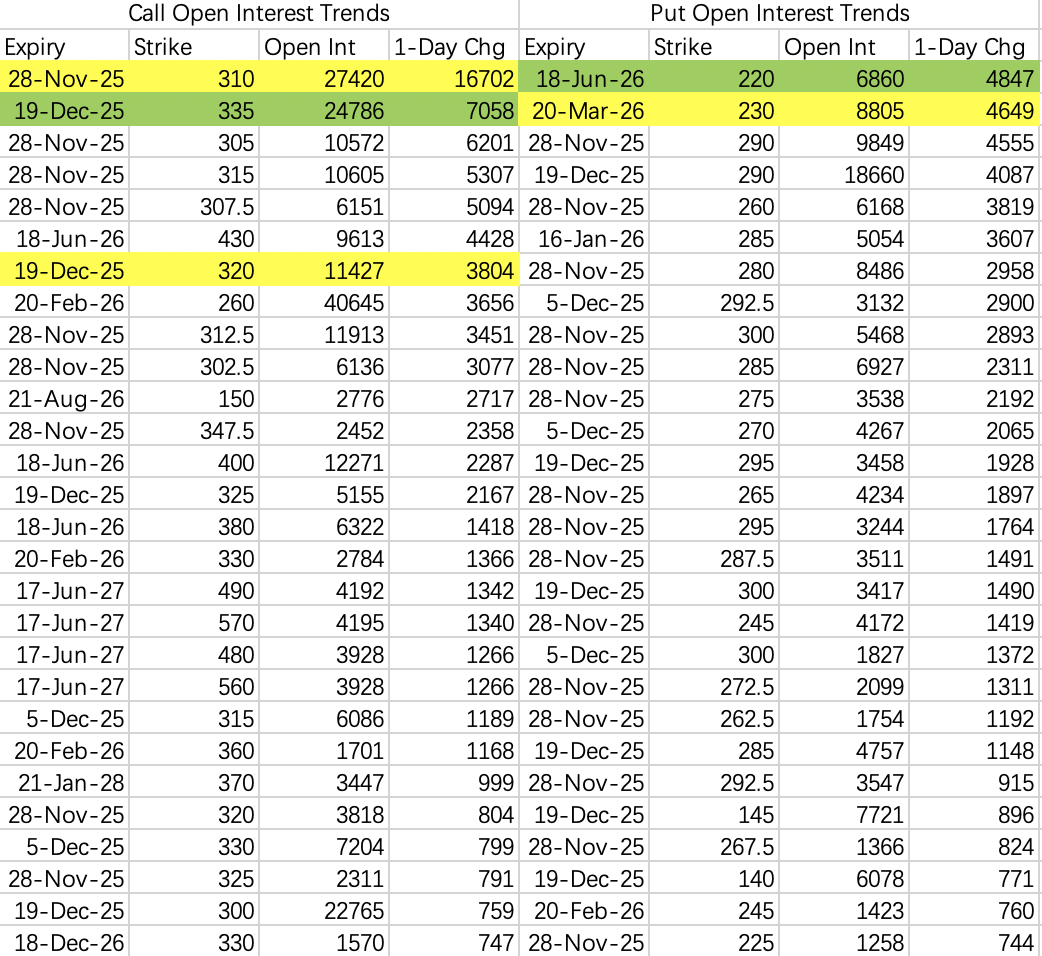

$NVDA$

Frankly, many individual stocks might not even be worth watching closely. If SPY has 630 in sight, how much better can individual names really fare?

NVDA's expected range this week is 160-185. Institutions are selling the 182.5 call $NVDA 20251128 182.5 CALL$ and hedging by buying the 192.5 call $NVDA 20251128 192.5 CALL$ .

A startling 100k contracts of the weekly 165 put $NVDA 20251128 165.0 PUT$ were opened, with volume hitting 148k contracts. Most of this flow came during the latter part of Friday's stock rebound, near the close.

The heaviest volume was primarily buyer-driven.

As we've discussed before, heavy put opening volume itself is a bearish signal, regardless of whether it's buys or sells. In any case, stock holders should implement some protection this week – consider selling calls like the $NVDA 20251128 195.0 CALL$ .

There is some bullish flow too. Two notable strategies: one is selling the Jan 177 put $NVDA 20260116 177.0 PUT$ – at that horizon, 177 isn't expensive, maybe large funds find the price acceptable.

The other is more complex:

Sell Jan 165 put $NVDA 20260116 165.0 PUT$

Buy two Jan 185 calls $NVDA 20260116 185.0 CALL$

Sell two Jan 195 calls $NVDA 20260116 195.0 CALL$

Although buying the 185 call is aggressive, the 165 put and 195 calls largely finance it, making the cost nearly zero. I'm generally wary of such structures – it suggests the trend is truly weak when institutions can position long for almost no cost.

Overall, based on the opening flow, don't expect a rebound back to 200 this year unless something major changes.

$GOOGL$

Option openings are bullish in nature, with support seen at 280-290. While there are some far OTM bearish positions, they are structured as zero-cost strategies: buying the Mar 230 put $GOOGL 20260320 230.0 PUT$ financed by selling the Jun 220 put $GOOGL 20260618 220.0 PUT$ .

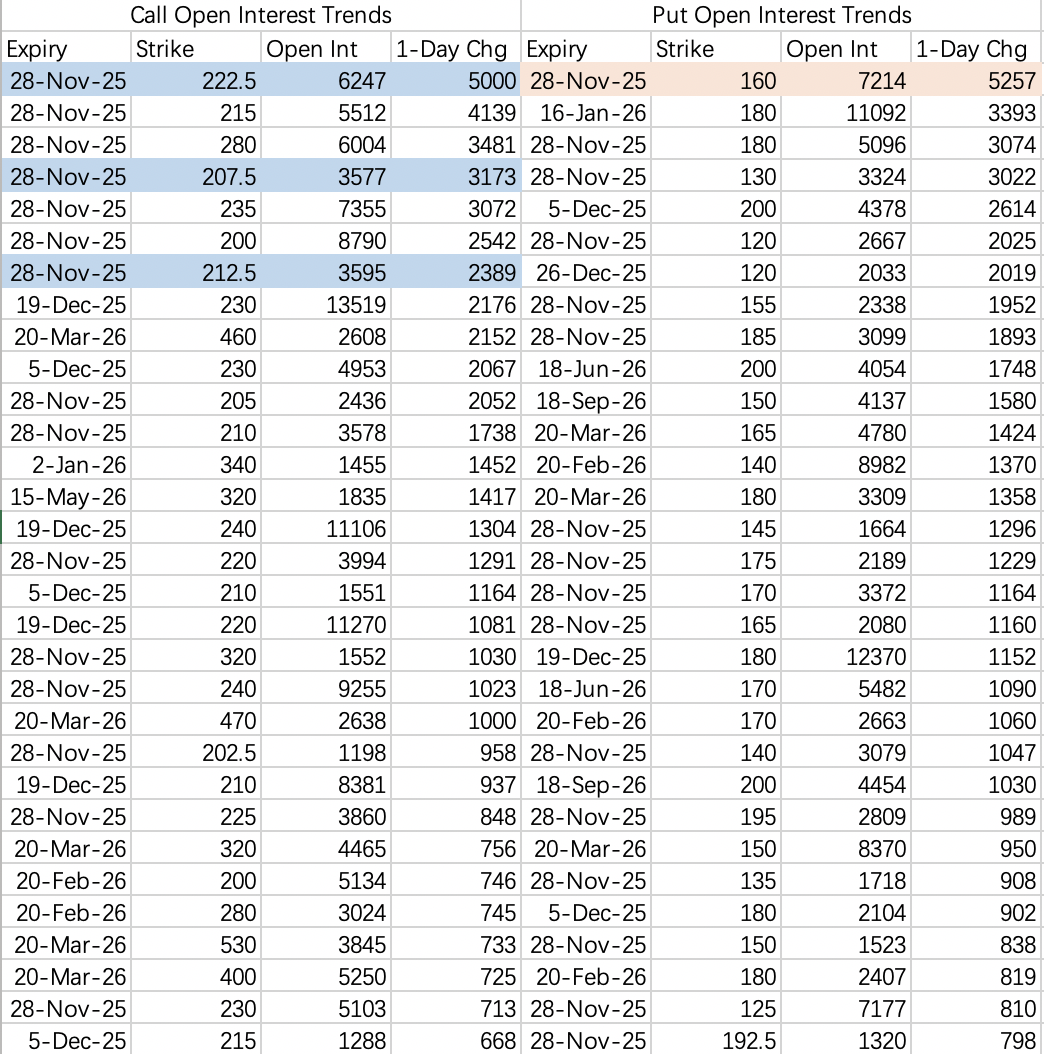

$AMD$

Institutions are running a call spread: selling the 212.5 call $AMD 20251128 212.5 CALL$ and buying the 222.5 call $AMD 20251128 222.5 CALL$ .

Considering potential for a short squeeze, if selling calls, the 230 strike $AMD 20251128 230.0 CALL$ might be a choice.

The pullback target is essentially the 120-day moving average around 180.

$TSLA$

Long calls are being rolled down: closing the Jan 455 call $TSLA 20260116 455.0 CALL$ and opening the Feb 440 call $TSLA 20260220 440.0 CALL$ .

Institutions have various bull call spread combinations. For a conservative sell call approach, the highest strike among them, the 435 weekly call $TSLA 20251128 435.0 CALL$ , could be considered.

For new short positions on a pullback, levels above 350 are preferred. Notably, bears didn't aggressively add shorts on Friday.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.